Expert Declares the End of Self-Custody Era for Bitcoin

The era of self-custody for cryptocurrencies is nearing its end.

The era of self-custody for cryptocurrencies is nearing its end as major players increasingly favour ETFs, according to Martin Hiesboeck, head of blockchain research at Uphold.

The real reason for all the whale movements out of self-custody is simple: taxes.

We are witnessing the first decline in self-custodied Bitcoin in 15 years.

BlackRock’s iShares spot Bitcoin ETF (IBIT) has facilitated over $3 billion worth of Bitcoin conversions from whales.… pic.twitter.com/yepXRbLozM

— Dr Martin Hiesboeck (@MHiesboeck) October 22, 2025

Tax incentives, improved institutional infrastructure, and the ability to manage capital through advisors while accessing a broader range of services are driving the shift back to traditional financial instruments, the expert believes.

“We are witnessing the first decline in self-custodied Bitcoin in 15 years,” he added.

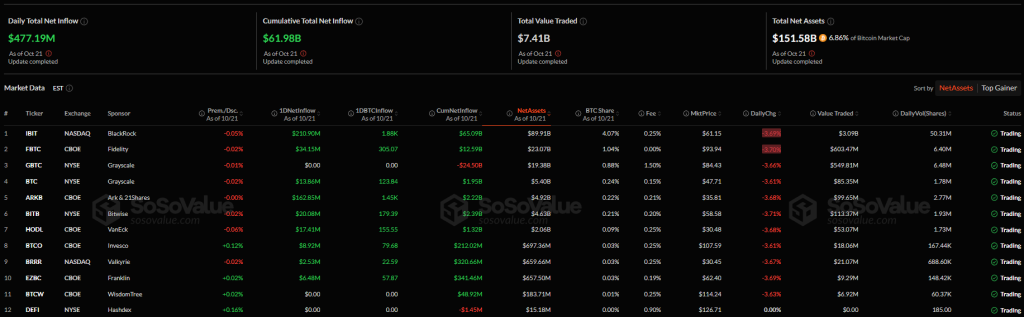

According to Hiesboeck’s calculations, BlackRock’s IBIT fund has enabled whales to convert over $3 billion worth of the leading cryptocurrency. In total, American issuers have absorbed coins valued at $151 billion—about 6.8% of the supply.

Recent regulatory changes by the U.S. Securities and Exchange Commission, allowing for the redemption of cryptocurrency ETFs in kind, have also accelerated the transition.

This innovation permits authorised participants to directly exchange cryptocurrency for fund shares, which is more efficient and potentially more tax-advantageous than cash redemption.

“The trend indicates a deeper integration of Bitcoin into the traditional financial system and a move away from the self-custody mantra—’not your keys, not your coins.’ Another nail in the coffin of the original cryptocurrency idea,” Hiesboeck emphasised.

Additionally, the development of cryptocurrency trading tools is accelerating in other major jurisdictions such as the EU, the UK, and Australia.

In October, the Hong Kong Securities and Futures Commission approved the region’s first spot ETF based on Solana.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!