Expert: Ethereum miners’ revenues to fall 20-30% after London hard fork

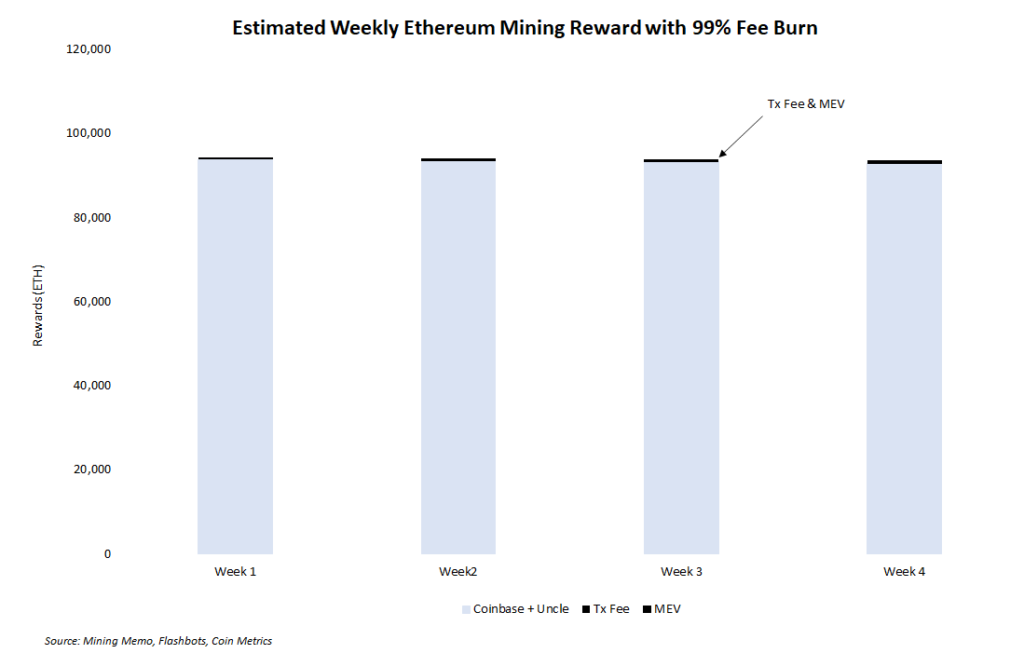

Activation of EIP-1559 as part of the London hard fork on the Ethereum network will lead to miners’ revenues falling by 20-30%. Such projections are put forward by experts at Compass.

Ethereum’s EIP-1559 activates this week.

Here’s what ether miners can expect. $ETH https://t.co/7ud9B0c3Jg

— Mining Memo (@miningmemo) August 3, 2021

They estimate that the activation of EIP-1559 will increase the share of revenue from block rewards. The reduction in transaction fees will be offset by the rise in Ethereum’s price, the analysts say.

EIP-1559 envisages burning a portion of transaction fees depending on network load and reducing the volatility of gas prices.

Technically, EIP-1559 involves:

- The block capacity could be doubled depending on the prior load;

- an algorithmic determination of the transaction fee based on a precondition for including a transaction in the previous block and the fees actually paid (the base fee). If a block is more than half filled with transactions, this parameter increases, and vice versa. The mechanism is designed to keep conditions broadly even across most blocks;

- the possibility of additional ‘tips’ for miners to prioritise time-sensitive transactions. Given the assumed load of ±50%, their size is expected to be small.

Analysts say users can expect an improved experience interacting with various dapps, as well as a reduction in gas-price volatility.

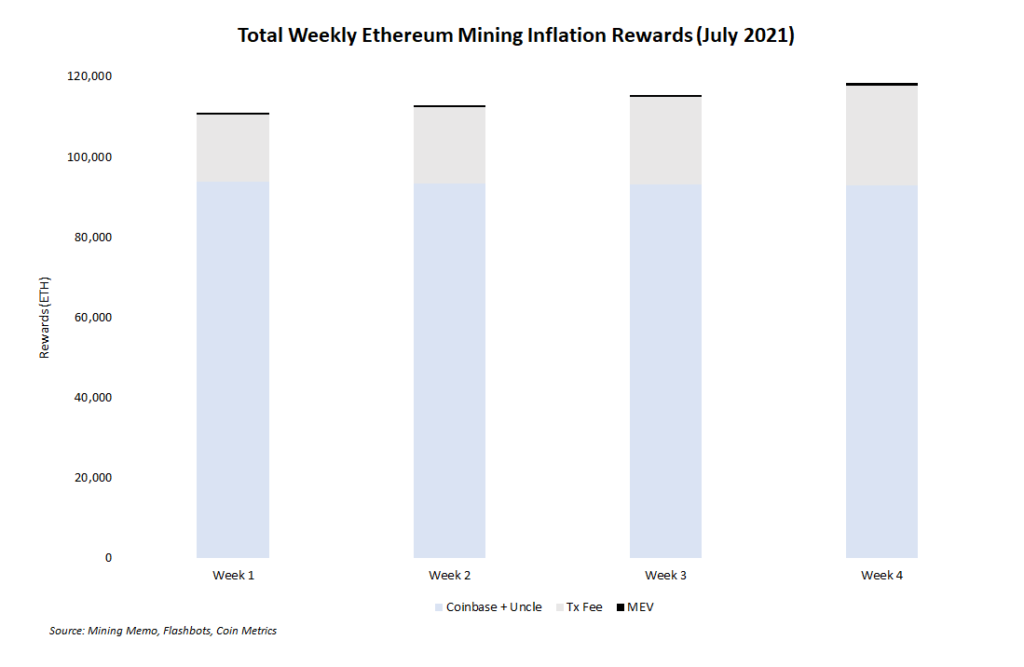

For miners, revenue will be broken down into three components:

- block rewards;

- transaction fees;

- Miner Extractable Value (MEV).

The diagram below shows Ethereum miners’ revenues before and after EIP-1559 activation (in the latter case with 99% of transaction fees burned).

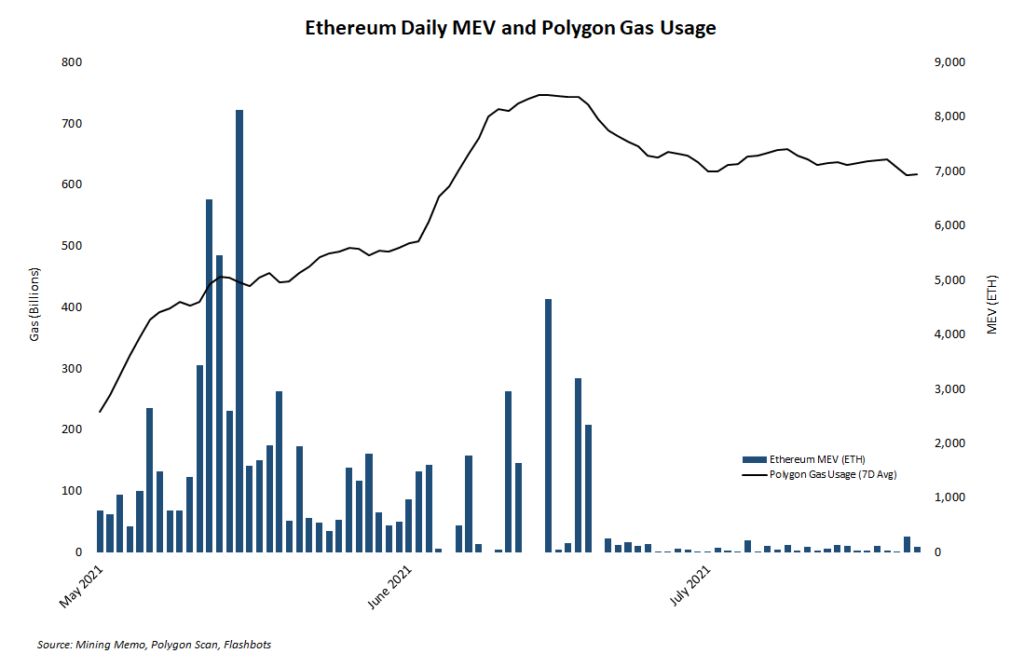

Compass analysts expect a sharp decline in MEV both in dollar terms and in ETH. The fact that 80% of miners altered their client settings to take advantage of MEV after the activation of EIP-1559 will not change the situation.

Experts attribute this to two factors:

- lower network activity and, as a result, lower gas prices after the May crash;

- users shifting to Polygon as a cheaper and faster alternative to transacting on the main network.

As of writing, before the London hard fork which will occur on block #12965000, less than two days remain. Less than two days.

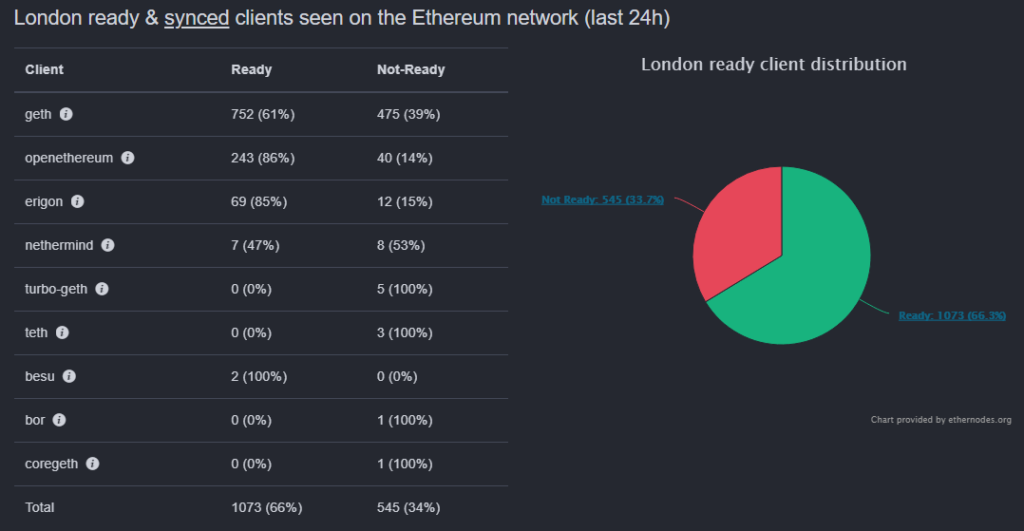

Currently, 66.3% of nodes have signalled readiness for the hard fork. Earlier opponents of the proposal sought to concentrate more than 51% of hashrate in the Ethermine pool. Their bid, however, failed.

Pantera Capital CEO Dan Morehead named EIP-1559 one of the drivers of Ethereum’s outperformance versus Bitcoin in the near term. Among other factors, he highlighted the growing popularity of DeFi apps and the forthcoming transition to Proof-of-Stake.

The expert projected Ethereum hitting $700,000 within a decade. By the end of 2021, he expects the price of the second-largest cryptocurrency to rise to $80,000-$90,000.

Analysts told Forklog about the impact of the London hard fork on Ethereum’s price.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!