Ethereum Foundation’s Financial Cushion Evaluated by Expert

The Ethereum Foundation (EF) possesses sufficient funds to operate for approximately 10 years, based on the current ETH exchange rate. This assessment was provided by Ethereum researcher Justin Drake.

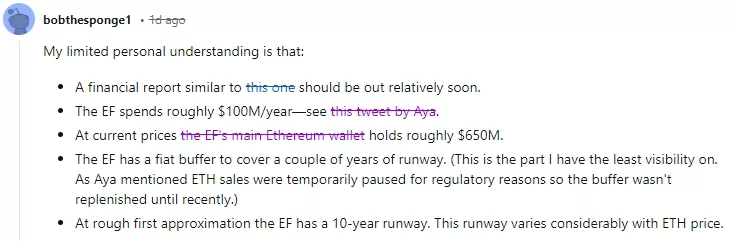

During an AMA session on Reddit, the expert revealed that the Swiss-registered non-profit organization will soon release a financial report.

The EF’s main wallet holds digital assets valued at approximately $650 million. According to the expert, there is also a “fiat buffer that covers a couple of years,” though he is “not very informed” about this part of the treasury.

The foundation’s annual expenses amount to about $100 million, as Drake cited from Ethereum Foundation Executive Director Aya Miyaguchi.

This is part of our treasury management activities. EF has a budget of ~$100m per year, which is largely made up of grants and salaries, and some of the recipients are only able to accept in fiat. This year, there was a long period of time when we were advised not to do any…

— Aya Miyaguchi (ayamiya.eth) (@AyaMiyagotchi) August 24, 2024

“The approximate budget strategy is to spend 15% of the remaining funds each year. This implies a path for EF to continue indefinitely, gradually diminishing as part of the ecosystem,” commented Ethereum co-founder Vitalik Buterin on the subreddit.

Community attention to the organization’s financial policy was drawn by the August transfer of 35,000 ETH ($94 million at the time) to the Kraken exchange. This was the foundation’s largest transaction in several months.

Members of the ecosystem called for greater transparency from the leadership. Some deemed the sale of assets inappropriate given current market conditions. Others found it “offensive” to learn about such significant fund movements from “bot reports” on X.

“This year, there was a long period when we were advised not to engage in any treasury activities due to regulatory complexities, and we couldn’t share the plan in advance. Moreover, this transaction does not equate to a sale. From now on, they will be planned and gradual,” Miyaguchi responded at the time.

According to CoinGecko, ETH prices have declined by 13% over the past two weeks. The coin is trading near $2325.

Analysts at QCP Capital have suggested the crypto market correction may continue into September.

Derive founder Nick Forster deemed it unlikely for ETH to return to its peak price of $4878 this year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!