Fidelity counters common arguments against Bitcoin

Ria Bhutoria, Fidelity Investments’ chief analyst in the digital assets division, offered responses to six of the most common theses against Bitcoin.

From “bitcoin is wasteful” to “bitcoin is too volatile to be a store of value,” our Director of Research @riabhutoria dispels the most common bitcoin misconceptions.

Read now: https://t.co/fBdBEXpOgf pic.twitter.com/hL4HwJzCv7

— Fidelity Digital Assets (@DigitalAssets) November 13, 2020

She laid out the six principal ‘claims’ against Bitcoin and presented her rebuttals.

Too volatile to be a store of value

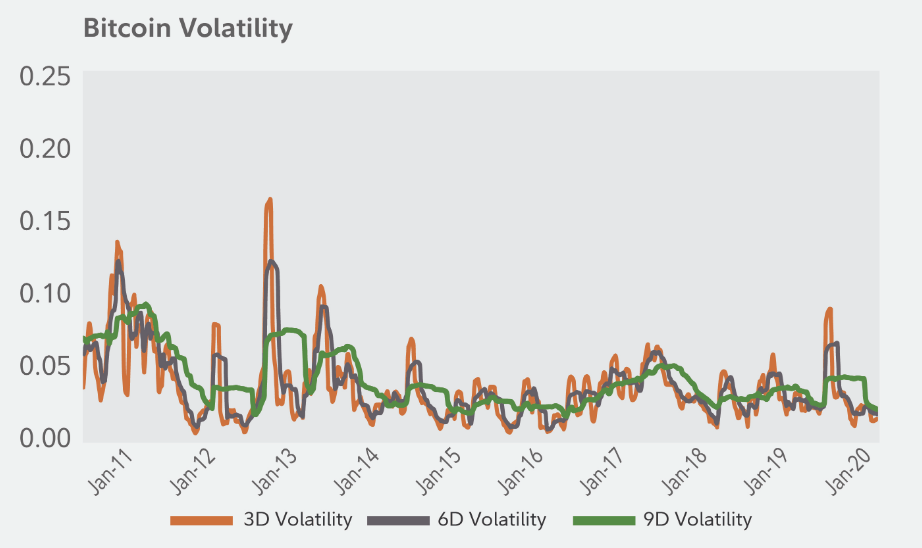

Bitcoin’s volatility is a balance between the absence of central-bank interventions and the inelasticity of supply. The analyst forecasts a continued decline in volatility as derivatives and investment products develop, and as Bitcoin’s broad adoption accelerates.

Bhutoria likened Bitcoin’s development to gold, which was volatile in the early days of exchange trading. For example, in 1973, one-tenth of days saw price moves of more than 3%.

Source: Fidelity Digital Assets.

Not suitable as a means of payment

Bitcoin offers decentralization and immutability, hence its throughput is limited. Given the high guarantees of settlements, the first cryptocurrency is suitable for transactions whose execution through traditional payment channels would be difficult.

Bhutoria noted the potential benefits Bitcoin could bring for settlements between large multinational corporations (and possibly in the future between governments and central banks). Demand for smaller transactions could be met by second-layer solutions.

Mining is wasteful and economically inefficient

A sizable portion of Bitcoin mining is powered by renewable energy or by energy that would otherwise be wasted.

The expert cited Cambridge University’s third global report, according to which the share of miners using renewable energy (RE) reached 76%. According to the document, the aggregate RE share in miners’ energy consumption rose to 39%. The analyst also noted deals to build resource-efficient mining operations, for example involving En+ Group and BitRiver.

Used for illicit activity

The share of Bitcoin transactions related to illicit activity is very small overall.

Bhutoria recalled Elliptic analysts’ findings that this figure stands at 1%. She also urged not to conflate pseudonymity with Bitcoin’s anonymity and drew attention to growing regulatory and industry scrutiny of transaction monitoring.

Not backed by

Bitcoin is not backed by cash flows, industrial utility or the law. It has code and a consensus that are shared by key stakeholders.

The expert pointed to Robert Grier’s «What is a store-of-value asset?» (Journal of Portfolio Management, 1997). Its author identified a group of store-of-value assets, including gold and fiat currencies.

Bhutoria maintains that Bitcoin satisfies the same criteria. Users, miners, developers and nodes make a choice to use and support the network. This is the same belief that underpins fiat currencies—the belief in governments’ and central banks’ ability to manage them, which in recent years has been eroded by crisis responses in the economy.

Will lose out to rivals

While Bitcoin’s blockchain could fork, its community and network effects do not. The first cryptocurrency creates a balance of core properties that the market sees as valuable, the Fidelity Investments analyst argues.

No altcoin has managed to improve Bitcoin’s deficiencies. Competitors have attempted to get around the first cryptocurrency’s limitations (for example, low transaction throughput or volatility). But they have done so by sacrificing the core properties that make Bitcoin valuable (for example, scarcity, decentralization, immutability).

Bitcoin’s market capitalization is orders of magnitude higher than its rivals, Bhutoria adds.

In a recent Citi report, Tom Fitzpatrick called Bitcoin digital gold of the 21st century and pointed to a price path toward $318,315 by the end of 2021.

Earlier, billionaire Stanley Druckenmiller said that Bitcoin could prove to be a better store of value than gold.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!