Glassnode sizes up the impact of Trump’s tariffs on bitcoin’s outlook

- Support for the first cryptocurrency is $76,000; resistance is $93,000.

- The market correction has pushed medium-term holders to sell.

- Selling pressure in bitcoin and Ethereum shows signs of exhaustion.

A combination of on-chain metrics and technical indicators suggests the first cryptocurrency must reclaim $93,000 to restore upward momentum, Glassnode concludes.

Tarrifs and Turmoil: the latest Week On-Chain report is now live.

The announcement of “Liberation Day” #tariffs sent shock waves through the markets, digital assets being no exception.

Does it mark the end of the bull market? Read the full report here: https://t.co/KlyxtoarDb pic.twitter.com/DFSun6mxOw— glassnode (@glassnode) April 9, 2025

The aforementioned level aligns with the 111 DMA. To end the correction, the price should not establish itself below $76,000 (365 DMA). In early April, quotes briefly undercut that level for the first time since the 2021 cycle, the firm noted.

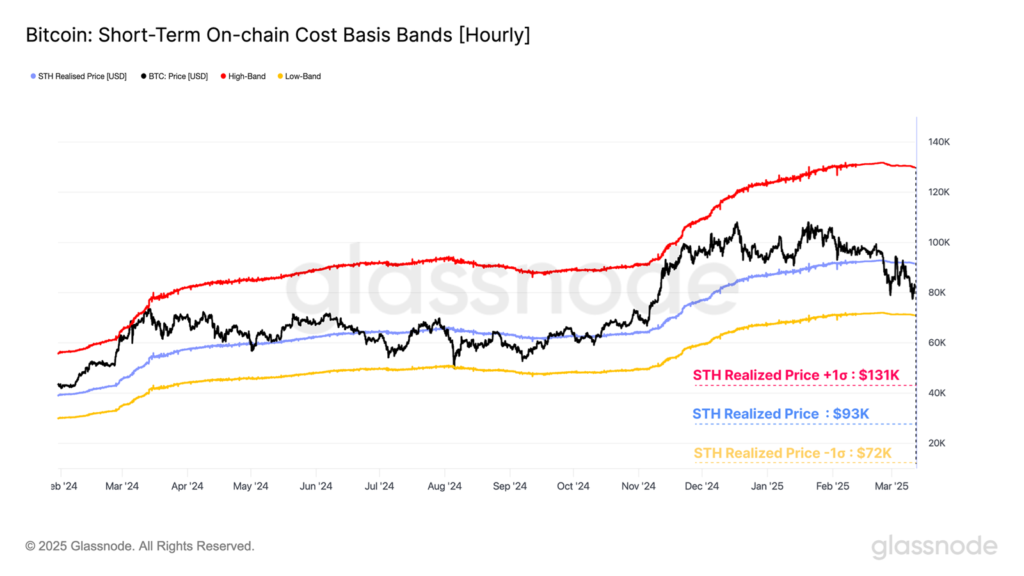

$93,000 also corresponds to the cost basis of coins held by short‑term market participants. One standard deviation below that implies about $72,000.

At present, the price of digital gold sits between these two reference points, the experts said.

Longer‑term fundamental support lies in the $65,000–71,000 area. A move below this corridor would strip most active investors of their remaining profits.

According to the analysts’ calculations, during the current correction since February 27 the share of loss‑making sales of coins aged three to six months has risen from 0.8% to 19.4%.

In comparison to previous large #Bitcoin sell-offs YTD, losses are now spreading to older coins — especially in the 3m–6m group, whose share in loss realization jumped from 0.8% to 19.4% of total losses since Feb 27: pic.twitter.com/cShuvGCuLz

— glassnode (@glassnode) April 9, 2025

“This marks a structural shift in loss realisation and points to sustained pressure on medium‑term holders,” the experts stressed.

BTC vs ETH

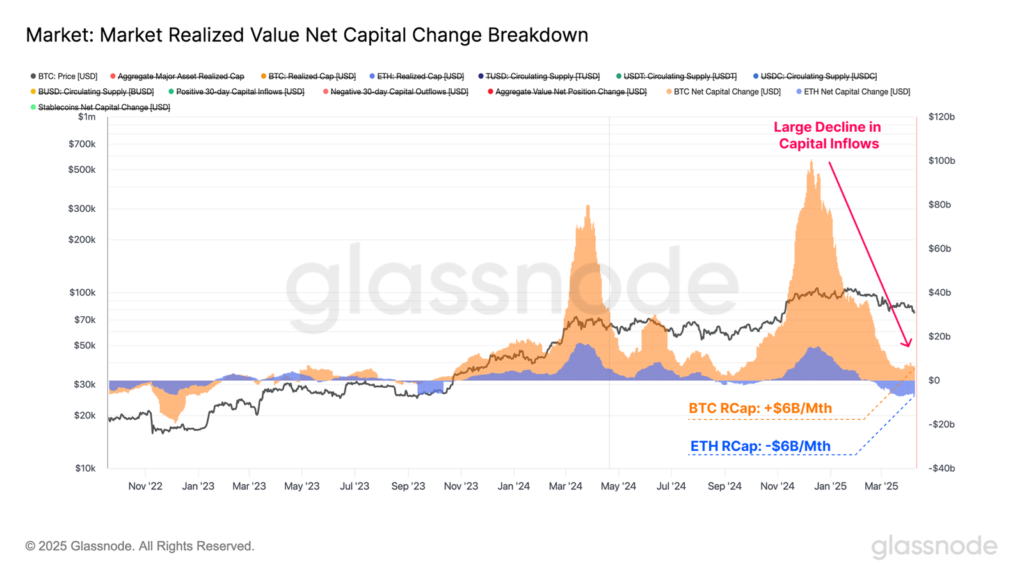

The analysts reported shrinking capital inflows into the two leading cryptocurrencies, reflected in changes to realised capitalisation (30 DMA).

After monthly peaks of $100bn and $15.5bn for bitcoin and Ethereum, the metrics fell to $6bn and −$6bn respectively. The negative figure in the latter case indicates net losses relative to the acquisition price.

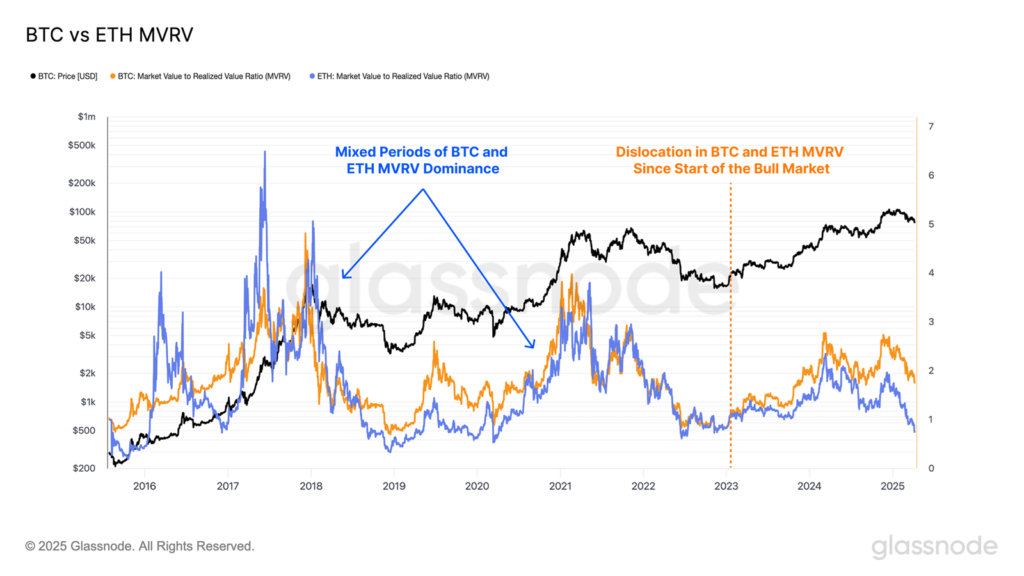

Ether’s MVRV ratio fell below 1, showing the “average” holder is in loss. For bitcoin, the indicator remains comfortably above that boundary.

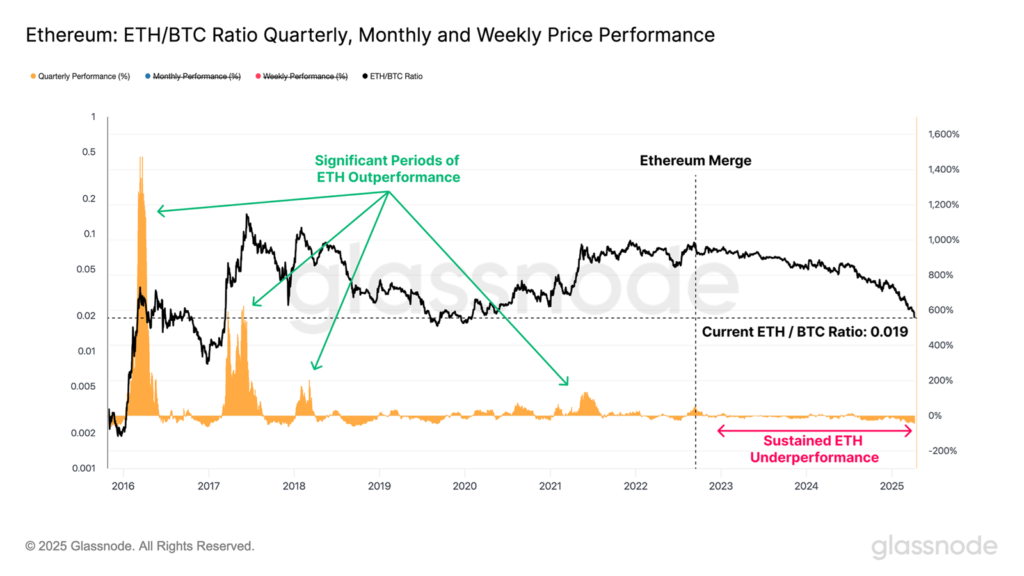

The specialists noted Ethereum’s uncharacteristic underperformance versus bitcoin for a bull cycle.

As a result, ETH/BTC has fallen 75% since the Merge, to 0.0196. That is the pair’s lowest since January 2020, with a lower value seen on only 500 of 3,531 trading days, the experts calculated.

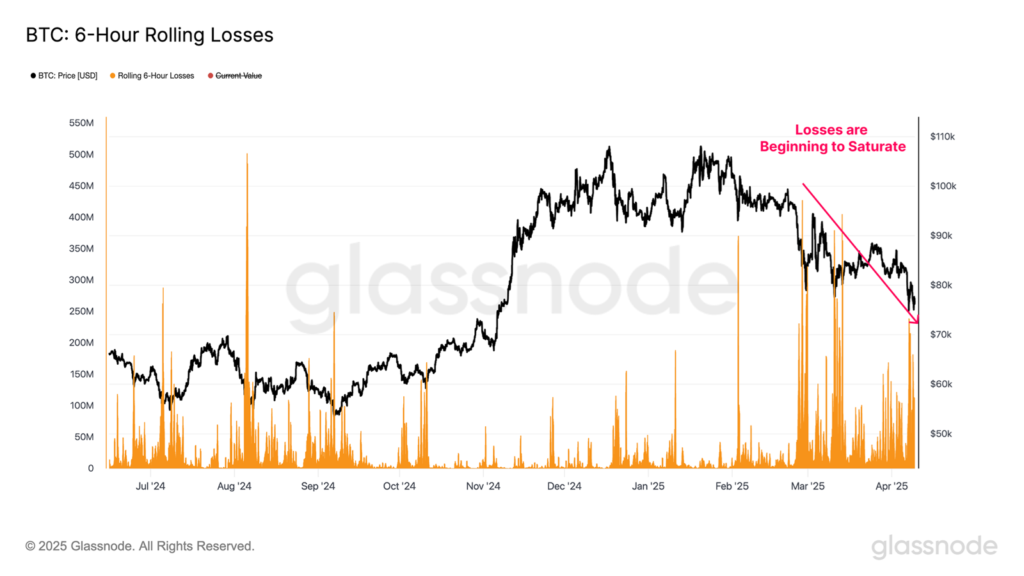

Glassnode estimated the peak of six‑hour loss realisation in bitcoin at $240m, comparable with some of the largest such episodes in this cycle.

“With each subsequent price decline, the magnitude of realised losses began to shrink. This may indicate some exhaustion of bearish pressure. Investors are increasingly acclimatised to lower price ranges and unsettled market conditions,” the review said.

Ethereum shows a similar picture: losses of $564m rank among the largest since the peak of the bull trend in January 2023.

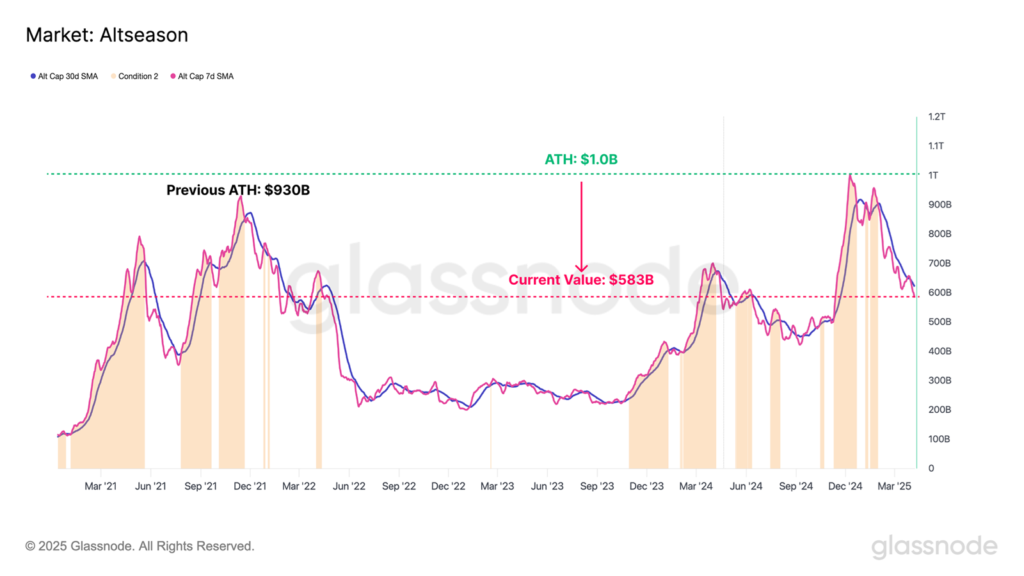

The liquidity squeeze triggered a significant negative repricing across the altcoin sector. Assets further out along the risk curve proved more sensitive to turbulence.

Sector capitalisation (excluding Ethereum and stablecoins) has slumped by more than 40% — from $1trn in December 2024 to $583bn.

Earlier, Bernstein called the resilience of bitcoin’s price “impressive” amid tariff turbulence.

Earlier, former BitMEX CEO Arthur Hayes said that new US tariffs could drive capital into digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!