Grayscale Bitcoin Trust jumps 12% in a day

On January 9, GBTC rose 12%. The market reaction aligned with news that Morgan Stanley bought Grayscale Investments’ Bitcoin Trust shares for $3.6 million through a European fund, Bloomberg writes Bloomberg.

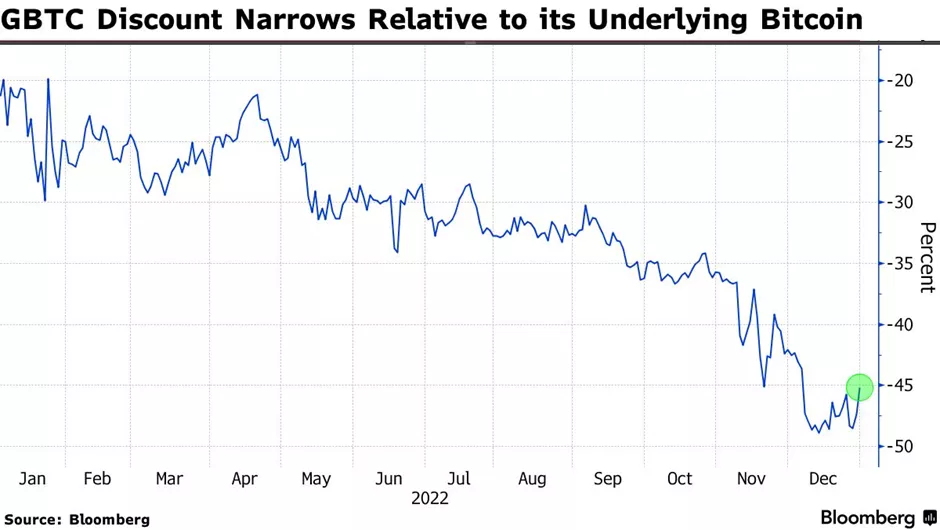

The daily gain was the largest since February 2022. The GBTC discount to NAV narrowed from a record 49% to 44%.

On January 8, the deadline set by Gemini Trust founder Cameron Winklevoss for payment of DCG debt of $900 million arising at the subsidiary crypto-lending platform Genesis Global Capital, expired. The firm, along with Grayscale, is part of Barry Silbert’s holding company.

The latter was expected to publicly commit to working together on the problem that arose in November after the FTX collapse.

Winklevoss did not specify what would happen if no agreement was reached by January 8. An open letter to Silbert heightened fears that Genesis would file for bankruptcy.

In November, the platform did not rule out this scenario in an attempt to raise financing. Such a move raised concerns about the resilience of the parent DCG and the future of GBTC — the “cash cow” of Silbert’s empire.

David Bailey, CEO of Bitcoin Magazine and co-founder of the crypto hedge fund UTXO Management, organized the Redeem GBTC campaign.

Its demands:

- reduce management fees by 2% annually;

- establish a GBTC buyback mechanism without significantly impacting the Bitcoin market;

- initiate a leadership change by launching a competition for new trust sponsors.

According to Bailey, the initiative was backed by holders representing 20% of the shares.

Earlier in December, hedge fund Fir Tree Capital Management filed a lawsuit against Grayscale Investments to compel the company to resume the GBTC buybacks.

Subsequently, The Wall Street Journal, citing investor materials, reported that the asset manager proposed to buy back a fifth of the outstanding GBTC shares in case the SEC refuses to convert it into an ETF.

Follow ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!