Glassnode flags a probable local maximum for Bitcoin

“Explosive” rally of Bitcoin at the start of the year wiped out investors’ and miners’ ‘paper’ losses and, at the same time, called into question the continuation of the positive momentum, according to on-chain metrics. Glassnode analysts concluded this.

After one of the least volatile months in history, #Bitcoin has seen an explosive rally back above $21k.

In our latest piece, we analyse the rally and the key pricing and valuation models $BTC has broken above.

Read more in The Week On-chain 👇https://t.co/4PyCTob551

— glassnode (@glassnode) January 16, 2023

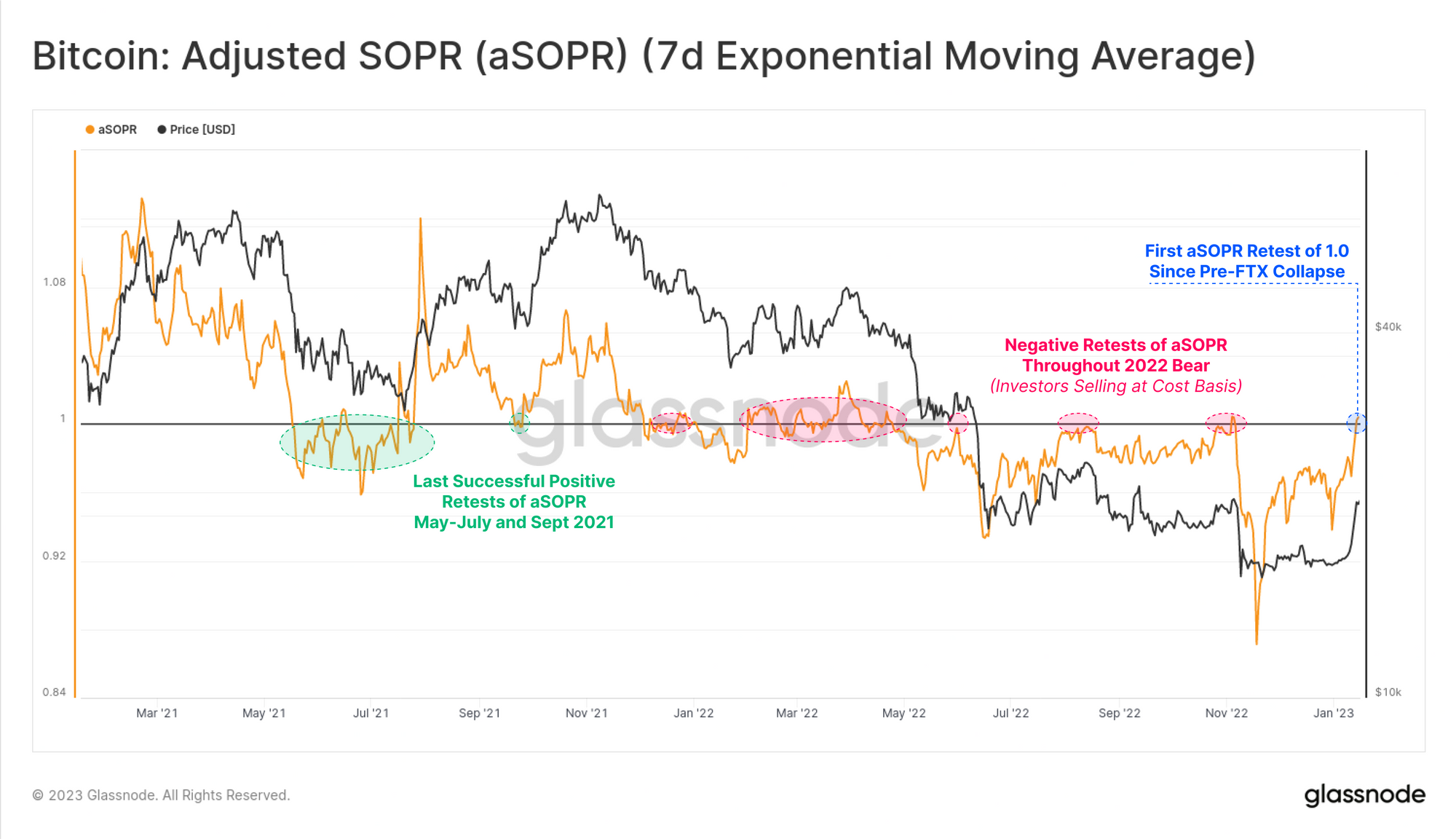

The aSOPR indicator approached testing resistance at the 1.0 level, the breach of which followed by a retest could signal the end of the bear trend. This would indicate sufficient demand to absorb selling pressure from profit-taking.

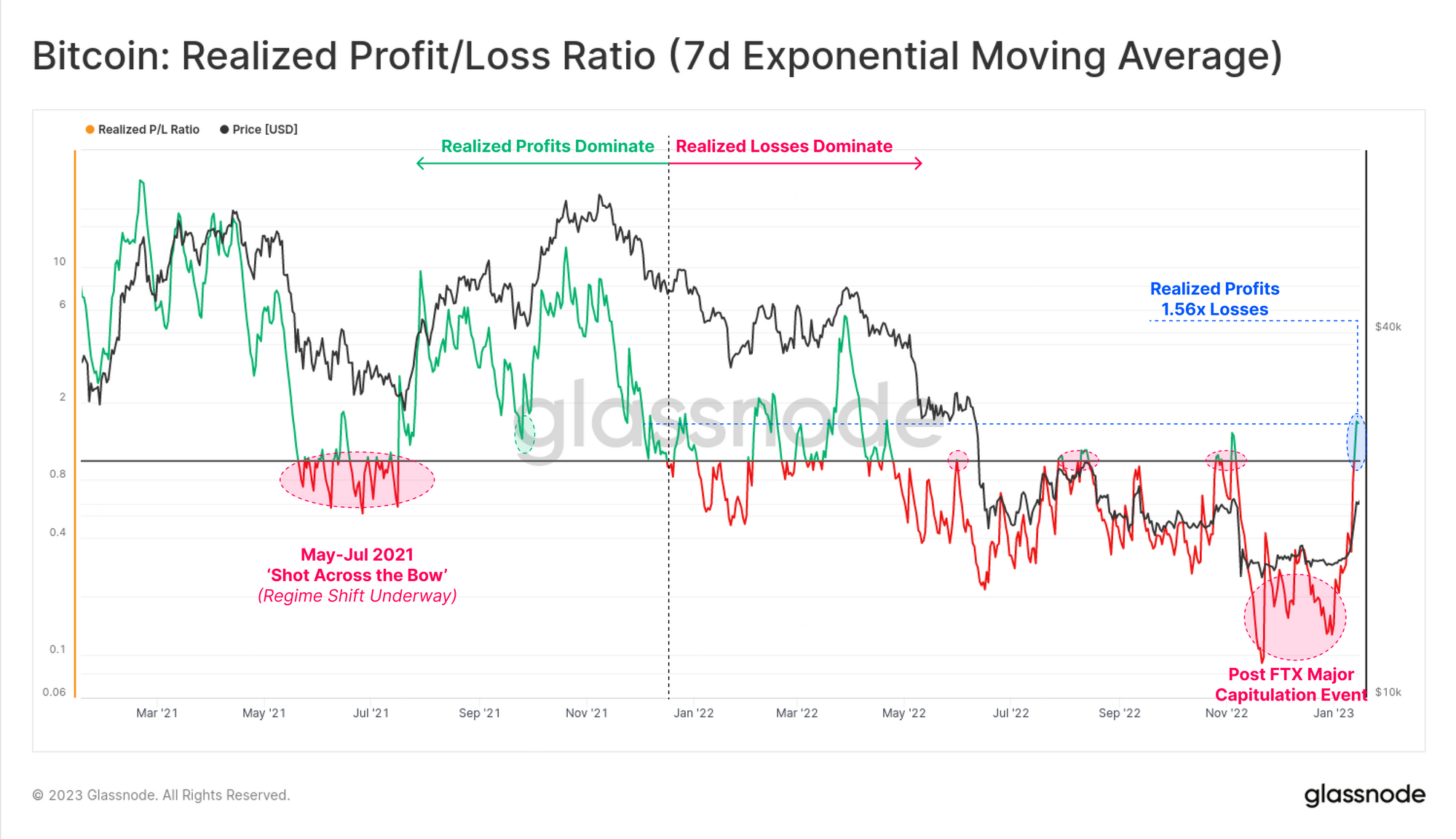

A similar conclusion was drawn by analysts based on realized losses/profits in dollar terms. Over the past week the indicator breached a significant 1.0 threshold.

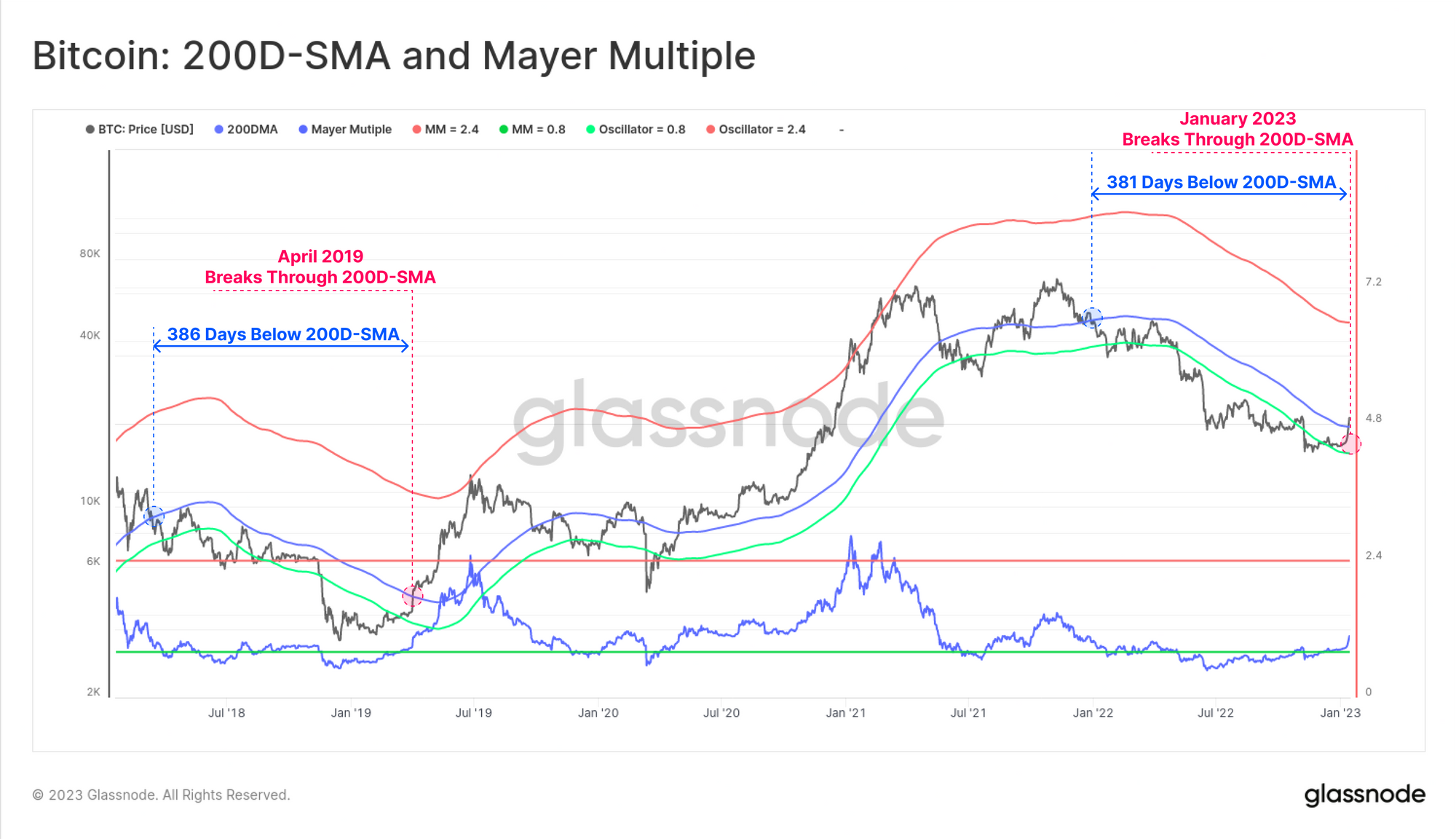

Resistance can also be identified from a technical-analysis perspective. Experts noted the price crossing above the 200-day simple moving average from below to above near $19,500. For 381 days prior, the quotes traded below this mark.

In the previous bear cycle of 2018-2019, such a period lasted five days longer.

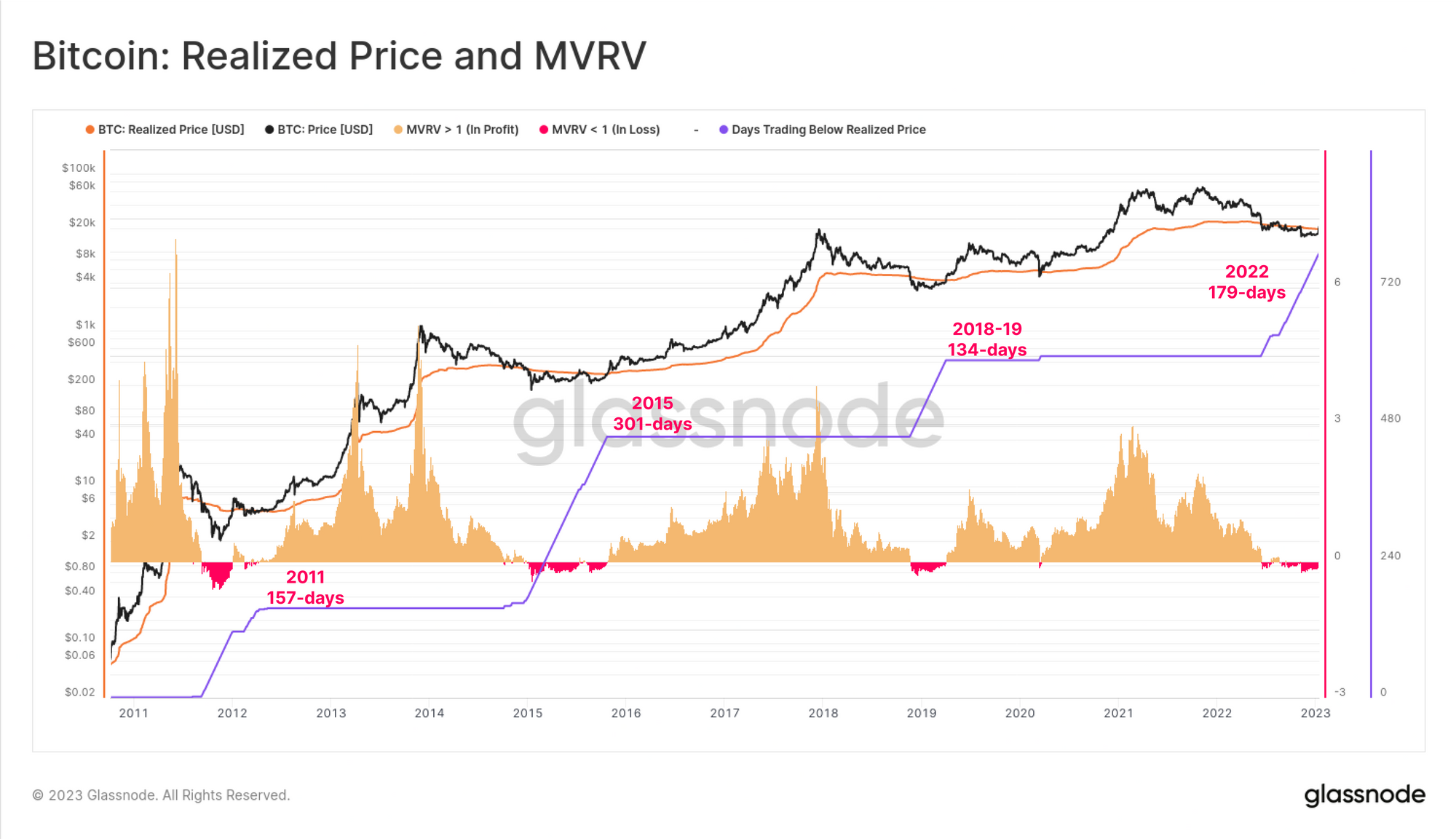

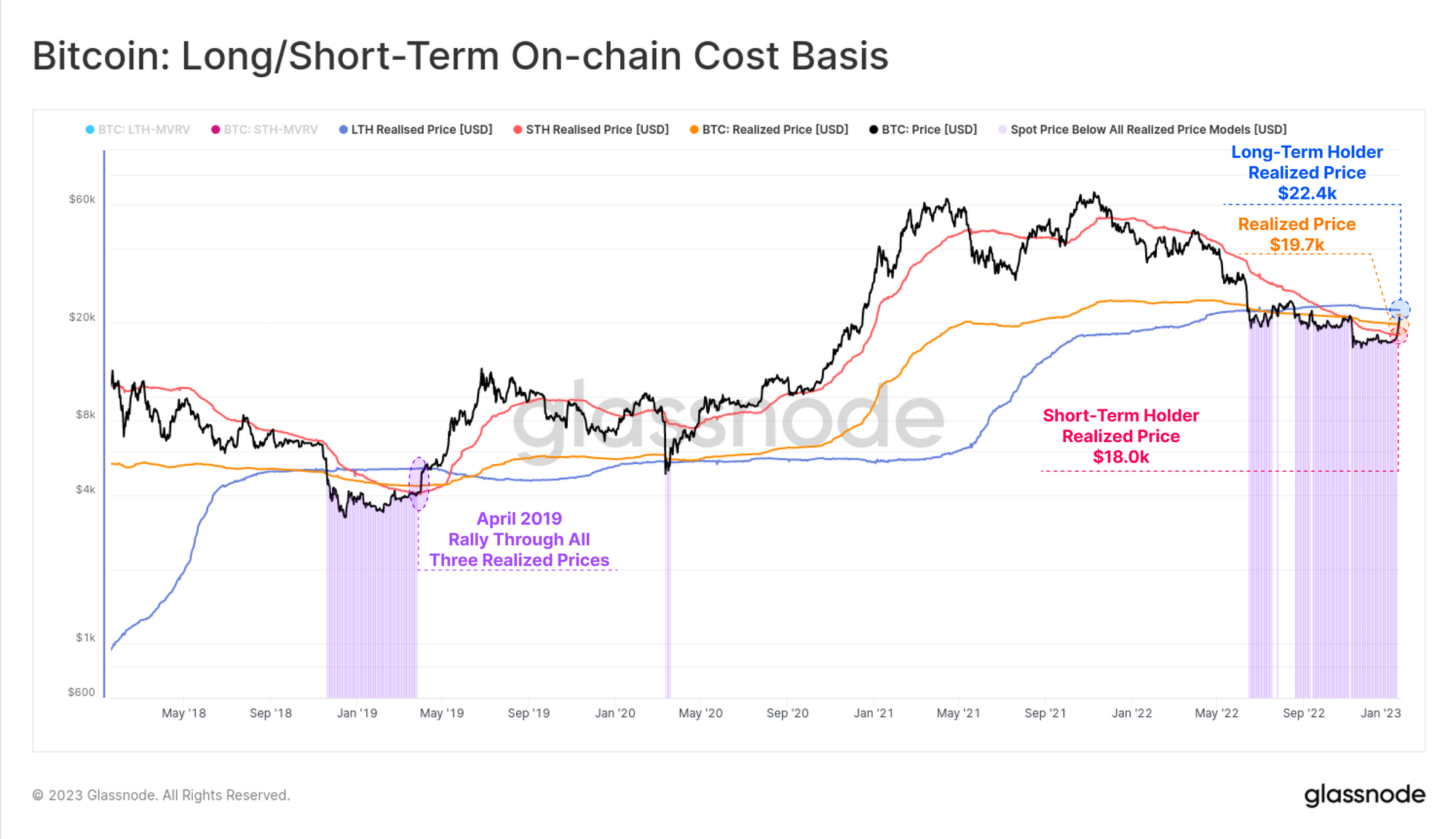

The current bear phase was the second-longest, in the context of the ratio of current to realized price ($19 700 at the time of writing). It lasted 179 days, trailing only the 2015 events (301 days).

When decomposing realized price into its components among speculators ($18 000) and hodlers ($22 400), analysts noted the convergence of indicators with the current market value, reflecting a large volume of “traded” coins following the FTX collapse.

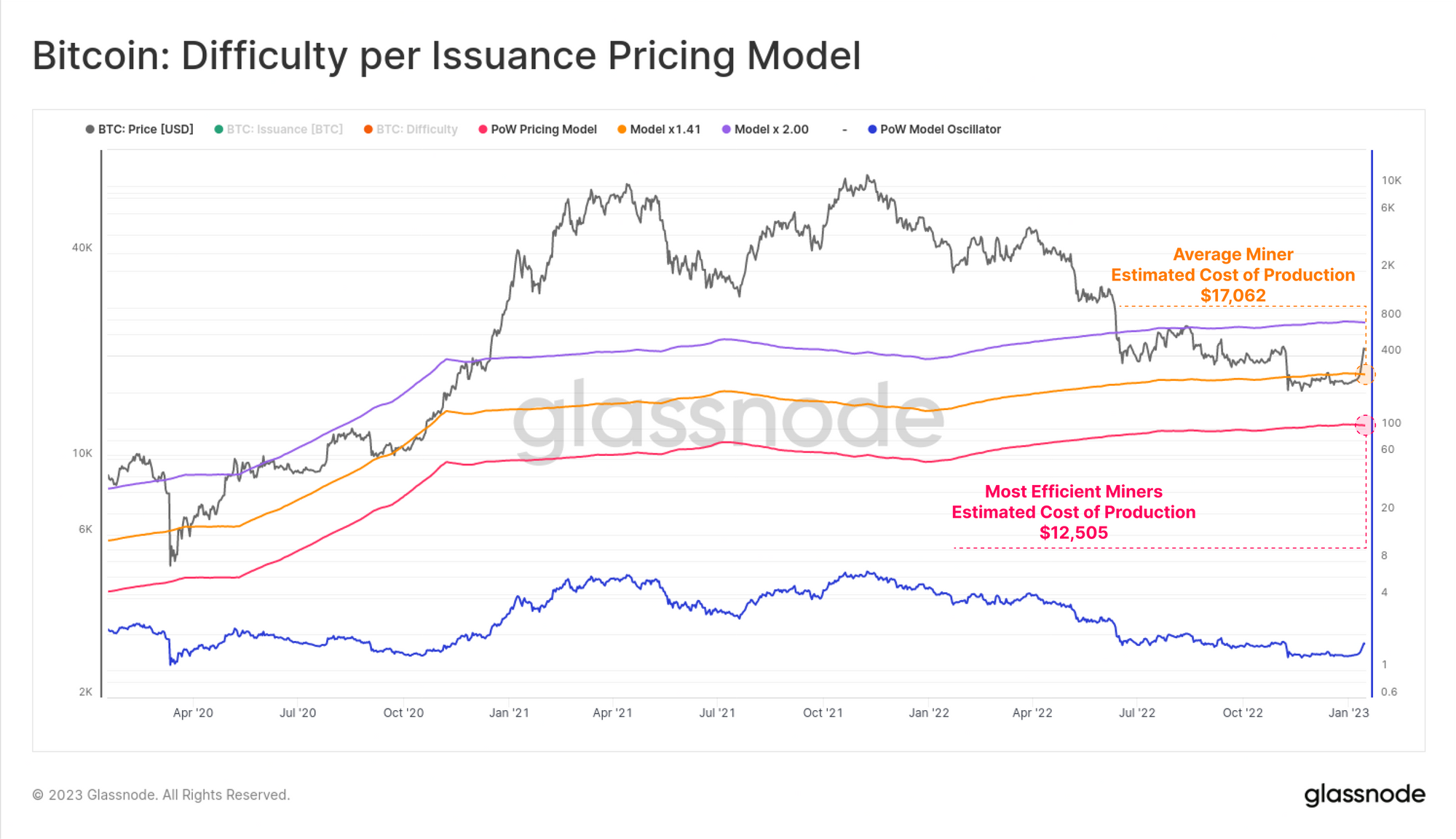

The situation has also improved for miners. A regression model linking Bitcoin’s price and mining difficulty indicates an average cost of mining 1 BTC at about $18,795.

An alternative view from comparing difficulty with coin issuance suggests potential renewed stress among this market segment if the price falls below $17,062. For the most efficient miners, the threshold sits at $12,505.

As a reminder, in December, Nansen analysts, in their base-case for 2023, named a new wave of stock-market sell-offs amid an economic recession. They warned that in these conditions cryptocurrencies will be subject to negative re-pricing.

Read ForkLog’s bitcoin-news on our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!