Glassnode analysts concede Bitcoin may have bottomed

Bitcoin has not been able to break out of the February-formed range, but the process of redistribution of coins from speculative investors to hodlers has already run its course. Glassnode did not rule out such a scenario.

This bear market has restructured #Bitcoin ownership, with $BTC moving out of Short-Term speculative, and towards Long-term investor hands.

On a statistical basis, it appears we have just seen the largest capitulation of both cohorts.

Read our analysis👇https://t.co/jooUzNt5k8

— glassnode (@glassnode) April 19, 2022

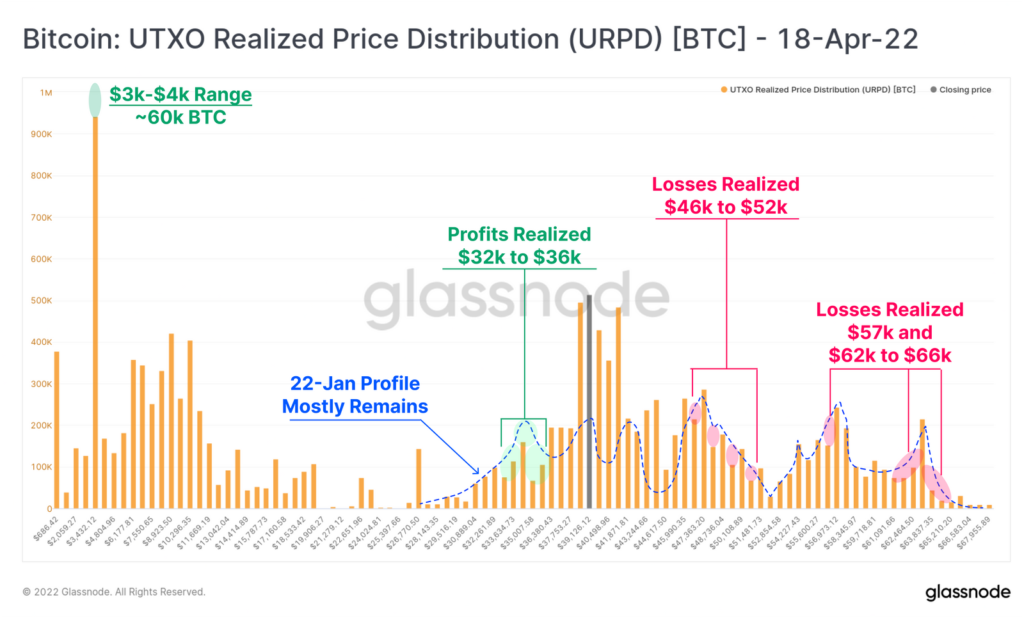

Experts again reminded of coin accumulation in the corridor $35,000-$42,000. Comparing the UTXO at the time of writing and as of January 22 (marked by a blue dashed line), they drew the following conclusions:

- The past 2.5 months of consolidation did not lead to active moves, including among those who hold coins at a loss;

- Many investors replenished their wallets again at prices from $38,000 to $45,000;

- The majority of Bitcoin bought above $40,000 moved into wallets of those who can be classified as hodlers;

- The bulk of redistributed coins came from bottom-fishers in the $32,000-$36,000 range and long-term investors who bought Bitcoin at $3,000-$4,000 (the latter sold a substantial 60,000 BTC);

- The share of those who bought after the all-time high in November has declined (they incurred losses).

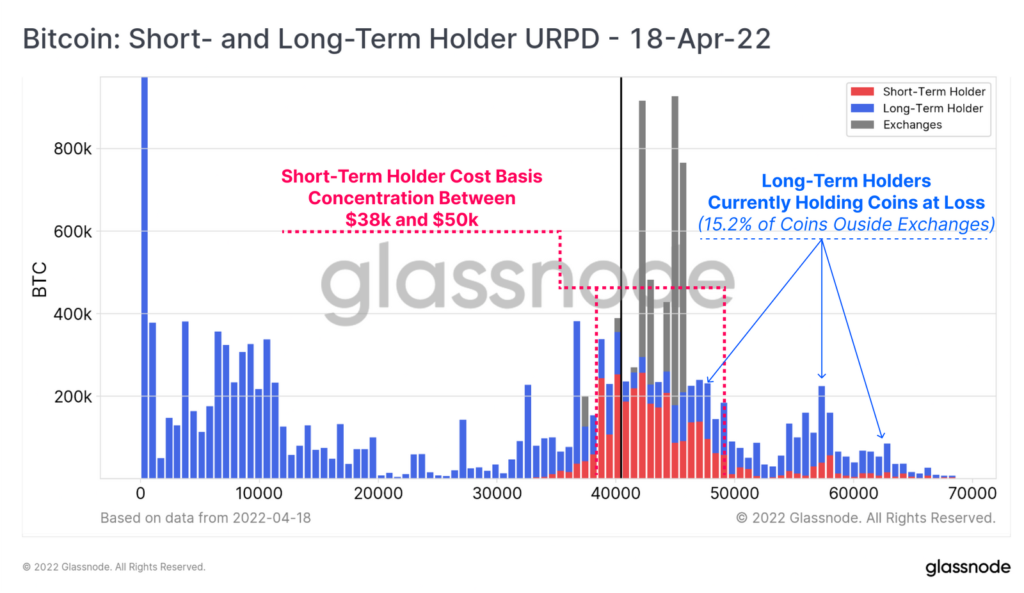

According to the market-profile chart, only a handful of speculators remain who bought BTC in the $50,000-$60,000 range, with most purchases concentrated in the $38,000-$50,000 band.

Hodlers hold 15.2% of the total circulating supply in loss, having endured the current 50% correction. In analysts’ view, this signals a low likelihood of downside selling pressure in the future.

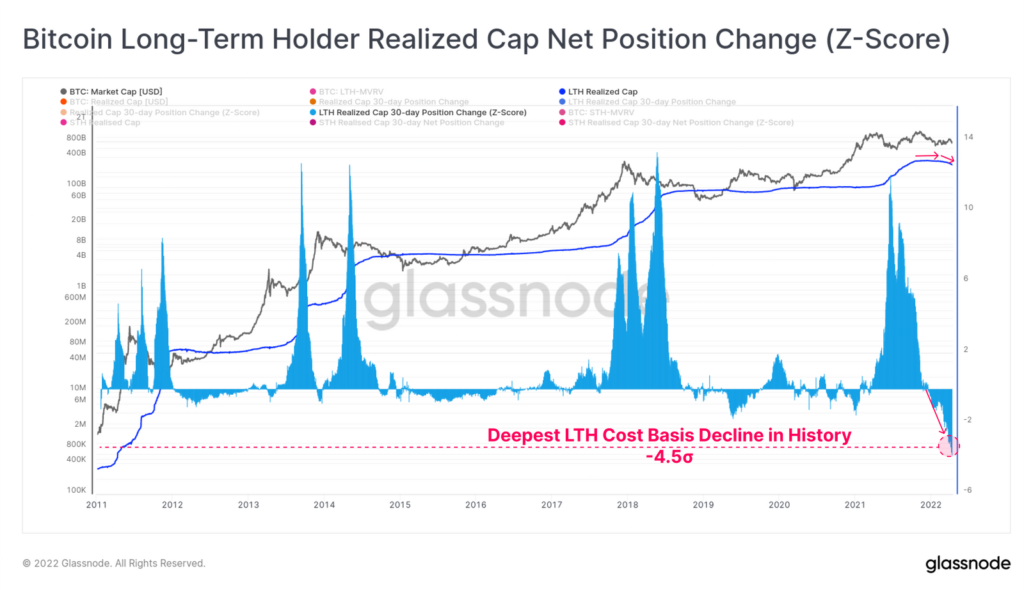

The pace at which coins moved into unrealized losses during the current correction proved significant in historical perspective.

Such a severe drop in net realized capitalization attributable to short-term investors (three standard deviations) has occurred only twice — at bear-market extremes of 2018. The current dynamics have surpassed the July 2021 correction.

More dramatic (4.5 standard deviations) declines were recorded by analysts in the metric for long-term investors. They were unprecedented.

According to the analysts, the most persuasive explanation is the capitulation of hodlers frightened by the pace of the current correction. They characterised buying at prices below the average cost and the shift of speculators into the long-term investor category as less significant factors.

As previously noted, Nexo head Antoni Trenchev predicted Bitcoin to rise to $100,000 within a year.

Co-founder of BitMEX Arthur Hayes called a likely drop of Bitcoin to $30,000 by the end of the second quarter due to Nasdaq declines.

Earlier Arcane Research found that the correlation between Bitcoin and tech stocks had reached its maximum since July 2020.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!