Glassnode: Hodlers Await Bitcoin Rally Before Selling

Last week’s narrow trading range for the first cryptocurrency coincided with an extremely low volume of on-chain value transferred. Most coins are ‘dormant’ in anticipation of higher prices, according to Glassnode.

The Bitcoin market has traded within an extremely tight price range this week, whilst on-chain volumes have been extremely light, hovering around cyclical lows.

Meanwhile, large swathes of the coin supply remain dormant in investor wallets with supply in several key age bands… pic.twitter.com/t2h5v5YnCT

— glassnode (@glassnode) May 22, 2023

Analysts noted an 85.5% drop in the volume of transferred on-chain value from the peak at the start of 2021 ($13.1 billion) to the current $1.9 billion. A similar trend is visible in transfers to exchange wallets — from $4.2 billion to $343.4 million (down 91.8%).

The aggregate volume of realized gains and losses has fallen to its three-year low, suggesting investors’ reluctance to spend Bitcoins.

“We have established that both nominal and realized throughput of the network remains cyclically low. For many market participants, the cost basis of the bitcoins they purchased is quite close to the spot price, indicating minimal incentive to spend them. It could intensify if volatility increases in any direction,” — the analysts noted.

Analysts’ estimates say that the realized price, excluding coins aged over seven years ($25,200), could provide psychological support. Current quotes are only slightly above that level. This reinforces the view that active market participants simply cannot earn significant profits (or losses), the analysts added.

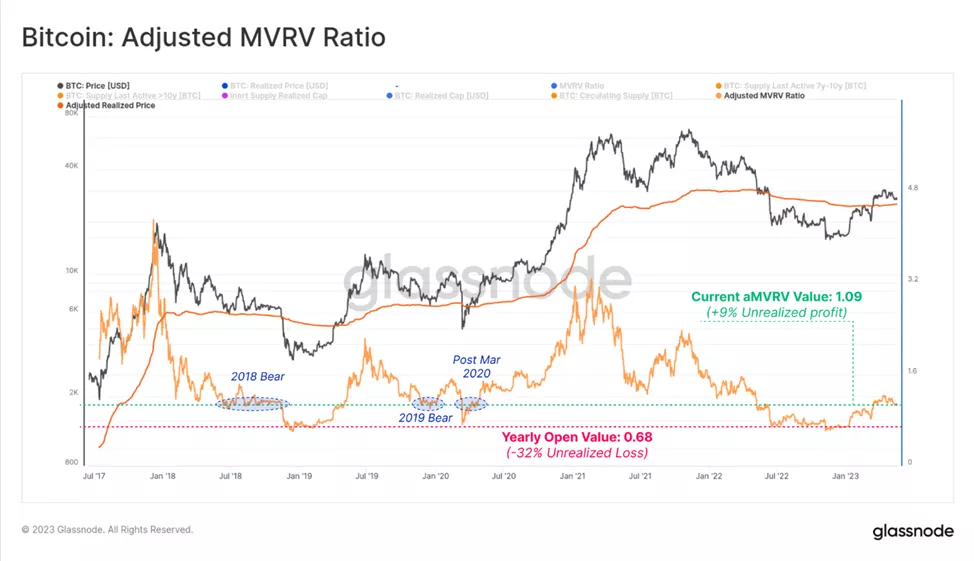

Price above $30 000 in April 2023 contributed to lifting the adjusted MVRV ratio to 1.21.

Currently the metric has fallen to 1.09 (unrealized profit stands at 9%). Such a value aligns with historical oversold levels at cyclical lows in 2018, 2019, and also in March 2020, the experts noted.

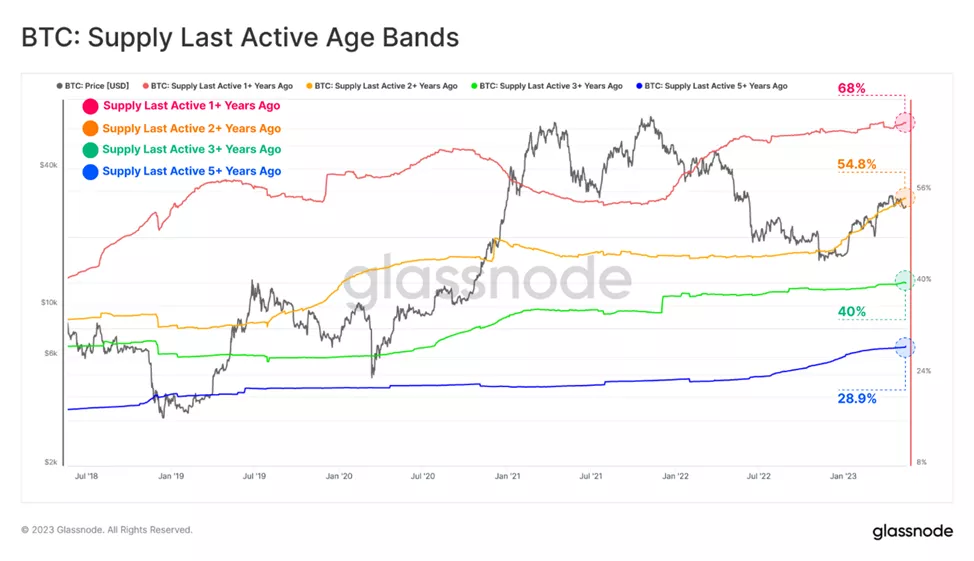

The rally at the start of the year did not break the trend toward hodling. The shares of Bitcoin holders aged over one, two, three and five years rose to 68.1%, 55.2%, 40% and 28.9% respectively.

The trend can also be illustrated by the total position of long-term investors, who own 14.46 million BTC (a new ATH).

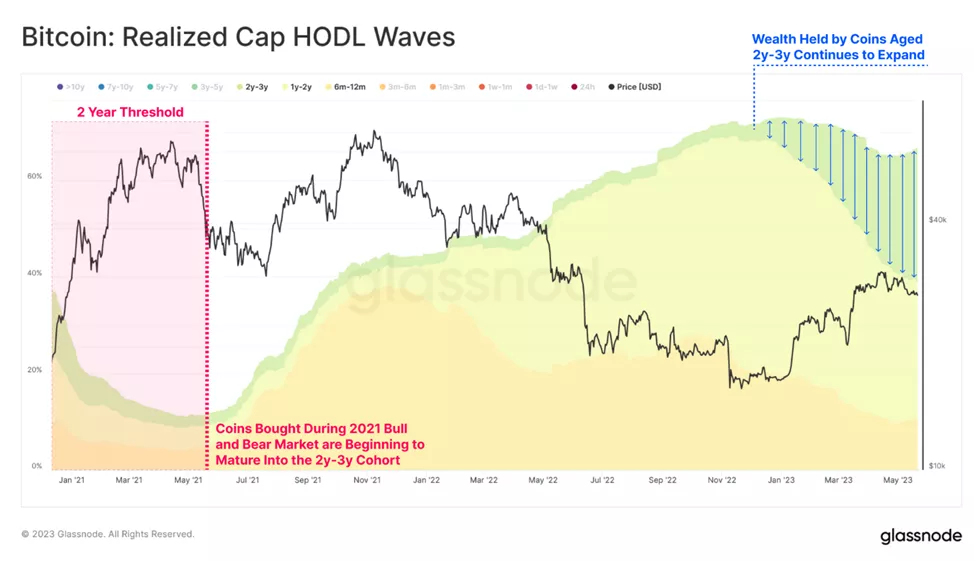

The graph below shows the ‘aging’ of Bitcoins in wallets to two-to-three-year ages — from a low in November 2022 their share increased from 3.1% to 27.7%. It also illustrates the growth in hodling among investors after the May 2021 sell-off — coins moved from the 6-month to 1-year category into the 1–2 year and 2–3 year categories.

Earlier CNBC experts showed bullish sentiment about Bitcoin. According to their forecasts, this year the asset could test the previous high and even reach $100 000.

Analysts at Standard Chartered had set the horizon for reaching $100 000 for digital gold at by the end of 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!