Fed signals three rate hikes in 2022 amid inflation risks

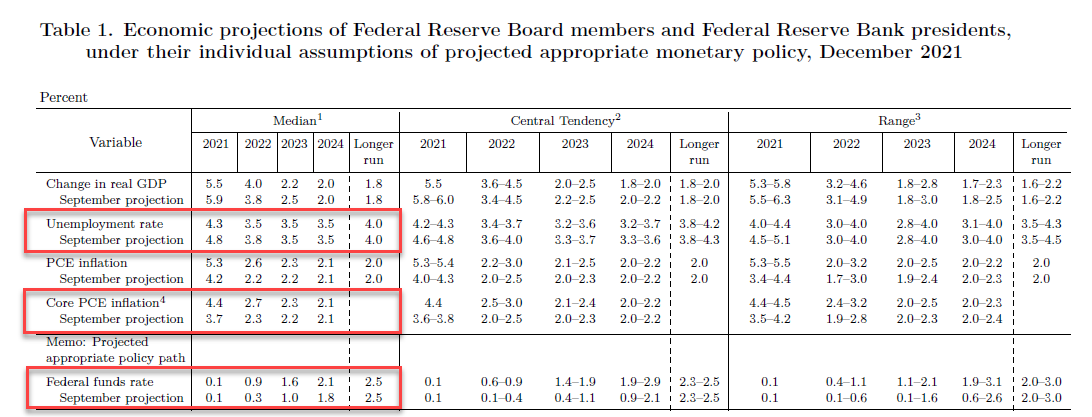

Following the December 14-15 meeting, the Fed pushed back the timing of the end of its asset-buying program from June to March. The updated projections anticipate three rate hikes over the next two years.

The previous allowed forecast in September allowed only one rate hike in 2022 and two in 2023.

The pace of asset purchases tapering was doubled — from $15 billion to $30 billion. On November 30, did not rule out such a scenario during Powell’s testimony before the Senate.

The trigger for the Fed’s stance shift was rising inflation, which by October hit a 30-year high (6.2% year over year).

At the December meeting, the Federal Reserve rejected treating the rise in inflation as temporary. The Open Market Committee raised its inflation forecast—from 4.2% to 5.3% for 2021 and from 2.2% to 2.6% for 2022.

At the press conference, Powell said that rate hikes would not occur before the completion of the QE tapering. He said he could not judge how long this temporary lag would last, but noted that the Fed expects to maintain a steady pace of monetary-policy normalization. Rate hikes could begin before the employment goal is reached because inflation is rising, he added.

The Fed chair drew attention to the risks from the spread of the Omicron variant and allowed for a slower pace of tightening if growth slows. Separately, he described asset valuations as “slightly overvalued”.

Stock markets, gold and reserve currencies in dollar terms strengthened after the Fed decision despite some volatility. That came thanks to Powell’s neutral tone, even as the Fed surprised the market by forecasting three rate hikes in 2022 instead of the two in analysts’ consensus.

The market’s reaction can be explained by doubts that policymakers will be able to deliver on the plan, given growth slowdowns caused by tighter policy.

This is evidenced by the U.S. Treasuries market, whose yield curve has flattened. The inverted yield curve is a leading signal of an impending recession. In particular, the spread between four-year and two-year notes has turned negative.

Cryptocurrencies, like other risk assets, rose on the Fed decision, but the rebound was modest. As of writing, Bitcoin is trading near $49,000, close to the middle of the $46,000-$51,000 range over the last 11 days. Ethereum has reclaimed the $4,000 level.

In a Q&A on December 15, Powell said he does not see cryptocurrencies as a financial-stability risk. He described them as “speculative assets.”

They are not backed by anything. There is a big problem with consumers who may understand, or may not understand, what they are getting, Powell said.

Powell backed the conclusions of the President’s Working Group on Financial Markets regarding “stablecoins,” which called on Congress to treat asset issuers as banks.

Stablecoins, undoubtedly, could become a useful and efficient part of the financial system if properly regulated. They have the potential to scale, especially if linked to one of the very large existing technology networks, Powell said.

In December, held hearings in the U.S. Senate on stablecoins. Earlier, lawmakers requested information from issuers about how stablecoins work.

Earlier, Bank of America called regulation of stablecoins a catalyst for their widespread adoption.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!