Glassnode Reports Waning Investor Appetite for Bitcoin

Bitcoin’s realized capitalization has reached a historic peak of $872 billion, yet data indicates a decline in investor appetite at the current price level, according to Glassnode.

#Bitcoin’s realized cap has reached an all-time high of $872B, yet monthly growth has slowed to +0.9%. This indicates that while capital inflows remain positive, investor appetite is softening — signaling continued risk-off sentiment. pic.twitter.com/XBgZP7NoWo

— glassnode (@glassnode) April 17, 2025

Analysts from the platform noted that the monthly growth rate has slowed to 0.9%, despite record levels. This suggests a market reluctance to take risks.

Realized capitalization accounts for the total asset value at the price of its last movement. This metric reflects the actual invested capital. While capital inflow remains positive, the slowdown in growth implies a reduction in the number of new investors and the activity of current bitcoin holders.

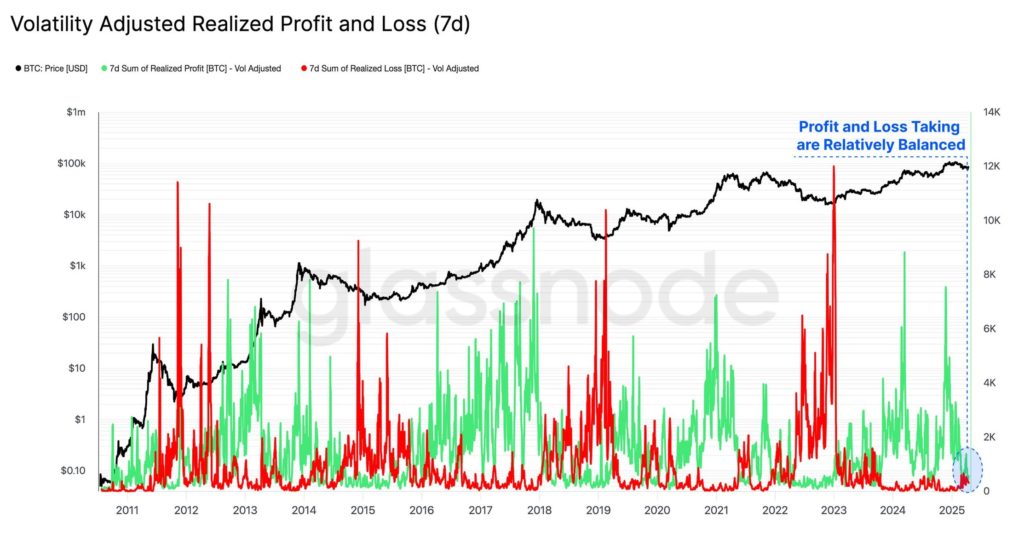

Experts also noted that the chart of realized profits and losses, adjusted for volatility, has shown an almost equal balance in recent weeks.

“This indicates a saturation of investor activity and often precedes a consolidation phase as the market seeks new equilibrium,” Glassnode stated.

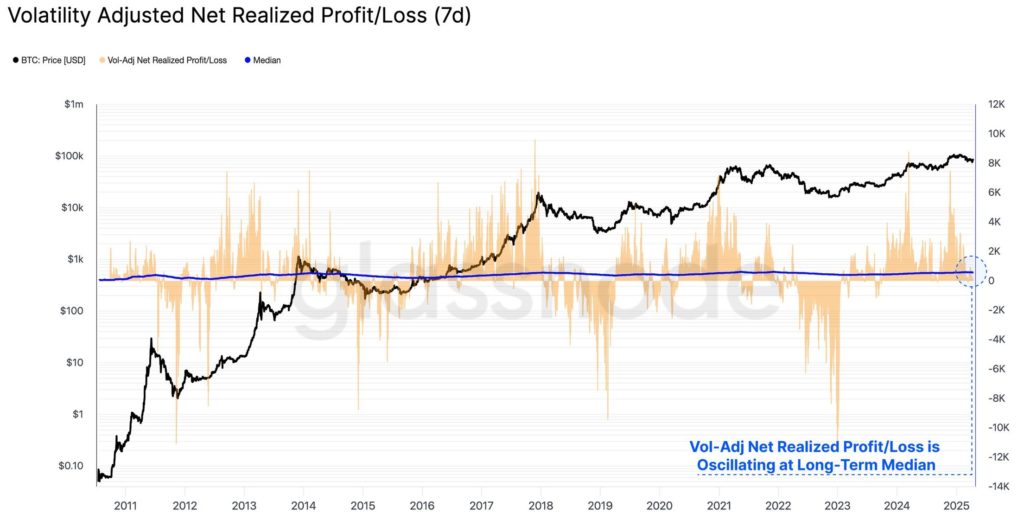

Meanwhile, the volatility-adjusted net realized profit/loss in bitcoin has returned to the long-term median, analysts noted.

“This historically marks the boundary between bullish and bearish regimes, placing the market at a critical point for determining direction,” they emphasized.

Analysts also pointed to a slowdown in stablecoin supply growth in recent weeks. This is another sign of decreasing liquidity in digital assets and the formation of a more risk-averse environment, they believe.

#Stablecoin supply growth remains positive but has softened in recent weeks. As stablecoins serve as core quote assets across crypto markets, this slowdown adds further evidence of a broad contraction in digital asset liquidity and a more risk-off environment. pic.twitter.com/2ccBnwsSzp

— glassnode (@glassnode) April 17, 2025

A Glimmer of Optimism

A CryptoQuant author known as Avocado highlighted the divergence between the movements of the Coinbase Premium and the Korea Premium Index.

Coinbase Premium Recovers, Korea Lags

“This divergence highlights that current market direction is largely driven by U.S.-based activity on platforms like Coinbase, while interest from Korean investors appears muted.” – By @avocado_onchain

Read more ⤵️https://t.co/G6AjBaNbGH pic.twitter.com/aLLv3bvahx

— CryptoQuant.com (@cryptoquant_com) April 17, 2025

The indicator, traditionally signaling activity from American investors, shows increasingly lower highs and higher lows. This suggests potential for a renewed upward momentum in bitcoin — historically, the metric has served as a leading indicator.

The “kimchi premium,” on the other hand, traditionally reacts to price movements of the leading cryptocurrency reactively, Avocado noted. Throughout the 2024 correction period, it showed a steady downward trend and only began to rise following digital gold.

“While overall market conditions remain unstable, the upward trend in Coinbase Premium lows indicates healthy demand. This foretells a potentially strong medium- and long-term recovery in bitcoin’s price trajectory,” the analyst concluded.

According to another CryptoQuant author, pseudonymously known as Crazzyblock, the current selling pressure is observed from retail investors, while whales and seasoned players continue to accumulate the leading cryptocurrency.

Who’s Really Selling Bitcoin? Let’s Break It Down

“The real sell pressure is not from whales or old hands, but from retail, mid-sized cohorts (shrimps to sharks) and short-term holders — a classic shakeout.” – By @Crazzyblockk

Full post ⤵️https://t.co/7byGSp2gSH pic.twitter.com/Qycs9yyaaZ

— CryptoQuant.com (@cryptoquant_com) April 16, 2025

The expert believes a “classic shakeout” is occurring — the displacement of speculators and small participants from the market.

As reported by Bitwise, specialists identified four potential drivers for bitcoin’s growth in the second quarter.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!