Institutions bought more than 1 million BTC, worth about $40 billion at current prices

Last year, institutions bought more than 1 million BTC (5.57% of the cryptocurrency’s circulating supply) worth about $40 billion, according to Bitcoin Treasuries.

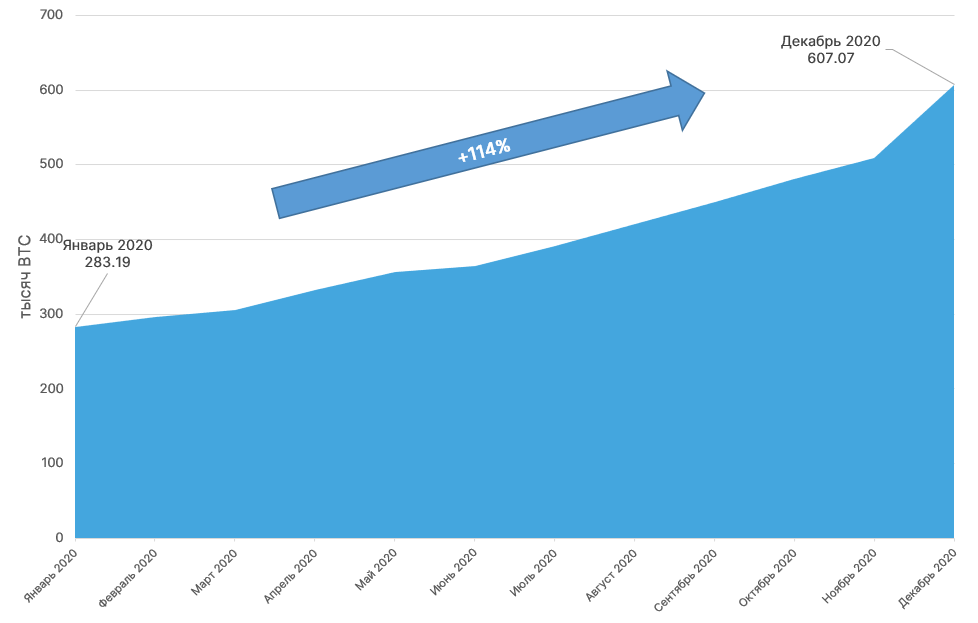

One of the most active institutional investors in 2020 was Grayscale Investments, which manages around 600,000 BTC.

01/11/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $24.5 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/WgFd5UCENP

— Grayscale (@Grayscale) January 11, 2021

The total value of Grayscale Investments’ crypto assets under management was estimated at $24.5 billion as of January 11, 2021.

Growth in Grayscale Bitcoin Trust assets in 2020. Data: grayscale.co, ForkLog’s 2020 report.

However, the trend of investing in Bitcoin as a hedge against risk began with MicroStrategy, which in August 2020 purchased 21,454 BTC for more than $250 million. A month later, the Nasdaq-listed company invested another $175 million in Bitcoin, and in December of last year — an additional $650 million.

Total MicroStrategy has invested $1.12 billion in Bitcoin and now owns 70,470 BTC (more than $2.5 billion at the time of writing). Against the Bitcoin correction, the company’s shares fell 7.5% since January 7 — from $535.48 to $495.25.

Data: Yahoo Finance.

Earlier, in October 2020, Square, Jack Dorsey’s company, purchased 4,709 BTC for $50 million. In December, Ruffer Investments bought 45,000 BTC for $744 million. In early 2021, SkyBridge Capital’s Anthony Scaramucci launched a bitcoin fund with assets of $310 million.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!