Expert flags fixes to Binance’s handling of BUSD reserves

The cryptocurrency exchange Binance has addressed deficiencies in the management of Binance USD (BUSD) reserves, which at times led to a shortfall of more than $1 billion. This conclusion was reached by ChainArgos founder Jonathan Reiter, Bloomberg reports.

These are the BUSD in the BNB Beacon Chain and BNB Smart Chain networks, with a combined market capitalization of $5.4 billion of the total $16.4 billion.

They hold BUSD reserves on the Ethereum blockchain. The latest stablecoins are backed by US dollars and are under under Paxos control with an NYDFS.

Platform representatives confirmed the accuracy of the analysis.

The process of maintaining the peg involves many steps and has not always been flawless, which may have led to delays in operations in the past. Earlier we improved it through enhanced checks for discrepancies to guarantee a stable peg [BUSD in BNB networks to BUSD on Ethereum], — they said.

Binance staff did not specify how long the period of under-collateralisation of BUSD in the BNB networks lasted, when the exchange noticed and remedied it. They assured that the stablecoin is currently fully collateralised and users’ interests have not been harmed.

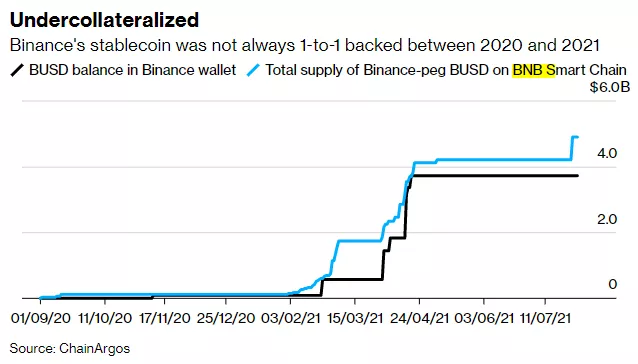

According to ChainArgos and Bloomberg’s analysis, the gap between BUSD issuance in the BNB networks and the reserves backing it was observed from 2020 to 2021. In three separate cases this gap exceeded $1 billion.

When buying BUSD in one of the BNB networks, Binance purchases BUSD from Paxos and issues the corresponding number of tokens on the BNB Beacon Chain or BNB Smart Chain.

The user will receive their BUSD; the same value of BUSD is locked on Ethereum and backed by US dollars, — a Binance spokesperson said.

A similar explanation is provided on the platform’s website.

Reuters’ analysis showed that this process was breached — BUSD issuance occurred without locking the corresponding number of tokens on Ethereum.

According to CoinGecko, BUSD market cap has fallen by 30% since mid-November, to $23.5 billion.

The trend emerged after the FTX crash and amid doubts about the completeness of Mazars’ report on the platform’s bitcoin reserves.

In December, amid outflows from the exchange, its CEO Changpeng Zhao said that Binance has sufficient liquidity so that, if necessary, all clients could withdraw 100% of their assets.

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!