Grayscale Says It Is Prepared to Sue the SEC if GBTC Is Not Converted Into an ETF

Grayscale Investments chief Michael Sonnenshein, in an interview with Bloomberg, did not rule out the possibility of filing a lawsuit against the SEC in the event that GBTC’s registration as a spot Bitcoin-ETF is denied.

The top executive did not rule out the possibility of using the Administrative Procedure Act in case of an adverse outcome. It governs the process by which federal agencies make decisions and gives federal courts oversight over their actions.

“All options are on the table. The team has put ‘all its resources’ […] Investors should know that we will advocate for them and continue to do so. GBTC sits on the balance sheets of 800,000 accounts across 50 states. Across America, people are patiently waiting,” he said.

Grayscale Investments filed an application to convert the digital-gold-backed trust into a spot Bitcoin-ETF on October 19, 2021.

On December 17, the SEC deferred its decision on Grayscale Investments’ application to launch a spot Bitcoin-ETF. In February, the Commission went back to this step.

Bloomberg analyst James Seyffart estimated that the final verdict on Grayscale’s application should be expected around July 6. According to his colleague Eric Balchunas, 95% of interested parties support launching the financial instrument.

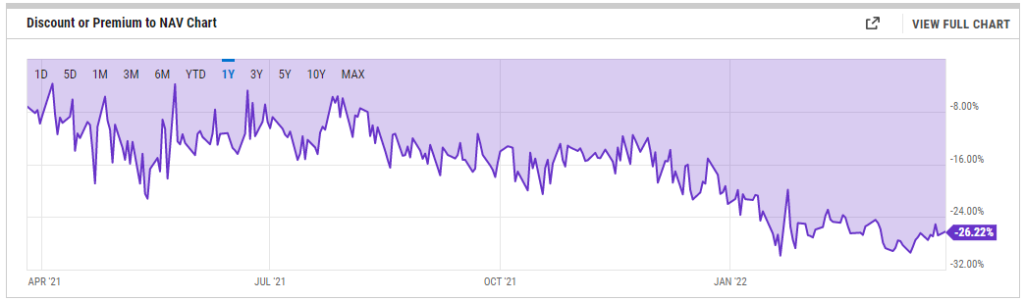

GBTC shares are trading at a 26% discount to its net asset value (NAV). The discount has been observed since March 2021.

“We believe that approval of a spot Bitcoin-ETF is a matter of time”, said Sonnenshein.

Recall that Bloomberg analysts predicted a positive shift in the regulator’s stance by mid-2023.

Earlier, Grayscale suggested that the Commission violated the law when approving the futures-based Bitcoin-ETF.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!