Glassnode: Long-term investors ramp up purchases during Bitcoin’s current correction

The current correction was driven by panicked selling among short-term investors, while long-term holders were buying the dip. Analysts at Glassnode concluded as much.

As Elon Musk reverses his #Bitcoin sentiment, we observe new entrants panic selling and hodlers stepping in to buy the dip.

This is a historically significant correction that is testing $BTC hodler conviction.

Read more in The Week On-chain👇https://t.co/g8yPbizGbB

— glassnode (@glassnode) May 17, 2021

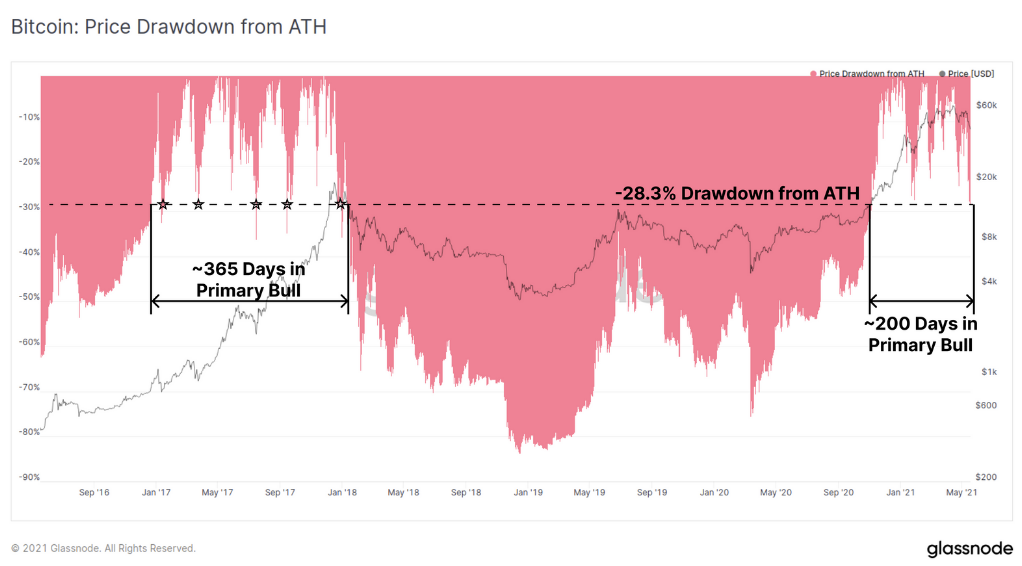

Bitcoin’s pullback from its all-time high (ATH) by 28.3% did not exceed the depth of corrections typical of the previous bull market.

Analysts noted the relative youth of the current uptrend. Its duration has reached 200 days, compared with 365 in the previous bull phase.

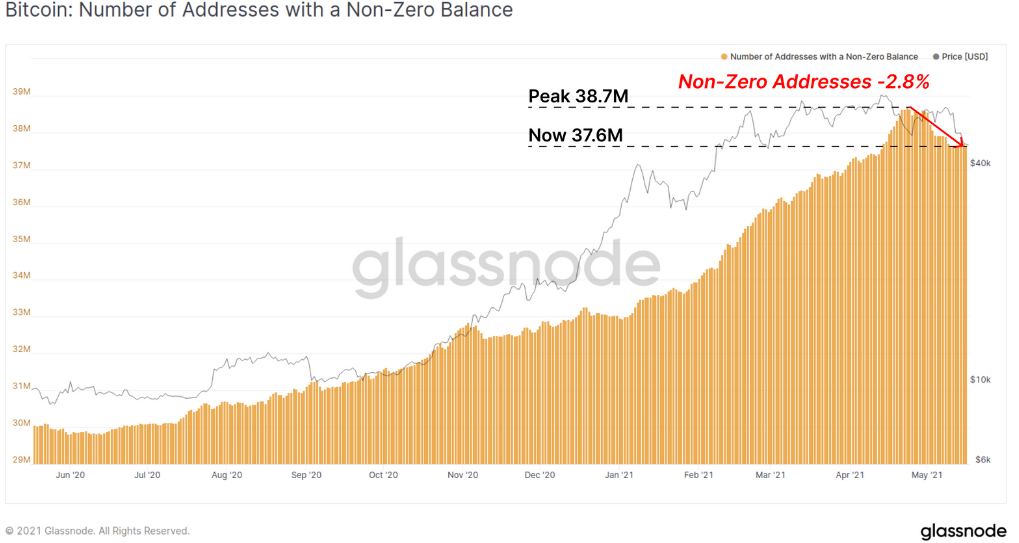

The total number of Bitcoin addresses with non-zero balances fell 2.8% from the ATH of 38.7 million.

“About 1.1 million addresses spent all their coins during this correction. This is another argument in favour of panic selling”, the analysts wrote.

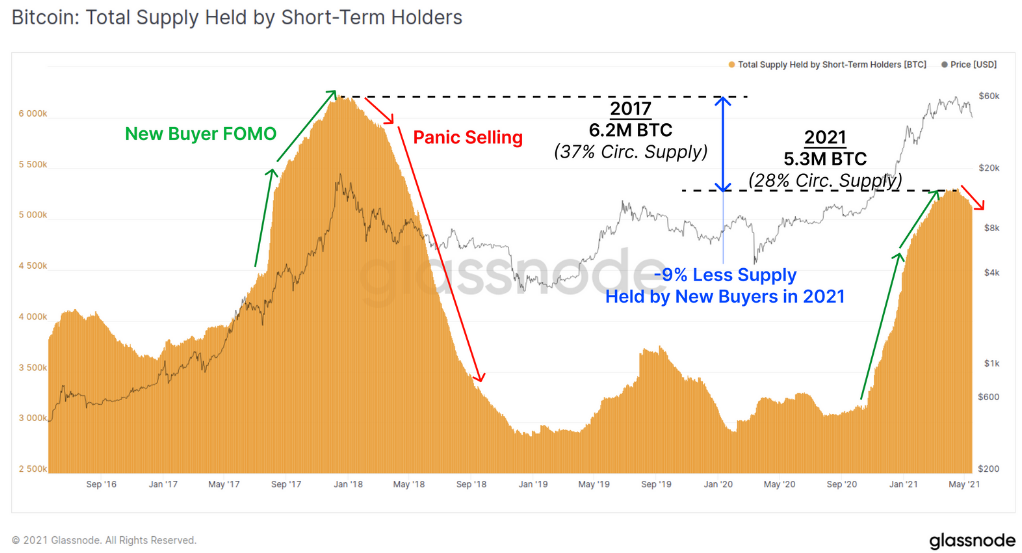

Experts drew parallels with 2017. As then, the price reached ATH as the share of coins in the hands of new holders increased. Markets typically reach peaks when a significant portion of assets is in the hands of new holders, they noted.

Unlike the events of three years ago, this year’s figure rose only to 28% (5.3 million) versus 37% (6.2 million) in 2017. Analysts explained that, on the one hand, this may reflect the influence of rising prices, and on the other — the risk of a continued pullback within the bullish cycle.

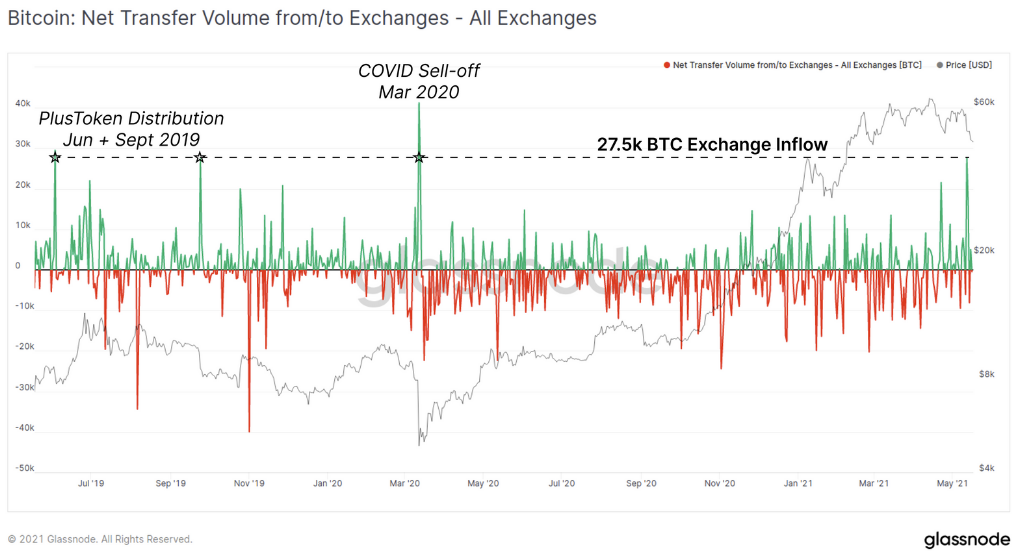

A total of 27.5 thousand coins flowed to exchange addresses. This is comparable only with the March 12-13, 2020 sell-offs and the actions of PlusToken operators.

Analysts noted a 1.1% increase in the number of addresses that accumulate and do not spend coins — from 530k to 536k.

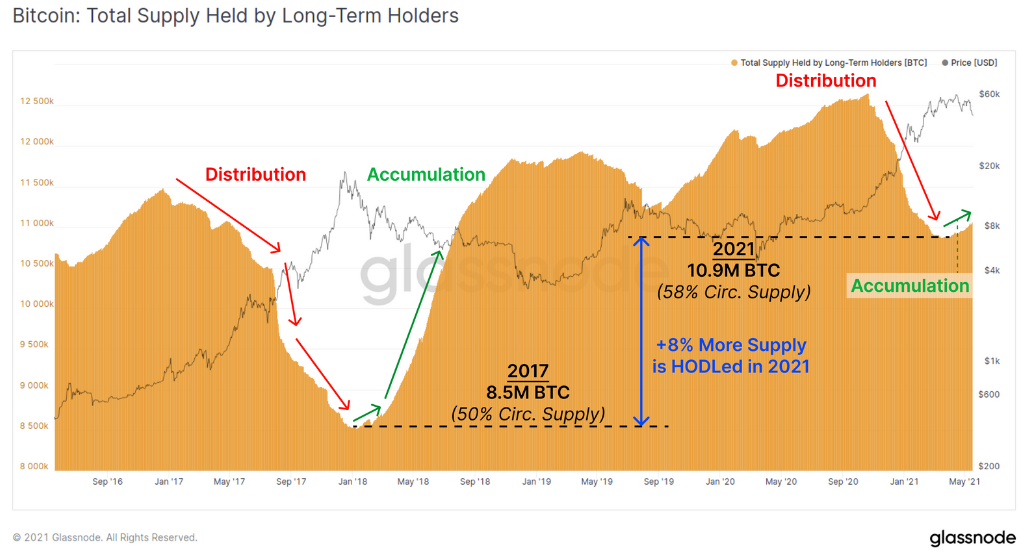

The amount of bitcoins held by long-term investors has also resumed growing. Hodlers currently hold 58% of circulating coins. In January 2018, this figure stood at 50%.

The conclusions of Glassnode analysts were summarised by user @dilutionproof.

“On-chain data point to activity of short-term holders who capitulated at a loss. Long-term holders and miners are buying the ‘bottom’,” he noted.

The story of this #Bitcoin dip in 4 charts ⛓️

Most of the on-chain volume came from short-term holders that ended up capitulating at a loss 🪦

Meanwhile, long-term holders & miners are stacking sats at an increasing pace, clearly buying the dip 💪 pic.twitter.com/TSa37T17nV

— Dilution-proof (@dilutionproof) May 17, 2021

Glassnode stressed that the current correction is significant in historical retrospect. The ongoing discussions about ecological sustainability of Proof-of-Work are testing the market’s resilience. Long-term investors were not unsettled by this news backdrop, they concluded.

Guggenheim Partners warned of a possible correction to to $20,000. At the same time, the firm has not changed its long-term forecast for Bitcoin to reach $400,000 – $600,000.

Subscribe to the ForkLog channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!