Glassnode: Bitcoin on-chain activity remains at historically low level

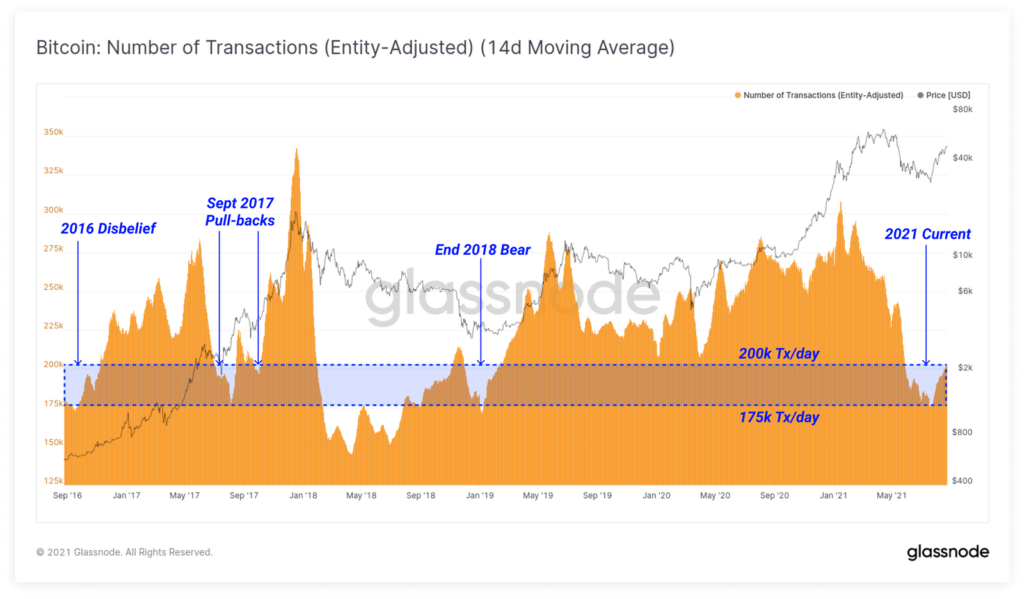

On August 23, Bitcoin prices rose for the first time since May to surpass the $50,000 mark. However, on-chain transaction activity (с поправкой на субъекты) in the Bitcoin network remains at historically low levels — about 175,000 to 200,000 transactions per day, Glassnode said in its report.

#Bitcoin rallied towards the $50k level last week, absorbing the profits realised by spenders on-chain

This week, we assess who is spending coins, flows of coins to exchanges, and rising open interest in derivatives markets

Read More in The Week On-chainhttps://t.co/BZ9q1WyXhS

— glassnode (@glassnode) August 23, 2021

Analysts noted that over the past five years such a situation has occurred only three times:

- during the 2016-2017 bull market, amid the “disbelief rally”, when everyone doubted the uptrend, and during mid-cycle deep pullbacks;

- in the bear market of 2018-2019, when interest in digital gold waned and prices corrected by 85% from their peak;

- Currently.

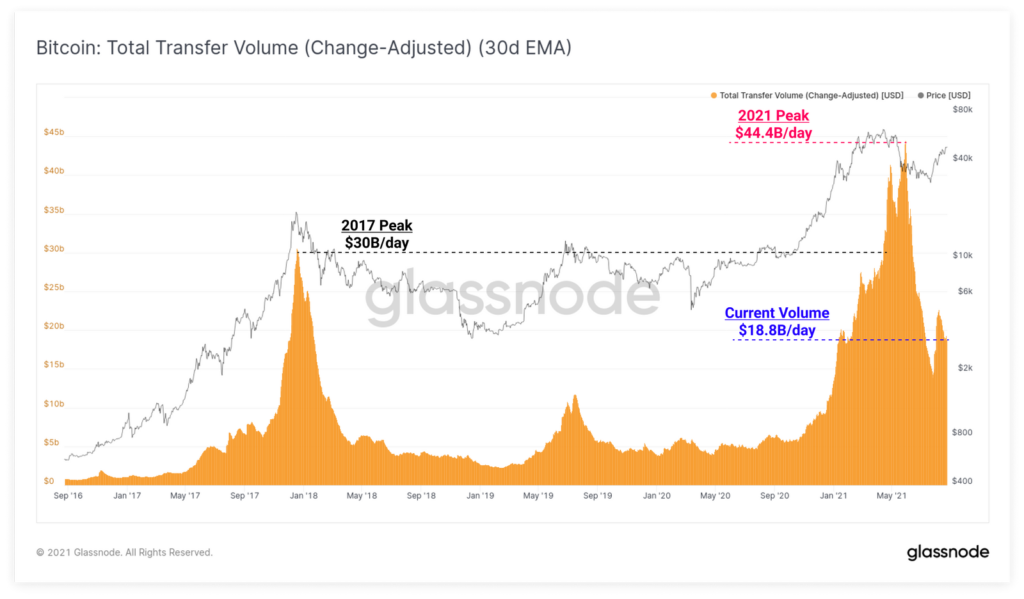

Analysts noted that transaction volume is also down. Glassnode estimates the network’s average daily volume at about $18.8 billion, down 57.6% from May’s figure.

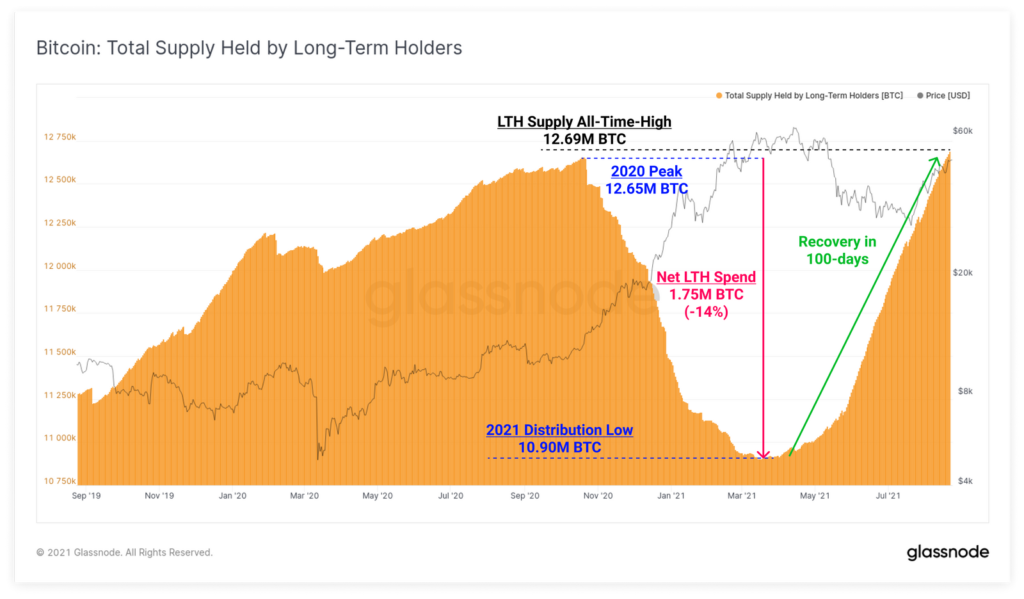

“However, despite such a sizable divergence between rising prices and low on-chain activity, the overall dynamics of supply remain extremely macro-bullish,” — the analysts write.

Analysts noted a noticeable rise in the sale of older coins that had sat in holders’ wallets for at least five months over the past week. At the same time, the amount of cryptocurrency on addresses of long-term holders increased.

“The weekly volume of supply held by long-term holders reached a record high — 12.69 million BTC, surpassing the level reached in October 2020,” the report says.

Glassnode believes that hodlers cashed in part of their funds as prices reached peak levels and have since scaled back spending. In addition, the long-holdings metric, which includes coins that have lain idle for 155 days, now accounts for coins acquired from December 2020 through March 2021.

“The long-term holder selling observed this week is likely related to low coin turnover and strategic risk reduction rather than a loss of confidence and a mass exodus,” the analysts stressed.

Bitcoin’s hash rate also indicates the onset of a new bull run. The smoothed 7-day moving average rose above 127 EH/s.

At the time of writing, Bitcoin is trading near $49,700. Over the week, the asset’s price has risen by almost 8%, according to CoinGecko.

As Yuriy Mazur, head of data analysis at CEX.IO Broker, notes, if Bitcoin can hold above $50,000 in August, cryptocurrency prices could rise to $70,000–$75,000.

Read ForkLog’s bitcoin news in our Telegram — news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!