How Much Do Bitcoin Miners Influence the Market? Part I

Analyst Karim Helmi and the Coin Metrics team developed a new methodology for quantitatively assessing the assets at the disposal of Bitcoin miners. Its hallmark is the separation of miner and mining-pool activity, allowing a more precise assessment of the coins under their control.

ForkLog magazine offers readers a translation of the article Following the Flows: A Look at On-Chain Miner Payments, in which the features of the new approach are described.

- Under the new methodology, addresses associated with miners and pools are analysed separately, inventories and activity of market participants are evaluated.

- This method offers advantages over previous approaches to miner expenditure analysis, which focused on the activity of the pool operator rather than the actions of miners.

- The supply held by miners is gradually shrinking, while net flows from their addresses stabilise. Over time, miners’ influence on the market wanes, but remains substantial.

Miners and the Market

Beyond securing the network, miners exert a substantial influence on market dynamics. By receiving newly minted bitcoins rather than buying them, miners are net sellers of the asset. This effect is amplified by the fact that miners’ operating costs, dominated by electricity and rents, are denominated in fiat currency, while revenue is denominated in bitcoin.

The new approach, drawing on previously unavailable data, analyzes miners’ activity and motives, and assesses the impact of their expenditures on the market.

On-chain data point to a gradual reduction in miners’ influence on the network. Yet these market participants remain key players in the ecosystem, with access to large pools of funds.

Summing the Market Supply of Coins

To compute miner flows, we start by grouping all addresses that were paid directly from coinbase-transactionsразработали যান. Пометим их как 0-hop addresses. Addresses receiving payments from the 0-hop sample will be labeled 1-hop.

In a typical arrangement, pools receive the block reward first, then it is distributed among miners. 0-hop addresses are usually associated with pools, 1-hop addresses with miners. For this reason, existing systems that attempt to deduce miner behaviour from 0-hop flows are theoretically flawed. They do not assess what they ought to assess, instead focusing on the activity of the pool operator.

Of course, labeling miners and pools by distance from the coinbase transaction is an imperfect method. Especially when applied to the network’s early stages, when solo mining and alternate pool models were more common. Alternative pool models existed then.

Since the first mining pool, Slush Pool, mined the debut block in December 2010, observations prior to that date should be treated as reference data only. In addition, miners’ addresses that did not receive funds from 0-hop addresses are not labelled. Overall, however, this heuristic represents a significant improvement over current approaches and aims to more accurately reflect broad trends.

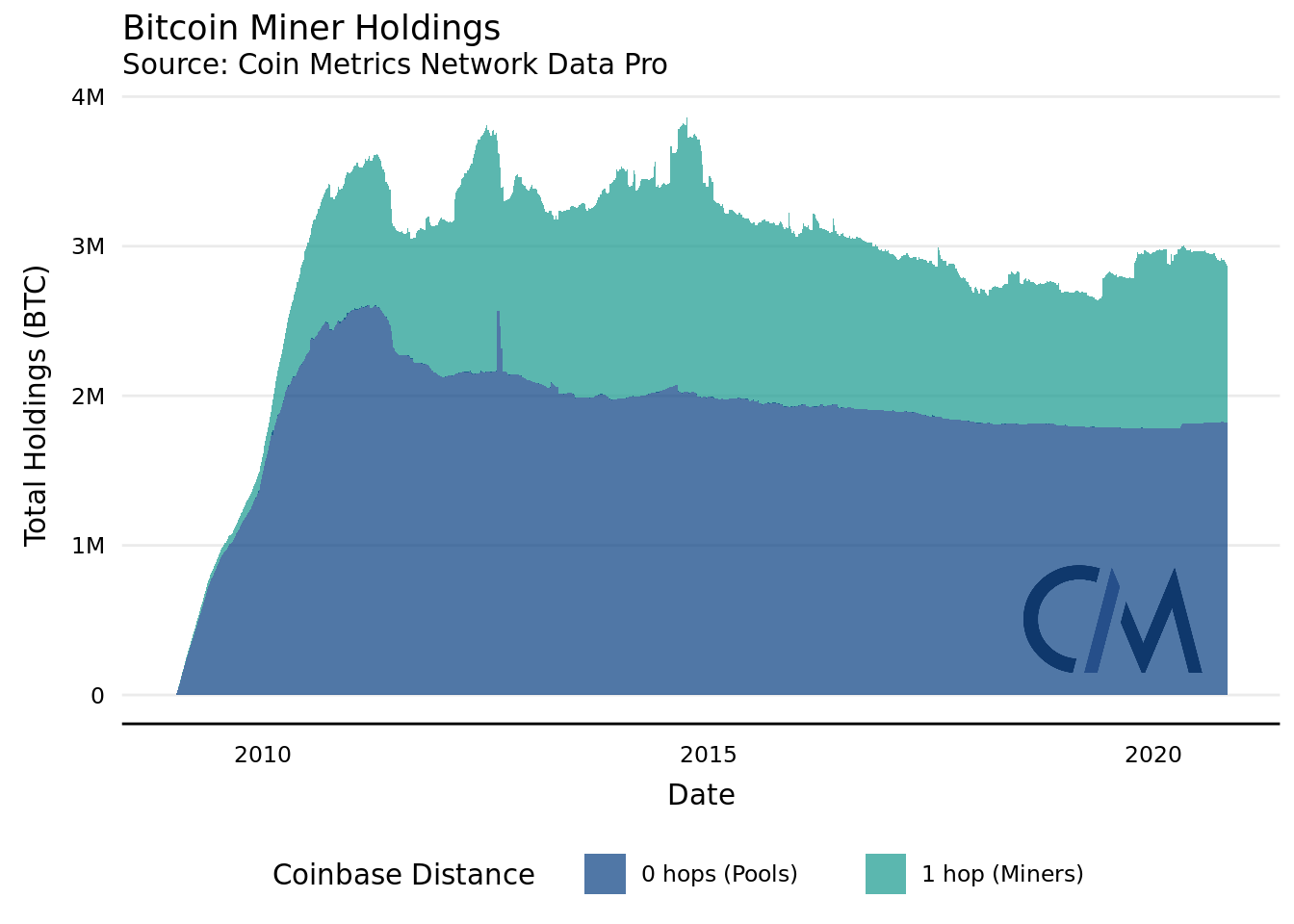

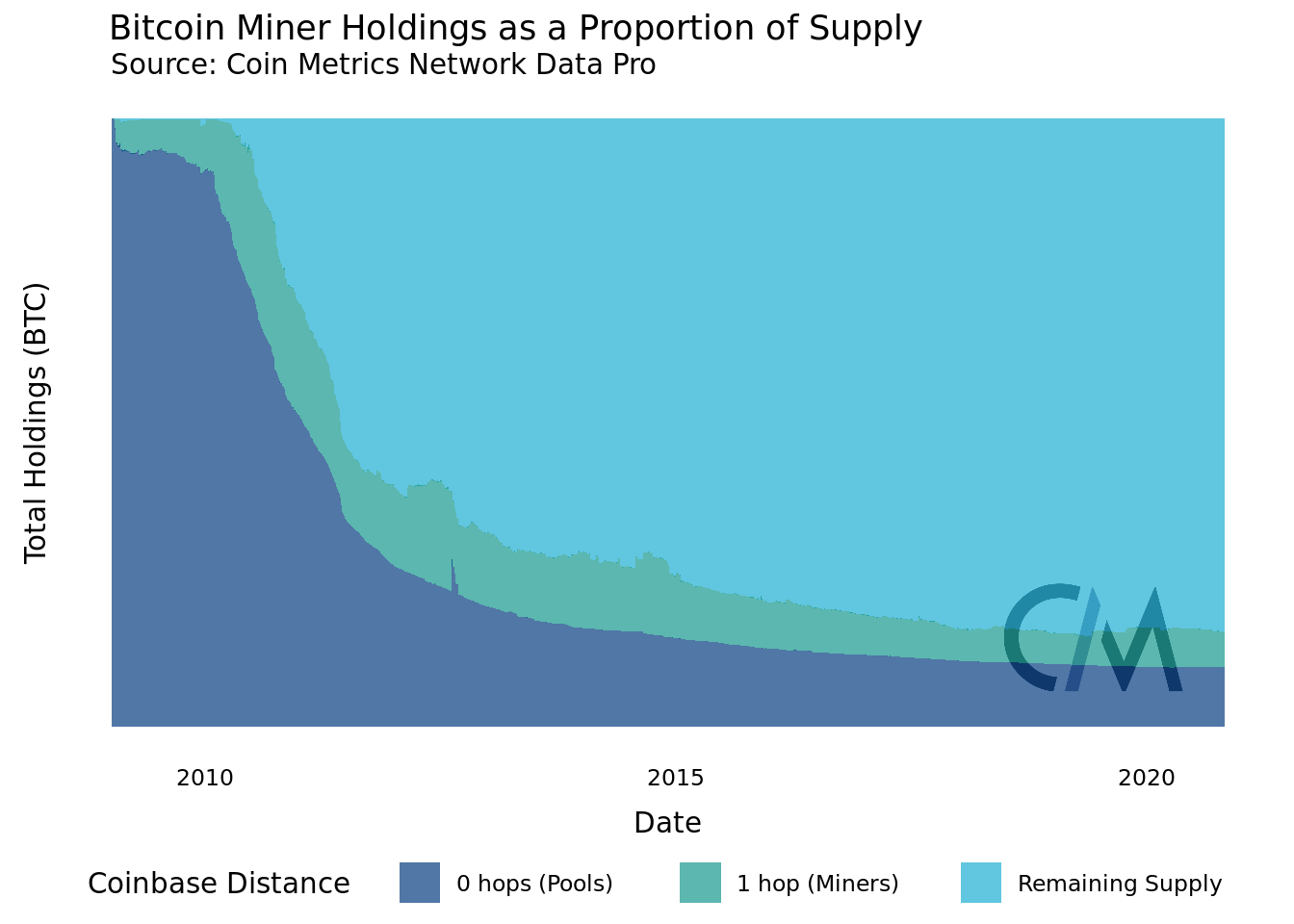

Miners, especially those active in the network’s early years, controlled a substantial share of Bitcoin. The number of coins held on 0-hop and 1-hop addresses generally declined over Bitcoin’s history. In the second half of 2019 and the first half of 2020, in the run-up to the halving, a notable shift in the trend occurred.

During this period, miners accumulated an additional 383,000 BTC. The effect was largely confined to 1-hop addresses, while supply concentrated in 0-hop addresses remained largely unchanged.

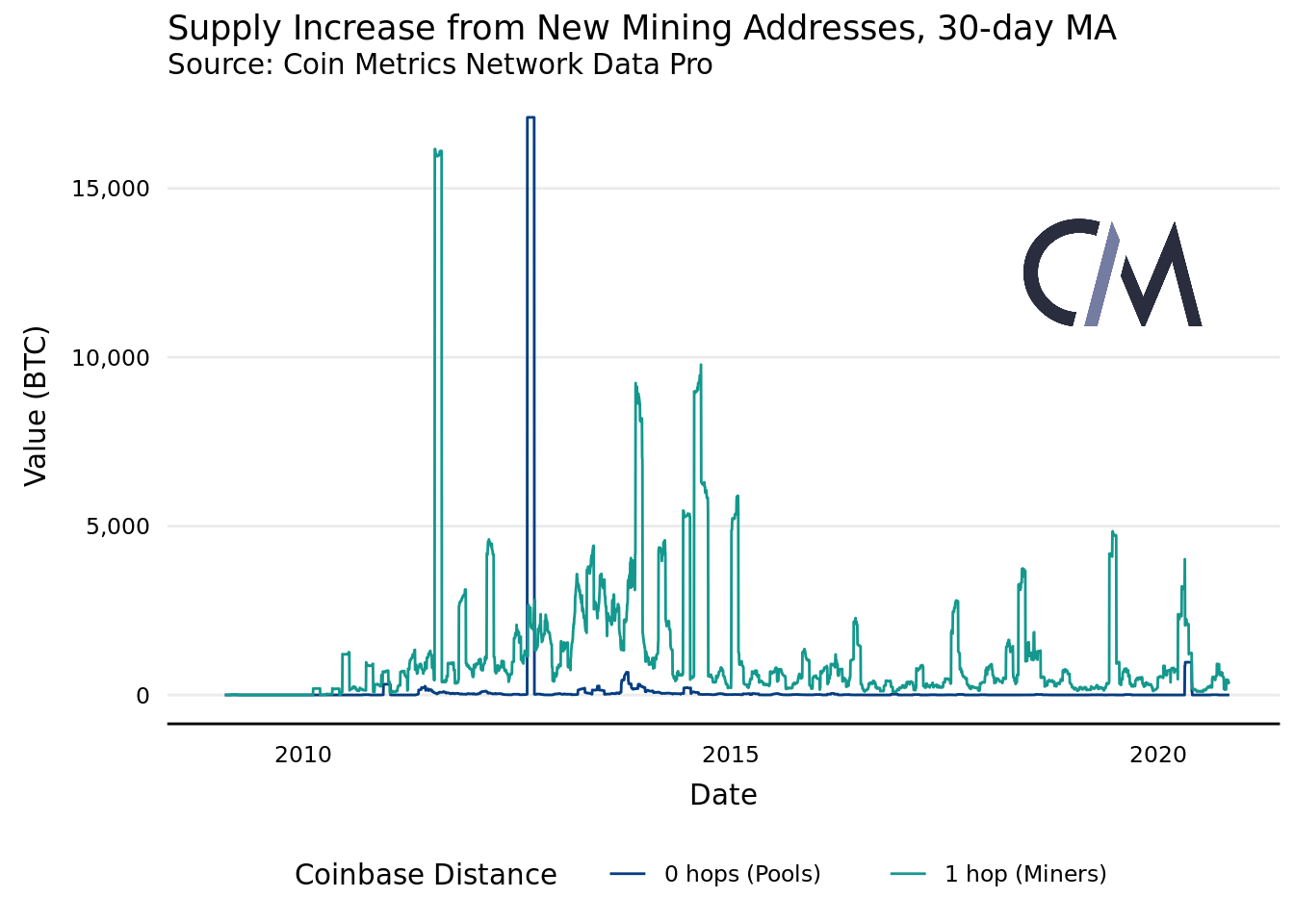

There are several notable surges in miner-held supply. These spikes often coincide with addresses that hold large balances, when they mine their first block or interact with a 0-hop address for the first time.

The most conspicuous jump occurred on 16 August 2012, when a whale holding more than half a million bitcoins whale received a portion of the block’s coinbase reward.

New market entrants are also responsible for increasing the miner-supplied supply in the run-up to the third halving.

In light of inflation, the gradual reduction in miner-held inventories becomes more significant when viewed in the context of overall issuance. This aligns with the broader trend toward a more even distribution of Bitcoin supply.

Also, this mirrors the widespread adoption of the pool model. The latter implies a low probability that unaffiliated addresses will be mislabelled as 1-hop.

Yet even today, miners and pools command a sizeable share of Bitcoin’s total supply.

Pools and Payments

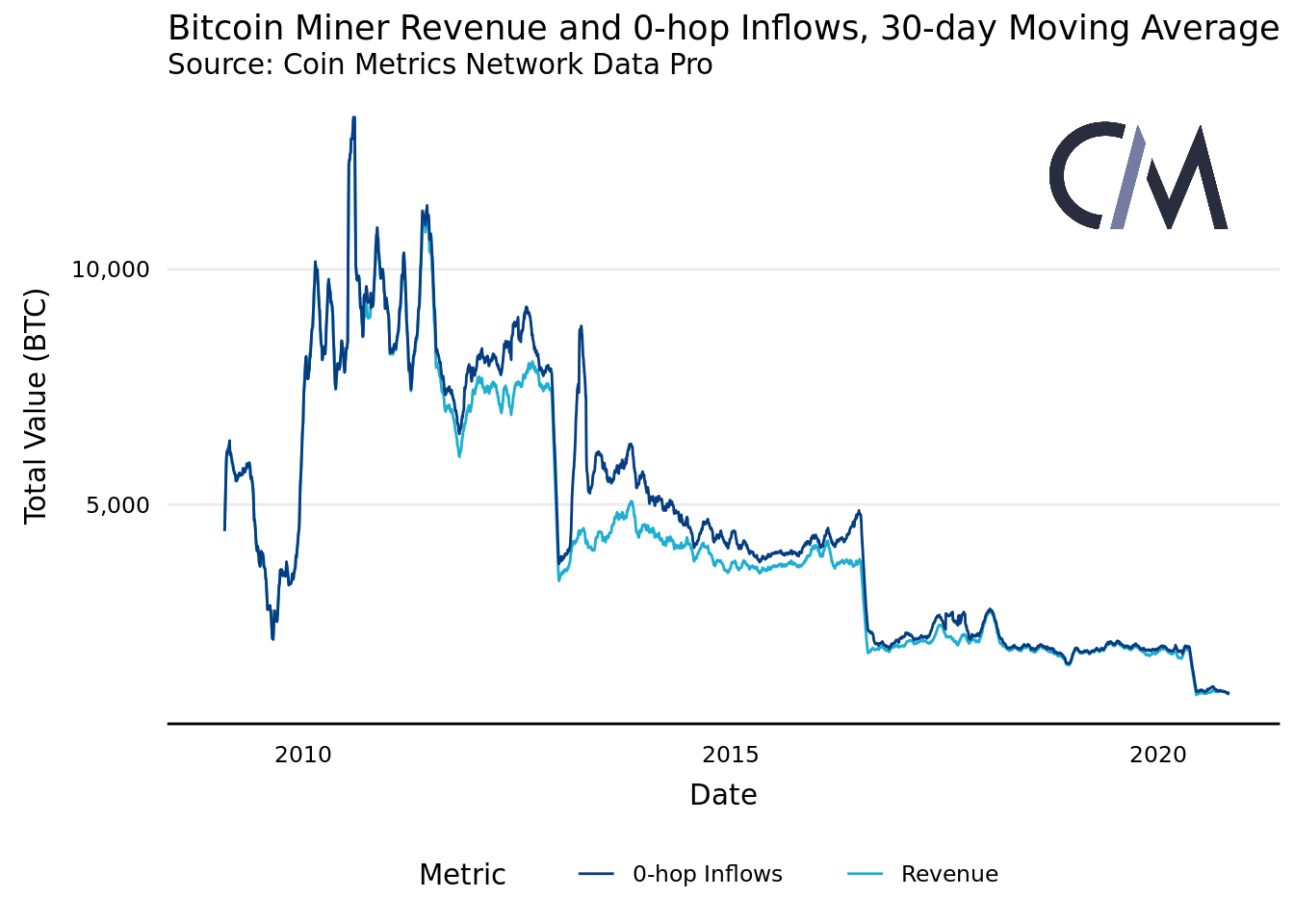

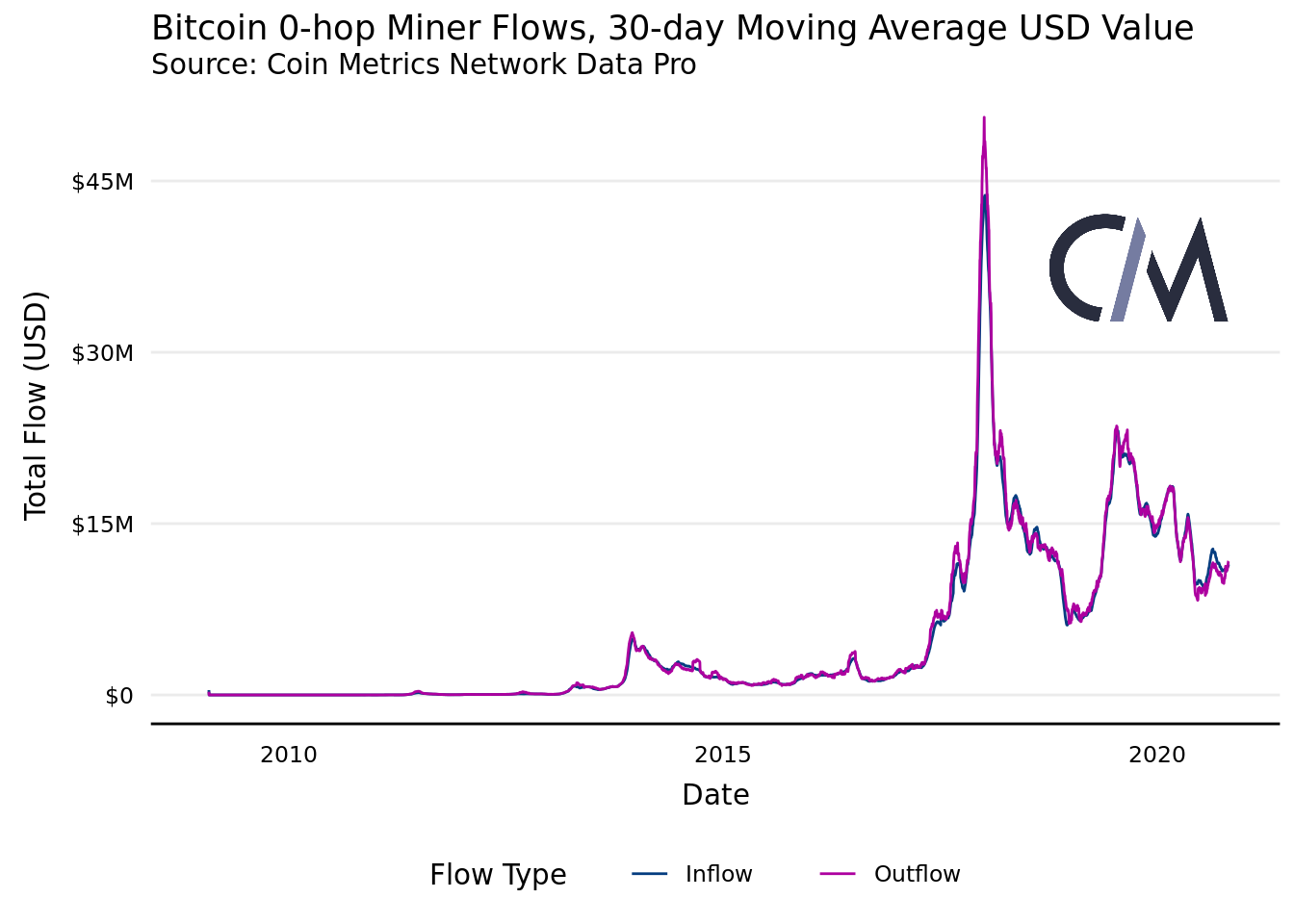

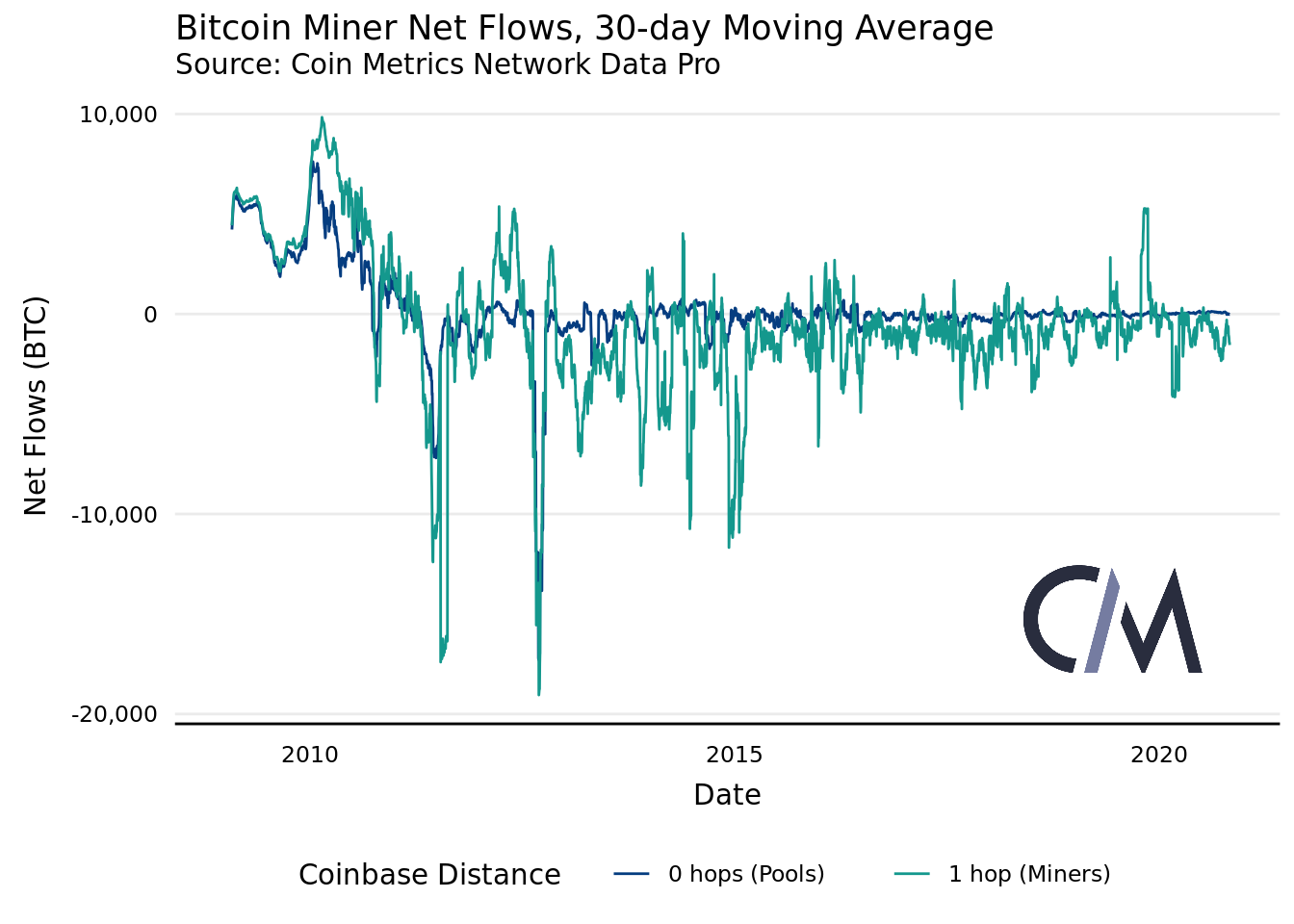

Inflows and outflows to these two address groups — and from them — constitute another powerful on-chain signal. Since pools typically receive the coinbase reward immediately, 0-hop flows are a useful indicator of mining-pool activity.

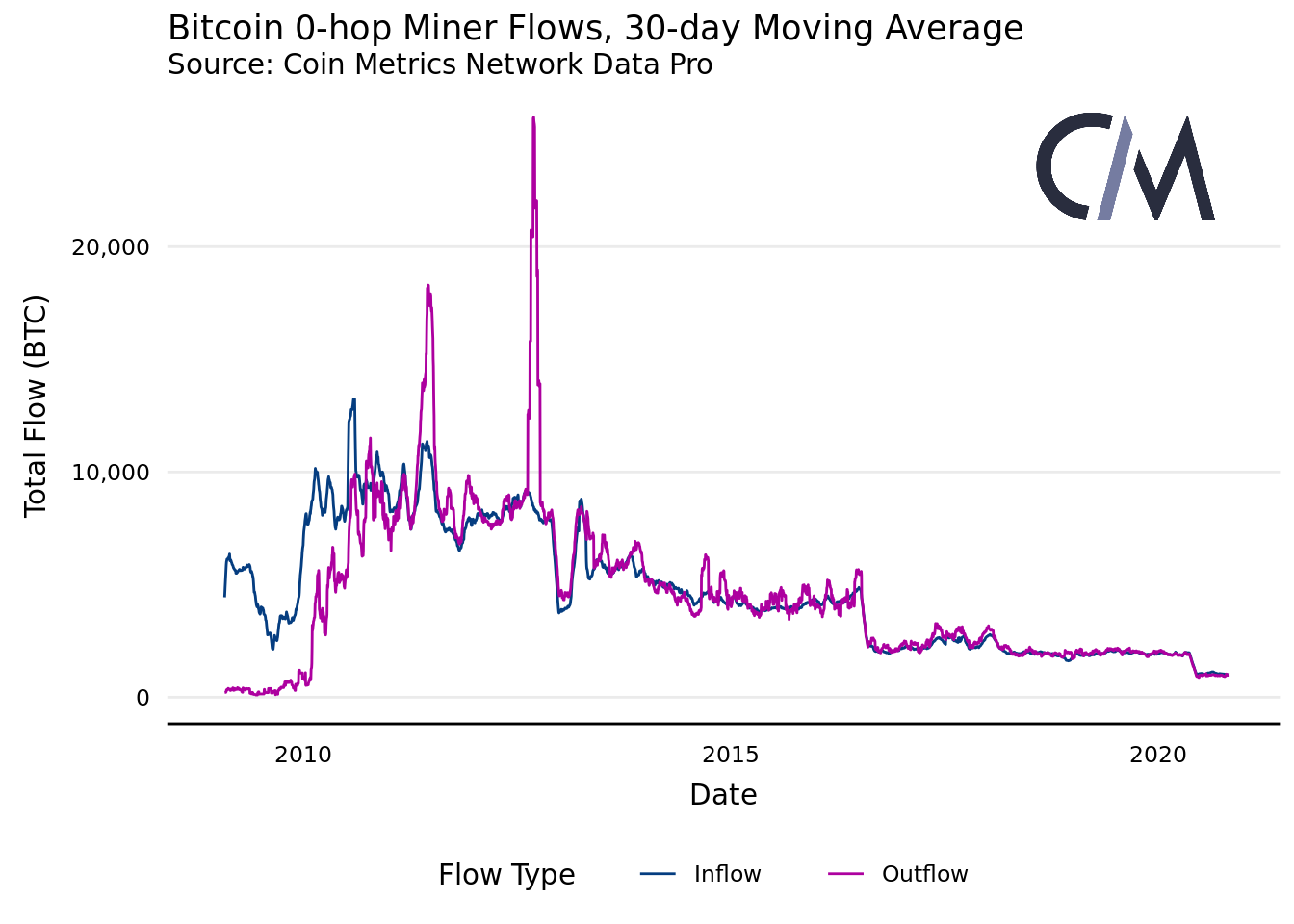

From the network’s early days, flows into and out of 0-hop addresses have tended to decline. The exception is a few spikes of activity, the most notable of which is linked to the whale mentioned above.

Miner revenues or block-reward inflows constitute the bulk of inflows to 0-hop addresses. While miner income fluctuates in the short run due to changes in block rewards and fees, it remains relatively stable over the long run.

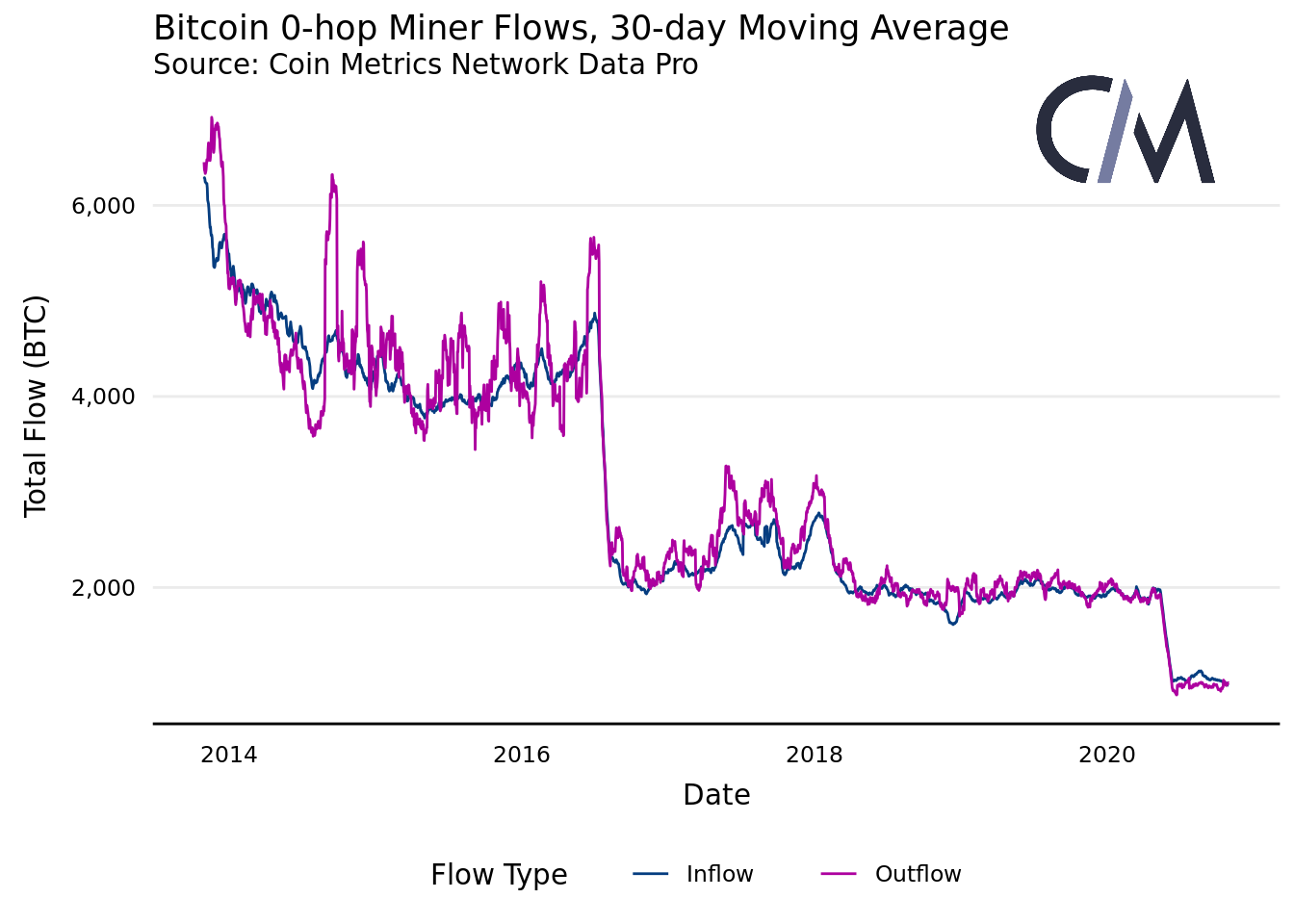

Inflows and outflows are closely correlated. However outflows are far more volatile, as miners can move funds from mining-pool wallets at any time. The halving events of 2016 and 2020 are reflected in shrinking flows. After the 2020 halving, inflows generally exceeded outflows, reversing a historical trend.

Inflows and outflows are closely linked. Yet outflows tend to be more volatile because miners can move funds from pool wallets at any moment. The effects of halving in 2016 and 2020 are evident in the reduced flow. After the 2020 halving, inflows generally outpaced outflows, marking a shift in the historical pattern.

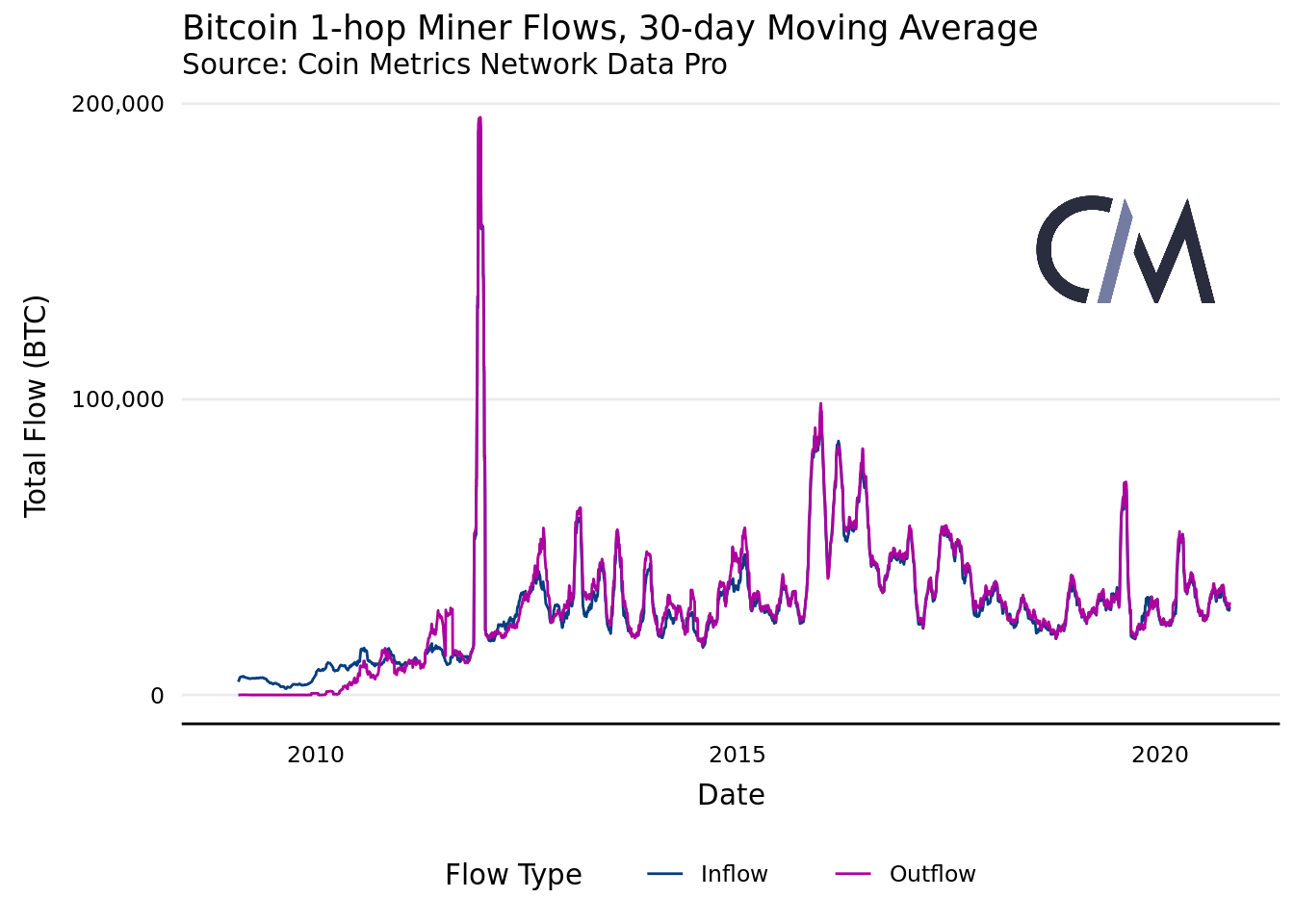

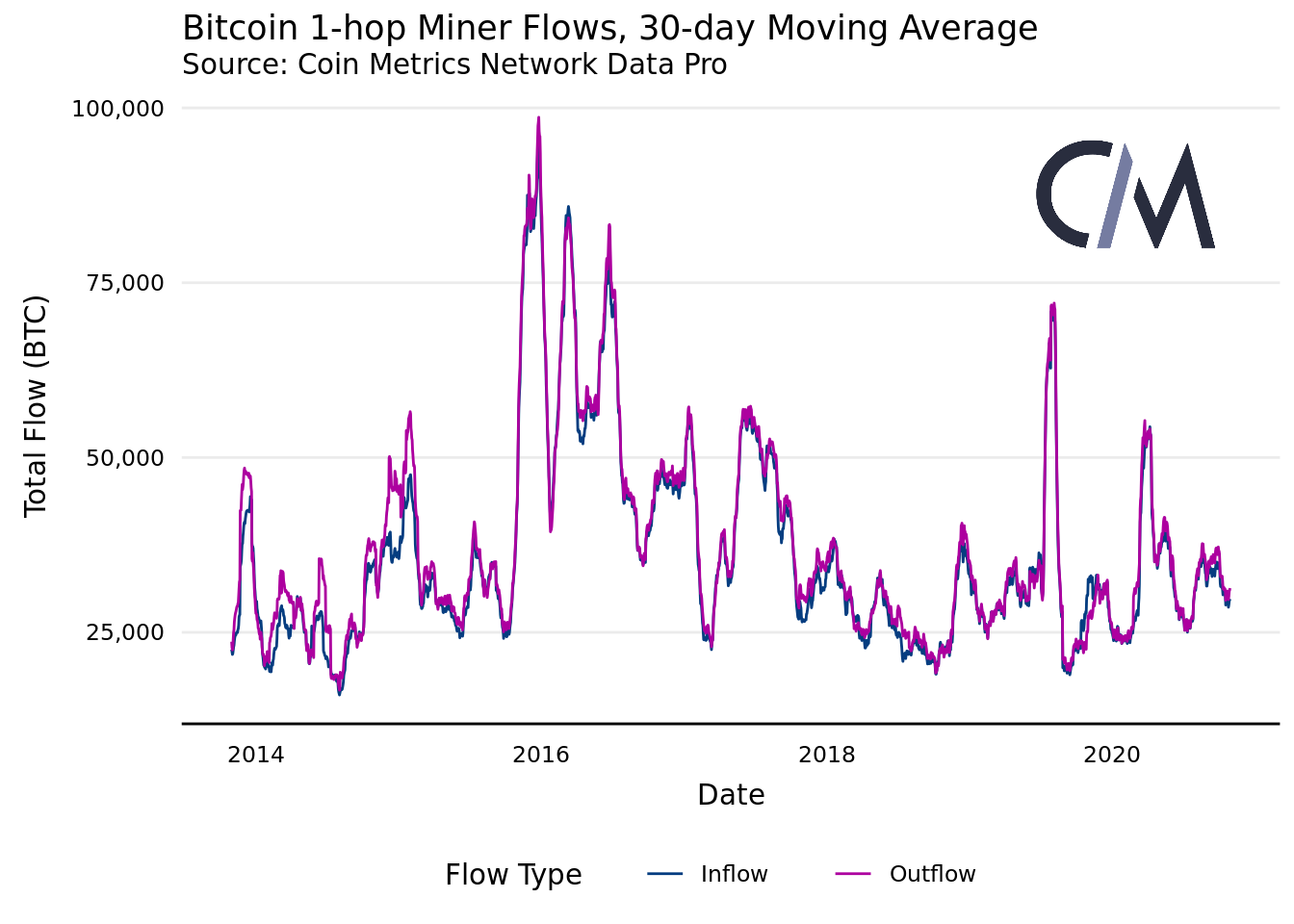

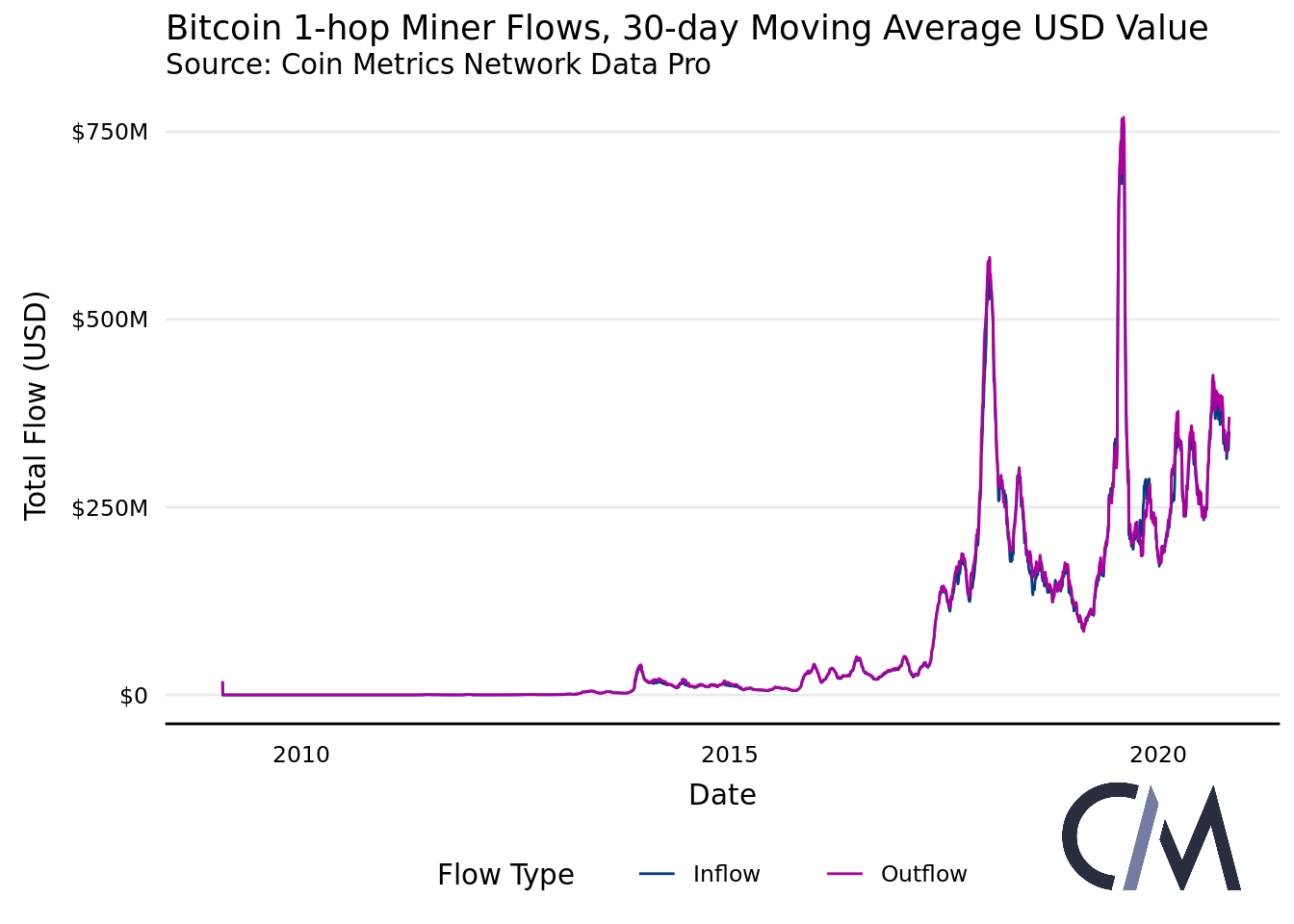

In the context of the pool model, flows to 1-hop addresses better reflect miners’ expenditures. This report marks one of the first attempts to analyse such flows. Due to the much larger number of relevant addresses and the high velocity of money, these flows are far larger and more volatile than 0-hop.

For analysing movements on the network’s early days (before pools became the dominant mining method), 0-hop flows can be a more appropriate instrument. Yet even today, analysing 1-hop flows yields only an approximate gauge of miner activity. This stems from differences in pool-wallet structures, which can cause exchange addresses to be inadvertently swept into these flows. Nonetheless, the model provides a more holistic view of miners’ expenditures in modern conditions.

As with 0-hop, inflows and outflows for 1-hop are tightly coupled. Because block rewards constitute only a small portion of 1-hop inflows, inflows and outflows in this category remain highly volatile. The halving’s impact on this subset is not as obvious.

Over the last year or so, flows related to miners have increased modestly, signalling higher activity. Because net flows have remained relatively stable and less volatile, the rise in activity does not appear to translate into greater network influence.

The close link between inflows and outflows suggests most miners tend to move coins promptly after receipt. Given that derivative exchanges and fiat-enabled lending services are predominantly custodial, miners may use financial instruments to hedge Bitcoin-related price risk.

However, Cambridge Centre for Alternative Finance findings indicate that the adoption of such tools remains low — miners largely prefer to hold sizeable reserves in Bitcoin. Large sums traded could imply miners are active market participants selling much of the mined coins.

Through the Dollar Lens

Since miners’ costs, profits and losses are expressed in dollars, it makes sense to view their flows in USD terms. Because 0-hop flows mainly consist of block rewards, their USD charts closely resemble miners’ revenue charts.

The USD chart of miner flows resembles the pool-flow chart at a larger scale, reflecting their dependence on Bitcoin’s price. But unlike pool flows, miner flows show a rising trend at the end of 2019 that briefly surpassed the 2017 peak, signalling greater miner activity in the network.

MRI Indicator

Analyzing inflows and outflows separately proves useful for assessing miners’ economic activity.

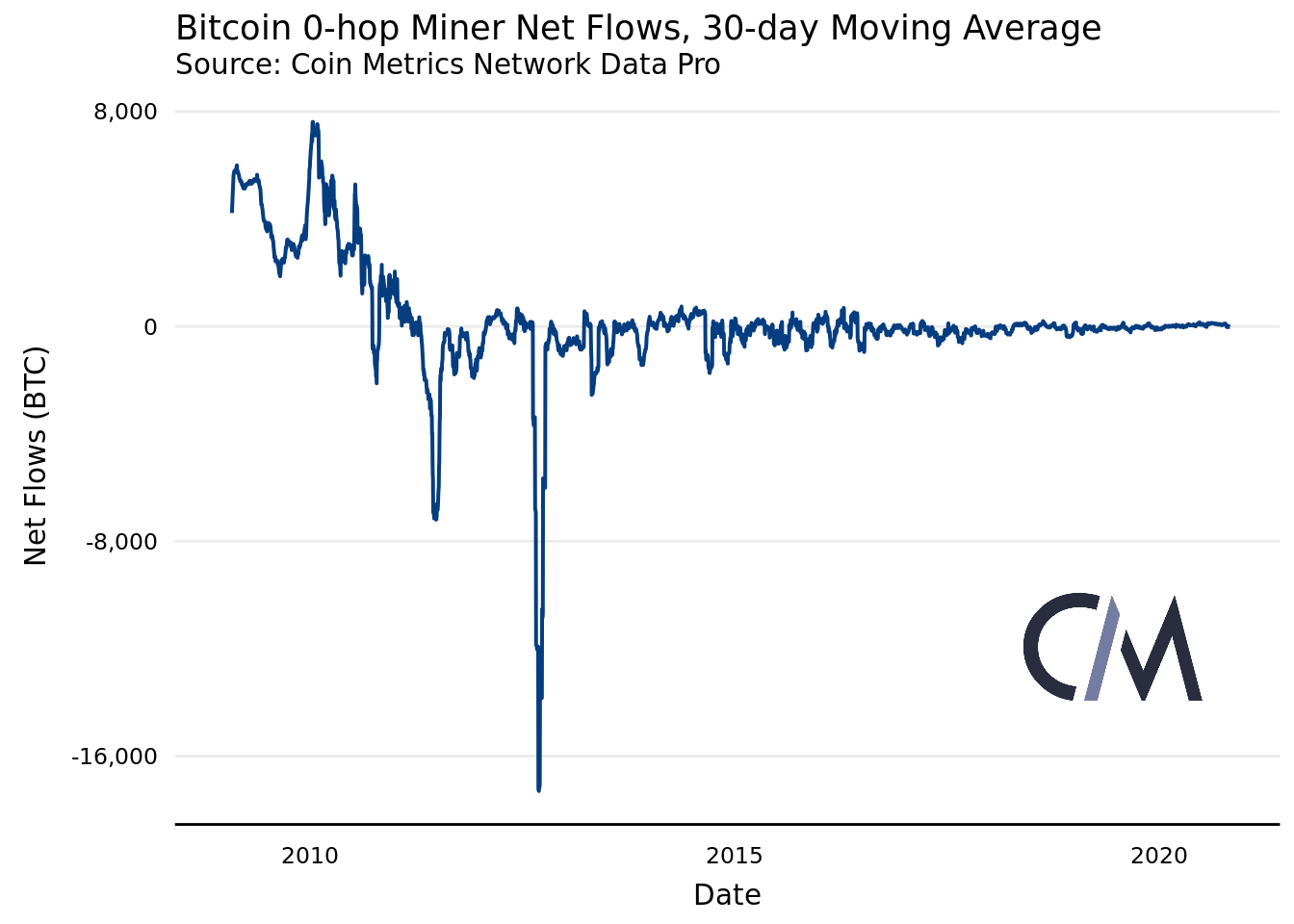

For much of Bitcoin’s history, net flows from 0-hop addresses hovered slightly negative, as these addresses typically spend more than they receive. In the early years, the volatility of these flows was pronounced, but has gradually declined, likely due to halving events.

Recent months have seen a slight positive shift in the volatility of the 0-hop net flow; inflows have begun to slightly exceed outflows.

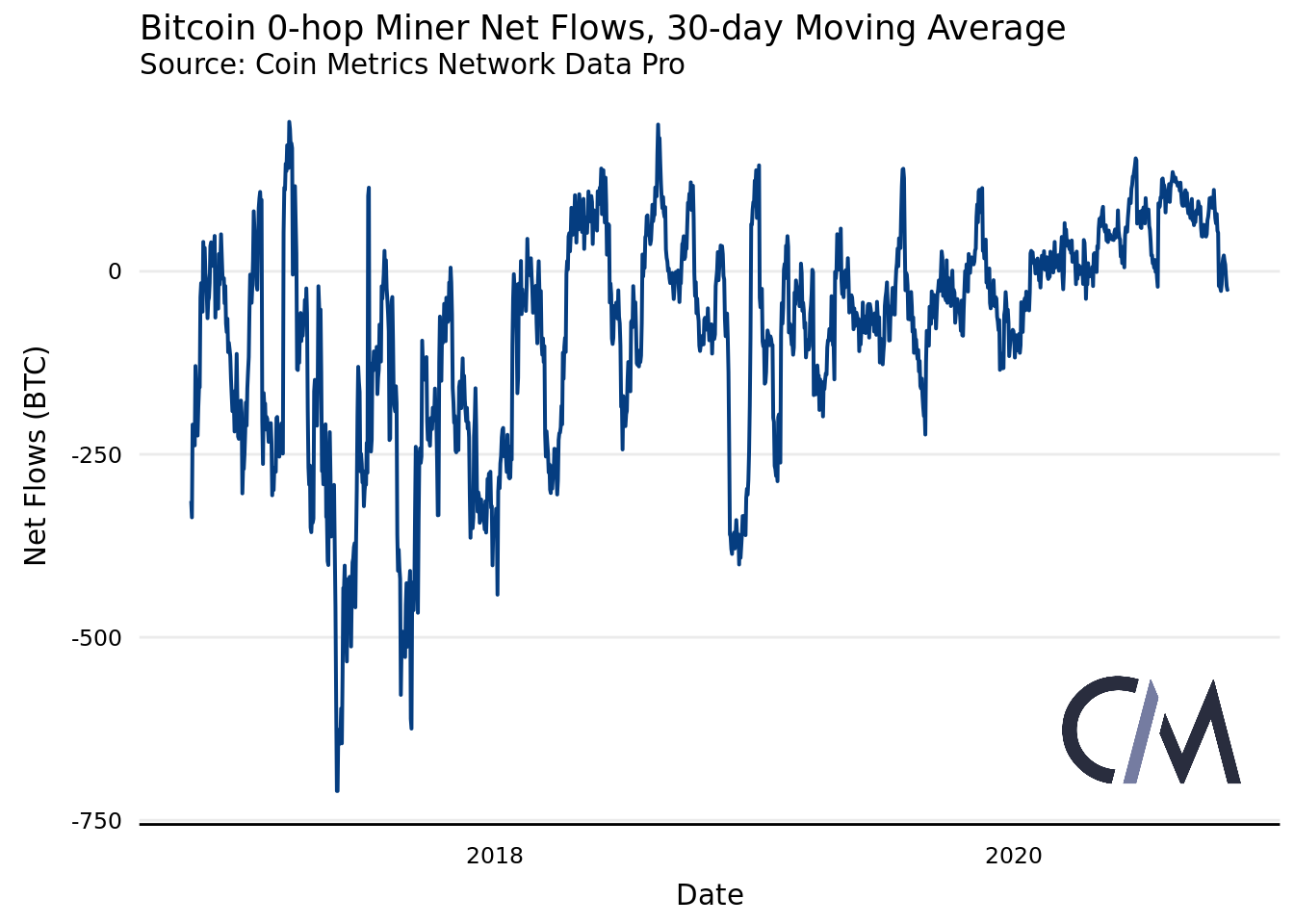

Net flows for 1-hop are far more volatile than 0-hop. As with 0-hop, net 1-hop flows have largely been negative. The volatility of these flows has also declined, indicating a gradual reduction in miners’ impact on liquidity.

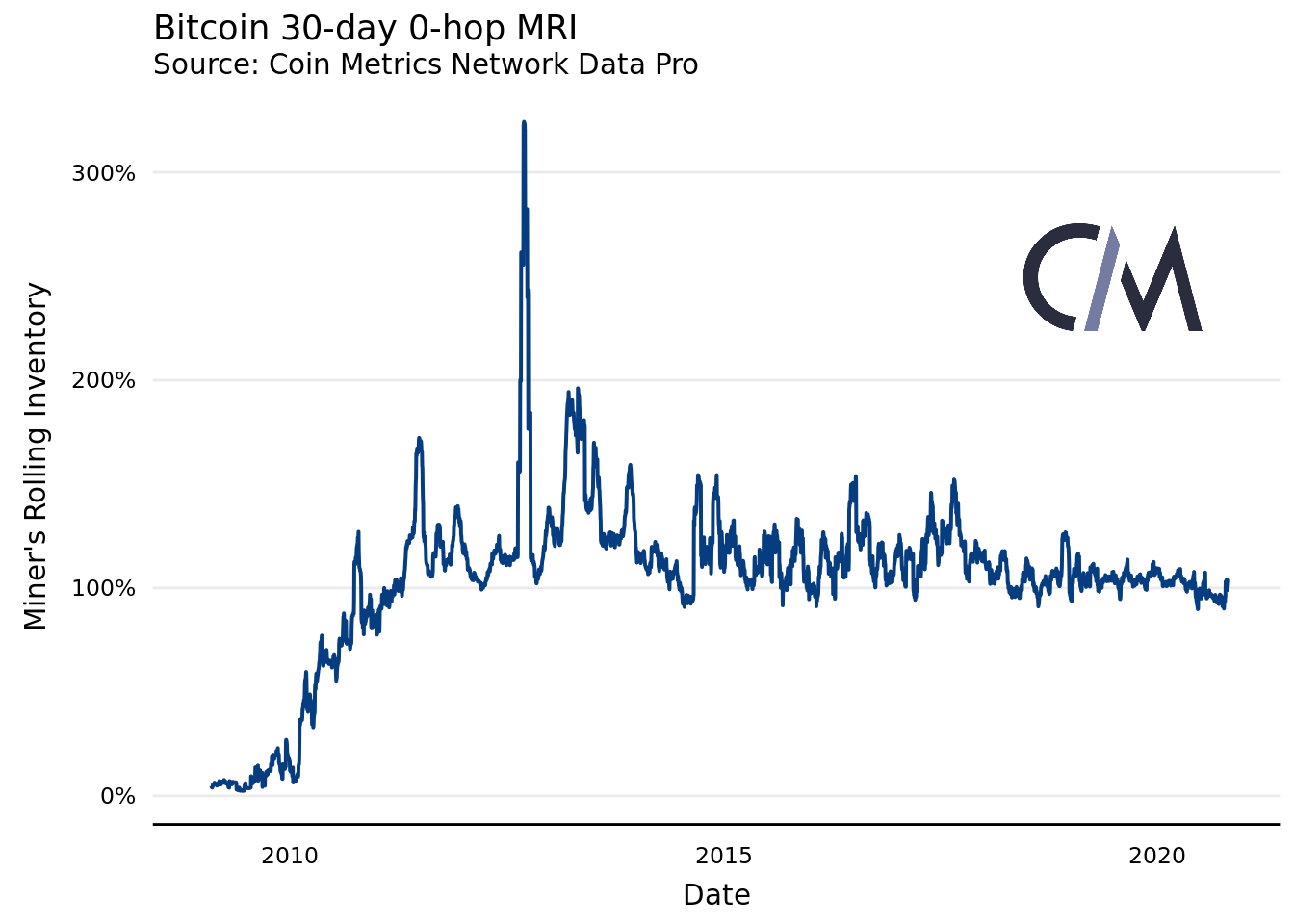

Another analysis tool is the Miner’s Rolling Inventory (MRI) indicator, which compares miners’ outflows with their income. In the context of 0-hop addresses, MRI helps determine whether miners hold mined coins in the pools’ wallets (MRI below 100%) or move them out (MRI above 100%).

Because 0-hop flows are closely linked to miners’ income, MRI has remained near 100% for most of the network’s history. The volatility of this indicator has gradually declined. The range of 0-hop outflow fluctuations has also narrowed.

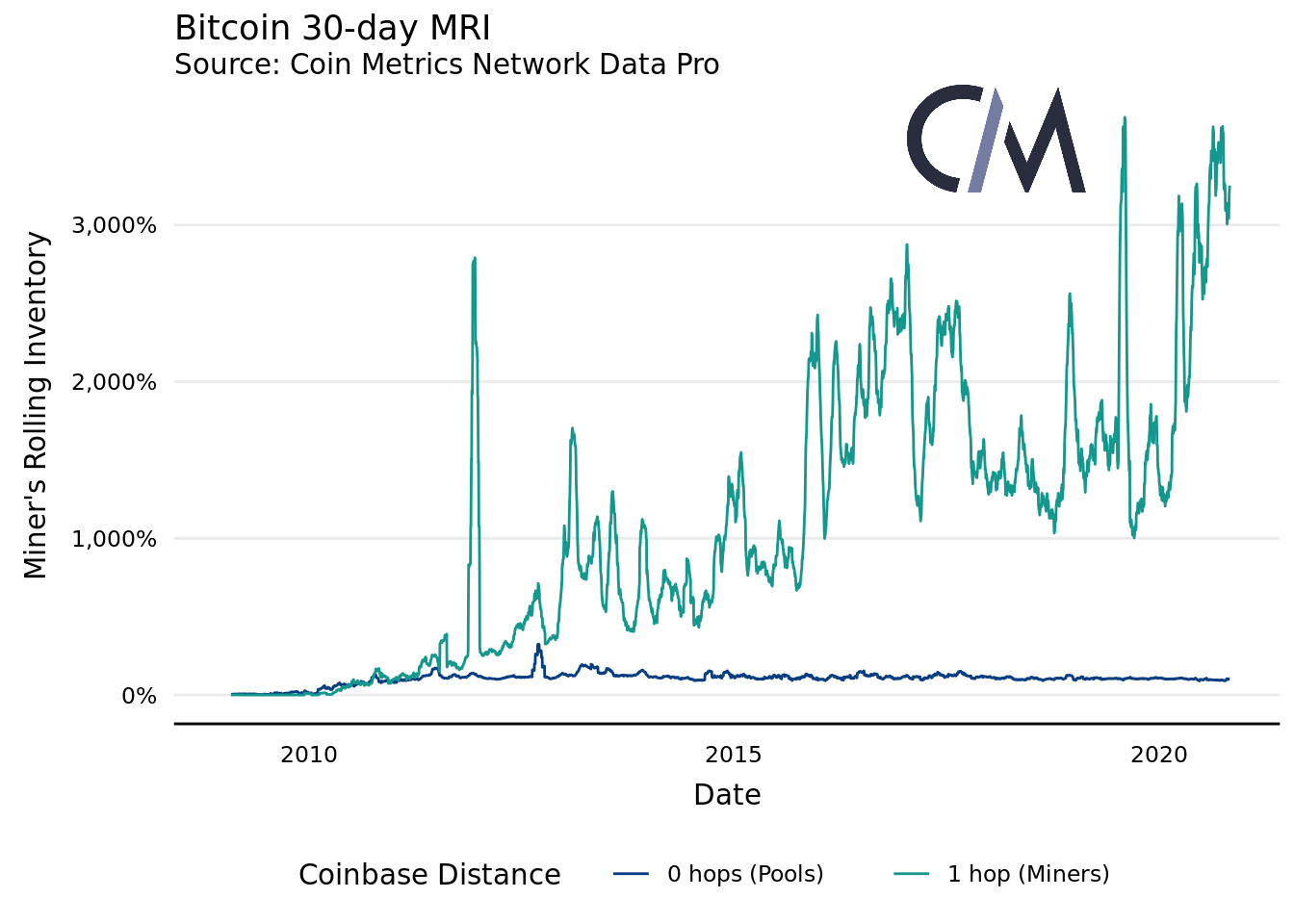

Unlike 0-hop, MRI for 1-hop addresses shows a clearer linkage between miners’ expenditures and their income. While 1-hop flows remained relatively stable throughout the network’s history and halvings reduced issuance, MRI for 1-hop addresses rose in a stepwise fashion.

Because 1-hop expenditures exceed miners’ revenues by a wide margin, MRI dynamics for this category are measured in thousands of percent.

And Where Do We Go from Here?

On-chain flow and inventory metrics point toward a gradual decline in miners’ influence on the network. Yet miners’ activity remains substantial, and these participants still command a sizeable share of Bitcoin’s market supply.

As the sole direct recipients of new issuance, miners and pools affect the network in ways that are not easy to quantify. The indicators presented in this article offer only a surface-level view of miners’ behaviour.

In the future we hope to analyse flows from miners to exchanges, more precisely assessing their impact on the market. We also plan to study supply concentrated at miner addresses, excluding coins lost in the network’s early days, and to take account of pools’ wallet structures. This will allow a more granular examination of miners’ behaviour.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!