Glassnode analysts flag bear trend in Bitcoin price

A record drawdown in Bitcoin’s price since July 2021, sizable realized losses among short-term investors, and the steadfastness of hodlers — all point to a bear trend for Bitcoin, according to Glassnode.

#Bitcoin bulls have been put firmly on the back-foot, with prices cut in half since the Nov ATH.

In our latest analysis we seek to define whether #Bitcoin has entered a prolonged bear, using investor psychology, behaviour, and network profitability.https://t.co/4N1FKeHZHM

— glassnode (@glassnode) January 24, 2022

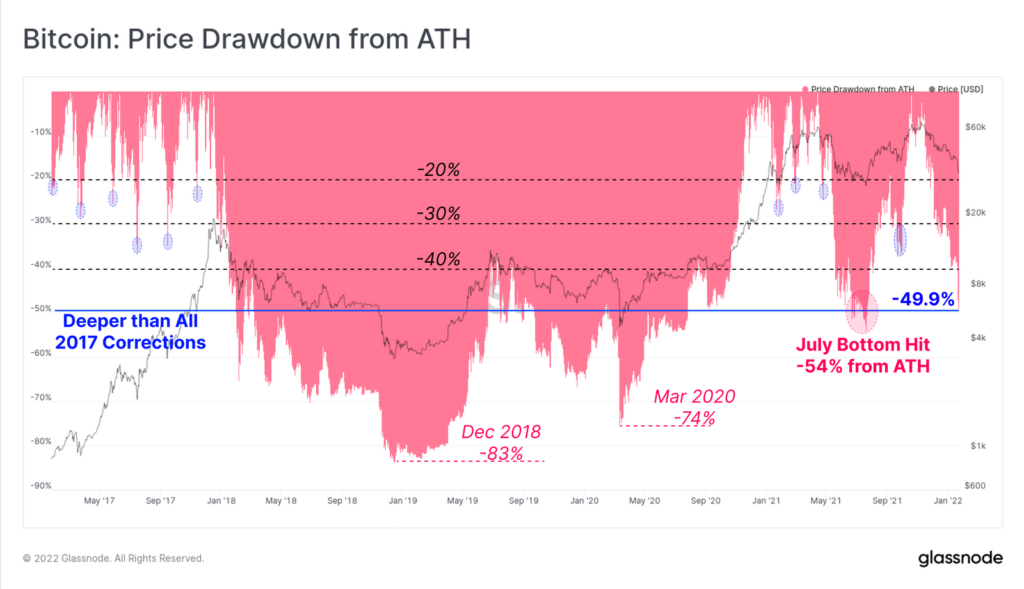

As of writing, Bitcoin’s pullback from its all-time high has nearly reached 50%. After the bear market of 2018–2020, the current decline is the second deepest since July 2021, when this metric stood at 54%.

By contrast, corrections within the 2017 and 2020–21 bull cycles did not exceed 20–40%. Analysts warned that such a disposition could alter investors’ perception of macro market conditions.

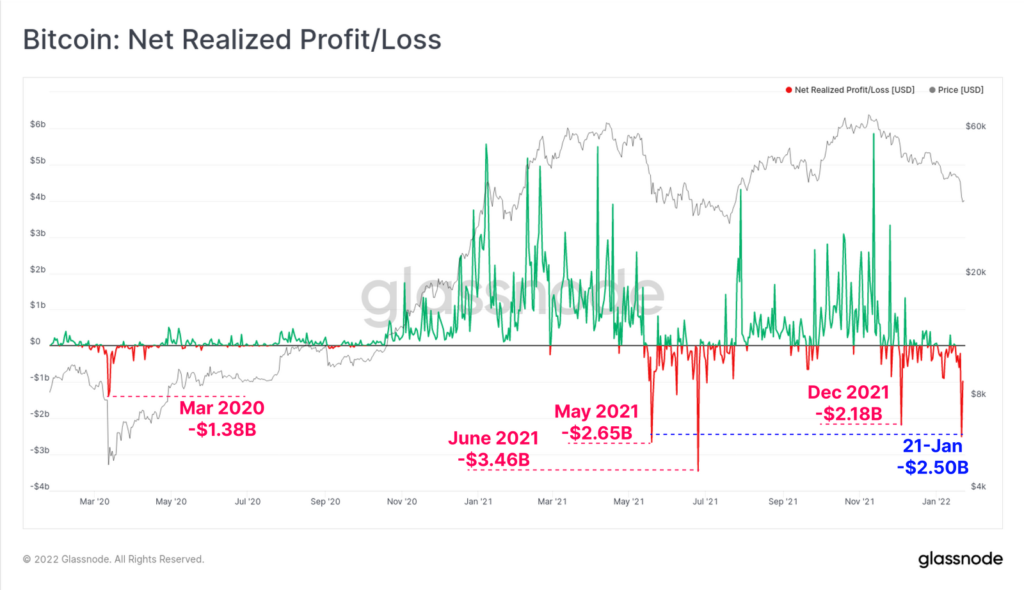

Last week, net realized losses (Net Realized Profit/Loss) totaled $2.5 billion. In other words, the market saw liquidation of positions at losses relative to the prices of previous on-chain operations. The lion’s share of this amount fell to short-term investors who last moved coins more than 155 days ago.

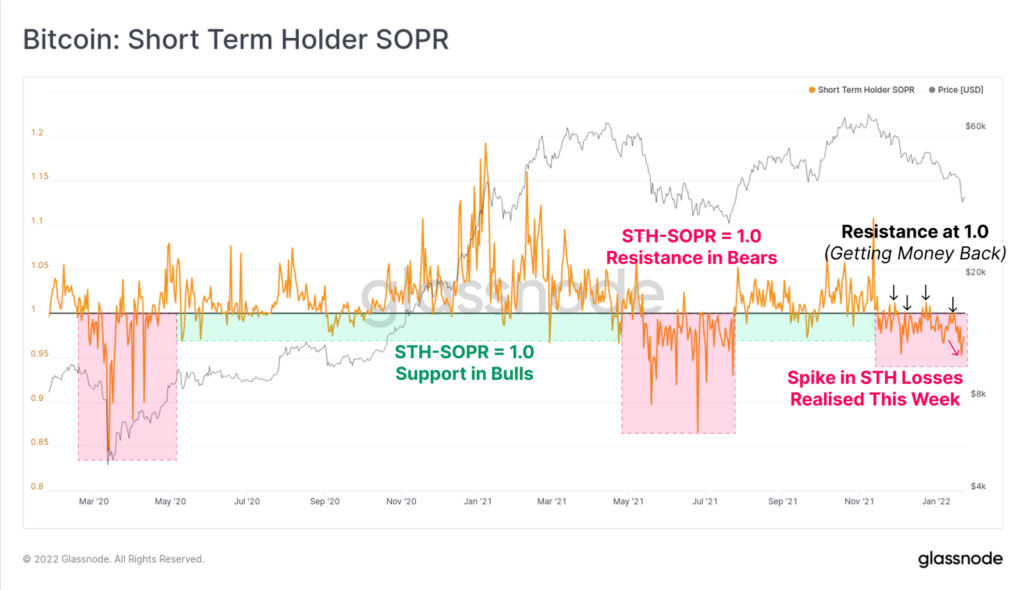

The Short Term Holder SOPR, applied to short-term investors, collapsed after testing resistance at the 1 level. Such dynamics indicate this group’s eagerness to ‘get their money back at any price’. Lower values point to growing relative losses.

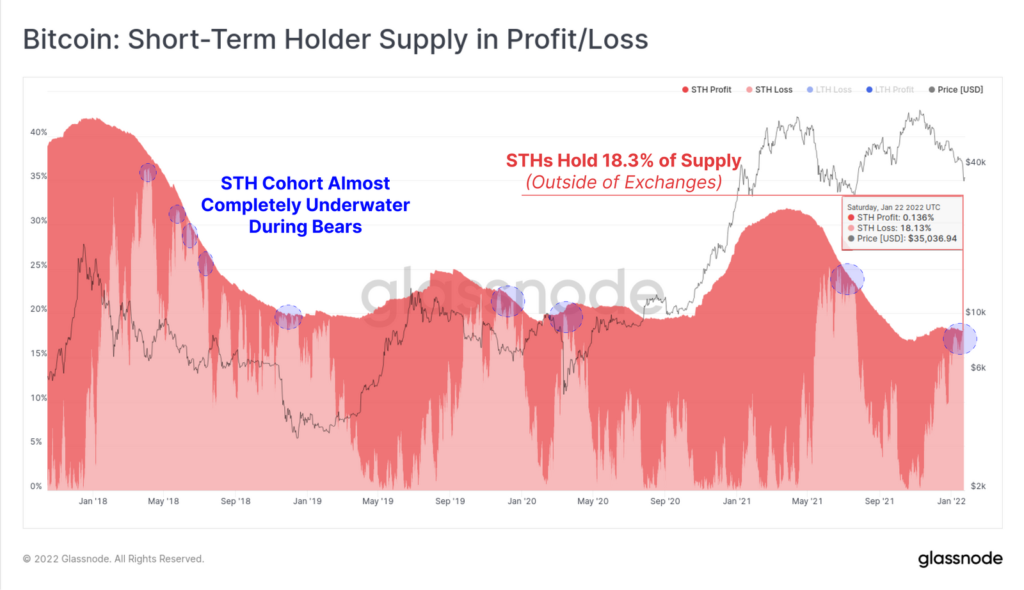

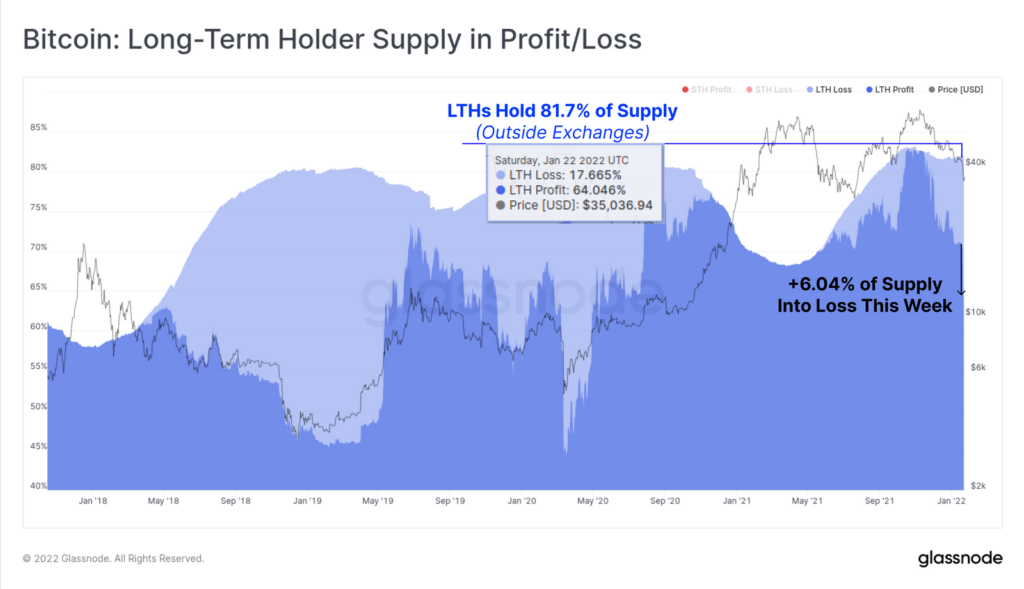

Experts estimate that short-term holders account for 18.3% of the total BTC supply (excluding exchange-held coins). Almost all of them are ‘in the red’ for the owners.

‘This creates a psychological barrier, which further increases the chances of selling’, the analysts said.

The share of coins held by short-term holders is near multi-year lows. The correction did not derail hodlers — they increased their share to 81.7% of the total supply, even as 6.04% of their BTC became unprofitable.

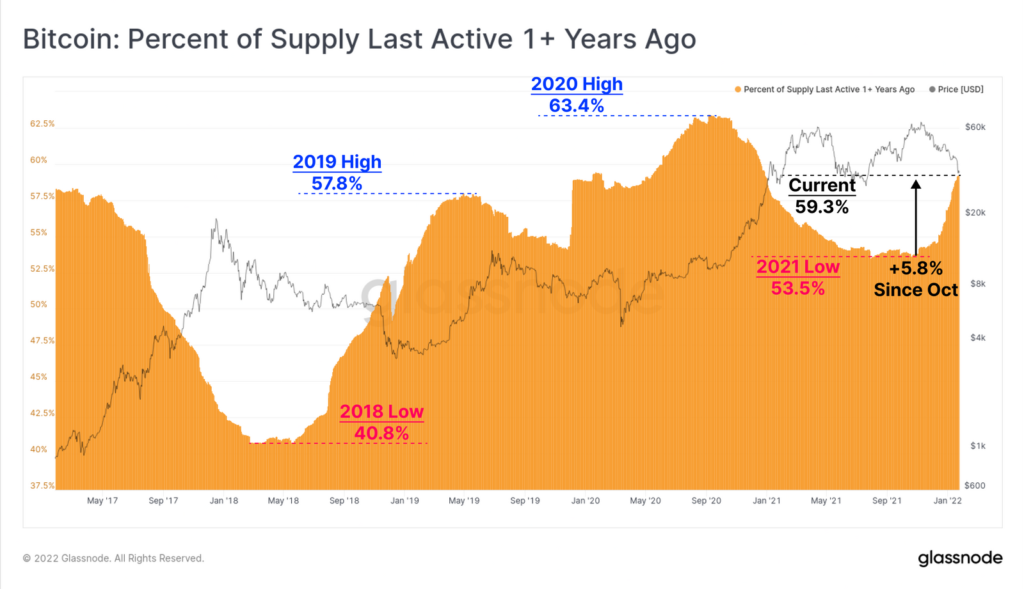

An age-based analysis showed that 59.3% of BTC last moved on the network more than a year ago. These are the coins that investors bought in the early part of the bull cycle (between October 2020 and January 2021) or earlier. Over the past three months, the figure rose by 5.8%. Experts noted that such behaviour is typical of bear markets.

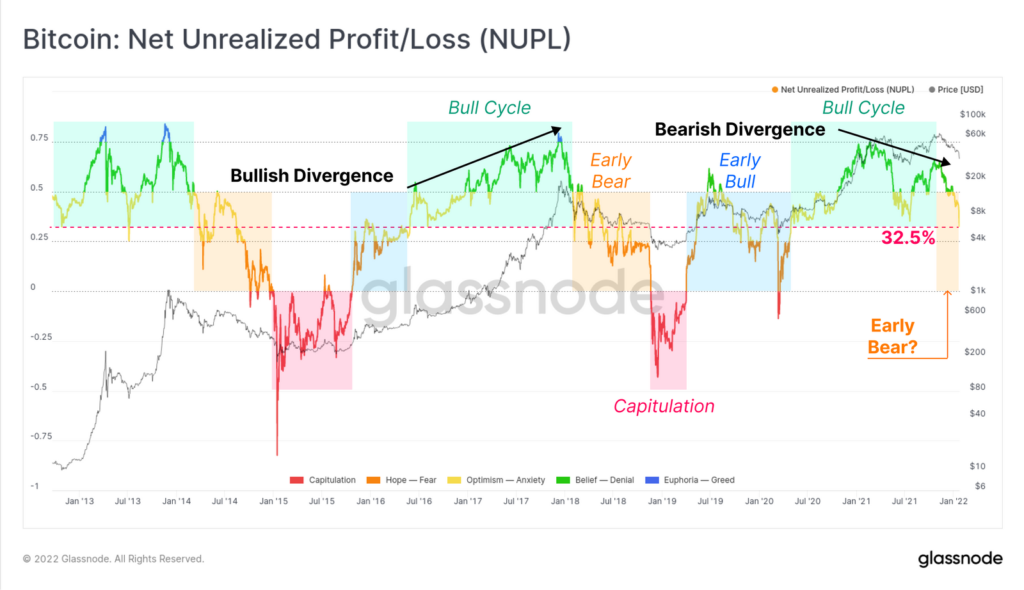

Analysts also examined the divergence between unrealized profits and losses based on the latest coin movement (Net Unrealized Profit/Loss, NUPL). It stood at 0.325, meaning roughly 32.5% of coins are in unrealized profit. This contrasts with the March reading of 0.75 and 0.68 in October last year.

‘Given previous cycles, such low profitability is typical of the early and middle phases of bear markets (highlighted in orange). Unlike the bull markets of 2013 and 2017, NUPL declined between the peaks of March–April and October–November. The reason lies in the distribution of coins at the highs. This led to higher overall market value and bearish divergence’, the analysts concluded.

ATH Analysts at UBS warned of the risks of an apocalyptic crypto-winter.

Invesco allowed Bitcoin to fall below $30,000 in 2022, as ‘the asset bubble is deflating’.

Subscribe to ForkLog’s news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!