Fed keeps key rate; Bitcoin briefly slips below $26,000

On June 14, the U.S. Federal Reserve System (the Fed) for the first time since March 2022 сохранила the target range for the federal funds rate at 5–5.25% per annum.

The decision came in line with market expectations. According to the Fed, inflation in the United States remains elevated, unemployment is low, and economic activity continues to grow at a modest pace. In the long run, the agency aims to achieve 2% inflation.

“The U.S. banking system is sound and resilient. Tighter lending conditions for households and businesses are likely to affect economic activity, employment and inflation. The magnitude of these effects remains uncertain. The Committee continues to be very attentive to inflation risks,” the press release says.

On June 13, the U.S. Bureau of Labor Statistics published a consumer price index report. The reading came in below analysts’ expectations — year-over-year inflation slowed in May from 4.9% to 4%.

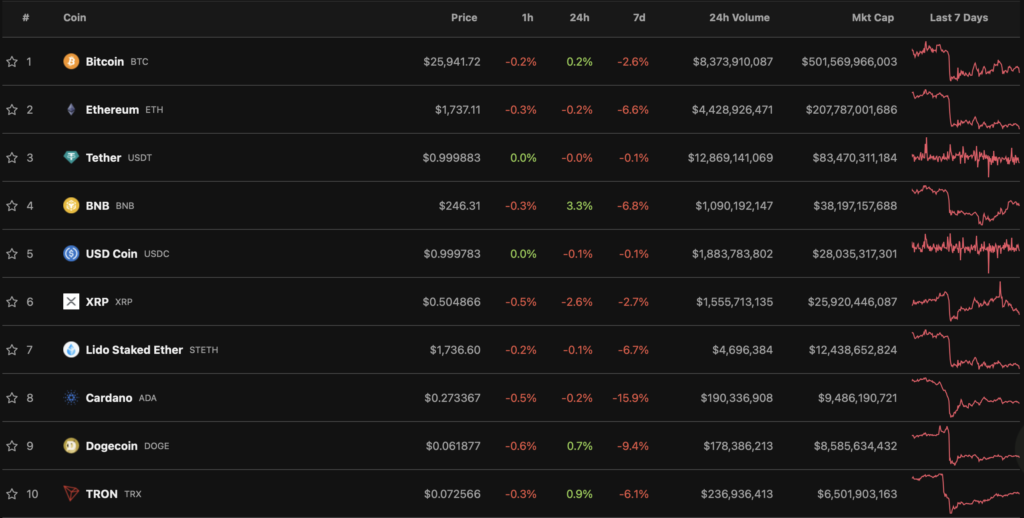

The crypto market hardly reacted to the news. According to CoinGecko, the prices of the largest-capitalization digital assets showed no significant movement.

Bitcoin initially fell to $25,750, then recovered to the $26,000 mark. At the time of writing, the aggregate market capitalization of cryptocurrencies remained at $1.1 trillion.

The rate hold was preceded by a streak of 10 consecutive hikes. Since March 2022 the target range for the federal funds rate has risen by 500 basis points.

As a reminder, in February 2023 the indicator reached 4.5-4.75% per annum. Bitcoin prices reacted by rising above $23 000.

In March Bitcoin held above $28 000 on the back of the Fed decision to raise the rate to 4.75-5% per annum. By the end of the month Bitcoin tested above $29 000.

In May the agency raised the target range to 5-5.25% per annum. Bitcoin then held above $28 500.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!