Expert says Bitcoin has moved from accumulation to a bull market

- Traders have observed Bitcoin’s move into a bull market that could last through the end of 2025.

- Altcoins are also joining the rally, though not yet showing multi-fold gains.

- Trading activity on CEX has risen, confirming the start of a new trend.

Bitcoin has ended the accumulation phase and entered the early stage of the bull cycle. This was stated by Michaël van de Poppe, founder of MN Trading.

#Bitcoin has ended the accumulation phase and enters the first part of the bull cycle

This is the first year of the bull cycle, as it’s quite clear that we’ve finished the bear market.

Altcoins are heating up and Bitcoin has broken through the $30,000 barrier. What’s next?… pic.twitter.com/uPgJG9Mg3o

— Michaël van de Poppe (@CryptoMichNL) November 8, 2023

In the chart he presented the four-year stages through which the first cryptocurrency typically passes:

- bear market — highlighted with a red rectangle;

- accumulation phase — in green;

- first part of the bull market — in purple;

- second (mania) — in light green.

According to van de Poppe, Bitcoin reached the bear market peak in November 2022. The following year saw the accumulation phase run its course.

Ahead is a year of the first part of the bull market, during which Bitcoin gradually rises but does not reach a new high. The latter is typical of the second part, about a year later, the expert explained.

When will altcoins wake up?

Van de Poppe’s optimistic view also extends to altcoins. He is convinced they have also emerged from the bear market.

«Until Bitcoin moves vertically (which does not happen in this cycle phase), altcoins will not “wake up” and will not show five- to ten-fold gains,» the specialist explained.

Last time we saw LINK/BTC reach ATH and the “DeFi Summer,” he noted.

«Over the coming spring/summer we will have a new leg of the market rally. At this stage, if you don’t have positions in the majority of altcoins, now is the time to do so,» Van de Poppe advised.

The expert expects Bitcoin to reach $45,000–50,000 on the eve of halving, followed by a pullback to $32,000–35,000 and a subsequent rise after consolidation.

It’s expected to see #Bitcoin reach $45,000-50,000 pre-halving, after which we’ll have a heavy correction back to $32,000-35,000 and consolidate from there.

Cycles repeat themselves and #Bitcoin has been suffering a lot the past two years.

— Michaël van de Poppe (@CryptoMichNL) November 9, 2023

StockmoneyL analysts drew similar analogies.

Same procedure as every #Bitcoin cycle. pic.twitter.com/Ydvqh8jLAf

— Stockmoney Lizards (@StockmoneyL) November 8, 2023

Colleagues’ conclusions align with trader Rekt Capital’s observations. The latter estimated the progress of the bull market at 26.8%.

#BTC Bull Market Progress:

▓▓░░░░░░░░ 26.8%$BTC #Crypto #Bitcoin pic.twitter.com/7BypMEP3C8

— Rekt Capital (@rektcapital) November 7, 2023

Rise in activity on CEX

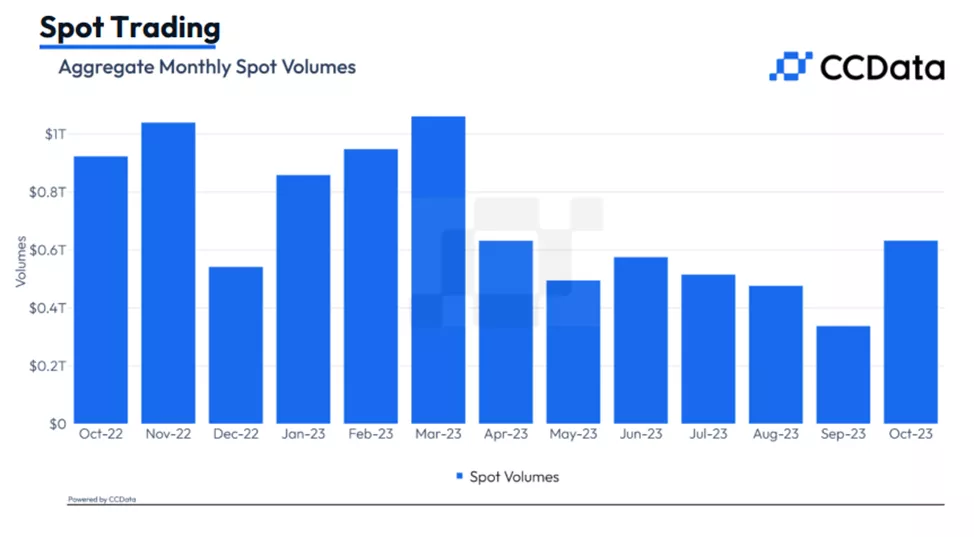

According to CCData, Bitcoin making new highs since May 2022 has been accompanied by higher spot trading volumes. Relative to September, the figure jumped 87.2% to $632 billion.

«This is the highest monthly CEX turnover since March 2023 and the largest monthly increase since January 2021,» analysts calculated.

Experts attributed the activity spike to the expectation of potential approval for the spot Bitcoin-ETF and the general bullish move in prices for major digital assets.

Bitfinex analysts explained holding Bitcoin’s price near $35,000 in hopes of a softer policy by the Fed.

CoinShares likewise concluded similarly. In their assessment, inflows into crypto investment products from Oct 28 to Nov 3 amounted to $261 million, after a record $326 million the prior week in July 2022.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!