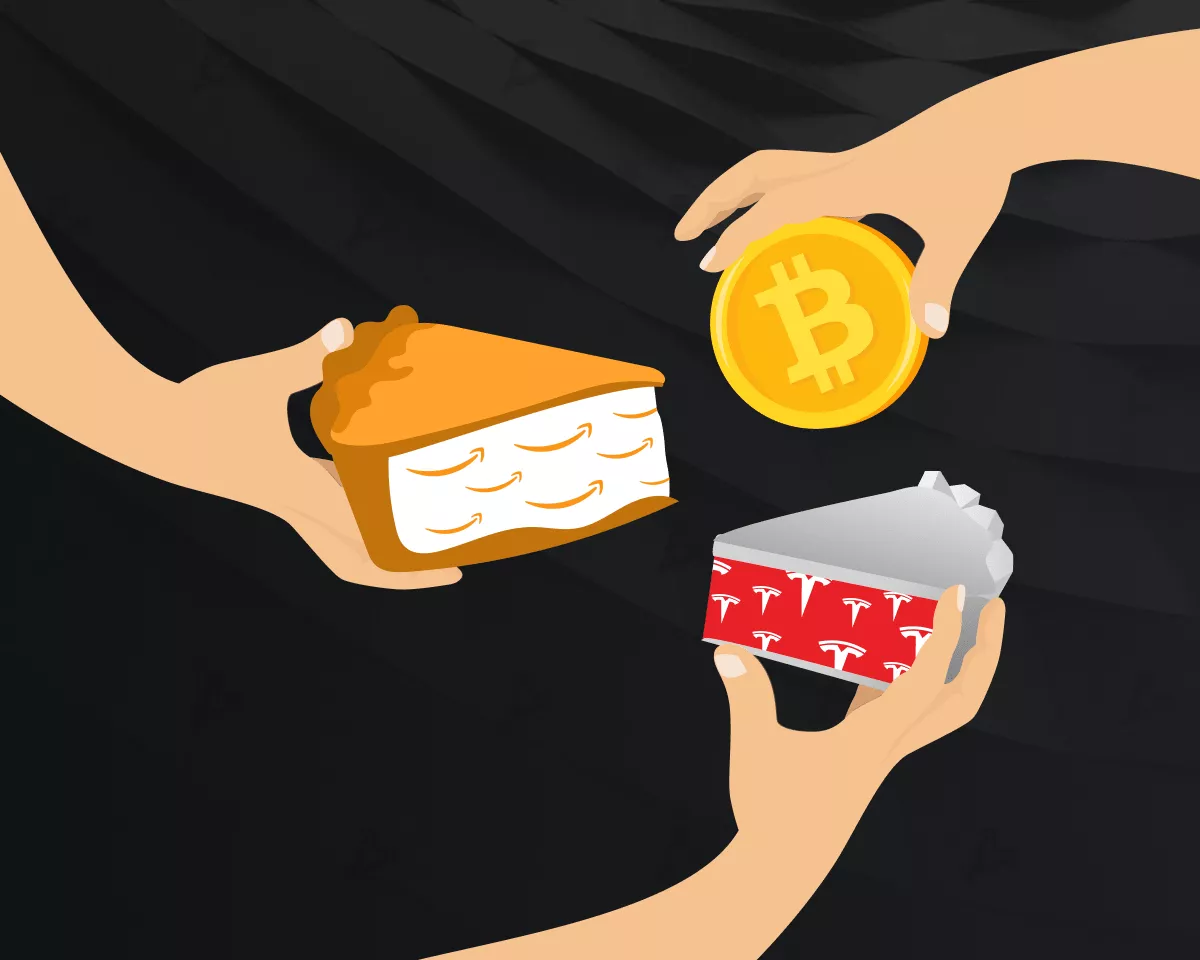

The cryptocurrency derivatives exchange FTX announced the listing of tokenised shares, including Tesla (TSLA), Apple (AAPL), Amazon (AMZN), Facebook (FB), Google (GOOGL), Netflix (NFLX) and the SPDR S&P 500 ETF. Trading of tokenised assets will begin next week. FTX announced this on ForkLog Hub.

\n

Users will be able to purchase on FTX tokens that grant a right to a fraction of a real company’s share.

\n

“FTX lowers the barrier to entry for the stock market. Fractional assets will allow traders to trade the shares of the world’s largest companies even with a small amount of capital,” said FTX representatives.

\n

When dealing with tokenised assets, traders will pay the standard FTX commissions: 0% for market makers and 0.04–0.07% for market takers.

\n

The real securities are held by FTX’s partner CM-Equity, a German investment company. To trade tokenised shares, you must submit verification documents to CM-Equity after completing KYC 2 on FTX.

\n

FTX is a cryptocurrency derivatives exchange supporting spot, futures and over-the-counter trading. On FTX you can trade BTC options, leveraged tokens and MOVE contracts.

\n

Until November 4, the crypto exchange is running a promotion awarding bonuses to new users. 2,000 participants will receive from $5 to $500. The size of the bonus depends on the trader’s net deposit.

\n

Earlier FTX launched “Three-Digit Tournament” for Russian-speaking traders. Participants’ objective is to achieve the largest trading volume. Winners will receive from $333 to $999. Registration is open until October 31.

\n

Follow Forklog news on Facebook!