Hong Kong Launches Spot Bitcoin and Ethereum ETFs

On April 30, the Hong Kong Stock Exchange (HKEX) officially commenced trading of six spot ETFs based on Bitcoin and Ethereum.

The issuers are China Asset Management, Harvest Global, Bosera, and HashKey.

The instruments have been assigned the following tickers:

- Bosera HashKey Bitcoin ETF (3008.HK);

- Bosera HashKey Ether ETF (3009.HK);

- ChinaAMC Bitcoin ETF (3042.HK);

- ChinaAMC Ether ETF (3046.HK);

- Harvest Bitcoin Spot ETF (3439.HK);

- Harvest Ether Spot ETF (3179.HK).

ChinaAMC reported that the subscription volume during the initial offering for its Bitcoin-based product amounted to 950 million HKD ($121.4 million), and for the Ethereum-based product, 160 million HKD ($20.5 million).

ChinaAMC said its IOP (initial offering period) scale today is: HK$950 million for ChinaAMC HongKong Bitcoin ETF; HK$160 million for ChinaAMC Ethereum ETF, totaling approximately US$142 million. Bitcoin ETF is about 6x larger than Ethereum. https://t.co/9hgicVWsKc

— Wu Blockchain (@WuBlockchain) April 30, 2024

HKEX representatives emphasized that the listing of Asia’s first exchange-traded fund on virtual assets strengthens the city’s position as a leading market in the region.

In the first quarter, the net inflow into the three previously launched Bitcoin futures ETFs was 529 million HKD (~$67.6 million).

Besides Hong Kong residents, the instruments are available to qualified non-resident investors after completing KYC. Mainland Chinese residents still cannot invest in this new category of products.

Three Bitcoin and Ethereum spot ETFs in Hong Kong have officially started trading now. Non-Hong Kong residents can also subscribe or purchase ETF products if they meet local regulatory requirements, such as passing customer due diligence. https://t.co/RxbVcv1TSy pic.twitter.com/tkE5cKVrAW

— Wu Blockchain (@WuBlockchain) April 30, 2024

Unlike the approved BTC-ETFs in the US, their Hong Kong counterparts have a mechanism for subscription and redemption in kind. This allows for the exchange of underlying assets for ETF shares and vice versa, whereas American counterparts operate on a cash redemption model.

This approach enhances efficiency and expands arbitrage opportunities.

According to HKEX data, on April 30, the trading volume of spot ETFs on Bitcoin and Ethereum exceeded 49.4 million HKD (~$6.3 million) during the morning session. Of this, the fund based on the second-largest cryptocurrency by market capitalization accounted for 1.53 million HKD ($0.2 million).

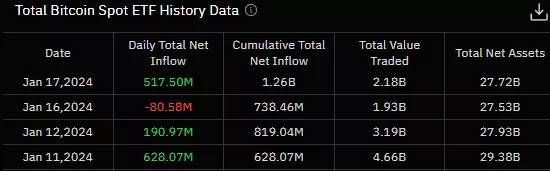

For comparison, the figure on the first trading day of 11 spot BTC-ETFs in the US reached $4.6 billion.

Bloomberg analyst Rebecca Sin forecasts that within two years, the inflow into this category of products could reach $1 billion.

Previously, her colleague Eric Balchunas stated that cryptocurrency ETFs listed in Hong Kong would be “lucky” to collectively attract $500 million. The expert called Matrixport’s projected $25 billion “madness.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!