Grayscale Bitcoin Trust clients earned less than BTC holders in October

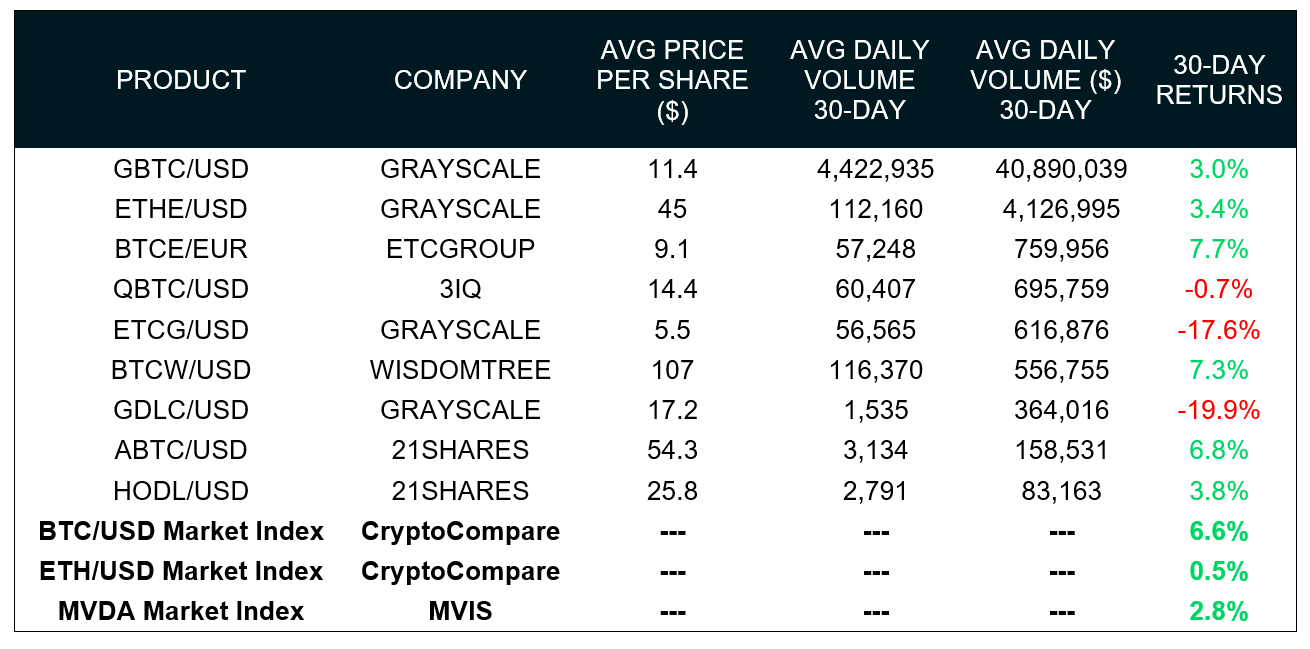

The value of Grayscale Investments’ Bitcoin Trust rose by 3% in the period from September 20 to October 20. In the same period, the spot price of Bitcoin rose 6.6% on the market, according to a new CryptoCompare report.

In October, the top three #ETPs were @Grayscale‘s #Bitcoin

product (#GBTC) & its #Ethereum Trust (#ETHE) & Ethereum Classic Trust (#ETCG) which traded just over $64.7mn in daily volume. Get the full monthly analysis in your inbox: https://t.co/N9vkJ2WYp4 pic.twitter.com/wEFvhWU8Dj

— CryptoCompare (@CryptoCompare) October 20, 2020

Analysts compared data for exchange-traded products (ETPs) from Grayscale Investments, ETC Group and Wisdom Tree. They are not tightly tied to the price of the underlying asset and on individual time spans may outperform or lag behind it.

Grayscale Bitcoin Trust (GBTC) remains a clear leader by assets under management — $5.4bn. The ETC Group and Wisdom Tree have $60.1m and $34.5m respectively. However, while the products of the two latter groups rose by 7.7% and 7.4% respectively, GBTC rose by only 3%. Bitcoin rose 6.6% in the period.

“The lagging momentum relative to the market was broadly characteristic of Grayscale’s investment products,” analysts wrote.

The Ethereum Trust, which accounts for 13.5% of Grayscale’s total portfolio, rose 3.4% during this period, “outperforming” the market by 2.9% (the price of Ethereum rose by 0.5%).

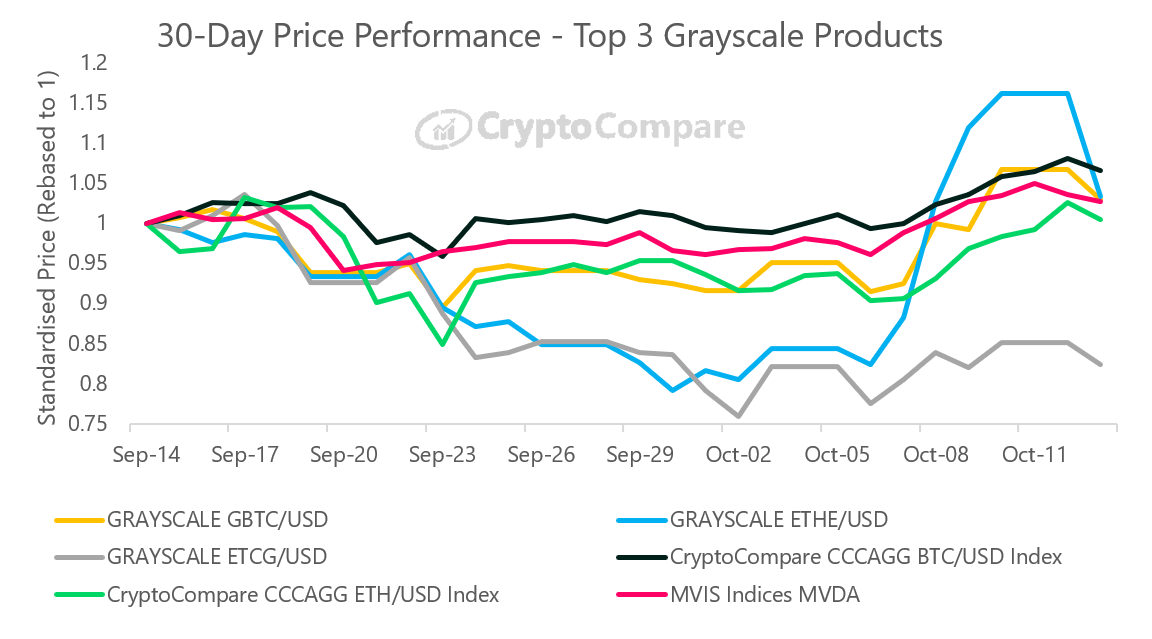

“The Grayscale ETHE/USD trust product showed a lag of up to 10% relative to the spot CCCAGG ETH/USD index. In the second week of October it outpaced ETH, adding 16%,” CryptoCompare explained.

Price dynamics chart of the three leading Grayscale investments trusts. Source: CryptoCompare.

Another Grayscale ETP, the Digital Large Cap Fund (GDLC), which includes Bitcoin, Ethereum, Ripple (XRP), Bitcoin Cash (BCH) and Litecoin (LTC), lost almost 20% of its value over the period. The Grayscale Ethereum Classic Trust shed 17.6%.

Price dynamics of ETPs on cryptocurrencies. Source: CryptoCompare.

Analysts at CryptoCompare noted that seven leading cryptocurrency ETPs outperformed the MVDA index they developed, which comprises the 100 largest digital assets.

In the third quarter, inflows into Grayscale Investments’ cryptocurrency funds amounted to a record $1.05bn.

Earlier this week, the company announced that the value of cryptocurrency assets under management reached $6.5bn.

Experts believe that widespread accumulation of Bitcoin by institutional investors could potentially lead to a shortage of the leading cryptocurrency.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!