Ethereum ETFs draw more than $1bn in a day

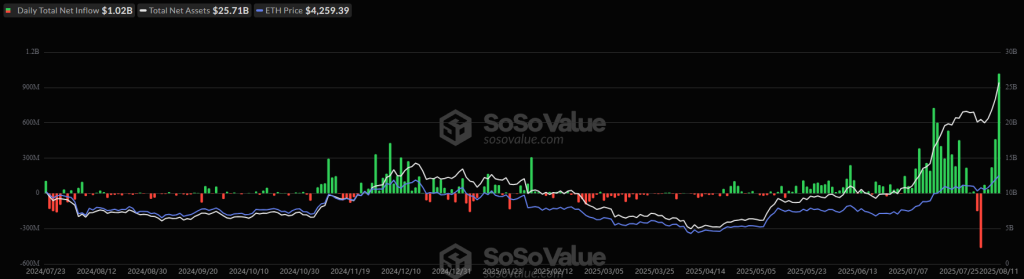

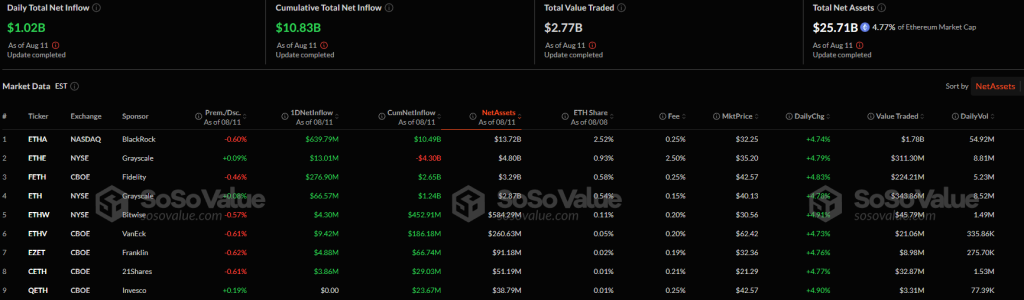

During the latest trading session, inflows into spot exchange-traded funds backed by ether hit a record $1.02bn.

Total assets under management in ETH ETFs rose to $25.71bn — 4.77% of the supply of the second-largest cryptocurrency.

As usual, the largest share went to BlackRock’s ETHA fund — $639.79m. Fidelity’s FETH also drew a nine-figure sum — $276.9m.

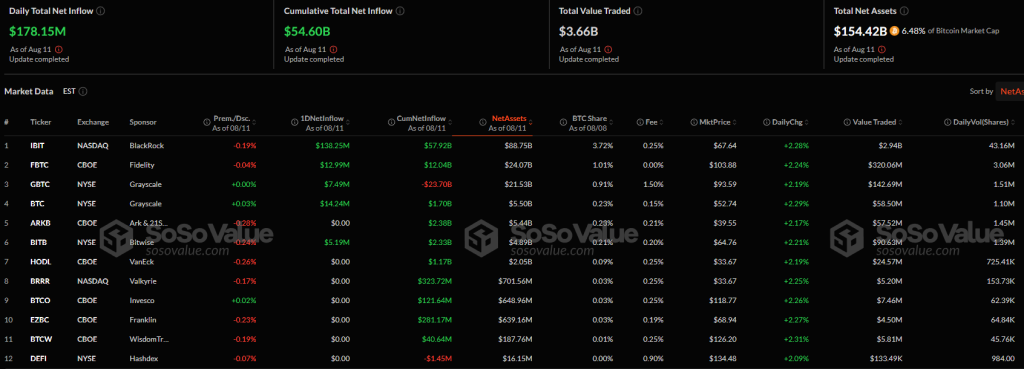

For comparison, similar instruments tied to digital gold took in $178.15m over the same period.

Total assets under management reached $154.42bn; cumulative net inflows stand at $54.6bn.

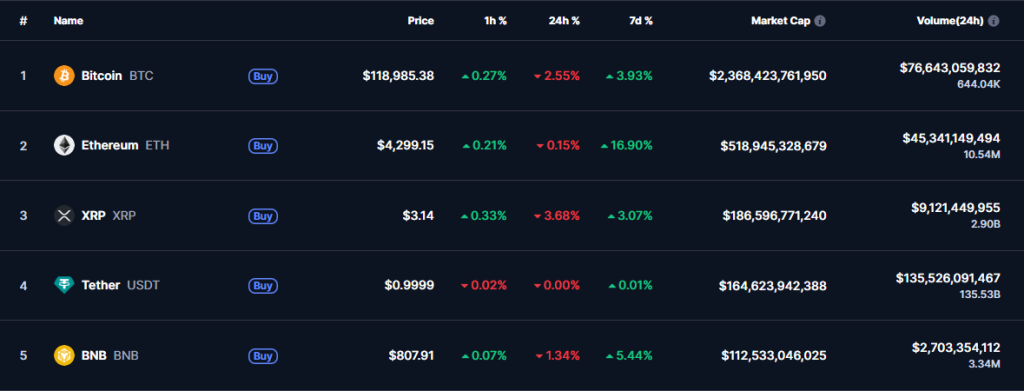

Over the past day, ether’s market price was little changed (−0.16%); bitcoin fell 2.53%, according to CoinMarketCap.

What do experts say?

Nick Rak, director at LVRG Research, told The Block:

“Investors increasingly view Ethereum as a store of value and the base layer for decentralized finance and Web3 innovation. Demand reflects growing institutional confidence in ether’s long-term potential.”

Vincent Liu, chief investment officer at Kronos Research, stressed that inflows are driven by an improving regulatory environment and record investments by TradFi companies with Ethereum treasuries.

According to him, this “helps form deep liquidity pools” and strengthens ether’s position as a key driver of mass crypto adoption.

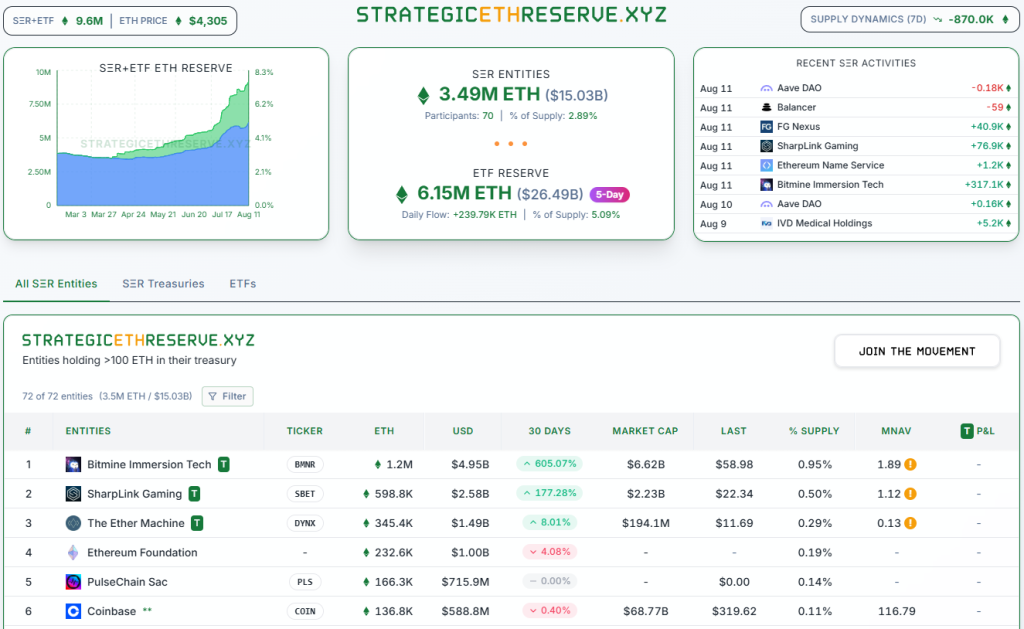

Such firms hold 3.49m ETH worth $15.03bn — 2.89% of the supply of the second-largest cryptocurrency.

Signs of FOMO

In July, trading volume in Ethereum futures on the regulated CME exchange hit a record $118bn, up 82% from June. Open interest (OI) rose 75% — from $2.97bn to $5.21bn.

According to The Block, a similar pattern was seen on other venues: aggregate monthly turnover in ether futures reached $2.12trn. That is 38% above June and 13% higher than the previous peak of $1.87trn set in May 2021.

OI on Binance alone reached $10bn, according to CryptoQuant:

Total futures open interest as of 9 August stood at $36.3bn, close to record levels. The metric is up 40% in a week and 500% since November.

Although August is not yet halfway through, Google search interest for Ethereum has already reached its highest since June 2022.

Noting the record inflow into Ethereum ETFs, MN Trading founder Michaël van de Poppe expressed confidence that the current cycle is far from over.

Absolutely crazy.

$1B inflow on a single day in the $ETH ETF.

This cycle is far from over.

Institutional interest into #Ethereum is significantly growing, and all those ecosystem plays are still undervalued. pic.twitter.com/oW4jk3qb3k

— Michaël van de Poppe (@CryptoMichNL) August 12, 2025

He said the role of institutions in the “undervalued” ecosystem is growing.

Ether outpaced bitcoin in growth for the first time since 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!