From MEV to MEV-Boost: Is the ‘invisible tax’ in Ethereum after The Merge still there?

Maximal Extractable Value (MEV) did not disappear after Ethereum’s largest-ever upgrade, The Merge and the move of the second-largest cryptocurrency to Proof-of-Stake. A modified MEV-Boost system, adapted for this algorithm, has emerged.

ForkLog has examined the features of the new solution, its adoption, and its impact on the market.

- The efforts of Flashbots have contributed to the democratisation of MEV opportunities, reduced gas costs, improved transaction privacy, and increased revenues for participants in the network.

- MEV-Boost relayers censor the majority of transactions that may not meet regulatory requirements.

- Some market experts are concerned about the dominance of the Flashbots system, which is not fully decentralised and implies a degree of trust.

MEV explained simply

Maximal Extractable Value (MEV) refers to the profit that miners or validators can earn by freely including, excluding, or altering the order of transactions before the validation of a new block in the network.

“If complex activity involving betting systems, decentralized exchanges or liquidation processes that use these systems occurs on the blockchain, the involved parties may receive additional rewards,” said in the BitMEX Research blog.

As a simple example, researchers point to a market buy of a token on a decentralized exchange, which creates arbitrage opportunities. The first to execute the operation earns a substantial reward. In traditional finance this process is known as front-running.

Those who identify MEV opportunities and execute transactions based on them are called “searchers”.

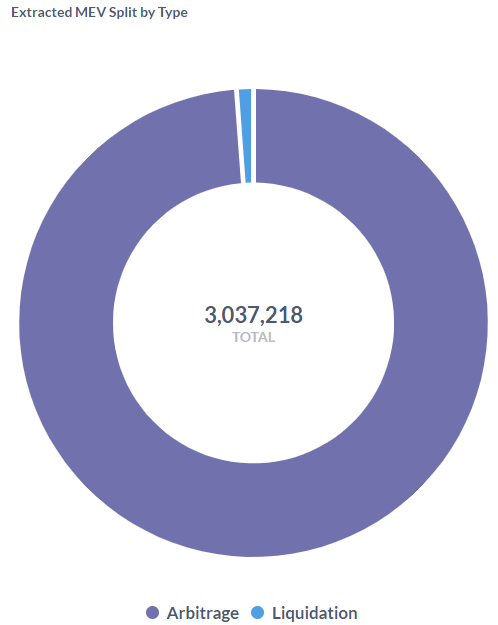

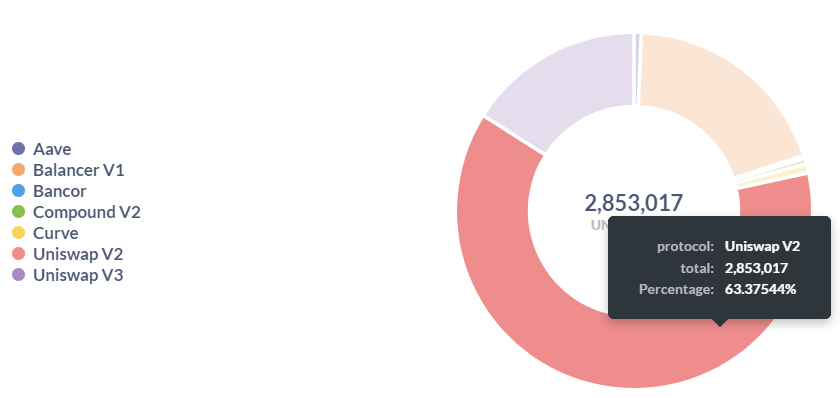

Analysts note that arbitrage operations generate more than 90% of MEV-related revenues.

For this purpose, most market participants use the Ethereum ecosystem’s largest non-custodial exchange, Uniswap.

Consider the generalized example where a user on Ethereum swaps 10,000 USDC for ETH at a price of $2,000 per coin on a DEX in the USDC/ETH liquidity pool. Here is what happens after submitting the swap order:

- Mempool bots monitor unconfirmed transactions and gather data from DeFi apps, including prices and liquidity volumes;

- upon spotting the user’s intention to buy ETH, the bots initiate an operation that pushes up the price just before the user’s transaction is executed. For example, a bot could add more stablecoins to the USDC/ETH pool to lift the price;

- thus, the expected price of $2,000 per ETH shifts to, say, $2,500 per coin. The transaction executes: instead of 5 ETH, the user receives 4 ETH. The initiator’s MEV profit amounts to 1 ETH, minus gas costs.

There are also more sophisticated MEV strategies to extract value:

- backrunning;

- sandwich attack;

- liquidation;

- Uncle bandit attack;

- Time bandit attack.

Because MEV increases user fees, it is also known as the ‘invisible tax’, a phenomenon not unique to Ethereum.

In November 2020, a centralized Flashbots system emerged, funded by the venture firm Paradigm. An open market in the form of a public auction for ETH transactions appeared, operating on the PoW version of Ethereum.

“Flashbots is a system that connects searchers with mining pools. Yet it does not use private contracts or arrangements; it is an open environment. Any searcher and any mining pool can join,” explained on the Alchemy project site.

Researchers argue that such a mechanism benefits the network by preventing “domination by a few private players” and encouraging competition.

“The original Flashbots product—MEV-Geth, a fork of Go Ethereum (Geth) used by miners to produce blocks,” explained on the Alchemy site.

How the system works:

- searchers analyse the blockchain and mempool to identify MEV opportunities;

- upon spotting one, they create a corresponding transaction (or bundle);

- transactions that include miner fees are sent to Flashbots’ server;

- the server forwards the transactions to miners in a way that they do not end up in the public mempool;

- miners select the fattest transactions and accordingly form candidate blocks.

Thus, it resembles an auction in which participants do not know what price others have bid.

“To maintain competition in the MEV-operations market, searchers must offer miners substantial rewards to ensure high chances of winning the auction and inclusion in a block,” noted BitMEX researchers.

Active miners in the system can include any transactions, including those from the public mempool.

In May 2022, more than 90% of Ethereum miners were connected to the Flashbots service. Researchers noted that 63% of MEV transaction rewards went to operators, with the remaining 37% going to miners.

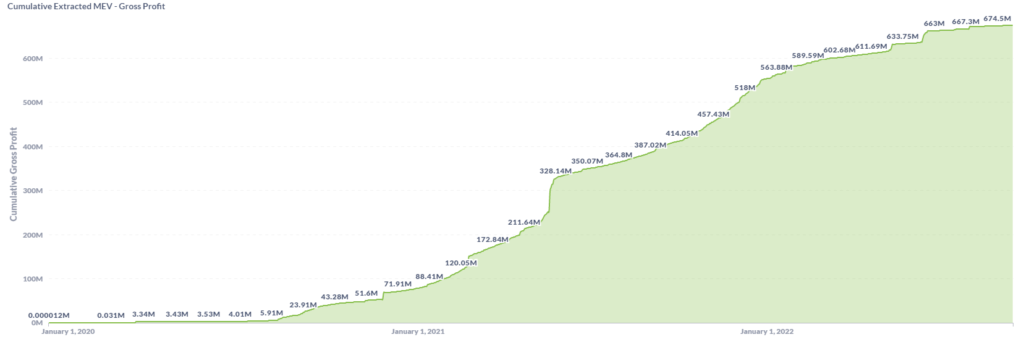

Since the start of 2020, the cumulative MEV total has reached about $675 million.

Thus, MEV remains a significant phenomenon in the ecosystem, influencing transaction fees. The MEV factor became particularly evident in 2021.

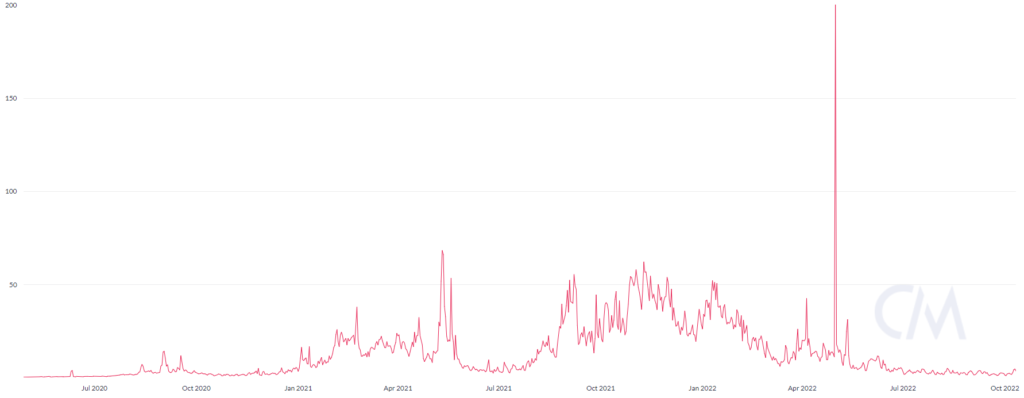

“When searchers saw MEV strategies from other searchers in the mempool, they immediately copied them with higher gas fees. Adopting a scorched-earth approach, searchers competed with each other for MEV opportunities. As a result, fees for all Ethereum users rose rapidly,” explained BitMEX Research analysts.

According to them, instead of sending MEV transactions to the open mempool, searchers began sending them privately to miners. This helped avoid the race that pushes up fees for many users.

However, BitMEX Research emphasised that this approach risks centralising mining.

“It is not hard to see why such a system could lead to a single dominant block producer. In the long run, this could undermine all key Ethereum characteristics, as a miner-monopolist could censor transactions,” noted the analysts.

MEV-Boost

The largest upgrade in Ethereum’s history — The Merge — did not put an end to MEV. A modified MEV-Boost system tailored for the Proof-of-Stake (PoS) algorithm has emerged.

Days after the upgrade, developer Elias Simos analyzed the first ~24,000 Ethereum blocks. He

We looked at the first ~24k blocks post-Merge and compared the performance of block proposers that are running mev-boost vs those that aren’t.

This is what we found 👇 pic.twitter.com/ko2gY6IBWT

— Ξlias Simos 🍬 (@eliasimos) September 19, 2022

Thanks to MEV-Boost, validators using it were able to earn 122% more profit. The blocks they formed contained 41.4% more transactions.

Additionally, MEV-Boost helped eliminate empty and missed blocks. Among validators not using this feature, the share was 1.2% and 1.5% respectively.

The modified system was created by the aforementioned Flashbots. In the developers’ view, MEV-Boost should counter the negative effects of maximal extractable value in the Ethereum ecosystem.

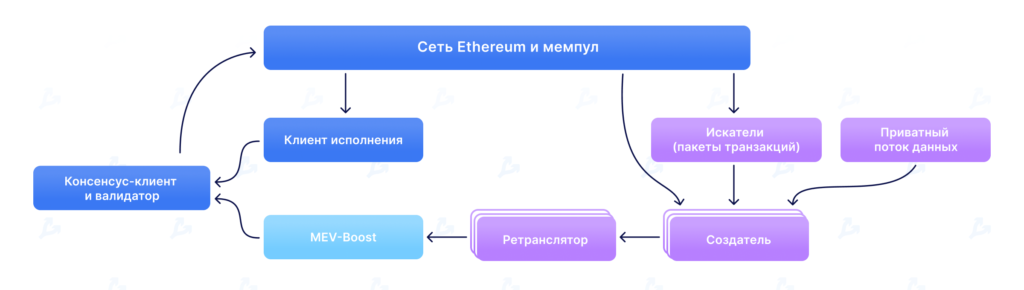

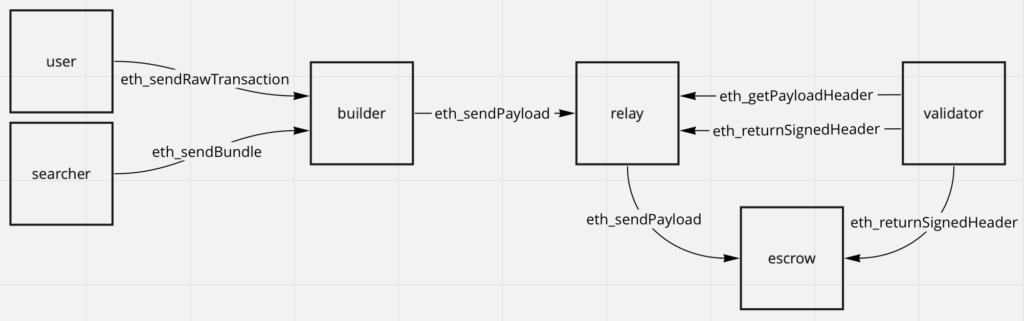

“As with MEV-Geth, MEV-Boost enables PoS validators to outsource block production. But the current design of the new solution has some differences: Builder API, block builders, escrow, and validators,” explained researchers at Alchemy.

Builder API — a modified version of Engine API used by Beacon Chain nodes to connect execution clients responsible for block creation, as well as consensus clients offering blocks.

Block builders (builders) “invest in specialized hardware necessary for the resource-intensive production of blocks.” Receiving transactions from searchers, they “form the most profitable block using various strategies”.

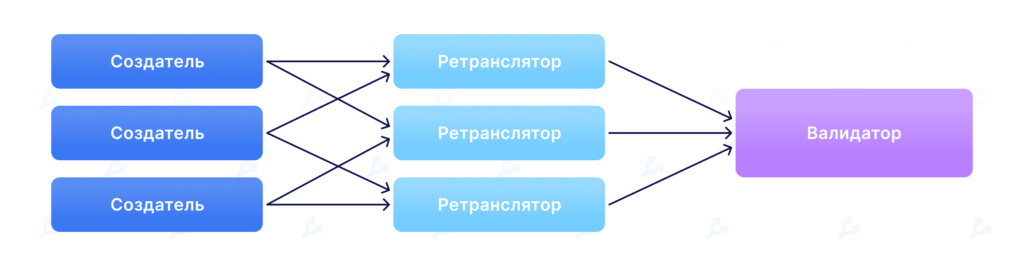

Relayers (relayers) verify blocks before forwarding them to validators. They also protect the network from spam and assess the MEV reward value.

Escrow receives the block contents from the relayer, ensuring data availability for the validator.

“Relayers must also trust the escrow not to reveal data to the validator before it is signed,” explained at Alchemy.

In the MEV-Boost architecture, a validator— a Beacon Chain staker chosen to propose a block for a specific slot— interacts with a relayer to obtain the most profitable block header, confirming it with a signature.

After adding the block to the chain, the validator receives transactional fees and MEV tips.

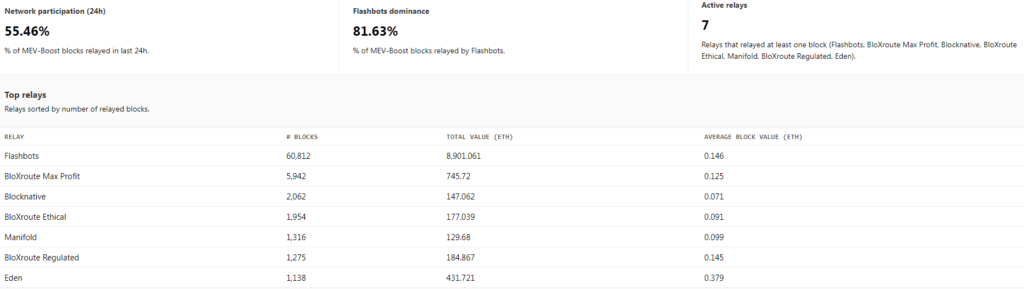

Flashbots holds an absolute lead in MEV (81.98%).

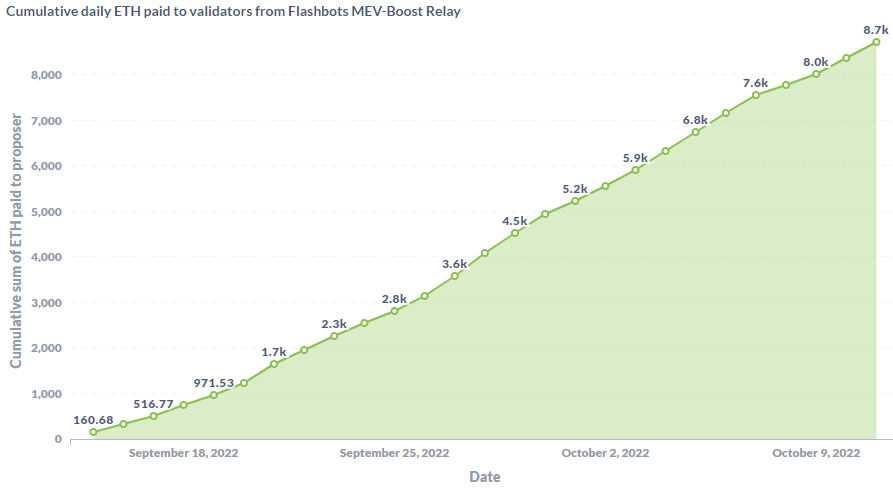

A chart below illustrates the cumulative sum handed to validators by the largest MEV-Boost service. As of 11.10.2022 the figure exceeds 8,700 ETH.

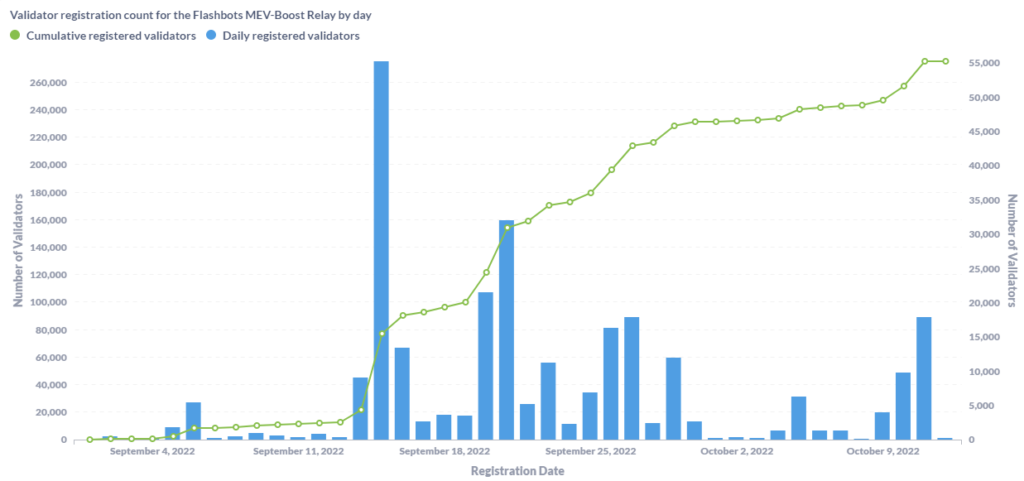

On the next chart you can see that the number of validators registered to interact with Flashbots is steadily increasing.

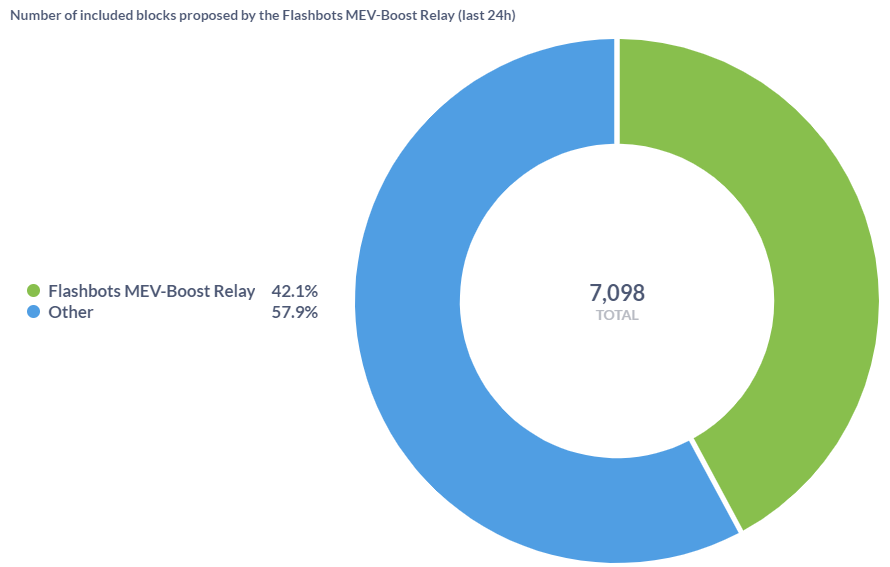

The share of blocks bypassing the largest relayer has already exceeded 42%. Other on the chart denotes other MEV-Boost services as well as regular blocks from the Ethereum mempool.

The remaining portion of the MEV pie—just under 20%—is accounted for by six other relayers:

- BloXroute Max Profit;

- Blocknative;

- BloXroute Ethical;

- Manifold;

- BloXroute Regulated;

- Eden.

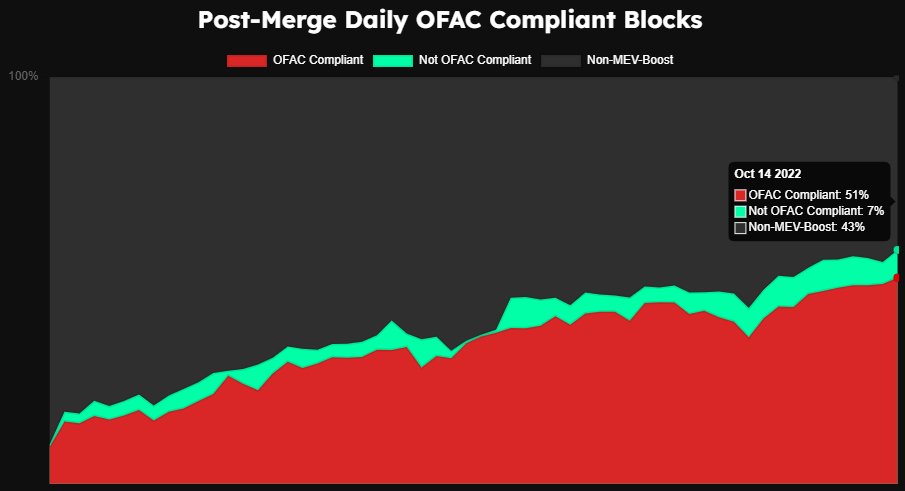

Some, including BloXroute Regulated, censor certain transactions in line with the US Treasury’s Office of Foreign Assets Control (OFAC) requirements. For example, those related to the Tornado Cash mixer.

By mid-October the share of regulator-compliant blocks exceeded 50%.

According to researcher Toni Wahrstätter, in almost two weeks after The Merge activation, not a single Tornado Cash-related transaction passed through a Flashbots relay.

Data shows that the Flashbots MEV-Boost Relay (same for the Flashbots builders) is censoring @TornadoCash transactions.

Since the Merge, not a single transaction interacting with the Tornado Cash contracts has been included in their MEV-boosted blocks. /1 pic.twitter.com/C1fbvolCcX— Toni Wahrstätter (@Nero_ETH) September 27, 2022

Blocknative predicts that over time Ethereum will see different block types:

- blocks with the maximum number of MEV transactions;

- blocks with MEV for charitable purposes;

- blocks with specific gas prices;

- time-ordered blocks;

- auctioned blocks;

- blocks with censorship;

- uncensored blocks.

It is also expected that due to epoch-specific dynamics (validator selection and block creation), MEV operators will know in advance which validators will propose the next block. This may lead to entirely new, long-term strategies.

Advantages and drawbacks of MEV-Boost

Experts at Alchemy list the following positives of MEV-Boost:

- democratisation of MEV opportunities, accessible to solo stakers as well;

- lower gas costs;

- enhanced privacy for Ethereum users.

They also note that maximal extractable value may lead to the emergence of permissioned mempools or a rise in off-chain operations among traders and block producers. This poses a potential threat to Ethereum’s decentralisation. MEV-Boost addresses this by democratising access to the system.

Additionally, large, high-yield staking pools may reinvest MEV profits to “unlock even more MEV opportunities”.

“In such a scenario, solo stakers may be pressured to join large pools to maximise yield. This matters because post-The Merge block rewards have fallen and MEV has become a meaningful part of validators’ remuneration,” researchers noted.

Alchemy emphasises that with MEV-Boost any validator gains access to MEV, while large staking pools do not have levers to monopolise.

As noted, MEV pushes up transaction fees via gas-auction dynamics within the DeFi sector (notably trading bots). The contribution of MEV-Boost is to shift these auctions off-chain.

“Ethereum users, especially DeFi participants, also benefit from increased transaction privacy. Using MEV-Boost is arguably the safest (and legal) way out of the ‘dark forest’ of the public mempool,” the researchers added.

The second-largest cryptocurrency is moving toward Proposer-Builder Separation (PBS), a key step toward dan kin sharding.

“Maximal Extractable Value gives validators and miners incentives to reorganise Ethereum, enabling ‘Uncle bandit’ attacks and off-chain operations with traders. PBS is designed to reduce MEV’s impact on consensus security,” the Alchemy analysts explained.

According to them, Flashbots’ MEV-Boost can be viewed as a precursor to Proposer-Builder Separation at the protocol level.

mev-boost is an implementation of proposer-builder separation (PBS) built by Flashbots for proof of stake Ethereum. Validators running mev-boost maximize their staking reward by selling blockspace to an open market of builders.

Learn more: https://t.co/lGtLI0wgyf pic.twitter.com/7OkPnW42xA

— Hasu⚡️🤖 (@hasufl) September 19, 2022

In a conversation with CoinDesk, Wahrstätter noted the following:

“Flashbots has done a lot to take MEV under control. It also opened the source code for MEV-Boost before The Merge, allowing competitors to enter the block-building market. It’s important to emphasise that Flashbots is fighting on the right side.”

Using the new solution significantly boosts validators’ profitability.

“This could increase rewards by 75.3% or yield an APR of 12.86% instead of 7.35% when staking ETH,” the Boost site notes.

However, BitMEX researchers contend that Flashbots’ system needs a profound overhaul, as it entails a degree of trust.

“It is not yet fully decentralised or permissionless. The relayer acts as a trusted escrow between the proponent (the validator) and the block builder. In this role, it can influence both sides,” explained on the project site the Boost site.

Drawing an analogy with Lido, some market participants argue that the system resembles a DAO aimed at removing centralised components.

“What Flashbots essentially achieved was to sacrifice decentralisation in MEV extraction to enable open participation instead of a closed system. That trade-off seems justified,” BitMEX researchers concluded.

Conclusions

The volume of maximal extractable value continues to grow as DeFi develops.

Flashbots has performed a commendable job. Its efforts have helped lower the average gas price, increase transparency, and democratise MEV opportunities. Yet some community members worry about the concentration of relayers that require trust.

Undoubtedly, MEV opportunities will endure in the future, particularly amid a forthcoming bull market. The next cycle will come sooner or later, reviving activity in the DeFi space.

Follow ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!