Inflation barely budges; Bitcoin climbs.

Year-on-year inflation in the United States slowed in April from 5% to 4.9%, below the 5% forecast. Bitcoin settled above $28,000, rising 2.1% on the day.

On a monthly basis, consumer prices rose 0.4%, up from 0.1%, in line with market expectations.

The core metric, which excludes food and energy, also matched analysts’ forecasts, at 5.5% year over year and 0.4% month over month. The previous readings were 5.6% and 0.4%, respectively.

Data from the U.S. Bureau of Labor Statistics (BLS) broadly met expectations and did not fundamentally alter market views on the end of Fed‘s tightening cycle.

According to calculations by Bloomberg, inflation in the services sector, which has recently been a key gauge for the Fed’s actions, slowed year-on-year to the minimum since July 2022 of 0.1% and 5.1%.

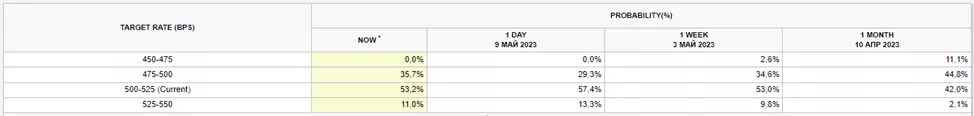

Investors were even more convinced that the May rate hike is likely to be the last.

The futures market trimmed the odds of further tightening in June from 21.2% to 14.2% and raised the odds of a 25bp rate cut in July—from 29.3% to 35.7%.

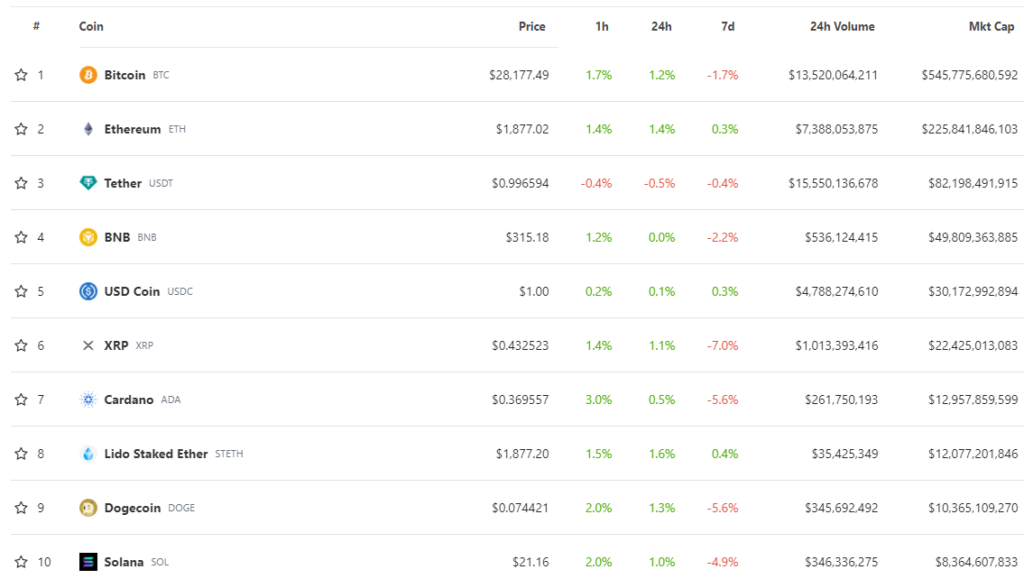

The cryptocurrency market reacted modestly positively to the BLS data. Bitcoin moved above $28,000, with digital gold up more than 2%.

Ethereum rose to $1,890, up 1.8%.

According to CoinGecko, all top-10 by market capitalization assets over the last hour were in the green. Gains ranged from 1.2% (BNB) to 3% (Cardano).

The stock market reacted positively to the employment data. As of writing, the Nasdaq 100 futures were up 0.9%, the S&P 500 up 0.75%.

On May 3, the Fed raised the target range for the federal funds rate to 5–5.25%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!