Emerging Economies Turn to Cryptocurrency Adaptation

Amid a shortage of dollars and soaring inflation, Bolivians are turning to digital assets, reports Reuters.

The country has nearly exhausted its reserves of American currency, and inflation has reached a 40-year high. The price of the boliviano on the black market has halved since the beginning of the year, although authorities artificially maintain the official rate.

Cryptocurrencies as an Alternative

Under these circumstances, Bolivians have turned to crypto exchanges like Binance, Bitcoin, and the stablecoin USDT from Tether. They use digital assets to protect against the devaluation of the boliviano.

According to the central bank, the volume of cryptocurrency transactions amounted to $24 million as of October last year. Analysts believe this figure has significantly increased since then.

The head of the Bolivian Blockchain Chamber, Mauricio Torrelio, compared the pace of cryptocurrency adoption in the country to that of Argentina and Venezuela. However, the overall market volume still lags significantly behind its South American neighbors.

Payments and Savings

In the city of Cochabamba, local entrepreneurs are actively adopting cryptocurrencies. Steakhouse owner Pablo Unsueta has installed a crypto ATM that allows coins to be exchanged for Bitcoin via the Blink wallet. He also accepts payments through Binance accounts.

“If you go to the bank today, there are no dollars. Paying for chicken with Bitcoin is the most innovative thing our city can do,” said Unsueta.

Spa owner Carla Jones offers discounts to clients who pay with cryptocurrency. According to her, this attracts young people and helps save money.

Tether’s head, Paolo Ardoino, sees this as a “quiet revolution.” He posted a photo from a Bolivian duty-free shop where goods are sold for USDT. In his view, digital dollars provide economic stability.

In Bolivia, real prices in shops are displayed in USD₮.

A quietly revolutionary shift: digital dollars are powering daily life, commerce, and economic stability. pic.twitter.com/dGP7I2ipxv

— Paolo Ardoino ? (@paoloardoino) June 7, 2025

‘Crypto-colonialism’ as a Response to Crisis

However, experts warn that the rise in cryptocurrency popularity is not a sign of stability but a reflection of desperation.

Former central bank head José Gabriel Espinoza noted that the digital asset market in the country is still “nascent.” He estimates the daily trading volume of USDT at about $600,000. This is a small fraction compared to the formal financial sector ($18-22 million) and the black market for cash ($12-14 million).

Peter Howson, a lecturer in international development at Northumbria University in the UK, warned of the volatility risks for the population. He described the situation as “crypto-colonialism,” where companies persuade impoverished residents to invest their last funds in risky assets.

State Strategies: From Mining to Reserves

The Kingdom of Bhutan has taken a different path. The country has secretly built six mining centers operating exclusively on hydropower. Revenue from the rising Bitcoin price has allowed the government to raise civil servants’ salaries and strengthen currency reserves.

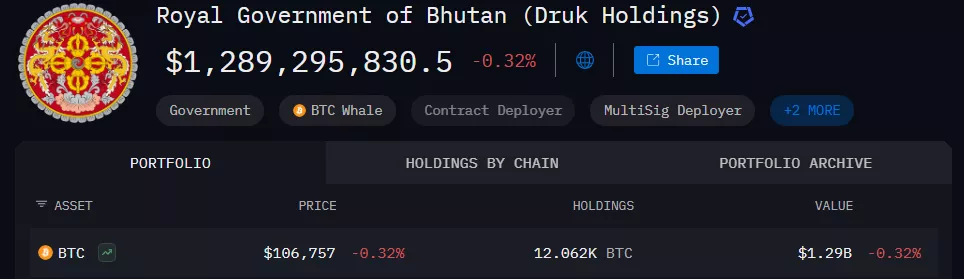

Bhutan’s state Bitcoin reserve has reached 12,062 BTC ($1.29 billion), accounting for nearly 40% of the country’s GDP. This places the kingdom among the world’s top three leaders in this regard.

This experience is being observed in other countries. Pradip Bhandari, a representative of India’s ruling party, called for a pilot project to create a state Bitcoin fund. He sees this as a strategic step towards economic resilience.

Bhandari noted that the US, China, Russia, and Brazil are actively developing their crypto initiatives without waiting for global consensus. In his view, clear regulation and the creation of a sovereign reserve will strengthen India’s economy and protect investors.

As reported by ForkLog, an investigation revealed how Bangladesh is attempting to balance its drive for innovation with a growing environmental crisis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!