Glassnode: Regulatory pressure on Binance has not broken Bitcoin hodlers

The CFTC‘s lawsuit against Binance and its CEO Changpeng Zhao did not lead to a significant outflow of users from the platform, nor did it shake investors’ confidence in the leading cryptocurrency. Analysts at Glassnode concluded as much.

With Binance firmly in the cross-hairs of US regulators, we investigate how the market has responded by assessing the netflow of coins through exchanges.

We also evaluate the supply dynamics of Bitcoin, to gauge the current state of holder confidence.https://t.co/JgxyrXIvYN

— glassnode (@glassnode) April 3, 2023

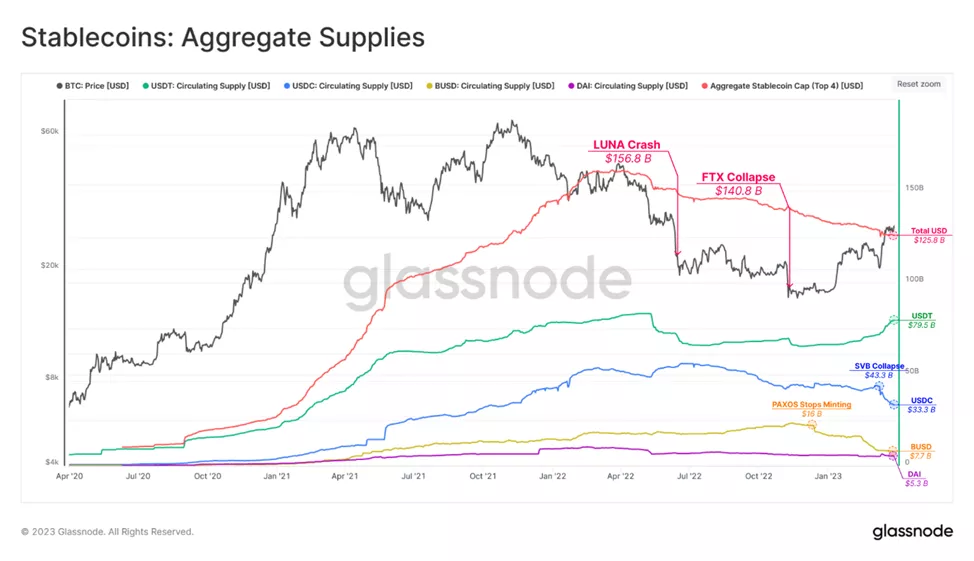

Against the backdrop of Bitcoin’s price continuing to consolidate in a narrow range with readings above $29,000, analysts noted a structural shift in stablecoins.

From its peak of $161.56 billion a year ago, the market capitalization of the four main “stablecoins” fell by 22% ($125.8 billion).

The USDT share rose to 63.7% ($79.5 billion) as USDC, which since the depeg amid turbulence in the US banking sector has recorded a net fiat conversion of $10 billion ($33.3 billion). The share of the Circle- and Coinbase-managed stablecoin declined to 26.5%.

The market capitalization of BUSD collapsed by 52% — to $7.7 billion with a 6.1% share, since the NYDFS ordered Paxos to stop issuing the stablecoin.

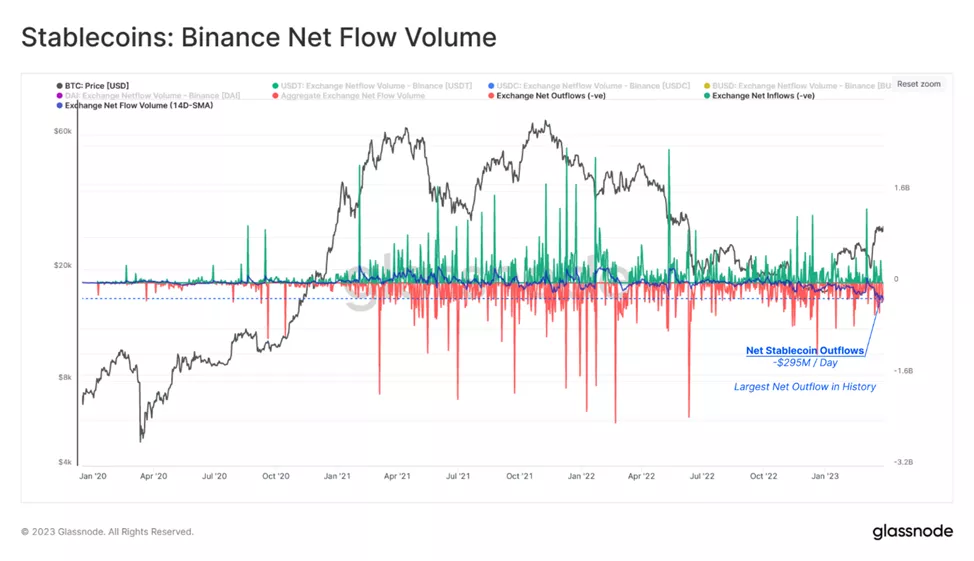

Analysts found a record net outflow of stablecoins on the Ethereum blockchain from Binance wallets amounting to $295 million (14D EMA).

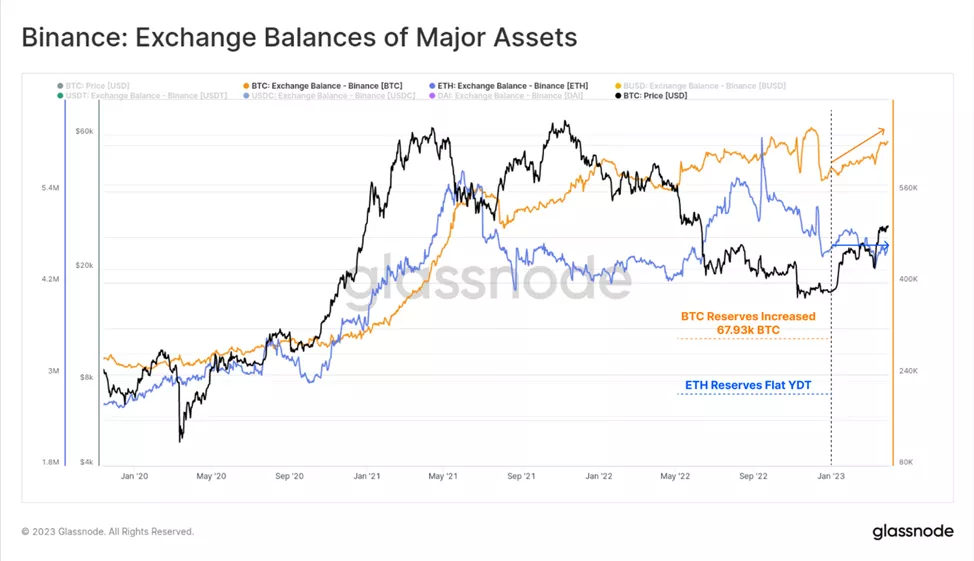

Binance’s balance denominated in Bitcoin and Ethereum, since the start of the year, rose by 67,930 BTC in Bitcoin terms and showed zero momentum in Ethereum terms.

“Even with the net outflow of stablecoins, the market does not express broad concern about the exchange’s position. The rising tensions between Binance and regulators have not affected its status as the largest CEX,” — analysts noted.

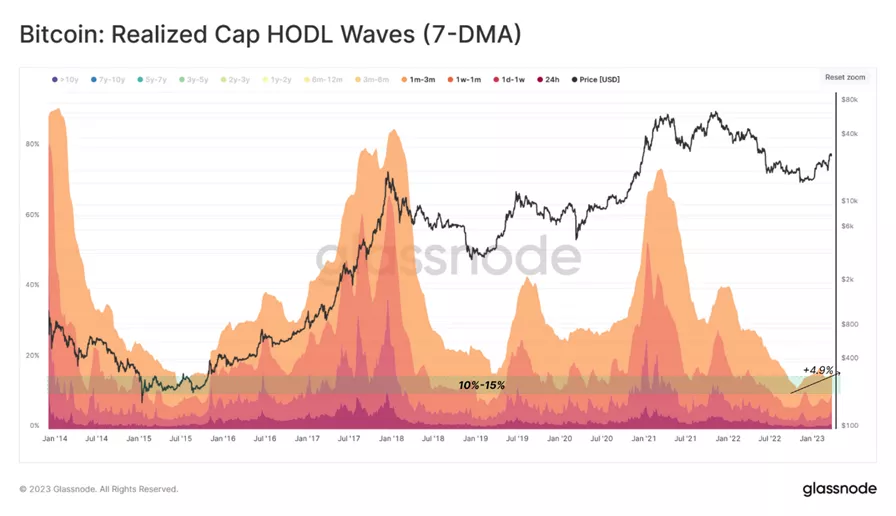

The current phase of Bitcoin’s recovery has led to a modest transfer of wealth, expressed in HODL waves, from holders (coins held for more than three months) to “hot money” (less than 90 days). The share of the latter rose by 4.9%.

In absolute terms, speculators still account for only 10-15% of the “total wealth”, which is typical for bottom-forming periods, the experts noted.

Back in March 2023, the founder and CEO of Messari, Ryan Selkis, forecasted Bitcoin to rise to $100,000 within 12 months. He called the leading cryptocurrency a sound investment amid the troubles facing the US economy.

Expressed by many industry experts, CNBC’s poll reflected a similar view.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!