I want to bequeath my entire estate to a cat. How to do it with Web3

A life spent working and trading, squinting at ‘golden crosses’, stacking every satoshi in a Web3 wallet and skimping on a personal life—and now the end approaches. What if you want to bequeath your crypto wealth to the only creature you truly care about—your beloved cat—but you trust only smart contracts?

Asking that question, Sergey Golubenko found an answer in the RWA segment of the market.

Tokenising property

Before transferring the right to real estate via a smart contract, the asset must be turned into a digital version.

Property has long been illiquid, requiring hefty capital and slow transactions. Blockchain has changed the field. Fractionalisation through tokenisation has lowered the investment threshold, enabling shared ownership of a single physical object. In the RWA segment, developers have addressed trust and transparency.

Real World Assets is a term for assets from the ‘real world’ issued as tokens on a blockchain. The segment includes real estate, title, works of art, jewellery and metals, traditional financial instruments and stablecoins. The last of these account for about 94%.

The concept involves tokenising existing assets to move value into dapps, cut costs or boost capital-efficiency with DeFi tools.

The investment giant behind a leading spot bitcoin ETF, BlackRock, is active in RWA. According to RWA.xyz, as of November 22, 2024 the tokenised money-market fund BUIDL leads the sector by AUM, with more than $535m under management.

Tokenising real estate means splitting an asset into digital tokens that represent the property together with its rights and obligations. Contract terms are encoded in smart contracts. The code triggers predefined events when conditions are met. For example, a smart contract can automatically—without human intervention—update a land registry.

Asset tokenisation typically involves four stages:

- Verification of ownership. The owner’s relationship to the asset is legally confirmed.

- Onboarding to a blockchain platform. The asset is migrated to a dapp that supports tokenisation.

- Valuation. Its price is determined and approved in line with regulatory requirements.

- Offering the tokenised asset. The asset is divided into one or many tokens for trading or investment.

For safe on-chain storage and distribution, timely information about the asset’s token is crucial throughout its lifecycle—creation, collateralisation, valuation and trading. The success of asset digitalisation relies on blockchain oracles such as Chainlink or Pyth, which stream up-to-date data about the object to connected dapps.

To bring housing from the ‘real world’ on-chain, non-fungible tokens (NFTs) are most often used. The ERC‑721 NFT standard ties to smart contracts that record all token transactions.

Ethereum-born standards ensure interoperability across networks and add useful functions:

- ERC‑20. The fungible-token standard, used also by Web3 real-estate platforms;

- ERC‑1400. Adds compliance procedures for regulated assets. Combines features of fungible and non-fungible tokens;

- ERC‑1155. Improves efficiency by supporting both fungible and non-fungible tokens within one contract.

At the time of writing, Ethereum ranks first by active RWA holders, with more than 58,000 addresses. A large share comprises tokenised US Treasuries and various funds. In Ethereum, such services are used mainly by large clients of platforms like Ondo Finance or BUIDL—for whom transaction fees matter less.

For an ordinary user who wants to leave a garage and a country house to a favourite cat, fast and cheap blockchains such as Solana are worth a look.

Solana’s high throughput and scalability allow for managing and transferring assets via native token standards. In addition to SPL, Solana developers let users create, trade and manage digital assets using the NFT standard from Metaplex.

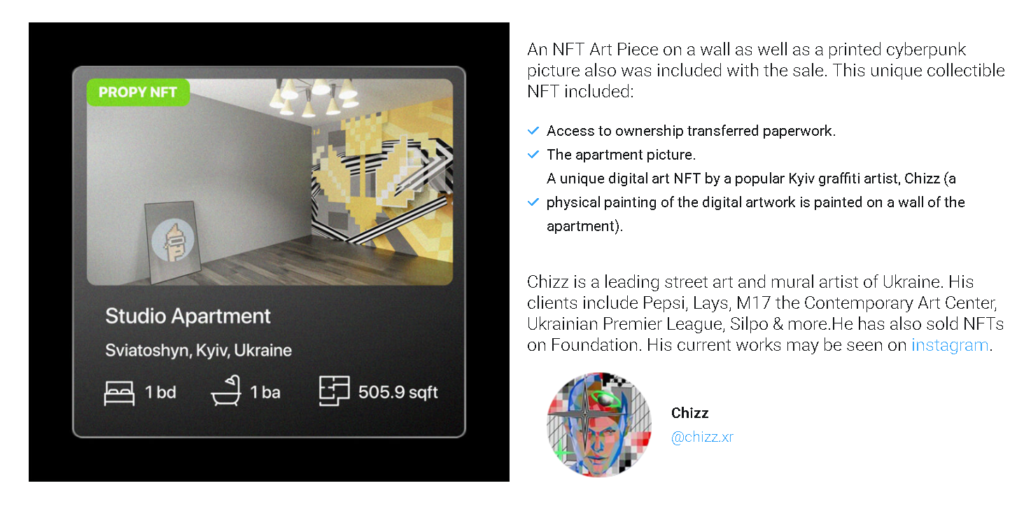

If you want to ‘upload’ your flat to an NFT marketplace for later sale for cryptocurrencies, the Web3 platform Propy is an option.

The first such deal on the platform took place in 2017. The flat sold with blockchain technology belonged to TechCrunch and Arrington XRP Capital founder Michael Arrington. In the deal, the businessman remotely exchanged 212.5 ETH (~$60,000 at the time the price was fixed) for an apartment on the right bank of Kyiv. The buyer paid all transaction expenses with PRO tokens.

The sale differed from a traditional transaction. Title to the property was drafted and registered in Ukraine through an American LLC (Limited Liability Company). The auction winner became the owner of an NFT that granted rights to this LLC. Michael Arrington signed specially drafted legal documents to ensure title could pass to future buyers. The contract was notarised by private notary Zoltan Rusanyuk.

A trust for a pet

In early 2024 an elderly woman in Shanghai left 20m yuan (~$2.8m) to her cats and dogs. To circumvent legal limits that prevent leaving property to animals, she appointed a veterinary clinic to manage the funds for the pets’ care.

Such cases are not rare. In the United States, owners increasingly set up Pet Trusts, which channel funds for long-term care. Using one, fashion designer Karl Lagerfeld bequeathed a large part of his $300m fortune to his cat, Choupette.

Because animals cannot be direct beneficiaries or run trusts themselves, a Pet Trust provides for legal guardianship should the owner die. A notarised document can set regular payments for care and stipulate what happens to remaining funds after the animal’s death. In the US, such trusts are recognised in all states.

A pet trust can include any movable and immovable property in a will. For example, a bitcoin wallet address with a seed phrase, or an NFT conferring ownership of a flat, can be left to a guardian. The trustee may be a person or an organisation.

Web3 inheritance platforms

Decentralised platforms can serve as an alternative to a notarised will. An owner can select a guardian as heir and write them into a smart contract using a specialised dapp—Safe Haven.

The company provides blockchain-based FinTech solutions. The startup offers security services for finance, backup, inheritance and data transfer for individuals and large organisations.

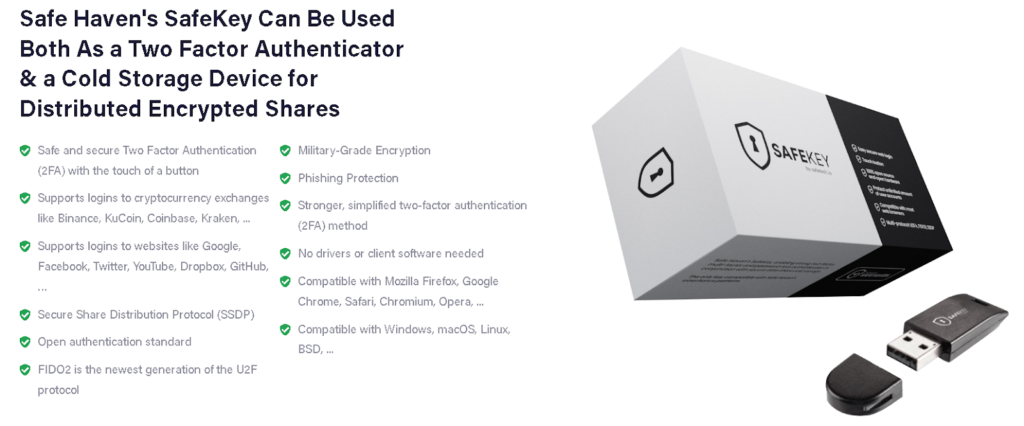

Safe Haven’s main products include the decentralised, patented inheritance and data-recovery platform Inheriti, and a cold-storage device with a 2FA protocol—SafeKey.

The key to your digital life is handed to the person named in the will. The device works with the Inheriti dapp and can display exchange passwords and wallet seed phrases containing accumulated cryptocurrencies.

The ecosystem includes the SHA token and a cross-chain bridge for moving assets between blockchains—SafeSwap. In addition to Ethereum it supports several networks: VeChain, Polygon, OP Mainnet, Base and BNB Chain.

Another industry participant offering on-chain inheritance is Casa. The non-custodial platform lets users arrange an estate plan in 15 minutes. The flow proposes creating a number of keys to prove ownership and later transfer them to chosen people.

According to the project’s site, a considered system ‘waits’ six months before initiating the transfer. Requests arriving in the mobile app are checked to see whether anyone responds within that period. In the event of ‘dead silence’, the request goes to designated contacts for handover.

When the service has successfully provided the guardian with the keys to 10,000 BTC, the only task left is to use them wisely—and not let the animal spend everything in a day.

The fine print on how funds may be used can be set out in a traditional will or a smart contract. The latter requires serious programming skills or a budget for professionals.

By analysts’ estimates, by the end of 2022 the global real-estate market totalled $379.7trn. The total crypto market capitalisation at the time of writing exceeds $3.3trn, of which RWA accounts for about $200bn. The total number of holders is around 66,000 users.

According to Tren Finance, by 2030 the RWA industry will grow to $4trn under conservative forecasts and to $30trn under optimistic ones.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!