Glassnode: Bitcoin enters the acceleration phase of the bull market

- The rise of digital gold by 141.6% year-to-date matches the cycles of 2015–2017 and 2018–2022 in terms of duration of the recovery and the drawdown after the ATH.

- Most Bitcoin investors are in profit, with several on-chain metrics moving into the enthusiasm phase of an uptrend.

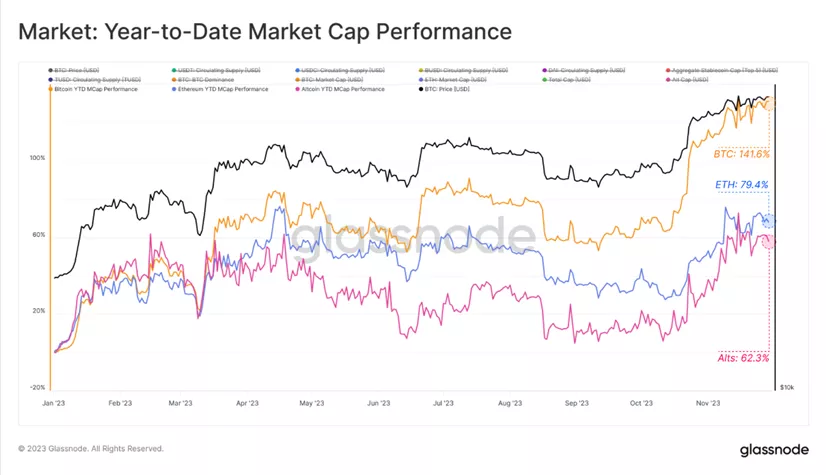

Bitcoin has risen 141.6% year-to-date and more than twice as high as gold. Bitcoin remains the dominant cryptocurrency in the digital assets industry, according to Glassnode.

Year-to-date results recorded (as of writing):

- Bitcoin: +141.6%;

- Ethereum: +79.4%;

- altcoins (excluding Ethereum and stablecoins): +62.3%.

Analysts note that market indicators for digital gold after the cycle peak resemble both the 2013–2017 and 2017–2021 periods. Below are the drawdown magnitudes:

- 2013–2017: -42%;

- 2017–2021: -39%;

- ⚫ 2021–2023: -37%.

The similarity is also evident in terms of the distance from cyclic lows and the duration:

- 2015–18: +119%;

- 2018–22: +128%;

- ⚫ 2022–23: +146%.

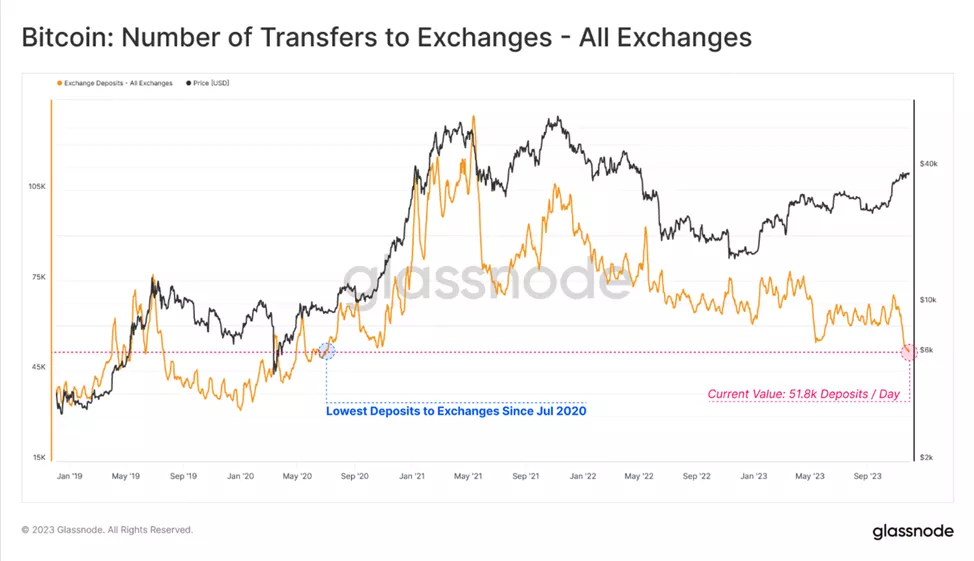

Experts also noted that after periods of impressive growth it is prudent to monitor CEX transactions for any notable deviations in activity or capital flows. Despite a strong year, the trend of deposits falling to multi-year lows remained in place, they added.

The 2023 rally pushed Bitcoin’s price above two key price levels:

- Realized price, which separates the profits and losses of the ‘average coin’;

- The indicator True Market Mean Price ($31,000), developed jointly with ARK Invest, indicating profits for the average active investor.

Such a combination has historically signaled a transition to a more active bull market, the analysts noted.

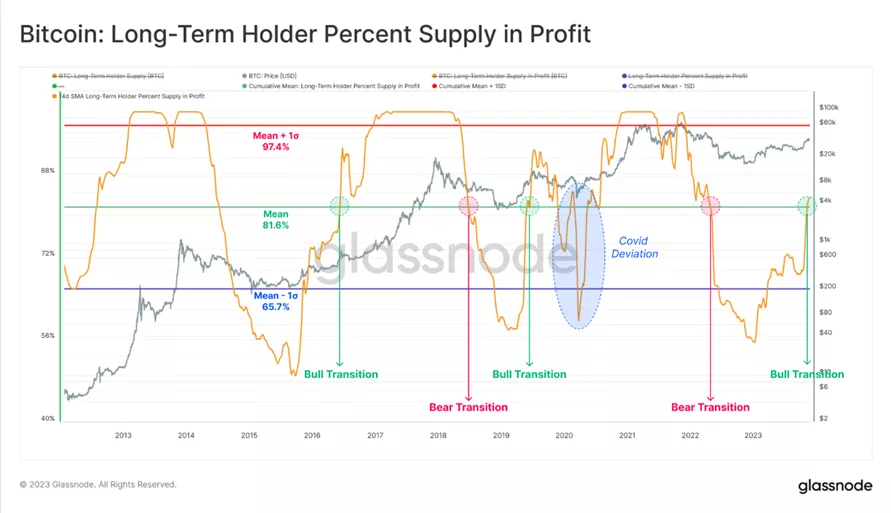

Price growth since the start of the year has increased the share of “profitable” coins in holders’ hands from 56% to 84%. The metric surpassed the long-term average of 81.6%.

Previous breakouts above this level coincided with transitions to strong uptrends. Among short-term market participants, this metric reached 95%. It exceeded one standard deviation, which is also associated with the acceleration stages of the bull market.

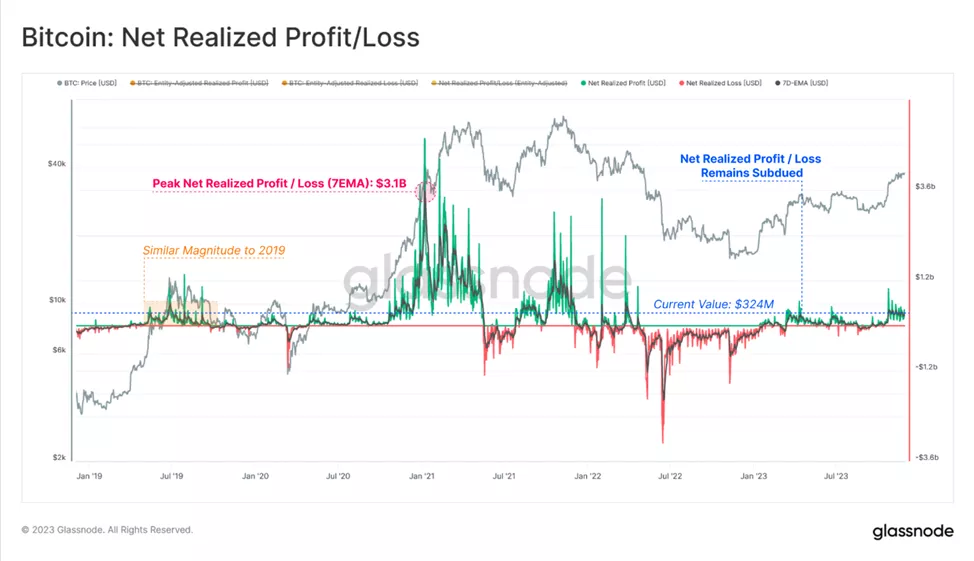

In conclusion, experts assessed a daily net realized profit of $324 million. This is orders of magnitude below the peaks seen in the later stages of the 2021 bull market (over $3 billion).

“Despite the rise in prices and substantial (paper) profits for investors, the situation remains largely within the early rather than late stage of the bull market,” — the analysts explained.

Earlier, analyst James van Straten estimated that Bitcoin holders realized profits of $5 billion in the period from December 1 to 4, which is comparable to the levels reached at the ATH near $69,000.

Matrixport analysts confirmed a forecast that Bitcoin would rise to $63,000 by April 2024.

Earlier, Blockstream CEO Adam Back forecast digital gold at $100,000 in the coming months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!