Glassnode: Whales trimmed 140,000 BTC in February

Large holders of the first cryptocurrency could have booked profits at peak levels by selling 140,000 BTC in February, according to a Glassnode report.

Last week #Bitcoin continued the trend of new ATHs alongside @MicroStrategy announcing another $1.05B convertible note to buy $BTC

We also study large wallets shuffling holdings and what it may tell us RE institutional hodlers

More in The Week On-chain👇https://t.co/hg22zegl71

— glassnode (@glassnode) February 22, 2021

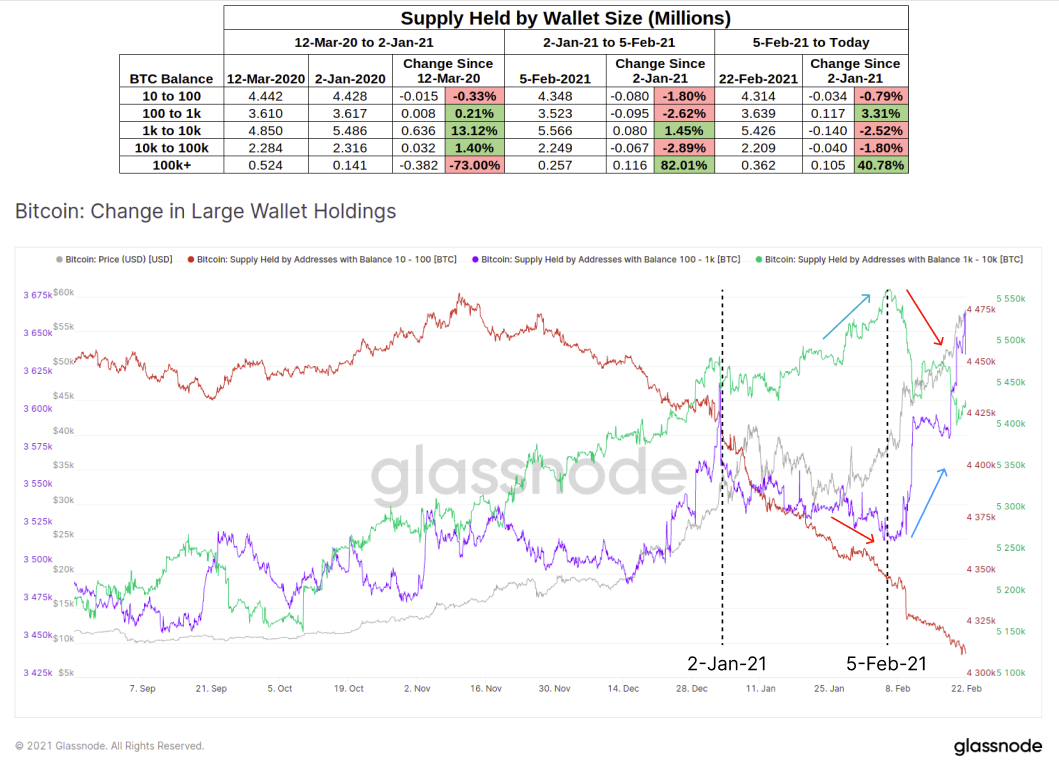

Analysts say that since the start of February Bitcoin wallets with assets from 1,000 BTC to 10,000 BTC reduced their stock by 140,000 BTC worth $6.72 billion. In January, whales bought more than 80,000 BTC.

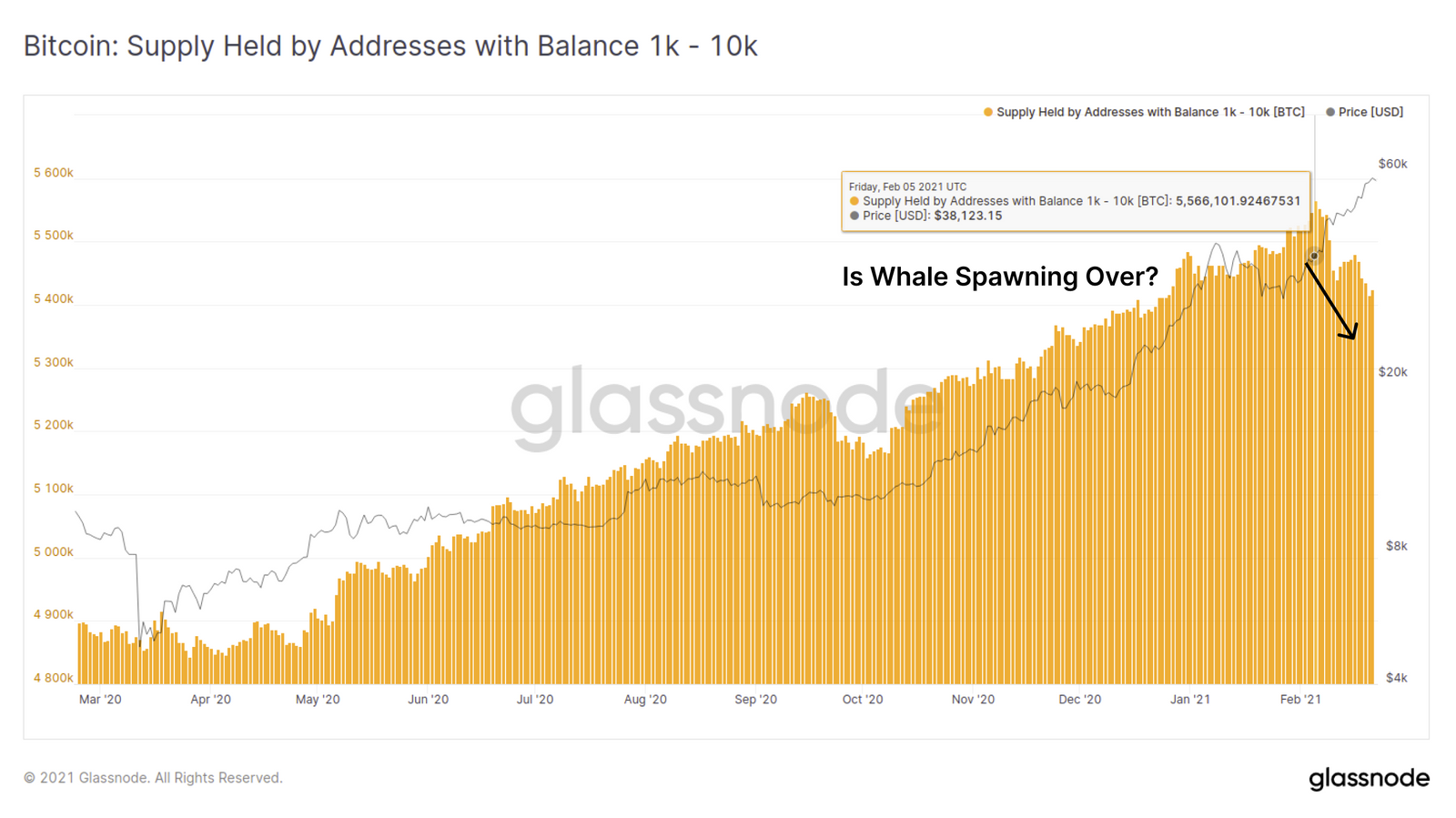

Reduction in the number of wallets with balances from 1,000 BTC to 10,000 BTC. Data: Glassnode.

Wallets with assets from 100 BTC to 1,000 BTC behaved differently. In January they sold 95,000 BTC for $4.56 billion, and in February they bought 117,000 BTC for $5.61 billion.

Bitcoin wallets with assets from 10 BTC to 1,000 BTC have been unloading stock for the fourth consecutive month. Since November 2020, they have sold 128,000 BTC for $6.14 billion.

Changes in the number of Bitcoin wallets depending on reserves. Data: Glassnode.

Analysts noted that whales may not have sold assets, but rather redistributed them. According to the report, in January holders preferred to store 1,000–10,000 BTC on their wallets. In February, analysts say the trend shifted toward a higher number of addresses with smaller balances.

«Возможно, монеты размещаются в схемах с мультиподписями или кастодианы осуществляют внутренние перемещения для удовлетворения требований своих клиентов», — предположили в Glassnode.

January wallet stock increases on Bitcoin wallets. Data: Glassnode.

On February 21, the price of the leading cryptocurrency reached $58,000. On February 23, the Bitcoin price touched the $45,000 level. At the time of writing, the asset was trading around $49,600. The market capitalization of digital gold stood at $921 billion, according to CoinGecko.

Recall that CrossTower analysts suggested that institutional investors will keep the Bitcoin price above $50,000.

Earlier, Indian Warren Buffett warned of a severe hangover after the bull rally in the flagship cryptocurrency. Rakesh Junjhunwala is convinced that the “Bitcoin party” will end badly for its participants.

Subscribe to ForkLog News on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!