Glassnode: Bitcoin market has not yet formed a firm bottom

The Bitcoin bear market has reached the final stage with signs of deep capitulation, but signals of a bottom approaching have not yet formed, according to Glassnode analysts.

The #Bitcoin market has many hallmarks of a deep capitulation, and a late stage bear market in play

Both Long-Term Holders, and Miners are now under extreme financial stress

However, is it enough to form a resilient bottom?

Read more in The Week Onchainhttps://t.co/9DUtlKahxG

— glassnode (@glassnode) July 11, 2022

The current situation bears many similarities to the price collapse in 2018–2019. At that time the trend lasted 15 months with a drawdown of almost 85%. Ahead of the final capitulation, the market struggled for a long time to hold support around $6,000. After failing for a month, it shed 50% of its value.

In 2022, the attraction level was the $30,000 mark. After breaching it, losses over two weeks reached 40%. The pullback from the all-time high stood at 72.3%.

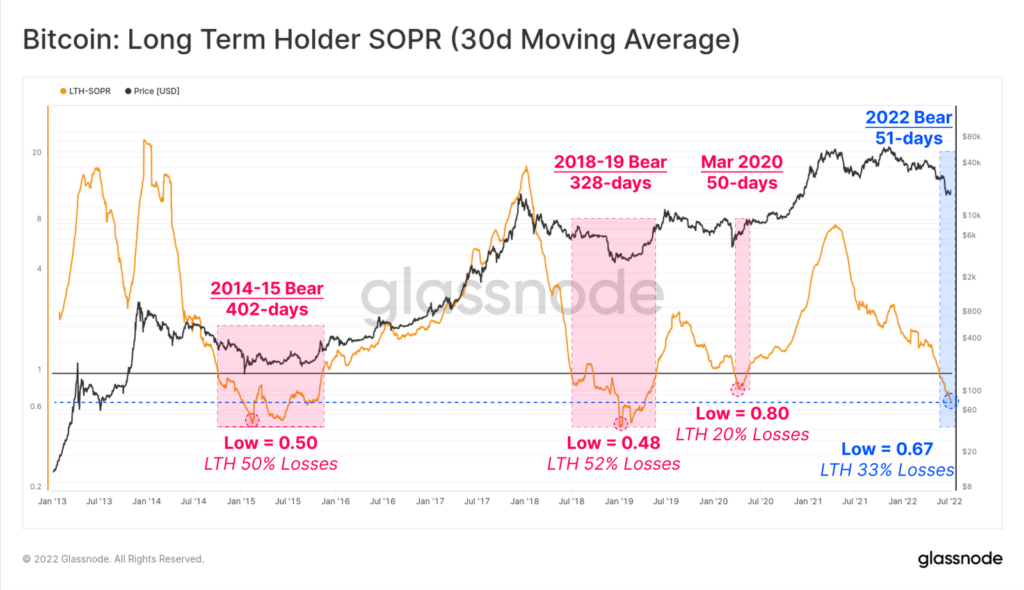

The factor driving the current decline includes sales by long-term investors. The LTH-SOPR indicator dropped to 0.67 (average loss reached 33%).

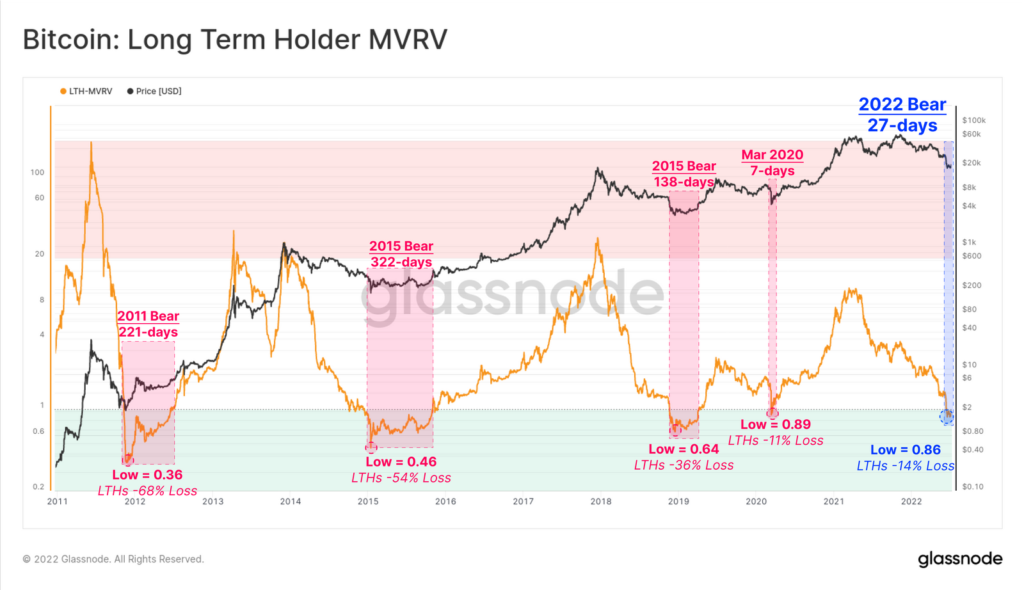

Analysts compared the above data with a cost basis of $22,300 and an unrealized loss of 14% for this market participant cohort. They concluded that the main outlays come from those who bought Bitcoin at much higher prices, while holders from 2017–2020 participate minimally in this.

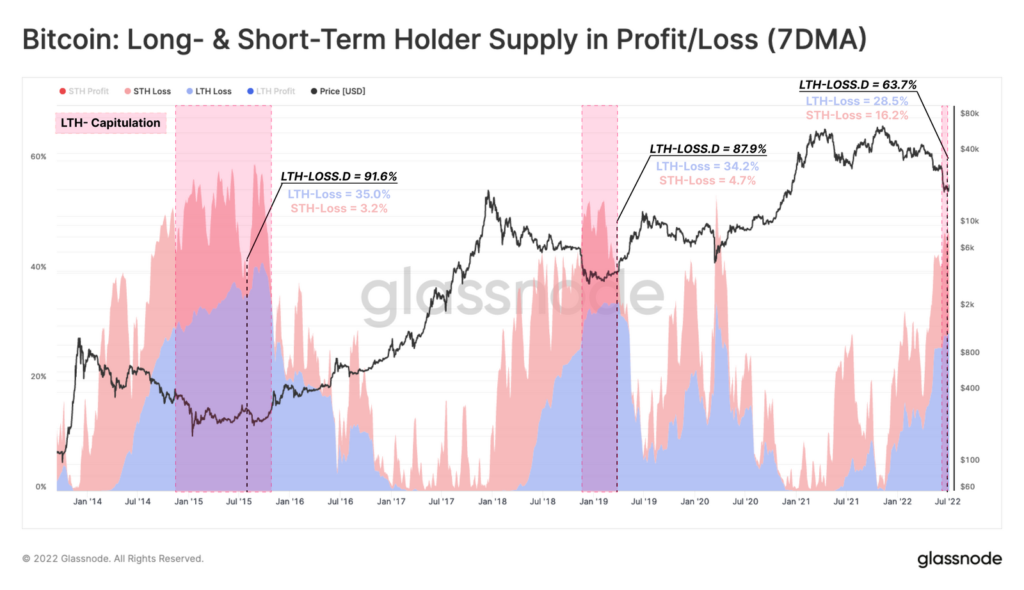

Experts noted that bottom formation is typically preceded by two conditions:

- investor capitulation with weak conviction (speculators);

- gradual handover of coins to market participants with relatively low price sensitivity (holders).

Historically, the share of “losing” coins among long-term investors reached 34–35%, short-term fell to 3–5%. Currently these figures stand at 28.5% and 16.2% respectively.

“Recently redistributed coins now need to undergo a maturation process in the hands of holders with higher conviction. Despite many signals of bottom formation, the market still needs time to transition to a sustainable growth trajectory,” the analysts stressed.

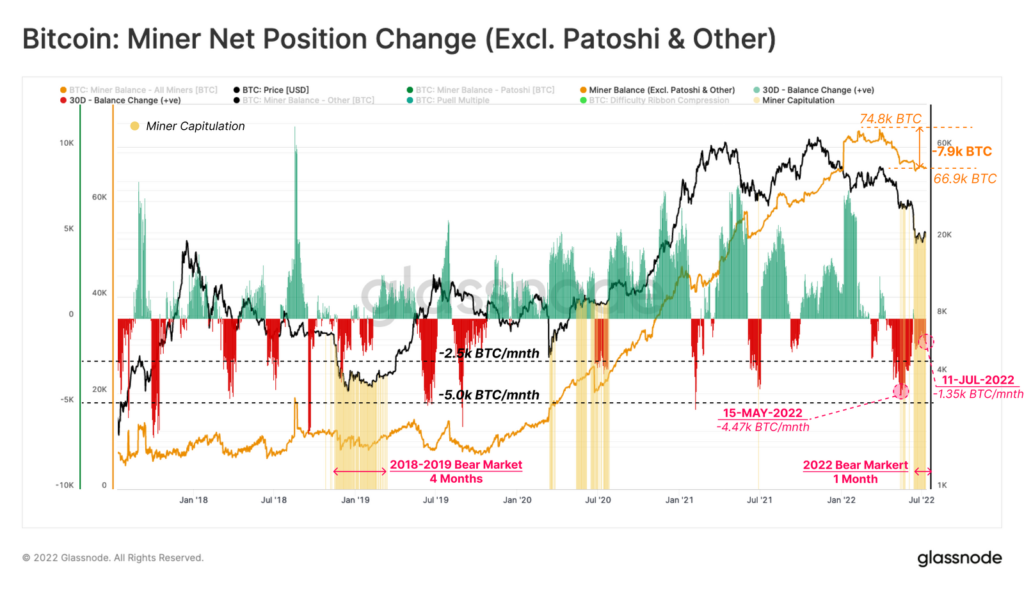

Capitulation continues among miners as well. Monthly balance reductions slowed from 4,470 BTC in mid-May to 1,350 BTC. They hold 66,900 BTC across their addresses. In the last two months, spending amounted to 7,900 BTC. During the 2018–2019 bear market, the trend lasted four months.

“In the next quarter, the risk of further distribution will persist if coin prices do not recover meaningfully,” the experts concluded.

Earlier, mining operations halted in Texas amid heat-driven peak electricity demand.

In June, total revenue for Bitcoin miners fell by 26%, to $668 million. The metric has been falling rapidly since March.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!