Experts warn of rising influence of cryptocurrencies on stock portfolio dynamics

The total market value of the shares of 52 companies that are in some way linked to digital assets amounts to $7.1 trillion. According to financial data provider MSCI, this increases the sensitivity of equity portfolios to developments around cryptocurrencies.

Notably included in the list are the Bitcoin exchange Coinbase, the holders of digital gold as a reserve asset—Tesla and MicroStrategy—as well as companies that have begun offering access to crypto-based products, such as financial holding JPMorgan Chase.

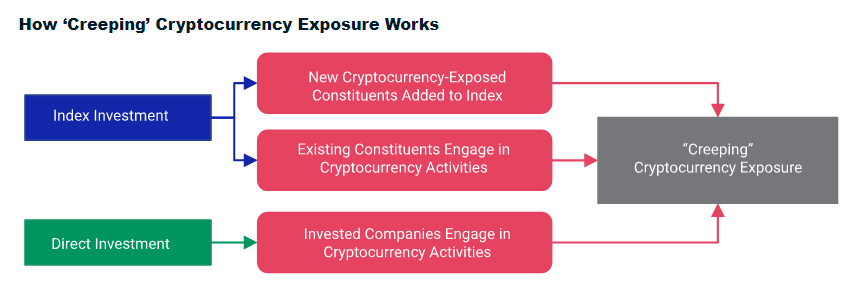

Institutional investors may be underestimating the creeping impact of cryptocurrencies — the shares of companies that have built their business on them are included in indices, and the securities of added players in the portfolio begin to encroach on this space.

MSCI’s report discusses the impact of the volatile asset class through the lens of ESG principles. In particular, the challenges may include mining, the lack of standards for accounting for cryptocurrencies and transparency in how networks operate.

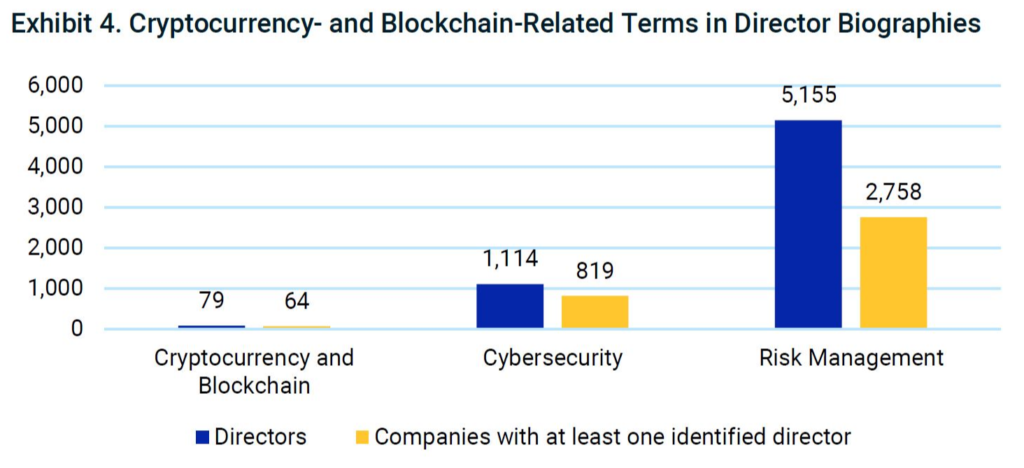

The report noted that board members of public companies have limited knowledge about digital assets.

According to Bloomberg, MSCI studied the biographies of about 6,500 top executives and found that only 79 people mentioned cryptocurrency or blockchain. At the same time, 1,114 listed cybersecurity among their competencies, and 5,155 — risk management.

“In other words, boards of directors will need more laser eyes [Bitcoin supporters], given the impact of cryptocurrencies on business,” the experts concluded.

In October, SEC approved Volt Equity’s filing to launch an exchange-traded fund (ETF) on a basket of stocks of companies, “driving a revolution in the Bitcoin industry.”

Earlier, investment firm Invesco launched two blockchain-focused ETFs.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!