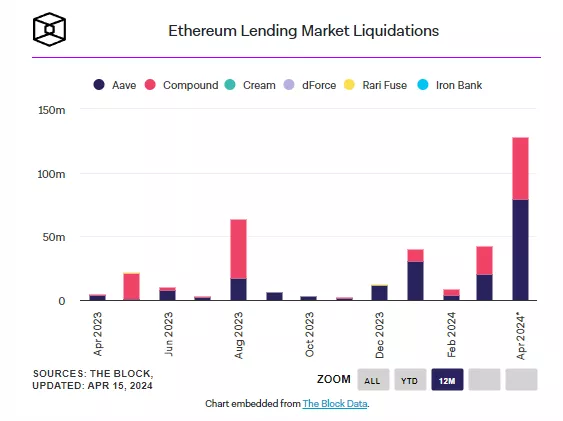

Ethereum Lending Protocol Liquidations Surpass $127 Million

In the first two weeks of April, the volume of liquidated positions in Ethereum’s lending markets reached $127.8 million, exceeding monthly figures not seen since at least June 2022, according to The Block.

The dramatic events of summer 2022 were driven by investors’ reactions to the collapse of Terra.

The publication noted that the surge in liquidations was triggered by a cryptocurrency price crash on April 12–13.

The vast majority of liquidations were attributed to the Aave protocol ($79.4 million) and Compound (~$48.3 million).

The price drop of Curve (CRV) also threatened the loan of the project’s founder, Mikhail Egorov. The entrepreneur managed to avoid a negative outcome and stated his intention to reduce his risks, according to The Block.

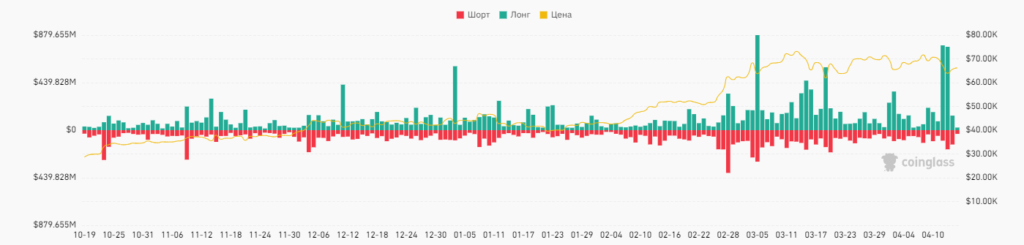

According to Coinglass, from April 12–14, the volume of liquidations in the crypto derivatives market amounted to nearly $2.1 billion.

Former BitMEX CEO Arthur Hayes suggested that Bitcoin could fall before and after the halving, while also calling the event a bullish catalyst for the market in the medium term.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!