Glassnode: Uncertainty in the crypto market will persist

Weak on-chain metrics and broad investor concerns in the derivatives market hinder Bitcoin’s recovery after a price slide since the end of March. Analysts at Glassnode conclude as much.

The severity of the bear market put a dent in macro price performance metrics of #Bitcoin and #Ethereum

This week, we analyse the diminishing return profile of both $BTC + $ETH, and what market structure, and on-chain usage tells us about the road ahead.https://t.co/5KK6xBLVUg

— glassnode (@glassnode) May 23, 2022

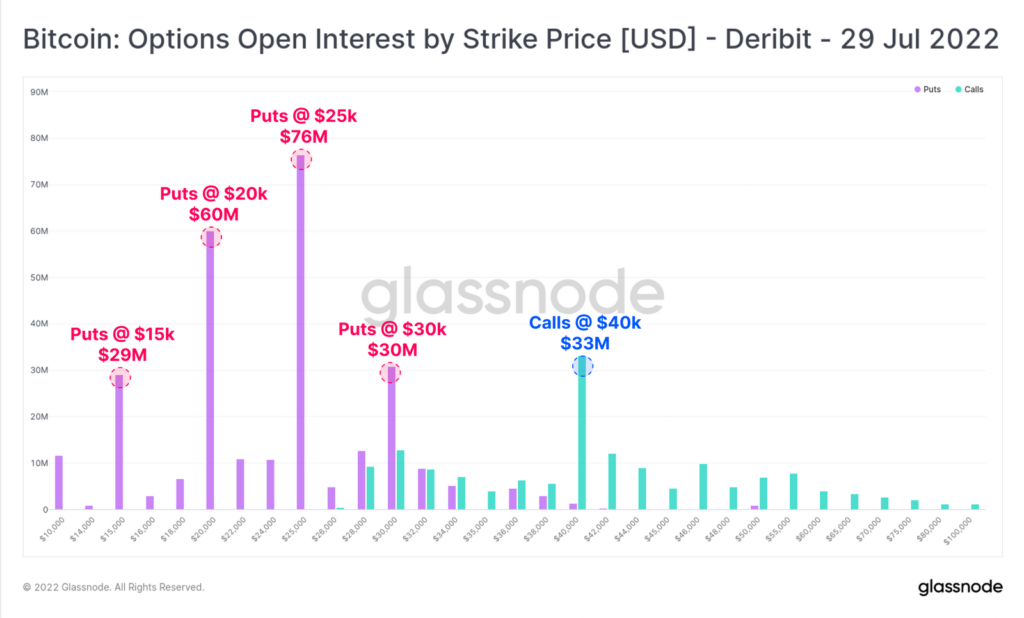

The collapse of LUNA and the broad market weakness affected derivatives market participants’ expectations. In Bitcoin, the ratio of open put and call options has risen from 50% to 70%, signaling a growing investor inclination to hedge positions against further negative momentum.

In July-dated call contracts, the largest open interest (OI) concentrates around the $40,000 level.

Participants show the greatest preference for puts that would profit if the price falls to $25,000, $20,000 and $15,000. In other words, through mid-year the market is oriented toward hedging risk and/or speculation on further price declines.

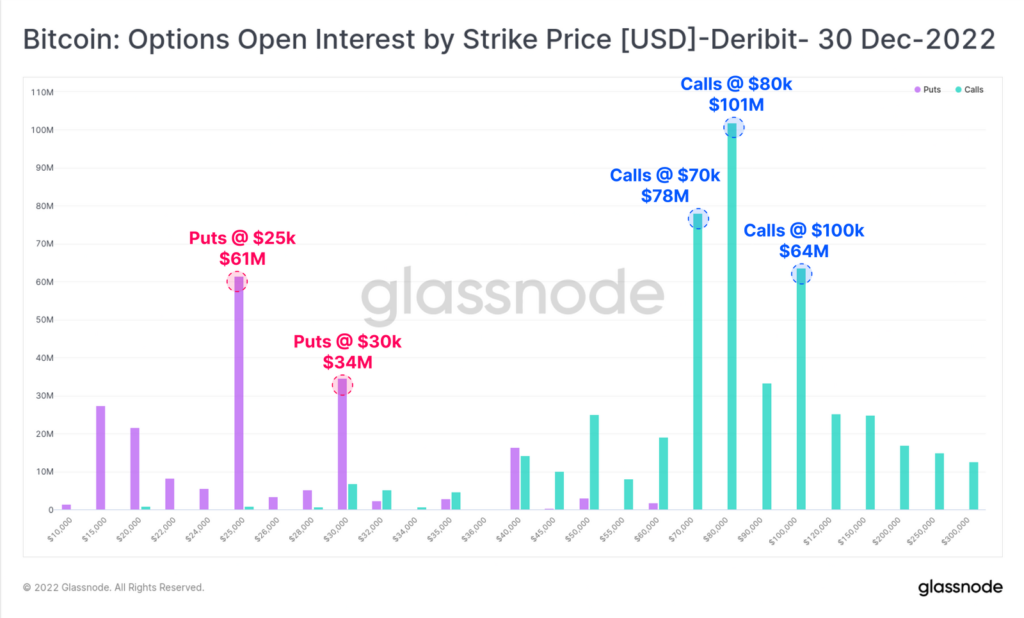

Over the longer horizon, optimists prevail. In year-end expiry contracts, the bulk of open positions sits in the $70,000 to $100,000 range. In put options, open interest is concentrated between $25,000 and $30,000, close to current levels.

On-chain indicators for Bitcoin and Ethereum point to waning demand for block space to multi-year lows.

In Bitcoin’s network, total daily transaction fees have returned to the range of minimal values observed since July 2021, around 10-12 BTC.

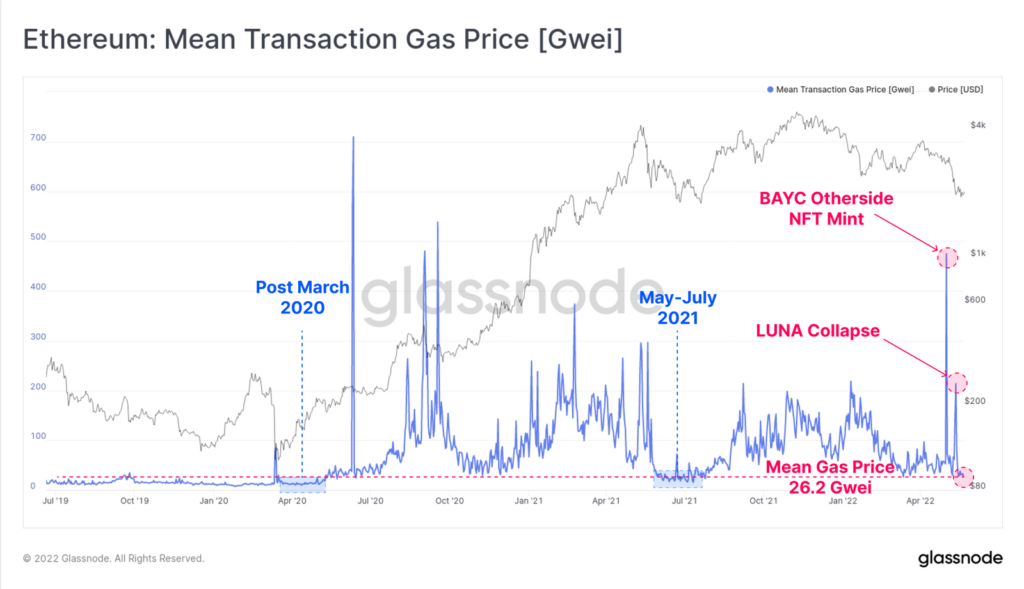

In Ethereum, the median gas price dropped to 26.2 Gwei after brief spikes driven by the distribution of NFT metaverse Otherside and Terra collapse. The last time such levels were seen was in May–July 2021 and after March 2020.

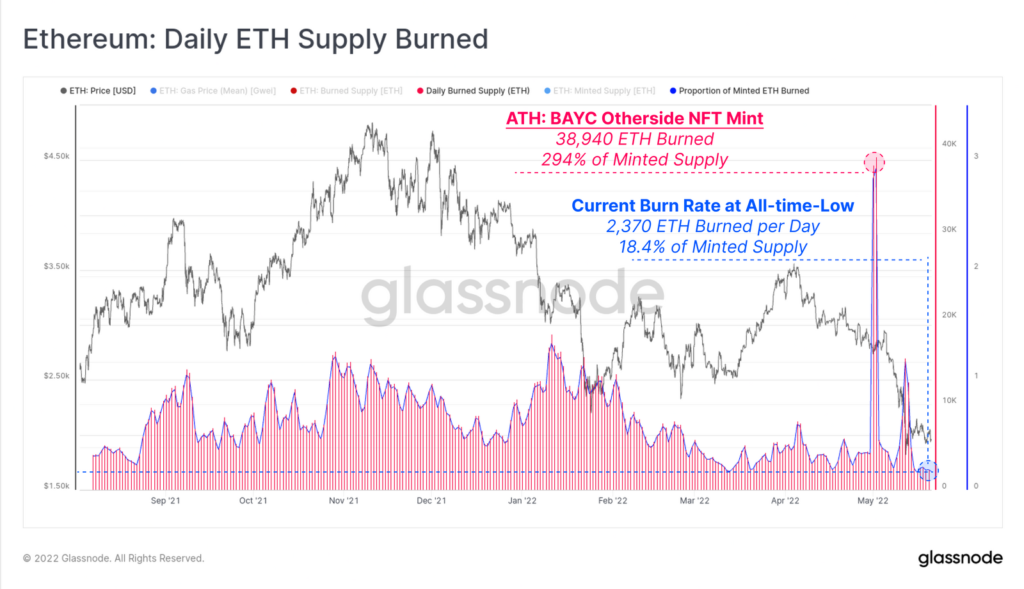

The rate of ETH burning via EIP-1559 hit a record low. Last week, 2,370 ETH were burned, down 50% from the pace at the start of May. The share of coins not subjected to this procedure reached a record 81.6%, which also exerted downward pressure on the price.

Analysts pointed to declines in active addresses and in the volume of value transferred when interacting with popular DeFi protocols such as Aave, Compound, and Uniswap.

Goldman Sachs warned of risks arising from increasing interconnectedness of DeFi projects.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!