Glassnode analysts report improvement in key metrics ahead of Bitcoin ETF launch

The state of the derivatives market and on-chain metrics confirm the enthusiasm of participants in the cryptocurrency market ahead of the launch of the first in the United States Bitcoin futures ETF. The same conclusions are contained in a report by Glassnode analysts.

#Bitcoin has broken above $60k and is consolidating just below the all-time-high.

We analyse whether Long-Term Holders are spending or HODLing through the rally, and whether risk is growing in options and futures markets.

Read more in The Week On-chainhttps://t.co/7dxNnSnt99

— glassnode (@glassnode) October 18, 2021

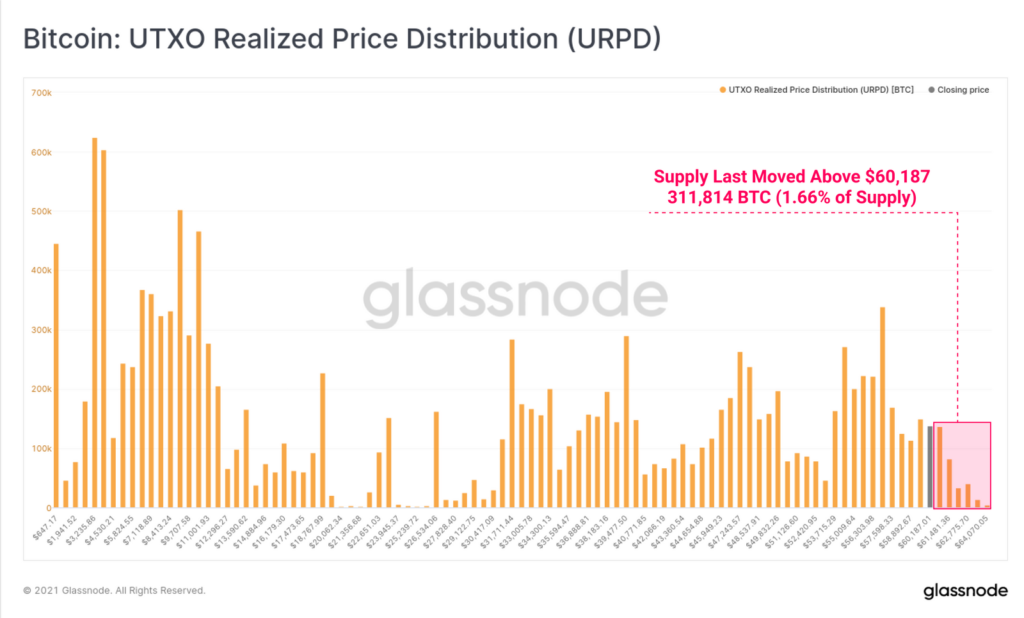

At the time the report was compiled, only 311,800 BTC remained whose movements were tracked at higher prices. These coins comprised just 1.66% of the total supply of digital gold. In other words, 98.34% of all BTC in circulation among investors were in unrealized profits.

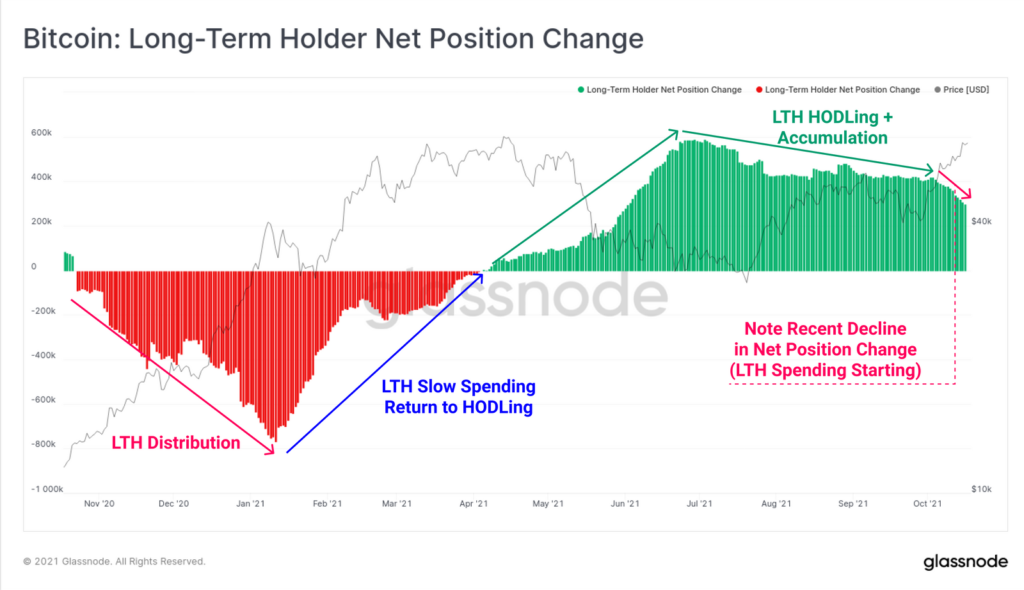

As prices rose above $60,000, holders started to realise profits. Nonetheless, the tendency to spend coins did not become dominant. Broadly, long-term investors tend to buy at market lows during bear phases and move to selling as prices approach and surpass prior highs, the analysts noted.

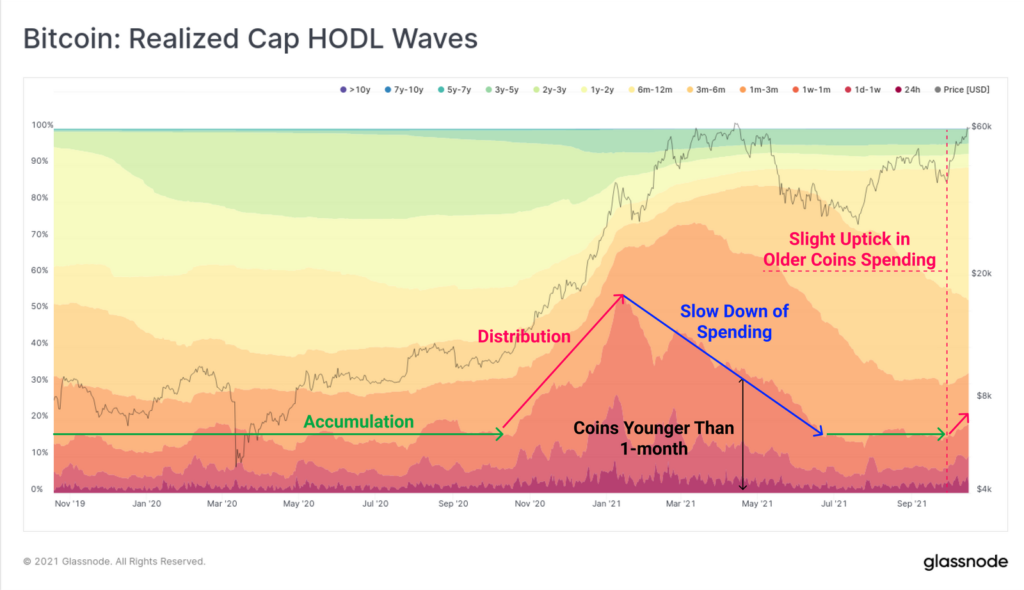

“The coin-age map shows a pause in the downtrend for younger BTC under one month old due to some unloading of older coins.”

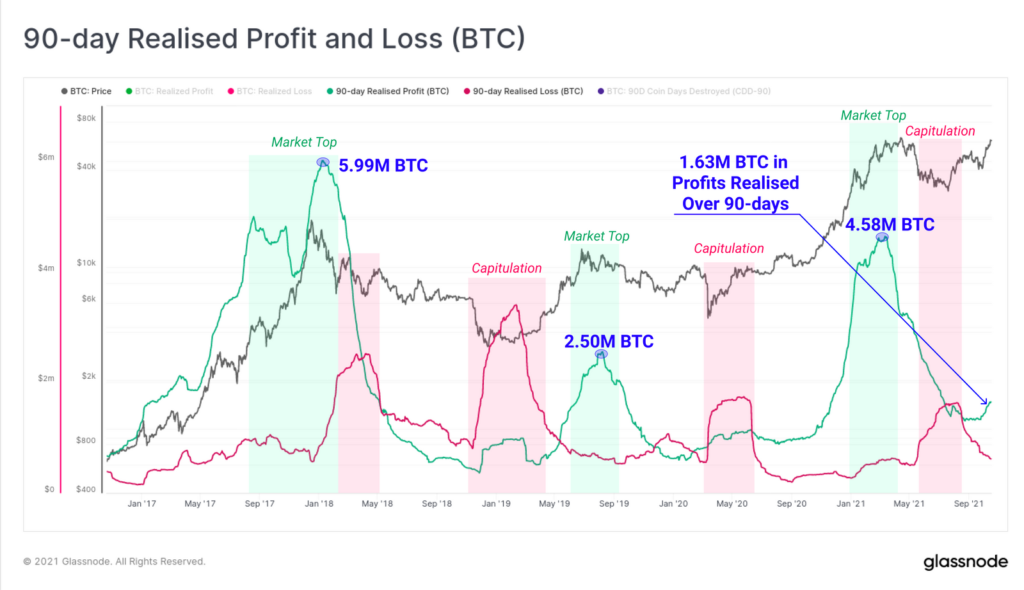

Over the last 90 days, investors realised profits of 1.63 million BTC and 676,000 BTC were sold at a loss. Analysts compared these figures with previous extremes. At the peak of 2018, profits were realised in 5.99 million BTC, in 2019 — 2.5 million BTC, just before the May correction — 4.58 million BTC.

“Current outlays are relatively modest relative to network valuation. Although profitable coins have moved, the metrics indicate that there is enough current demand to absorb selling.” — analysts noted.

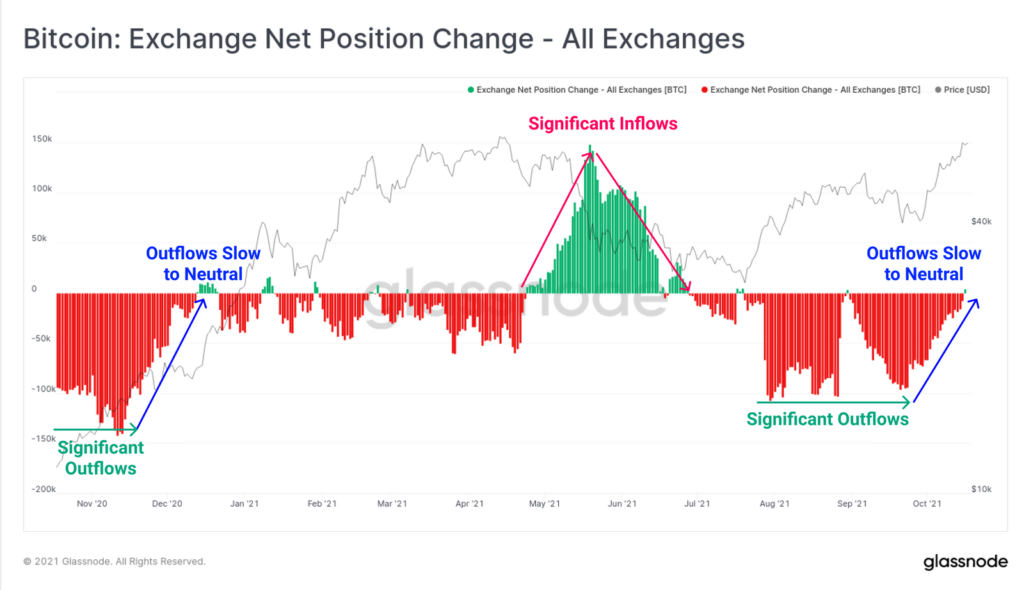

After a long phase of shrinking exchange balances, the momentum has shifted to a neutral stance. Over the last 30 days, inflows have matched outflows, underscoring sufficient demand to absorb supply.

Analysts noted that such a situation points to the fading of a price-supporting factor. A similar pattern formed in late 2020 when the price was around $20,000. Back then it did not prevent the rally to new all-time highs.

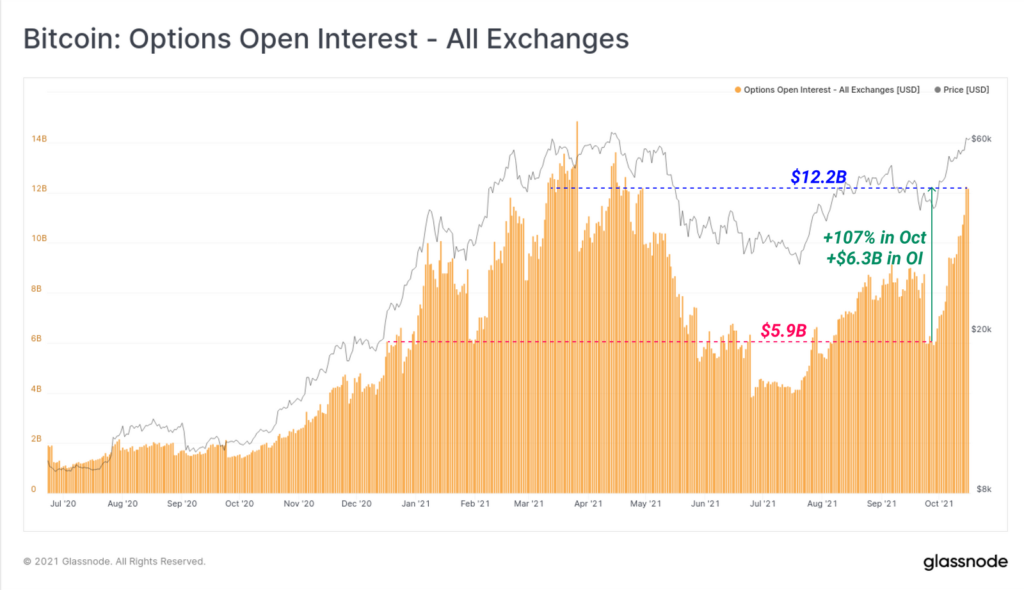

In the derivatives market, open interest rose, especially in options (+107%, or $6.3 billion in October). Turnover in these contracts exceeded $1.5 billion, a level last seen in March, April and May of this year.

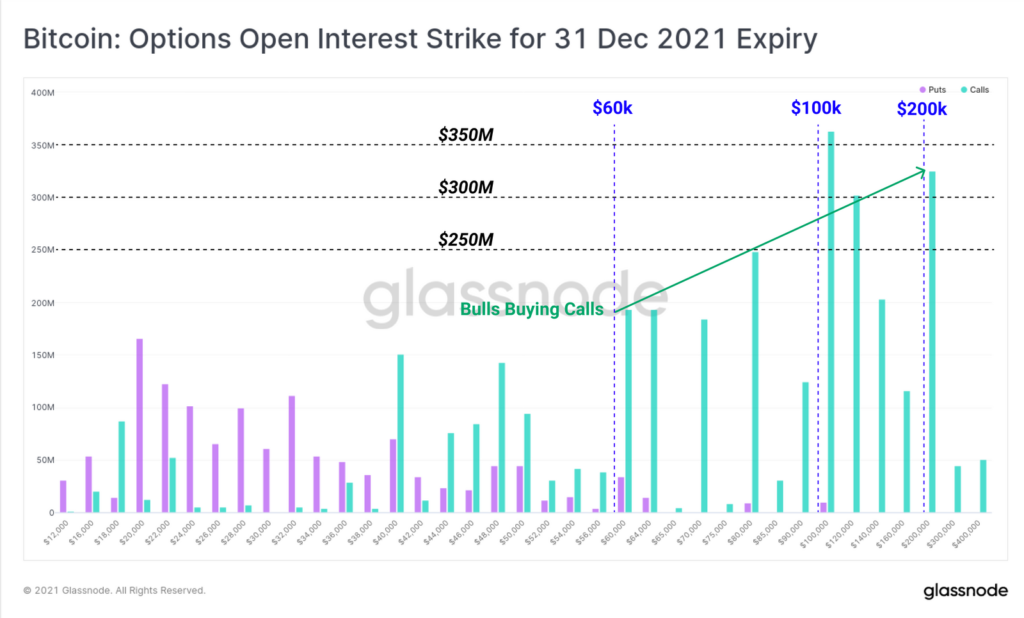

Reflecting bullish sentiment is also the dominance of demand for call options and the interest in strikes at $100,000 and $200,000 in contracts expiring at year-end.

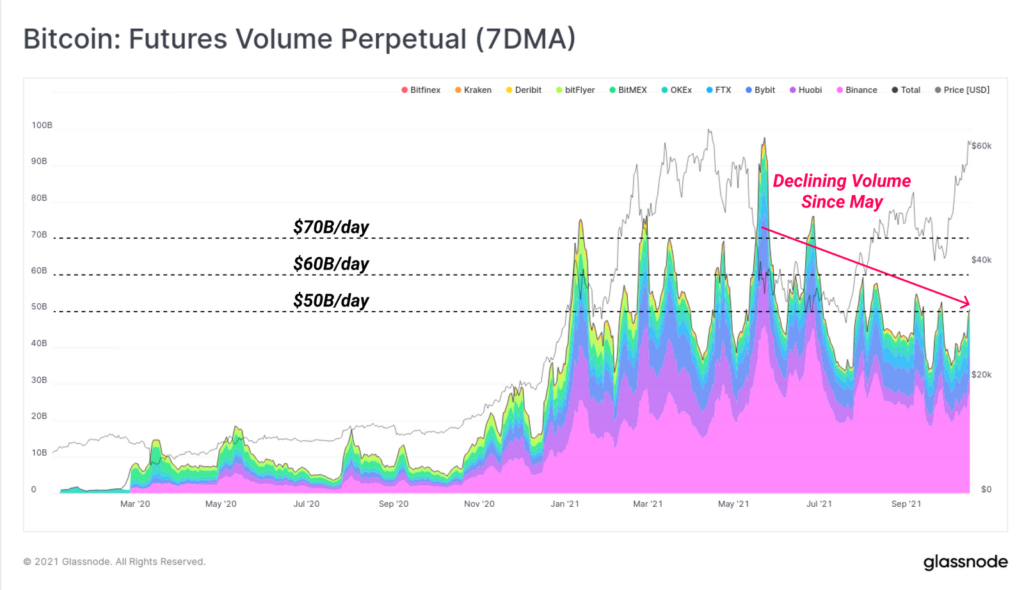

A worrying signal, in the analysts’ view, was the decline in trading volume of perpetual contracts as open interest neared its historical highs. They view this as a risk of a cascade of liquidations due to liquidity constraints if selling begins.

Experts urged market participants in the derivatives market to stay vigilant amid rising leverage usage.

Open interest in futures on Binance and CME hit new all-time highs.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!