Federal Reserve Maintains Key Rate as Bitcoin Shows Tepid Response

On June 18, the United States Federal Reserve maintained its key interest rate within the range of 4.25–4.5%.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. Uncertainty regarding economic indicators has decreased but remains high,” the Fed commented.

The decision aligned with market expectations and the consensus forecast of analysts.

According to the Fed’s statement, recent indicators point to economic activity growth, low unemployment, and stable labor market conditions. However, inflation remains elevated.

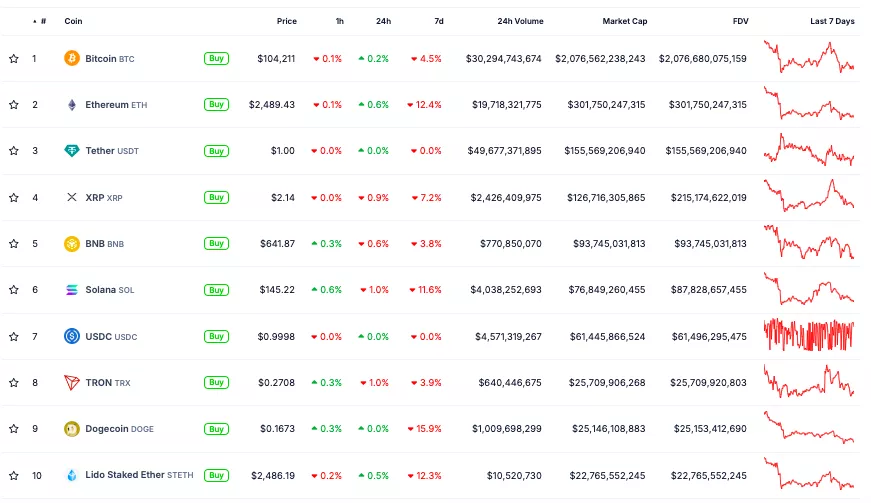

Following the data release, Bitcoin exhibited slight volatility and high trading volumes. Initially, the asset briefly surged to $104,800, but later fell back to $104,000.

At the time of writing, the leading cryptocurrency is trading around $104,500.

Overall, assets within the top 10 by market capitalization showed little reaction to the Fed’s data.

The total cryptocurrency market capitalization stands at $3.35 trillion, having decreased by 1.9% over the past day.

During a press conference, Fed Chair Jerome Powell stated that inflation in the United States remains high, and short-term growth expectations have risen due to trade tariffs.

In May, the U.S. Consumer Price Index increased by 0.1% compared to 0.2% in April. On an annual basis, without seasonal adjustment, the figure rose to 2.4%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!