How bitcoin mining works

Key points

- In simple terms, bitcoin mining is the process of creating new blocks on the first cryptocurrency’s network by having computers solve complex mathematical problems. One translation of the word “mining” is “extracting minerals”.

- The reward for mining is newly issued bitcoins. Mining is the only way the first cryptocurrency is created.

- Individuals and organisations (miners) take part by performing computations on specialised hardware and, as a result, creating new blocks. For this work miners receive network rewards — new coins.

- Beyond bitcoin, mining also exists in other cryptocurrencies that use the PoW algorithm. The hardware used can differ between networks.

Bitcoin mining: the process explained

Every transfer on the bitcoin network is confirmed and recorded in a block, which is then added to a single “chain” (blockchain). The essence of mining is to “find” or “extract” a new bitcoin block through resource‑intensive computation. Many miners perform these calculations simultaneously on specialised equipment.

Thus mining serves several functions: verifying transactions on the bitcoin blockchain, creating blocks and issuing new bitcoins. When a new block is produced, miners compete with one another.

Mining is an integral part of any blockchain that uses the Proof-of-Work (PoW) consensus algorithm. The process consists of computing the hash (output) of a block header in the blockchain. A block includes:

- The hash of the previous block header;

- The hash of transactions;

- A random number.

When a miner forms a new block, they receive a reward — a set amount of bitcoins. The higher the total computing power deployed, the higher the probability of finding a new block and thus receiving the reward.

As a rule, transactions included in a block are considered confirmed after six subsequent blocks have been added.

What is the reward for a new bitcoin block — and how does halving fit in?

The block reward in the bitcoin network is fixed and, as of 2022, stands at 6.25 BTC. However, since the first cryptocurrency’s blockchain launched, it has been steadily reduced.

The reward halves every 210,000 blocks, or roughly once every four years. In total, 32 halvings are scheduled in the bitcoin protocol; after that, no new coins will be created.

Halving is a deflationary mechanism embedded in the protocol of the first cryptocurrency by its creator, Satoshi Nakamoto. Its goal is to prevent bitcoin’s price from falling due to an increase in the number of coins in circulation.

At the network’s launch in early 2009 the reward was 50 BTC per block; in 2012, after the first halving, it fell to 25 BTC, and in the summer of 2016 — to 12.5 BTC. The most recent halving took place on 11 May 2020, reducing the reward to 6.25 BTC. The next “halving” is due in 2024.

In 2012, the future creator of Ethereum, Vitalik Buterin, explained its significance by comparing bitcoin to “digital gold”:

“The world’s reserves of the precious metal (gold) are limited; with every gram, extracting it becomes more difficult. The limited supply of gold has affected its value in international exchange and saving for more than 6,000 years. I hope that bitcoin will do the same.”

Why hash rate and network difficulty matter for bitcoin mining

Hash rate, or hashing speed, describes the total computing power of the network — that is, all active mining hardware at a given moment. Hash rate is a key metric because it directly affects miners’ eventual profitability.

Network difficulty is the amount of power required to mine a new block, which the protocol automatically adjusts in line with the hash rate. Difficulty is needed to keep block production time stable (around ten minutes). It can move up or down depending on the hash rate.

In other words, hash rate indicates how many calculations per second mining hardware can perform to find a block. As the first cryptocurrency’s network power increases, so does mining difficulty; it adjusts every 2,016 blocks, or roughly once every two weeks.

Computing power is measured in H/s (operations per second). For example, as of 6 September 2022, generating a block on the bitcoin network requires minimum computing power of 140 TH/s.

Is mining profitable?

The economics of mining the first cryptocurrency depend on several factors: the cost of electricity, hardware performance, computational difficulty and the asset’s market price.

Hardware is one of the foundations of the first cryptocurrency’s existence. When the bitcoin network launched in 2009, mining was done with a CPU on a home computer. The genesis block was mined by the cryptocurrency’s creator, Satoshi Nakamoto.

Over time, mining hardware improved and the new technology attracted more enthusiasts. GPU mining completely replaced CPU mining, offering greater computational throughput.

One of the first publicly available GPU‑mining software packages was released by a BitcoinTalk forum participant — Puddinpop.

By 2012 many miners were already building “farms” — rigs linking multiple graphics cards. That same year the first ASIC — a purpose‑built bitcoin mining machine widely used today — was released.

What is an ASIC, how much does it cost, and how does it help with bitcoin mining?

The computing resources spent hashing blocks far exceed the power of any single supercomputer. Modern mining therefore relies on expensive, specialised devices and chips, the production of which has become a standalone multimillion‑dollar industry.

An Application Specific Integrated Circuit (ASIC) is a dedicated microchip — specialised hardware designed to mine a specific digital currency.

ASICs deliver serious computing power but require substantial investment. They are typically produced by companies based in China. Firms such as PinIdea, Bitmain, Ebang Communication and Baikal supply such equipment.

In 2022, prices for bitcoin miners fell back to 2020 levels, and revenues declined markedly.

According to calculations by Arcane Research, a last‑generation ASIC miner, the Antminer S19, brings about $13,000 per bitcoin mined (with electricity priced at $40 per MWh). The older Antminer S9 already runs at a loss.

Mining the leading cryptocurrency remains profitable for now, but returns are under pressure from falling prices and a rising network hash rate. In such conditions many miners are forced to sell cryptocurrency to cover costs.

Can you mine bitcoin solo?

The cost of hardware needed for efficient mining of the first cryptocurrency keeps rising and can now exceed tens of thousands of dollars per machine.

Hardware also consumes a great deal of electricity and requires additional cooling. Rising network difficulty and lower rewards have made solo bitcoin mining uneconomic today — although occasionally a solo miner does manage to find a block. To participate and earn rewards, individual miners join mining pools.

As of 2022, numerous mining companies operate in the market. Some are large enough to have gone public, listing their shares on stock exchanges. In 2022 the share of public mining firms in bitcoin’s hash rate reached 19%. The largest include:

- Marathon Digital Holdings (MARA);

- Riot Blockchain (RIOT);

- Hive Blockchain Technologies (HVBTF);

- Hut 8 Mining Corp (HUTMF);

- Bitfarms Limited (BFARF);

- Bit Digital (BTBT).

How much do bitcoin miners earn?

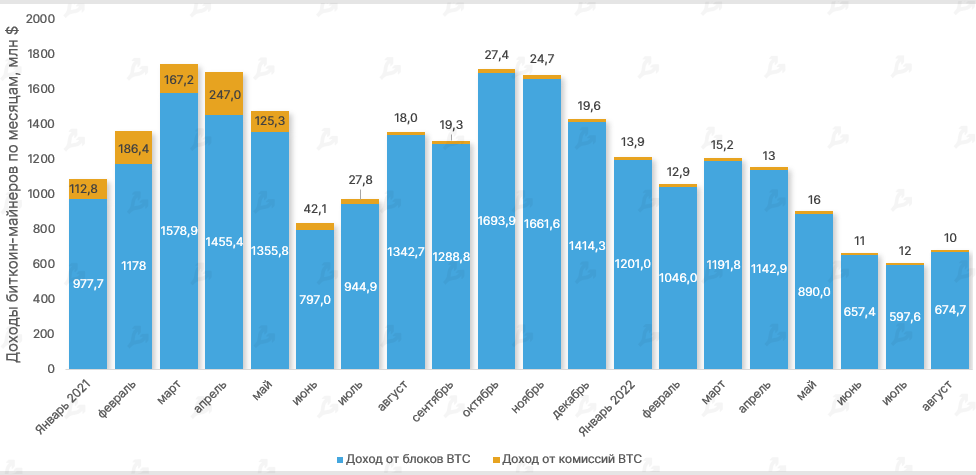

Bitcoin miners’ monthly revenue amounts to hundreds of millions of dollars. For example, in August 2022 they earned a total of more than $684m. Throughout 2021 and early 2022, this figure often exceeded $1bn.

What are mining pools?

Today there are two main approaches to mining: individual and collective — that is, solo mining or participation in a mining pool.

Solo mining means extracting cryptocurrency on your own hardware; the miner receives the entire block reward.

A mining pool combines the hardware power of several miners, increasing the probability of finding a block. Rewards are shared among participants.

For efficient joint work, mining pools typically appoint coordinators. They handle organisational matters and are responsible for distributing rewards. Payouts are calculated according to the amount of work contributed by each participant.

Two payout types are most common: Pay‑Per‑Share (PPS) and Pay‑Per‑Last‑N‑Shares (PPLNS). The key difference is that with PPS, participants are paid regardless of whether a block is found, whereas in PPLNS they are paid only when the pool successfully mines a block.

According to BTC.com at the start of September 2022, the largest bitcoin mining pools are Foundry USA, AntPool, F2Pool and Binance Pool — together accounting for two thirds of all hash rate.

Where are the largest mining farms located?

Mining farms are data centres that host specialised ASIC equipment.

Previously most mining pools were located in China, controlling 65% of the network’s hash rate. Malta ranked second with around 10%.

However, criticism of bitcoin in 2021 and calls by Chinese authorities to curb cryptocurrency mining prompted local firms to consider changing jurisdiction. Miners from China looked at North America and Central Asia, as well as Russia, for relocation.

Some mining pools are also located in the Czech Republic and Georgia. For example, the large industrial miner and hardware/software developer BitFury has data centres in the Icelandic municipality of Reykjanesbær and the Georgian cities of Gori and Tbilisi.

In some countries there are sizable projects for both conventional and “green” mining.

For example, a mining farm was built at a hydroelectric power plant in Costa Rica, and El Salvador began mining the first cryptocurrency using geothermal volcanic energy.

In addition, in 2021 “green” mining spread to the US states of Ohio and California. Infrastructure provider Standard Power signed a five‑year partnership with Energy Harbour to supply its data centre with carbon‑free electricity.

California‑based nuclear power operator Oklo and mining company Compass entered a 20‑year partnership.

A similar agreement to mine bitcoin using nuclear energy in Ohio was signed by mining‑infrastructure provider Standard Power and the power‑generation company Energy Harbour.

Where can you find a bitcoin mining calculator?

Payback on hardware investments depends on many factors. You should consider hash rate, energy consumption, price, energy efficiency and numerous other criteria.

There are many online services for estimating current mining profitability across algorithms and devices, such as Minerstat and CryptoCalc.

To run the calculation, enter a few inputs: the digital asset, hardware cost, electricity expenses and other parameters.

A two‑year payback period is generally considered good, though the most successful, well‑judged investments can pay back within a year.

How much electricity does bitcoin mining consume, and does it really harm the environment?

Debate over mining’s environmental impact has intensified year after year. Yet the role of bitcoin and other Proof‑of‑Work (PoW) cryptocurrencies is somewhat overstated — at least for now.

According to CCAF, the first cryptocurrency’s network consumes only 26% less electricity than gold mining. In terms of energy use it is comparable to the Philippines, Kazakhstan, Pakistan and the Netherlands. Their energy consumption is roughly 100 TWh per year — about 1% of global consumption.

The future energy intensity of the bitcoin network depends on many factors and is hard to forecast. But “digital gold” could become a significant consumer of energy if its price were to reach several million dollars.

Arcane Research estimates that if bitcoin’s price reaches $2m by 2040, network consumption would hit 894 TWh. If by then the price is around $500,000, consumption would be 223 TWh.

Further reading

What is NFT staking and how does it work?

Ethereum’s move to Proof-of-Stake (PoS): everything you need to know

What types of bitcoin addresses exist?

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!