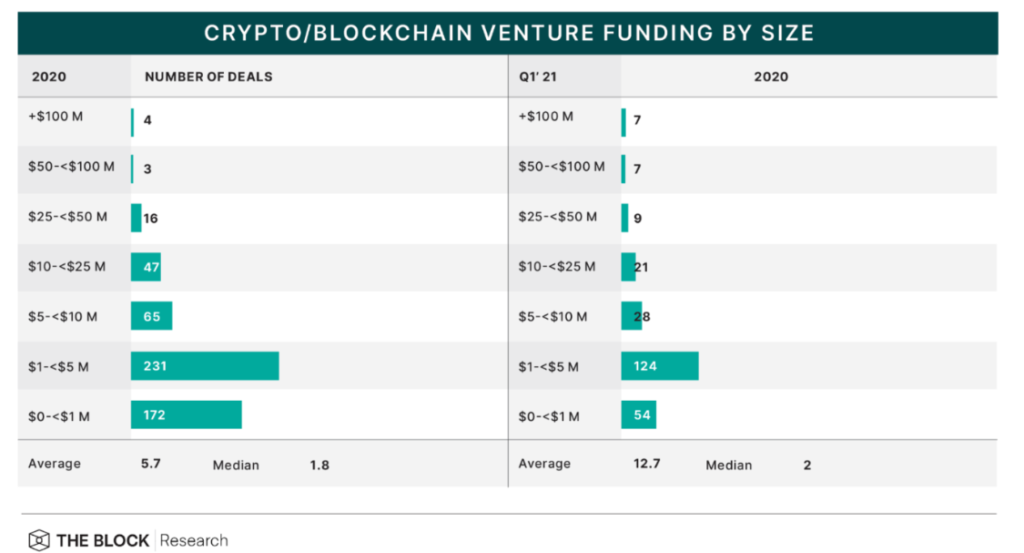

In 2021, the average size of venture investments in crypto companies rose by 120%.

In the first quarter of 2021, crypto companies attracted venture-capital sums of at least $50 million twice as often as in all of 2020. The data come from The Block Research.

According to the study, in the first quarter of 2021 venture investors closed seven deals worth more than $100 million each, compared with four in 2020. Another seven ranged from $50 million to $100 million — last year there were only three such deals.

According to analysts, by the end of 2020 the average deal size was $5.7 million. In the first three months of 2021 the figure rose to $12.7 million.

In the first quarter, venture capital investment volume in crypto companies was around $2.6 billion, according to CB Insights. This is more than for the entire previous year, when the industry attracted $2.3 billion.

Earlier, The Block analysts estimated that the crypto industry’s venture funding volume last year amounted to $3.1 billion and counted 774 deals.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!