Grayscale Investments pauses investments in six cryptocurrency funds

The investment firm Grayscale Investments has temporarily halted accepting deposits into six cryptocurrency funds. The information is posted on the product page of the asset manager’s products.

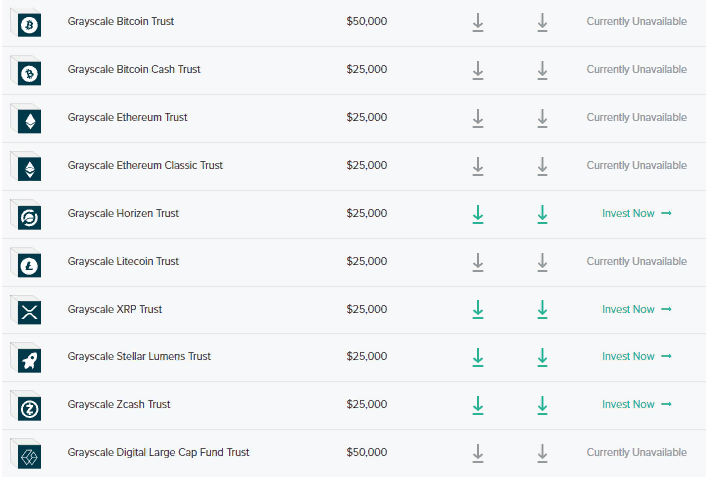

As of writing, investments are closed in trusts based on Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, and the Digital Large Cap Fund. New clients have access to deposits in Horizen, XRP, Stellar Lumens and Zcash funds.

Data: Grayscale Investments.

JPMorgan analysts suggested that a reduction in investments in the Grayscale fund could serve as a signal for a Bitcoin correction. In their view, institutional investors will not allow a negative trajectory to take hold, but given the overheated market their further actions could influence the trend.

Also Grayscale announced the management fee reduction for the Digital Large Cap Fund from 3% to 2.5%. It enables lump-sum investments in Bitcoin, Ethereum, XRP, Bitcoin Cash and Litecoin.

Capriole Investments co-founder Jan Autenhout noted that Grayscale acquired 12,000 BTC.

Grayscale temporarily stopped accepting new clients, but it looks like their existing clients are still quite hungry for more…

12k new bitcoin bought today. That is 13X the new supply today.https://t.co/TlnQpQjq6g pic.twitter.com/c2v1ZKt4DG

— Jan Uytenhout (@uytjan) December 22, 2020

As of December 22, assets under management stood at $15.9 billion.

12/22/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $15.9 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/PEigLDBf0G

— Grayscale (@Grayscale) December 22, 2020

As of December 22, assets under management stood at $15.9 billion.

Follow ForkLog on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!