Hackers attacked the Nirvana DeFi project. The NIRV stablecoin lost parity with the dollar.

The Solana-based yield farming protocol Nirvana Finance was attacked using instant loan. The attackers drained digital assets from the project’s treasury worth $3.49 million.

The Nirvana protocol suffered an exploit today.

The Nirvana team is investigating the attack and will make an announcement to the community as soon as possible.

— Nirvana Finance (@nirvana_fi) July 28, 2022

“Today the Nirvana protocol was exploited. The team is conducting an investigation into the attack and will make an announcement to the community in the near future,” wrote the developers.

Nirvana Finance representatives reached out to the hacker to return the funds and switch to white-hat status. For the disclosed vulnerability, the project proposed setting aside $300 000.

According to the statement, the developers managed to locate the attacker’s wallet on an unnamed centralized platform and are now working on its identification.

To The Nirvana Hacker:

On behalf of the Nirvana Finance community, we humbly ask that you return the stolen funds from our treasury. 1/5

— Nirvana Finance (@nirvana_fi) July 28, 2022

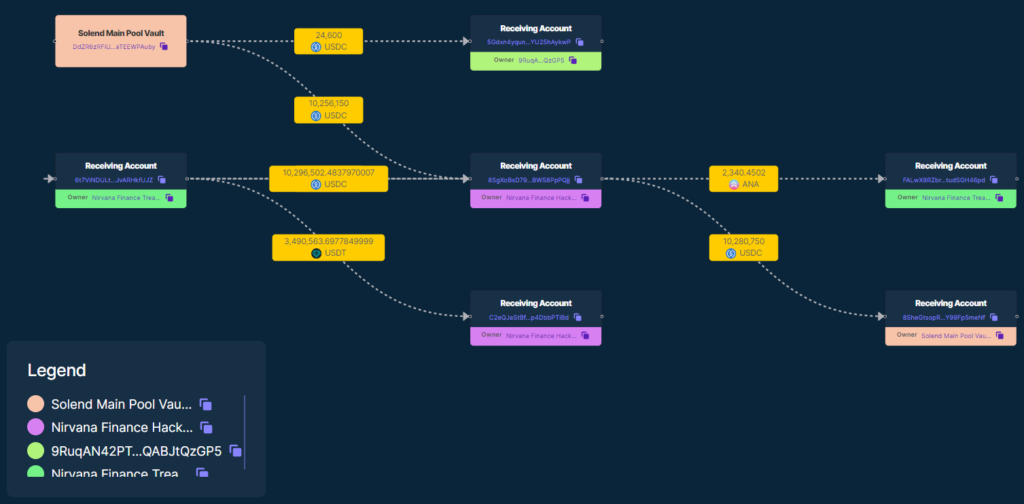

According to Solana.fm block explorer data, the hackers used an instant loan on the Solend platform in the amount of 10 million USDC to manipulate the protocol’s price oracle. The funds allowed them to issue a large amount of the project’s ANA utility tokens, whose value as a result of these actions exceeded $10 million.

2/ Key Accounts Involved

Nirvana Treasury Account: https://t.co/LIvivLjXqo

Nirvana Hacker Account: https://t.co/KNCwA7nEnU

Both accounts have been tagged on @solanafm explorer.

— FA2 | SolanaFM (@0xFA2) July 28, 2022

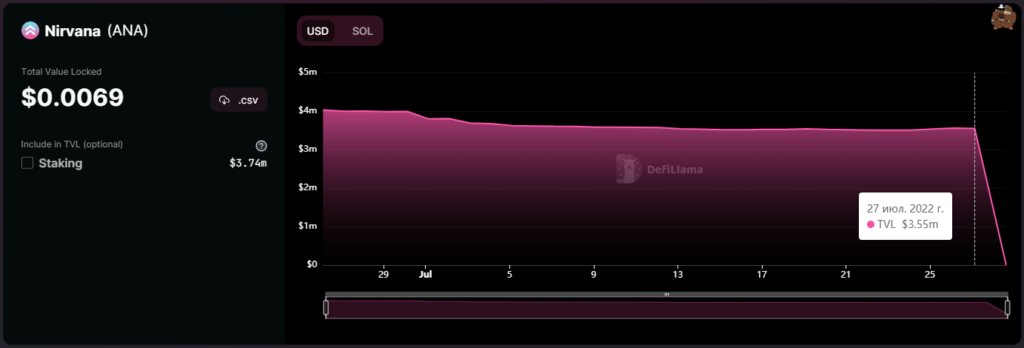

According to DeFi Llama, before the attack slightly more than $3.5 million in ANA had been locked in the project’s smart contracts (excluding staking).

At an inflated price, the attackers initiated the exchange of ANA utility tokens for $13.49 million in USDT. Since the protocol deemed the asset issuance legitimate, it freed liquidity from Nirvana’s treasury.

After obtaining the funds the hackers repaid the debt on Solend and moved the remaining amount to the Ethereum network via the Wormhole bridge.

According to CoinGecko, ANA’s price fell by 78% due to the attack, to $1.96. The project’s algorithmic stablecoin NIRV lost its peg to the US dollar — the asset is trading at around $0.18.

In the second quarter of 2022, total losses from hacks and fraud across crypto projects amounted to $670 698 280, according to Immunefi.

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!