Glassnode Assesses Potential Pressure from Mt.Gox Clients

The majority of Mt.Gox investors receiving payouts can be classified as hodlers, potentially mitigating the scale of selling pressure in the coming weeks, according to Glassnode.

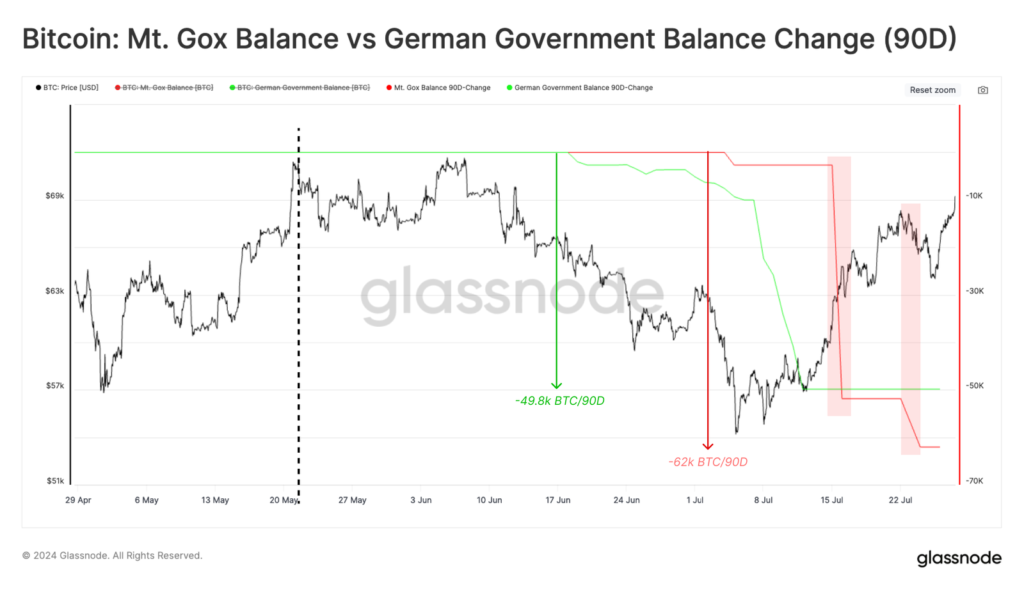

At the time of writing, the trustee of the bankrupt exchange has distributed just under 59,000 BTC out of 141,686 BTC (41%).

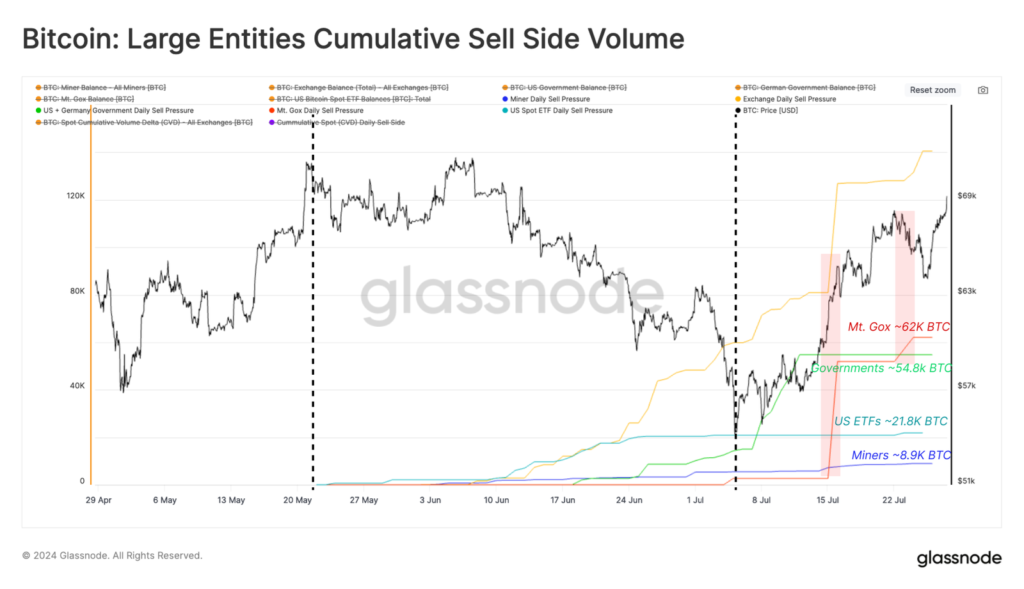

The Mt.Gox payouts have surpassed the scale of fund inflows into ETFs, miner issuance, and sales by German authorities. Experts were unable to specify the proportion of coins that will be sold, noting that any speculation on this matter is just that—speculation.

Analysts recalled that the market managed to absorb the sale of 48,000 BTC by German authorities—the price recovered from $53,000 to $68,000 and above.

The current fluctuations in the $66,000–68,000 range during the Mt.Gox client payouts may indicate weaker-than-expected seller activity and/or relatively stable demand.

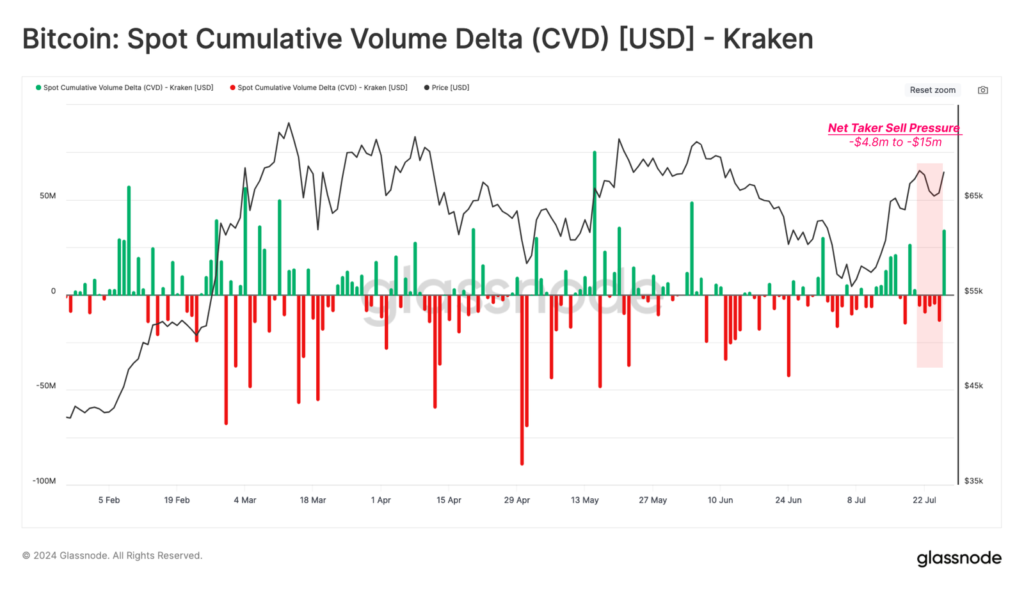

To substantiate their hypothesis, experts used the spot cumulative volume delta (CVD) metric applied to two recipients—Kraken and Bitstamp. In the first case, the indicator remained within typical daily ranges.

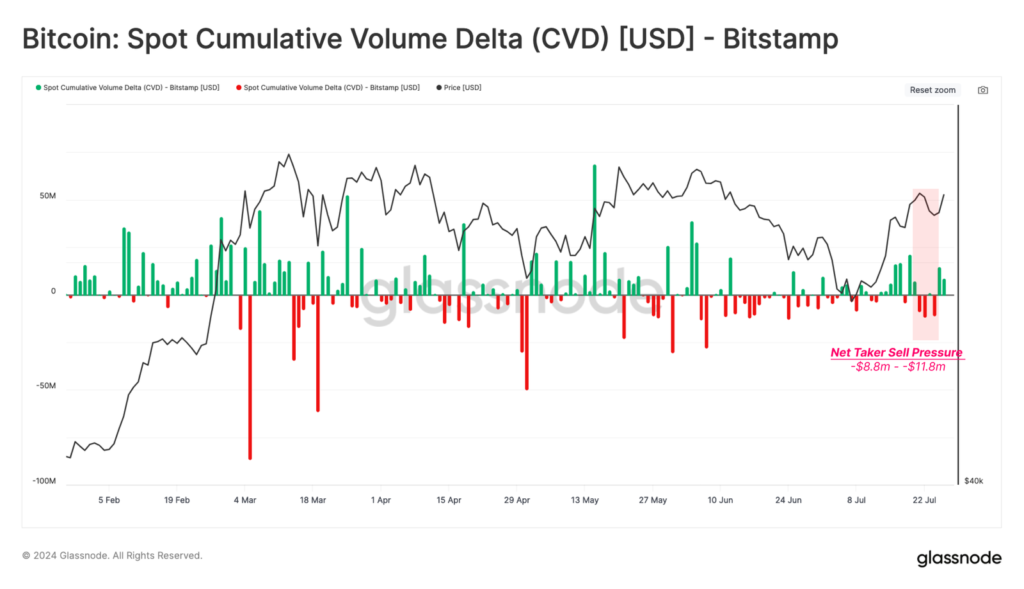

In the case of Bitstamp, specialists observed a similar picture with a slight bias towards seller dominance.

Analysts noted that such observations indicate a high proportion of hodlers among Mt.Gox clients. This is noteworthy given the significant price increase since 2013, they added.

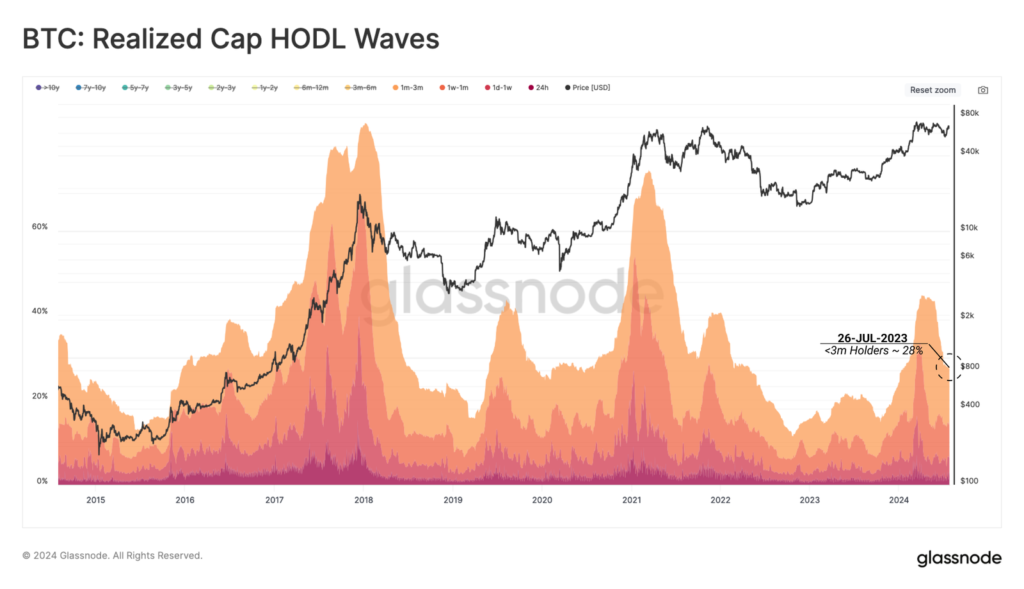

Using the Realized Cap HODL Waves metric, experts assessed the scale of demand inflow from new investors. Currently, the share of assets from the latter is declining and is far below levels typically observed at macro market peaks. This also confirms a shift in behavior towards hodling.

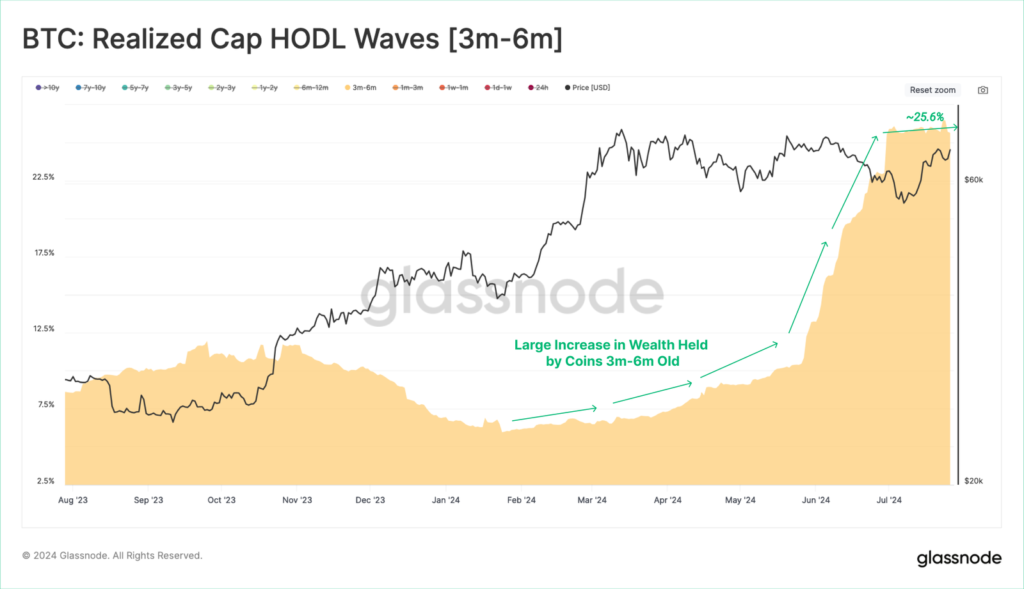

A similar conclusion follows from the growth of the “relative wealth” of holders who acquired bitcoins three to six months ago.

“This again speaks to the general trend: investors who were active at the beginning of the year are keeping their coins in a ‘dormant’ state and moving into increasingly older age groups,” explained the specialists.

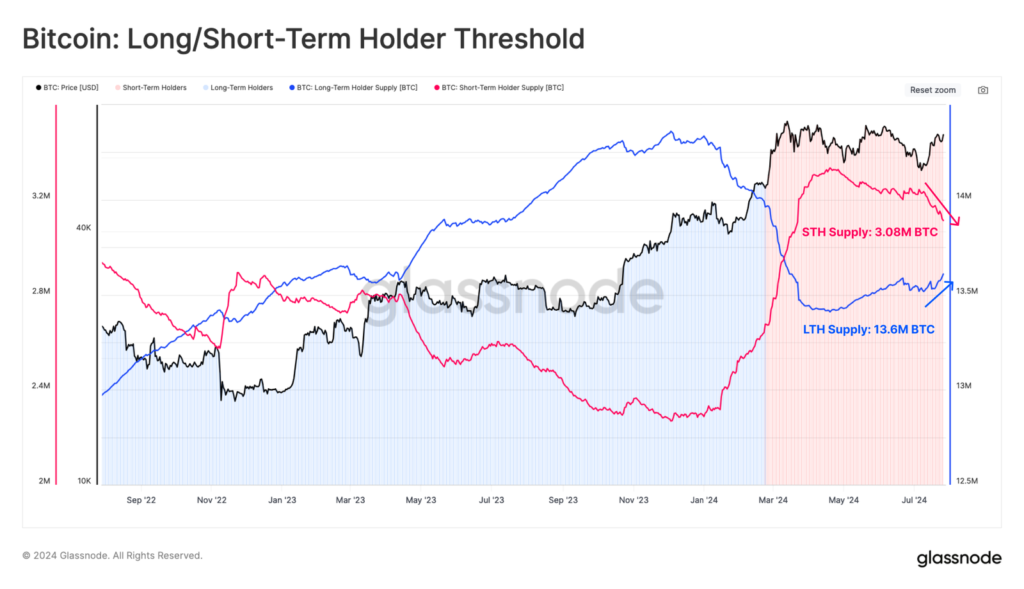

Comparing the overall balance of long-term and short-term holders, experts noted an increase in the share of the former to 13.6 million BTC at the expense of the latter (3.08 million BTC).

“The approximate age boundary separating LTH and STH runs through coins acquired before/after the end of February 2024, when the price was ~$51,000. It is likely that many bitcoins acquired during the ETF frenzy will soon begin transitioning to LTH status. And this divergence is likely to accelerate,” concluded the analysts.

Recently, Mt.Gox sent another 33,964 BTC ($2.25 billion) to an unknown address. According to Arkham, wallets associated with Mt.Gox still hold 80,128 BTC worth $5.32 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!