Hong Kong’s DDC Enterprise to Acquire 5,000 BTC Over Three Years

DDC Enterprise, listed on the AMEX, has embarked on a plan to acquire 5,000 BTC over the next three years, including 500 BTC by the end of 2025. The initial purchase amounted to 21 BTC ($2.21 million).

The payment was made with 254,333 common shares. In the “coming days,” the organization intends to increase its bitcoin holdings to 100 BTC.

DDC Enterprise is engaged in the sale of ready-to-eat meals. It is also known as DayDayCook.

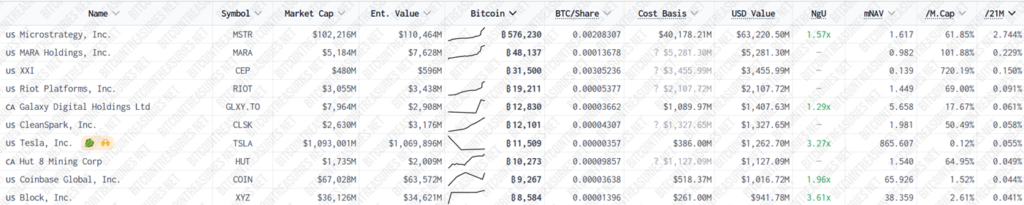

The plan to acquire 5,000 BTC will not place DDC Enterprise among the top 10 holders of digital gold among public companies. Block, which holds the 10th position, possesses 8,584 BTC ($941.54 million).

On May 22, the board of directors of Chinese electric vehicle retailer Jiuzi Holdings approved a plan to purchase 1,000 BTC over the next year using funds from a share issue.

On the same day, Swedish medtech firm H100 Group acquired 4.39 BTC for $490,830.

On May 25, the company secured SEK 21 million ($2.2 million) from Blockstream CEO Adam Back and other investors. The funds, in the form of convertible three-year loans at 0% interest, will be used to purchase bitcoin.

H100 Group sells medical instruments for people who prefer not to rely on a “reactive healthcare system.”

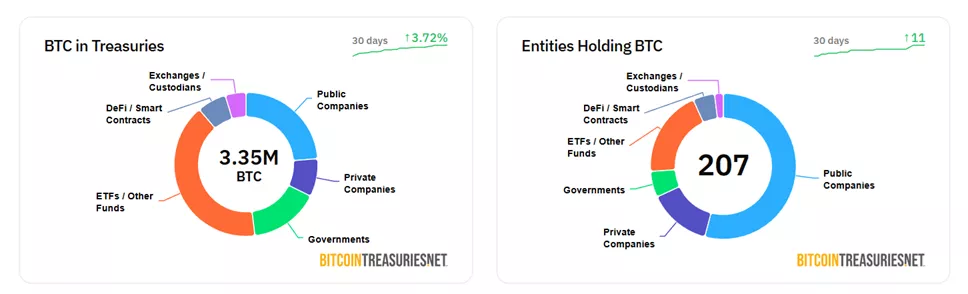

According to BitcoinTreasuries, the number of public companies that have adopted a bitcoin strategy has risen to 112. Collectively, they own 796,702 BTC (3.79% of the supply). The leader is Strategy with 576,230 BTC ($63.4 billion).

Jess Myers from Moon has forecasted that the share of digital gold on corporate balance sheets will rise to 50% by 2045.

According to Bitwise, by the end of 2026, institutional players, including governments and corporations, will hold 20% of the total supply of the coin (~4.2 million BTC).

Earlier, Bernstein predicted that corporate bitcoin reserves would grow to $330 billion by 2029.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!