Glassnode: Bitcoin price turnaround will take time

Bitcoin price bounced off the $20,000 level. Long-term indicators suggest that it may take additional time to form a solid foundation, analysts at Glassnode warned.

#Bitcoin has attempted to escape the gravity of the $20k zone in a long awaited relief rally.

Momentum in the short term is favorable, however longer-term indicators suggest additional time may be required to form a firm foundation.

Read our analysis 👇https://t.co/Oi0IykvUNn

— glassnode (@glassnode) July 25, 2022

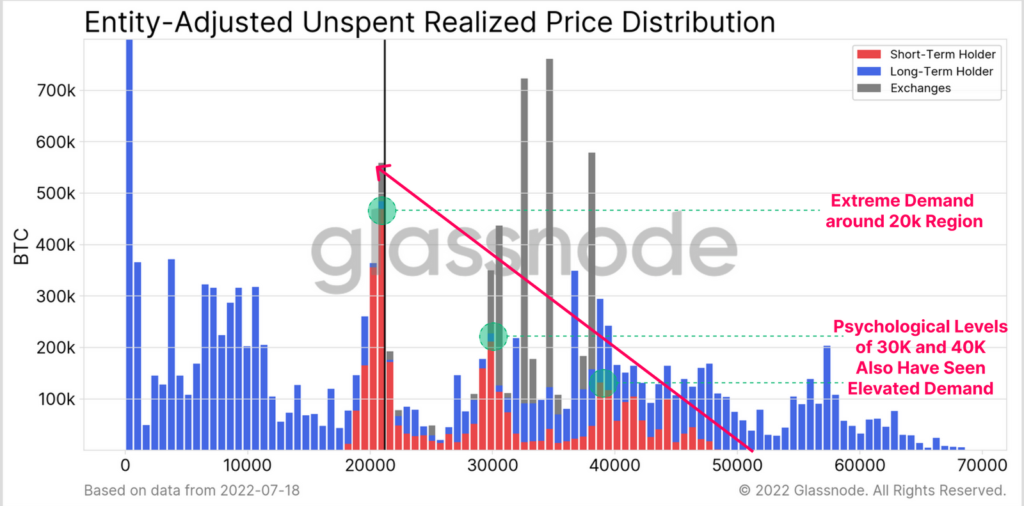

Experts grounded their view in the URPD indicator, which shows the structure of realized-price levels in the context of UTXO.

The $20 000 level drew the greatest appeal for speculators. This occurred as coins were transferred from capitulating hodlers to ‘new’ optimistic buyers.

A significant portion of long-term investors continued to hold Bitcoin purchased at higher prices, indicating their low sensitivity to changes in market conditions.

Experts noted that there was demand from speculators at the $30 000 and $40 000 levels as well. To improve the odds of a market turn, it is important to see these coins transition into the category of ‘held long-term’ (in other words, the ‘age’ since purchase must exceed 155 days).

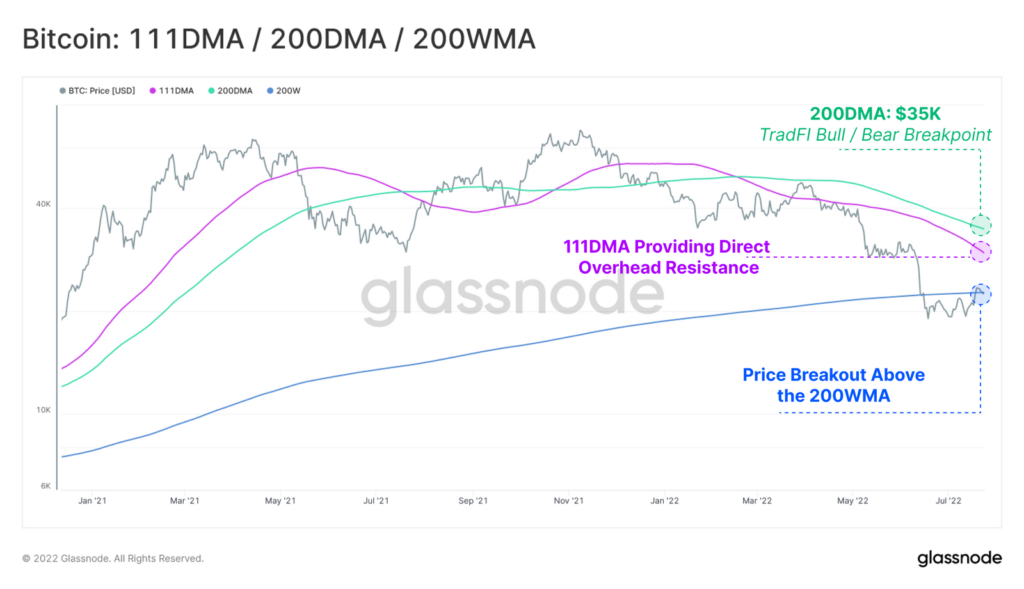

Specialists pointed to a possible resistance area within the current recovery rally, drawing on technical indicators and on-chain models.

As of writing, 111 DMA is near the psychological level $30 000. 200DMA, the crossing of which by price marks the boundary between bull and bear markets, has reached about $35 000.

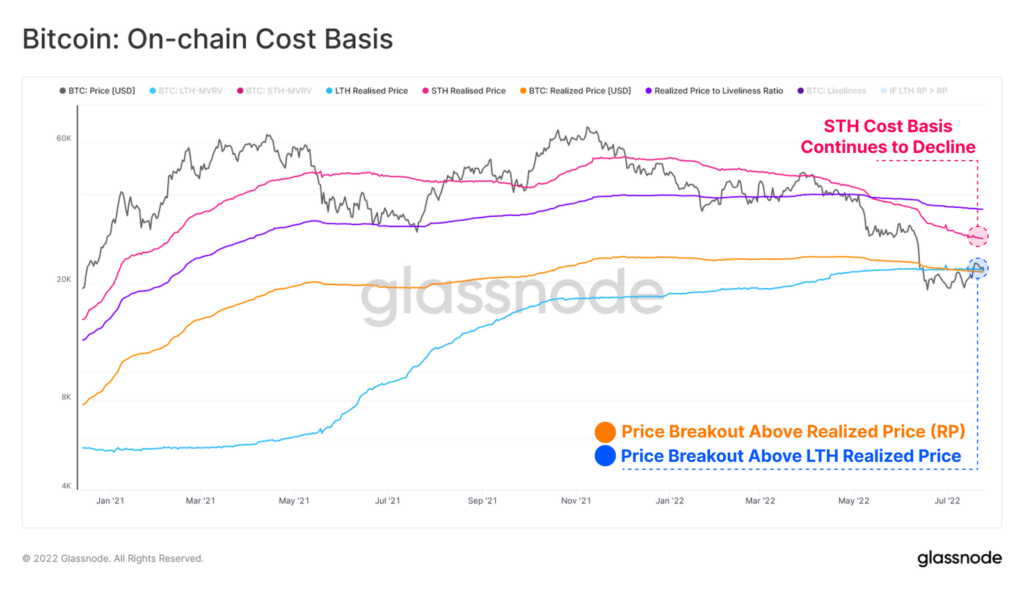

Near the 200DMA (~$35 000) sits the RLPL indicator, which compares hodlers’ spending with Bitcoin’s ‘fair value’ (the realized price). The latter metric for long-term investors stands at about $22 000, for speculators — $28 500.

Realized price for speculators is in a downward trend. This occurs because short-term investors realize losses and transfer coins to a new category of market participants who buy at levels below the realized price, a characteristic for speculators in general.

To raise the ‘fair value’ of Bitcoin for hodlers, either purchases of coins above their acquisition price are needed, or a transition of coins with a higher purchase price into the ‘long-term’ category must occur. In a bear market this happens rarely, the analysts noted.

Often, metric readings rise as profits are realized. This happens as a bottom is reached and subsequent inflows of funds sufficient to absorb selling materialise.

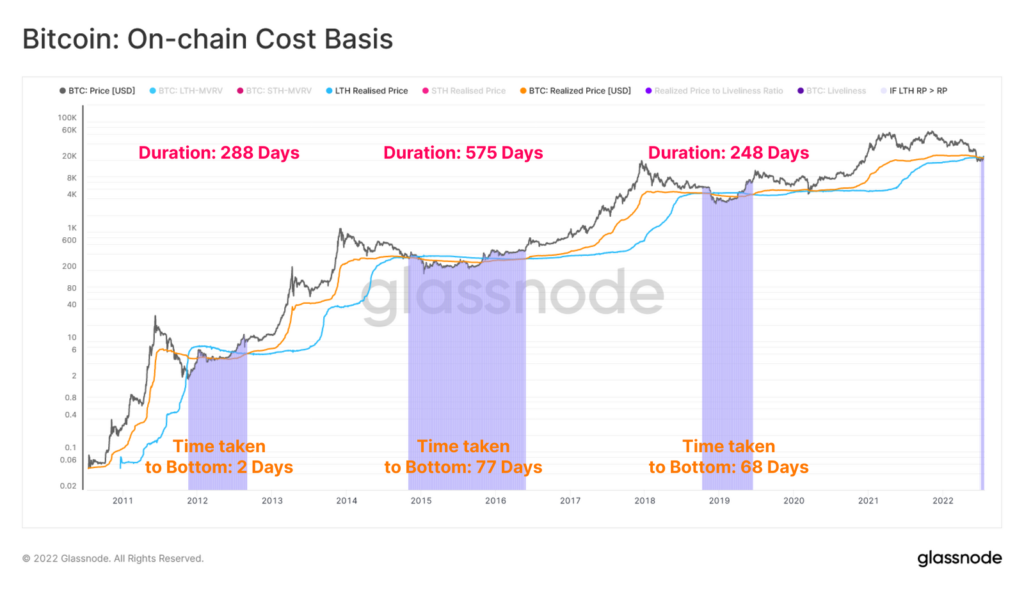

«The duration of the previous bear-market lows’ divergences ranged from 248 to 575 days. In the current cycle it has been only 17 days, a comparatively short period», the analysts concluded.

Earlier, Grayscale allowed the end of the crypto-winter by the end of March 2023.

Earlier, a former Goldman Sachs top executive and macro investor Raoul Pal predicted a Bitcoin reversal due to rising global liquidity.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!