How the Bitcoin Price Collapse Hit Major Miners and What Comes Next

Bitcoin’s drop below $20,000 was an unwelcome surprise for market participants. The price of the first cryptocurrency has never before fallen below the peak of the previous cycle.

Panic sentiment and selling at a loss have shown up in on-chain indicators such as aSOPR and the Fear and Greed index.

Some miners have already capitulated. However, large market participants, whose shares trade on public exchanges, remain. They account for roughly a fifth of the hashrate.

If Bitcoin’s price falls further, public companies will start divesting substantial cryptocurrency inventories as ballast. Based on materials from Arcane Research, ForkLog magazine assessed the likelihood of a new wave of selling pressure from major miners.

- The bear market weighed on large mining companies with access to capital markets, cheap electricity and cutting-edge mining hardware.

- Cash flows of giants like Marathon are insufficient to cover upcoming equipment deliveries.

- Mining companies may ramp up Bitcoin sales, creating additional pressure on the market.

Relentless Bear Market

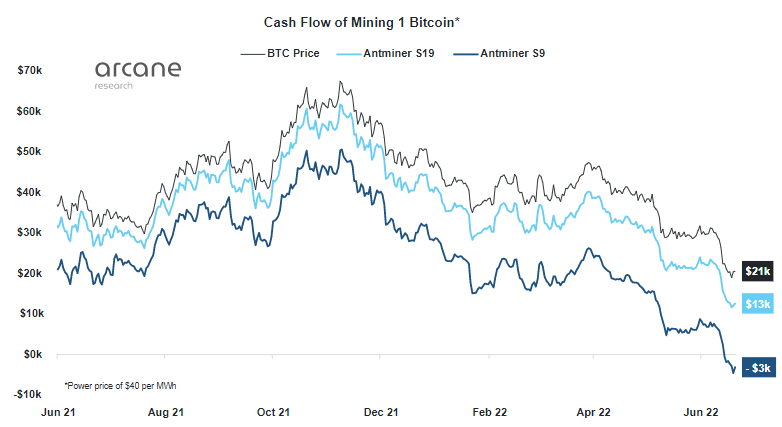

Against the backdrop of a deep correction, mining cash flow fell by 80% compared with the peak in November 2021 — to levels seen two years ago. Antminer S9 devices, once popular, began operating at a loss.

Despite access to lower energy tariffs, in May public mining companies sold 100% of the Bitcoin mined that month. Although in previous months this figure had been kept in the 25-40% range.

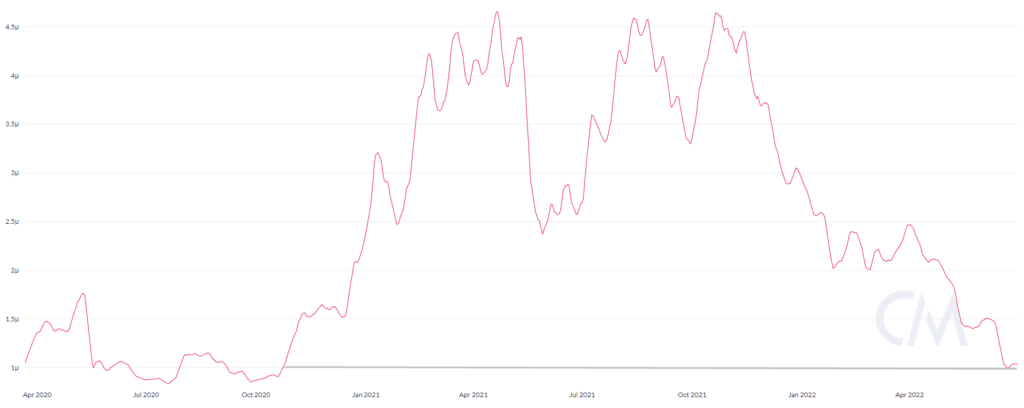

Hashprice fell to $0.09, corresponding to October 2020 levels. In this environment, many miners are forced to sell the cryptocurrency to cover costs, exerting pressure on the market.

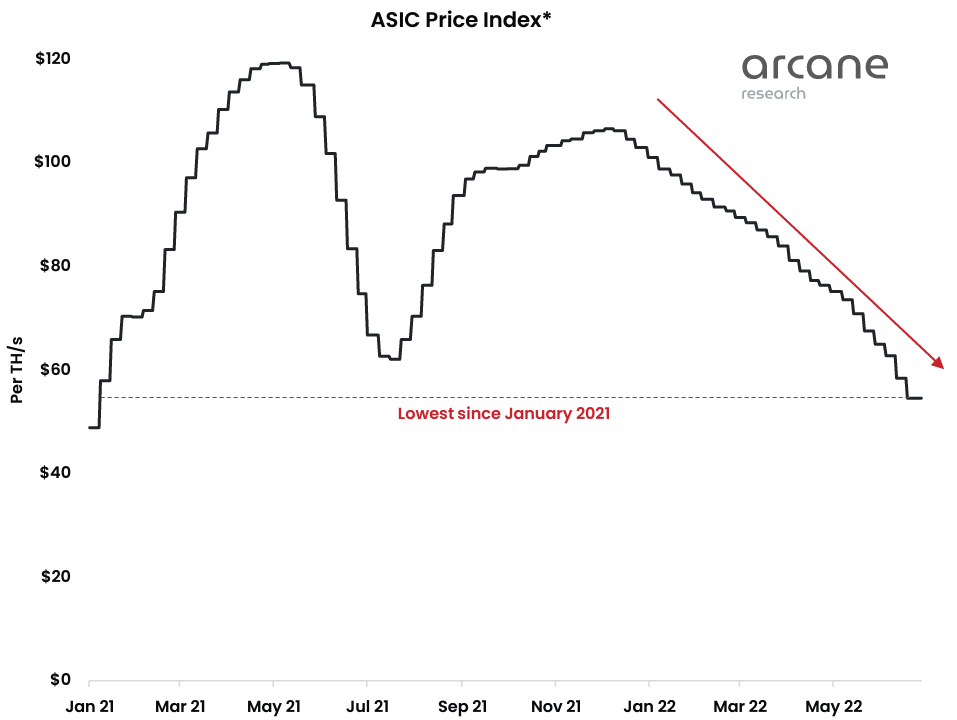

The cost of equipment per terahash fell below $60, matching January 2021 levels. Meanwhile, the current hashprice is roughly half of what it was 18 months ago. As a result, Bitcoin mining profitability at the start of last year was roughly twice as high.

Relatively high mining difficulty in the face of the Bitcoin price decline only worsens miners’ position. In this environment, mining profitability declines and costs rise.

However, as noted above, Marathon has extremely low cash flows relative to the volume of upcoming equipment payments.

Under a Cloud of Uncertainty

On June 11, a hurricane struck Montana. The storm damaged a power plant in Hardin that supplies Marathon Digital Holdings’ 30,000 miners.

The company said the equipment accounts for more than 75% of its active capacity. It is expected that some devices could be partially brought back online as early as July.

In April the company announced the transition of miners from the Hardin site to more stable energy sources to achieve carbon neutrality. The move was planned for the third quarter. Marathon now considers accelerating the relocation process.

Despite the problems and financial mismatches, the company reaffirmed its commitment to a reserve-building strategy in Bitcoin. Clearly, Marathon’s leadership believes in the long-term rebound of the asset’s price.

“Bitcoin certainly trades lower in dollar terms at the point of mining, but if you believe in the asset’s price to rise in the long run, earning more BTC is never a bad thing,” said Marathon’s vice president, Charlie Schumacher.

In the top executive’s view, a drop in Bitcoin’s price will push out less efficient miners and lift mining difficulty. That should allow those still operating to capture more digital gold.

Conclusion

Most mining companies are navigating difficult times despite access to cheap electricity and cutting-edge equipment. For many, operating cash flows are insufficient to pay for upcoming equipment deliveries, contracts struck during periods of high profitability and aggressive investment.

The current market environment makes capital-raising or debt financing difficult, including secured loans. Some firms like Marathon may face liquidity shortages and resort to dumping large Bitcoin reserves. That would add to selling pressure and potentially trigger a fresh round of market panic.

Yet a crisis is not only a problem; it also creates opportunities. Firms with sound finances and ample buffers could buy assets at fire-sale prices from miners that exit the scene.

Follow ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!