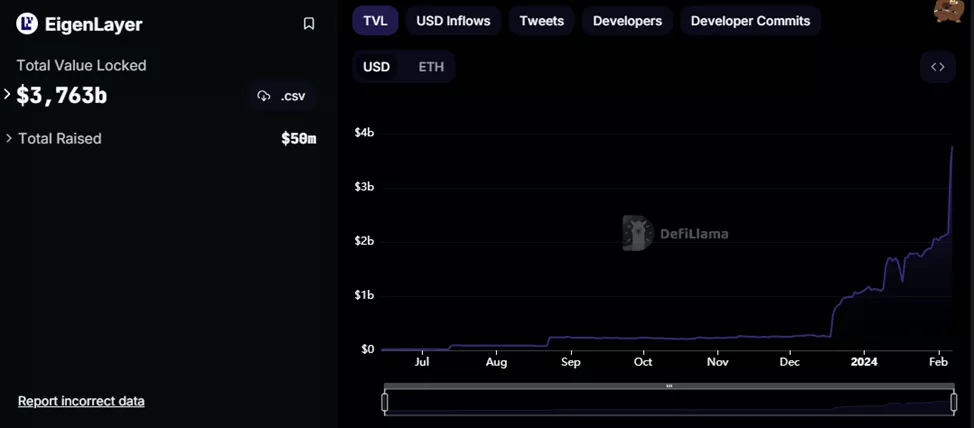

EigenLayer’s Asset Value Surges to $3.6 Billion Following Deposit Limit Removal

On February 6, the total value locked (TVL) in the EigenLayer restaking protocol reached $3.6 billion, marking a 71% increase in a single day. This surge was driven by the removal of deposit limits.

From February 5 to February 9, 12:00 PM (PT), the project team opened all pools — both existing and from new partners, including Frax Finance, Liquid Collective, and Mantle.

? EigenLayer Restaking Reloaded! ?

From NOW until Feb 9th, 12 PM PT, dive back into the world of LST restaking! All pools are fully uncapped, featuring both the existing pools and welcoming new partners @fraxfinance, @liquid_col, & @0xMantle. pic.twitter.com/yDGHiJjX3m

— EigenLayer (@eigenlayer) February 5, 2024

This decision marked a temporary lifting of the pause on fund deposits.

It is the first instance of removing the TVL cap for each token for a specific period.

The initiative sets the stage for a potential permanent removal of restrictions “in the coming months.”

According to the team, this move brings EigenLayer to a critical phase in its long-term goal to balance neutrality (minimal subjectivity) and decentralization.

The project’s blog states that achieving equilibrium is essential for maintaining trust and diversity within the ecosystem.

The developers proposed a phased approach:

- Remove restrictions on TVL placement.

- Eliminate limits on payouts to stakers from AVS.

- Set protocol incentive and governance limits at 33% for each participant.

The community is expected to discuss this proposal, with the possibility of further refinement and implementation.

In January, Binance’s venture arm invested an undisclosed amount in the Ethereum-based liquid restaking protocol Puffer Finance, built on EigenLayer.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!