Glassnode: Recent Bitcoin slump did not shake long-term investors’ sentiment

The sharp pullback in Bitcoin price last week, driven by liquidations in the crypto-derivatives market, did not shake long-term investors’ resolve to hold the coins they acquired.

Last week opened to a market wide deleveraging, as #Bitcoin sold off by $10k in 1hr.

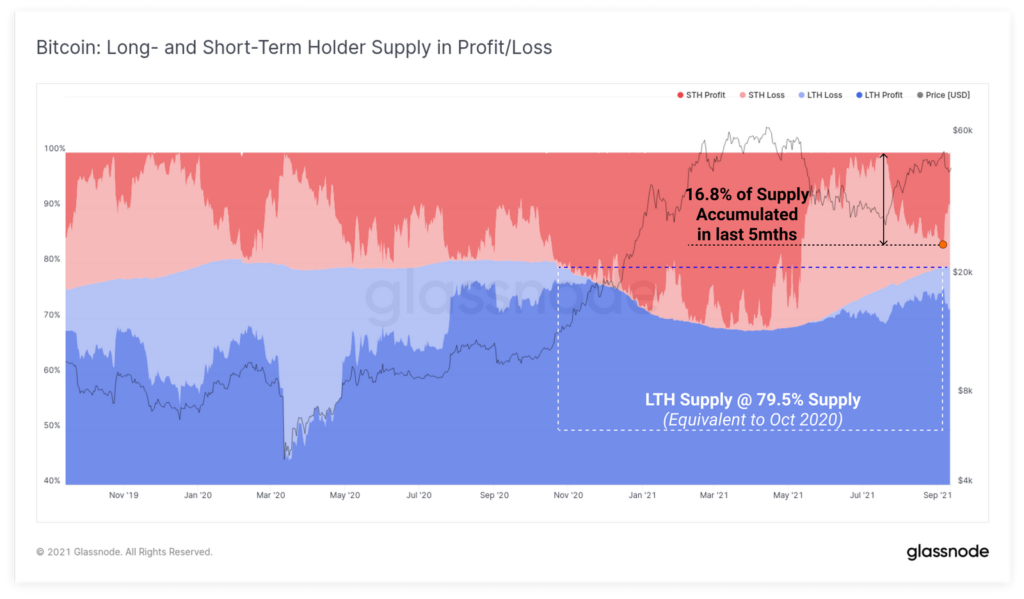

Despite downside volatility, long-term holders remain unshaken, with almost 17% of supply bought and held through significant corrections.

Read more in The Week Onchainhttps://t.co/bg6mjjqxY6

— glassnode (@glassnode) September 13, 2021

Analysts noted that such composure among holders persisted after the 50% downturn in May and after the sharp rally from the July lows.

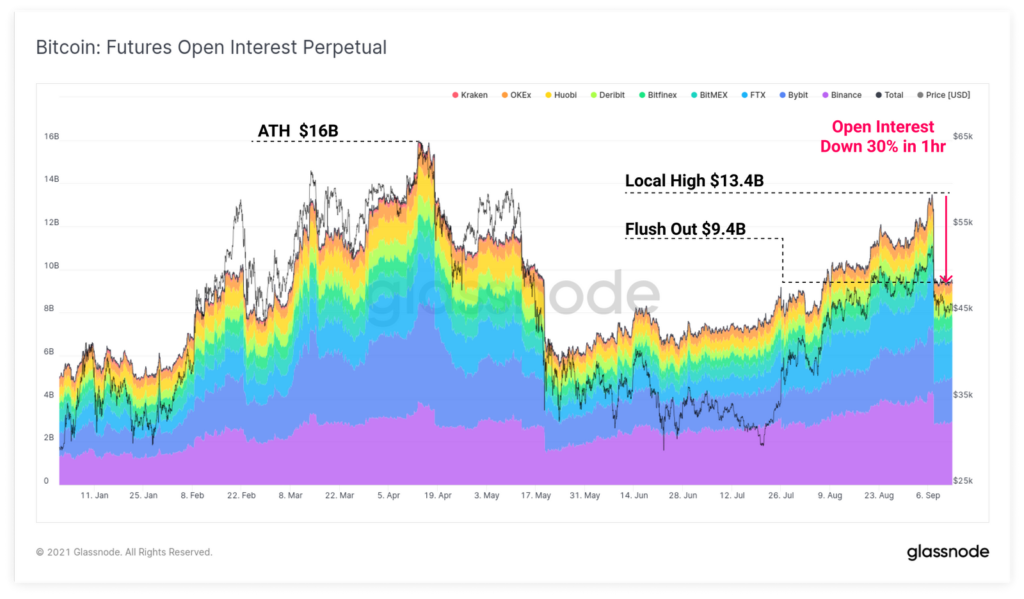

The driver of Bitcoin’s $10,000 drop within an hour was the liquidation of 30% of open positions in perpetual contracts, totaling around $4 billion. According to estimates, 68% of liquidations were longs.

In the options market on September 7, a spike in trading volume was recorded ($1.3 billion, the highest in four months).

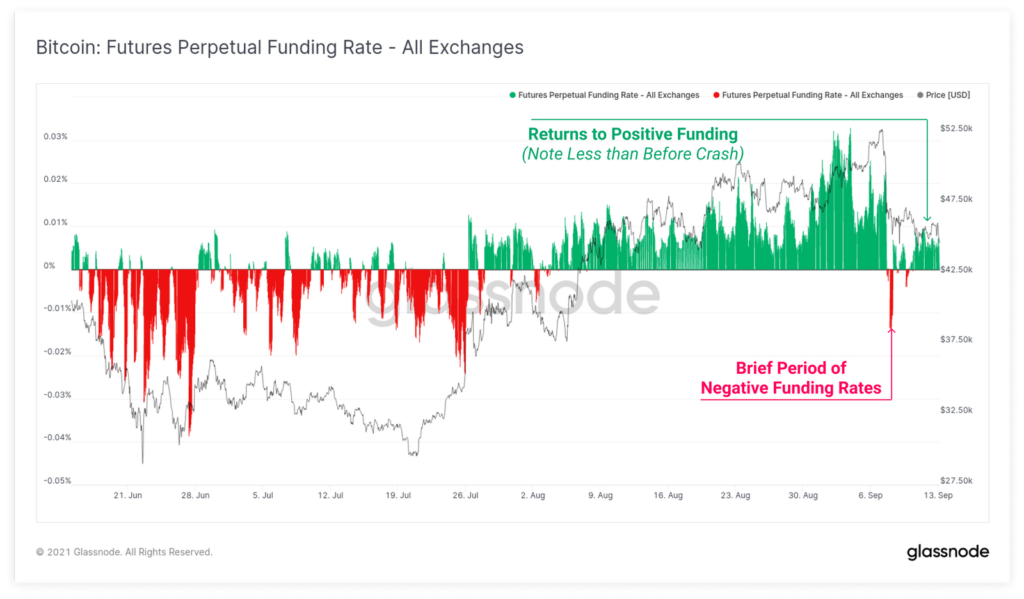

The funding rate for perpetual contracts remained in positive territory after a brief dip into negative territory, signaling optimism among market participants. A lower reading than that observed before September 7 suggests reduced leverage.

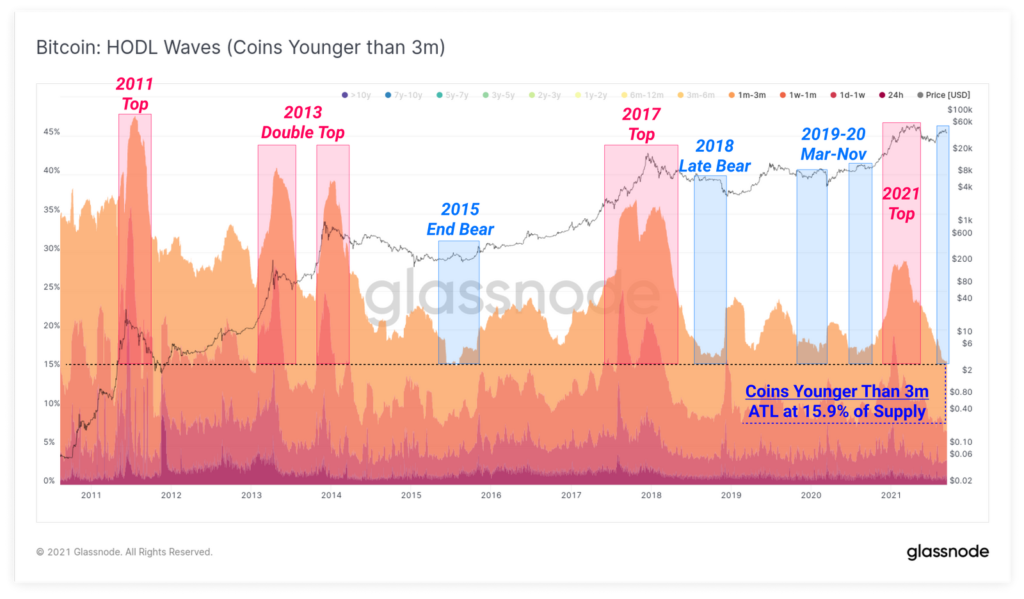

The share of coins aged less than three months since the last movement reached a record low of 15.9% of current supply. Analysts noted that this metric’s low reading is characteristic of late-stage bear markets; in the chart below it is highlighted in red. In these periods, accompanied by an absence of the FOMO effect, young coins are withdrawn from liquid circulation and begin to mature in investors’ wallets.

The next chart shows that 16.8% of the total supply bought in the last 155 days (STH) is in profit at current prices. Experts saw this as a sign of aggressive accumulation during the rally from the July lows.

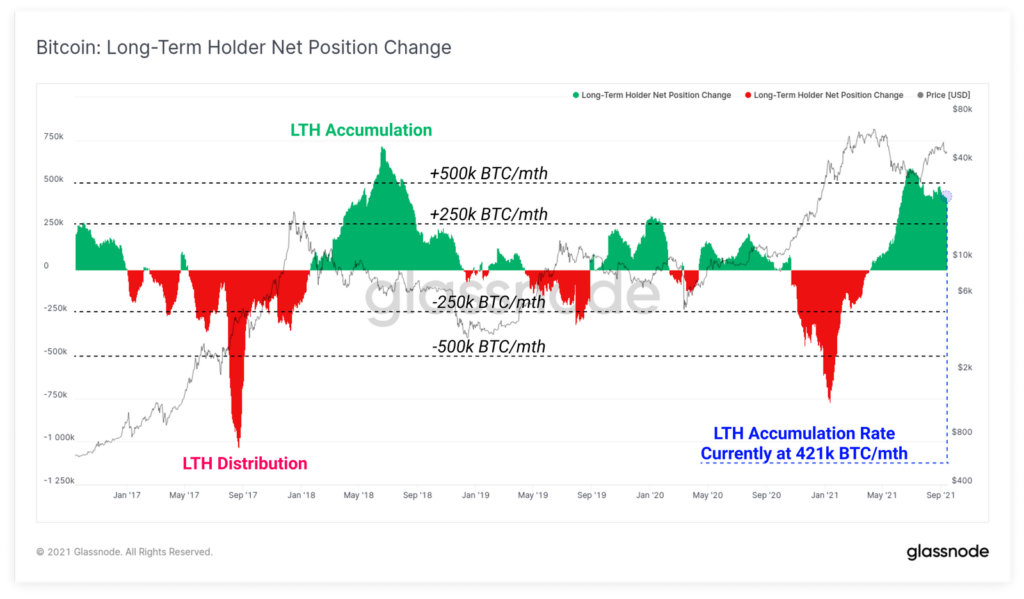

Bitcoin acquired during this period sits in wallets for long-term storage and is not used to realise gains. The pace of movement into the long-term holder tier (over 155 days) reached 421,000 BTC per month.

As noted, futures analysis after a 20% correction showed that the bulls were able to defend key supports.

Follow ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!