How and Why Central Banks Create Digital Currencies (CBDCs)

Experts already call central bank digital currencies (CBDCs) one of the most important trends that will determine the future of money in the coming decade. According to a BIS report, as of early 2019 CBDC research was being pursued by 70% of central banks. Because of the coronavirus pandemic, work on digital currencies in various countries will only accelerate.

On August 19, a report on CBDC development to date was published by The Block. It details why governments worldwide are betting on CBDCs, how digital currencies differ from traditional fiat, and what conclusions central banks drew from research and experiments. Forklog read the document and picked out the main points.

- Few central banks plan to issue a digital currency within five years, but several institutions have already conducted or are in the process of conducting in-depth pilot tests.

- Early CBDC experiments have shown that private-sector participation is needed to ensure competitiveness and adaptability to technological change.

- Most CBDC proposals envisage a two-tier monetary system: the central bank issues and controls the base, while licensed intermediaries (banks and other financial institutions) distribute and settle transactions.

- Assertions that CBDCs will eliminate anonymity are unwarranted. The ECB recently explored anonymizing transactions using ‘anonymity vouchers’ on a blockchain. In blockchain transfers such transactions could be made private.

- Private stablecoins and CBDCs do not exclude one another, but complement one another.

Incentives for issuing CBDCs

Today, central banks already practice virtual currency issuance, and a large share of payments and transfers is conducted digitally. The differences between CBDCs and the existing system are as follows:

- CBDC will simultaneously boost competition and stability in the financial sector as banks encroach on tech firms and cryptocurrencies.

- CBDCs can boost financial inclusion by offering a new payments infrastructure with lower transfer costs. In addition, central banks will find it easier to operate in a digitised economy.

- CBDCs will expand the tools of fiscal policy available to regulators — for example, to avoid the ‘zero lower bound’ trap. Through programmability and transparency, CBDCs make it easier for regulators to monitor deposits and loans at negative rates. More transparent data on payment flows will improve the quality of macroeconomic statistics.

- CBDCs also stimulate the use of local currency for paying goods and services, which is particularly relevant in countries prone to ‘dollarisation’.

- ‘Commercial’ version of CBDC (where the digital currency is available only to banks) will reduce settlement risks, provide round-the-clock liquidity for banks, and reduce costs for cross-border transfers, etc.

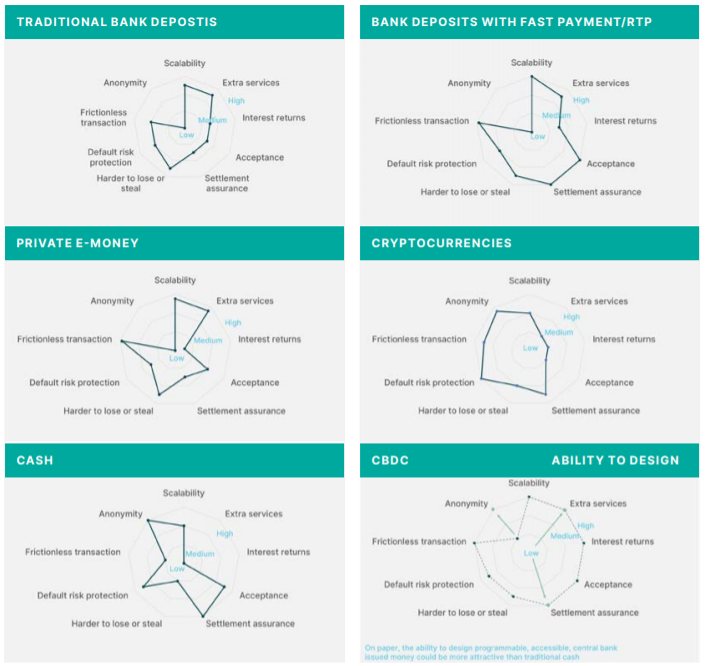

The IMF tried to illustrate the differences between different forms of money with a radar chart:

Retail CBDCs

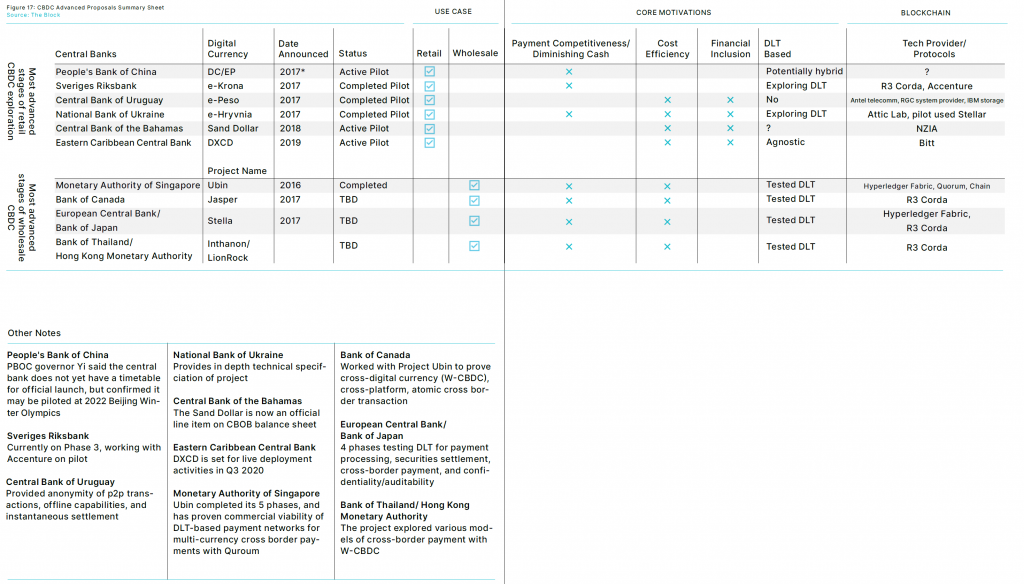

The authors of the report outlined the results of the most notable CBDC experiments in several countries:

Although a ‘commercial’ CBDC is seen as a safer option for financial stability, retail CBDC is of more interest to mass users — a full replacement for ordinary currency, usable for paying goods and services, storing on a bank account, etc.

One of the first countries to consider CBDCs was Sweden. The reason is the extremely low use of cash (only 5% of household payments relied on cash, while card payments accounted for 60%). Testing of the e-krona began in 2017 (news of plans surfaced a year earlier). After three years of study it moved to the pilot stage. In developing CBDCs, the regulator is aided by Accenture — it is responsible for payments, deposits, transfers and other functions on the blockchain platform R3 Corda.

Uruguay, one of the most economically prosperous countries in Latin America, conducted a pilot of its own CBDC (e-peso) from September 2017 to April 2018 among ordinary consumers and businesses. Instead of a distributed ledger, digital wallets managed by the state-owned telecom company Antel were used. The e-peso system included anonymous transactions and offline transfers, and each e-peso ‘note’ bore a unique cryptographic signature. The results are now being evaluated in terms of the feasibility of anonymity for users, the possibility of introducing ‘interest-bearing’ tools, and the overall impact on the economy.

According to the study, another European country actively developing a ‘retail’ CBDC is Ukraine.

The National Bank of Ukraine (NBU) successfully tested the ‘digital hryvnia’ over four months in 2018. During the test the NBU issued 5,443 electronic hryvnias, which were used on 79 wallets on smartphones. The wallets could be topped up through the Ukrainian Payment Space system, integrated into the CBDC platform. Users could transfer digital money between wallets, top up the balances of LifeCell mobile numbers, and make charitable donations.

The platform itself was built on a private version of the Stellar protocol and had two levels: on the first, the NBU controlled the registry unilaterally; on the second, banks and financial institutions controlled operations. Ultimately, Stellar was deemed unsuitable as a basis for a national-scale system, though no replacement was named yet.

Today, the Ukrainian central bank is examining both centralized and decentralized models for the digital hryvnia. Summarising the experiment at a CBDC conference in February this year, then-head of the NBU Yakov Smoliy said:

“We continue to study the possibility of issuing a digital hryvnia and will come back to this issue when we are confident that the initiative is technically feasible and that the digital currency will not hinder the central bank in fulfilling its functions to ensure the currency’s exchange rate and financial stability”.

Similar projects were also launched by the Central Bank of the Bahamas (Sand Dollar) and the Eastern Caribbean Central Bank (DXCD).

Wholesale CBDCs

Another type of digital currency is the so-called wholesale CBDC. This is currency intended for restricted use by specialised institutions. In principle, access to W-CBDC is limited to banks. The scope includes interbank operations, settlement operations, clearing and international trade (where banks often act as guarantors of deals).

According to the authors, wholesale CBDC is a further development of the practice whereby the central bank issues currency into a virtual account and lets banks access it, with banks then distributing the currency further into the economy.

However, compared with the current system, W-CBDC has a number of advantages. First, it provides round-the-clock access to funds, whereas today the central bank’s approvals are manual. Second, all transfers are recorded in a more reliable distributed ledger, improving settlement efficiency, and the source of funds and hence the guarantor of obligations is the central bank, reducing credit risk.

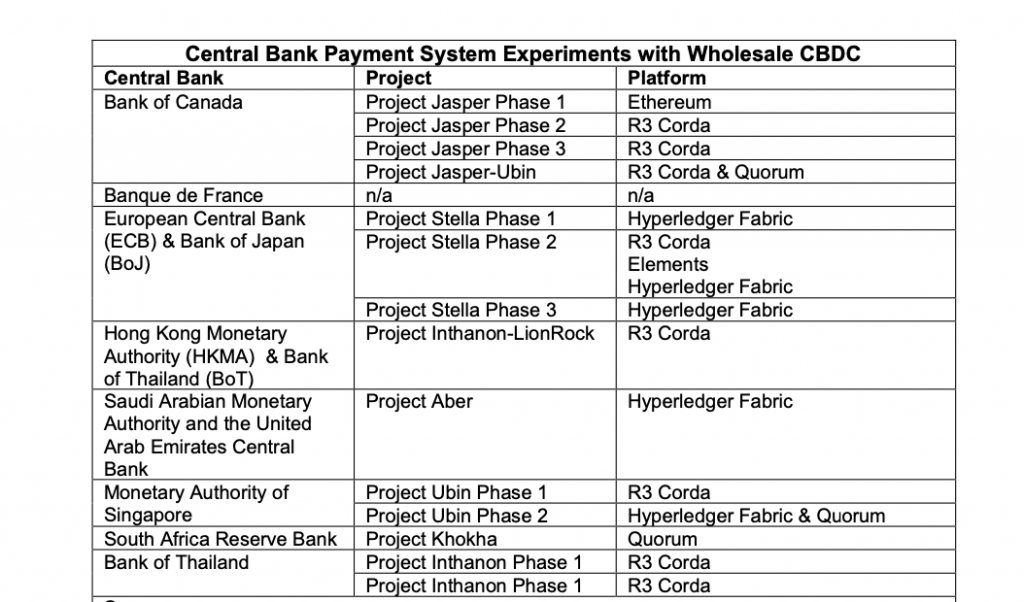

Among the main W-CBDC experiments noted were the ECB–Bank of Japan (Project Stella), Bank of Canada (Project Jasper), Monetary Authority of Singapore (Project Ubin), as well as Hong Kong and Thailand.

In all cases, testing of W-CBDC used popular enterprise blockchain platforms: R3 Corda, Quorum or Hyperledger Fabric. Some, however, argue that blockchain is not essential for CBDCs.

It was in Europe-Japan Project Stella that anonymity vouchers were deployed. These are electronic certificates that a platform participant could obtain. Transactions with attached anonymity vouchers could pass without ECB confirmation: the sender needed only specify the amount, the recipient’s identifier, and activate the anonymity function (the voucher would burn in the process). In such a scenario, the identities of participants were not verified.

The Chinese digital yuan

Perhaps the most attention is now focused on what the digital currency of the world’s second-largest economy will look like. According to The Block, work on the “digital yuan” (officially Digital Currency, Electronic Payment, or DCEP) began as far back as 2014.

This summer in several cities began a pilot test of payments with the digital yuan for small purchases by residents in the dining, retail and education sectors (in total over 20 companies and four state banks are involved). The DCEP is also planned for large commercial deals and in taxi services.

Judging by the ongoing test, the digital yuan will become a full substitute for cash. China is currently the largest market for mobile payments, with more than a billion users.

As noted in The Block, the issuing, operation of the main registry, and anonymity will be controlled by the central bank, while commercial banks will serve as wallet providers and the infrastructure for operations.

Chinese authorities want to bring the digital currency’s level of anonymity closer to cash — this is evident from patents registered by the People’s Bank of China. The DCEP architecture is set to include “controlled anonymity.” This means that different participants will have limited information about each other. Yet government agencies will be able to access the data when needed. Another feature of a cash-like digital yuan should be offline transactions.

Analyst Chuanwei David Zhu offered a forecast for the Chinese CBDC’s development. He said:

“I think more methods of use will be tested, as the People’s Bank of China wants to test the robustness of the chosen system design, as well as user experience and potential risks.”

In a year, the authorities should determine a strategy for bringing DCEP to the market, the expert says.

Beyond domestic use, China could use the digital yuan to challenge the U.S. dollar, which dominates international settlements. To this end, DCEP should become a competitor to SWIFT.

Moreover, as former IMF chief economist Kenneth Rogoff argued, one avenue for the digital yuan’s expansion abroad is the underground market. A likely testing ground for DCEP among foreign audiences could be the 2022 Winter Olympic Games.

As for the United States, The Block notes the Fed has so far taken a cautious stance toward CBDCs.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!