Ethereum ETF Trading Commences Amid Moderate Pressure on Price

On July 23, trading of spot Ethereum ETFs began. Within 20 minutes, the price of the second-largest cryptocurrency fell by 1.7% on increased volumes, nearing intraday lows.

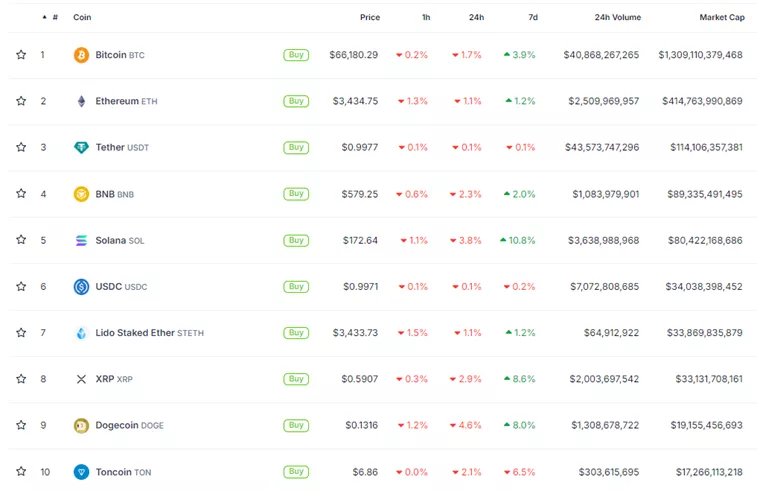

In the last 24 hours, Ethereum has decreased by 1.1%, outperforming other top-10 digital assets by market capitalization, excluding stablecoins.

In the first 15 minutes, the ETH-ETF turnover reached 50% of the first-day figure for bitcoin funds ($112 million).

Trading volume exceeded $200 million.

Michaël van de Poppe, founder of MN Trading, described the figures as “insane.” The expert is convinced that the market has “heavily undervalued the instrument.” He believes Ethereum will show positive dynamics towards ATH in the coming month or two.

The $ETH ETF has insane numbers.

First 15 minutes already 50% of #Bitcoin‘s first day in terms of volume: $112 million.

The Ethereum ETF launch is heavily undervalued and I expect it to trade towards an ATH in the coming 1-2 months.

— Michaël van de Poppe (@CryptoMichNL) July 23, 2024

According to Bloomberg analyst Eric Balchunas, the main contribution to the metric was made by Grayscale’s ETHE ($39.7 million). Other leaders include Bitwise’s ETHW ($25.5 million), BlackRock’s ETHA ($22.5 million), and Fidelity’s FETH ($15.2 million).

Here’s volume after first 15 minutes of trading. Total of $112m traded for the group (which is A TON vs a normal ETF launch but only about half of what bitcoin ETFs’ volume pace was on DAY ONE, altho 50% would exceed expectations IMO). Also Bitwise outperforming early. pic.twitter.com/RoN9J1VoP1

— Eric Balchunas (@EricBalchunas) July 23, 2024

Earlier, Bitwise CIO Matt Hougan noted that pre-market demand for the instrument was much lower than during the launch of its digital gold counterpart.

Pre-market trading of ETH ETPs is significantly lighter than pre-market trading of BTC ETPs on launch day. Still, good to see trading activity in the biggest expected players pre-market.

— Matt Hougan (@Matt_Hougan) July 23, 2024

Before trading began, issuers collectively contributed nearly $10.3 billion to the product.

Here are the starting asset levels for the Ethereum ETFs launching today. The whole complex starts trading with just shy of $10.3 billion (pretty much all from $ETHE‘s assets) pic.twitter.com/MAfjObFX4a

— James Seyffart (@JSeyff) July 23, 2024

Fees (excluding promotional offers) range from 0.15% (Grayscale’s mini-trust) to 2.5% (ETHE).

⚡️ JUST IN: #Ether ETFs officially begin trading in the US. pic.twitter.com/psJqVvckqU

— Cointelegraph (@Cointelegraph) July 23, 2024

Analysts at Arkham Intelligence have identified the addresses of all ETH-ETFs.

BREAKING: ALL ETH ETFS NOW ON ARKHAM

We have identified the on-chain locations of all ETH ETFs due to go live today.

We are the first to publicly identify these addresses.

Stay up to date with today’s ETH ETF launches: pic.twitter.com/P6P7Dj6A3I

— Arkham (@ArkhamIntel) July 23, 2024

Previously, the Ethereum options market indicated low chances of a pullback after the launch of the exchange-traded funds.

Earlier, Valentin Fournier from BRN predicted a price drop for the second-largest cryptocurrency to the $2800–3100 range following the ETF trading commencement. The expert believes that subsequently, Ethereum could rise to $4000 as the effect of fund inflows into the instruments becomes apparent.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!