Investment Advisers to Dominate Crypto ETFs by 2025, Says CF Benchmarks

By 2025, investment advisers plan to increase their holdings in Bitcoin and Ethereum-based ETFs to over 50%, according to experts at CF Benchmarks, as reported by CoinDesk.

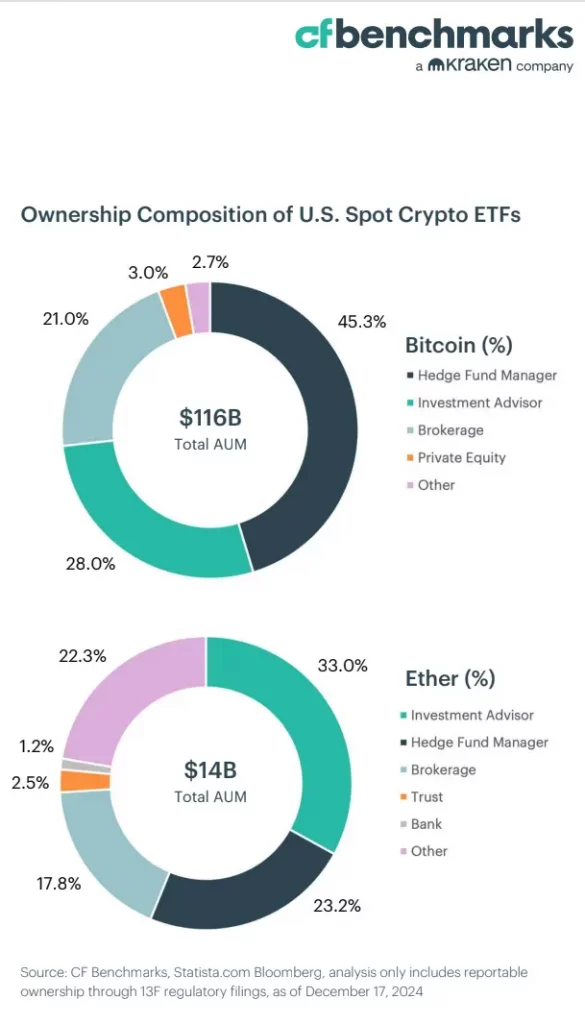

Since their inception, American spot cryptocurrency exchange-traded funds have attracted $36 billion in capital from various entities, analysts claim.

The primary interest has come from hedge fund managers, who currently hold approximately 45.3% in various crypto products. Investment advisers, intermediaries in retail and high-yield capital, rank second with 28%.

CF Benchmarks forecasts a shift in the coming year:

“We expect allocations to investment advisory services to exceed 50% for [BTC and ETH], as the $88 trillion US asset management industry begins to embrace these instruments. Net inflows into products will surpass the 2024 figure of $40 billion.”

The transformation, driven by growing client demand, a deeper understanding of digital assets, and the development of fund products, is likely to alter the current structure in crypto ETFs, experts believe. Investment advisers already lead in the Ethereum fund market and are expected to strengthen their position next year.

CF Benchmarks anticipates that the Ethereum network will benefit from the growing popularity of asset tokenization, while competing Solana will continue to expand its market share due to potential regulatory clarity in the US.

The US Federal Reserve is expected to take a “more restrained stance,” employing unconventional measures such as yield curve control or expanding asset purchases, specialists assert. They believe this will address the toxic combination of high debt servicing costs and a weak labor market.

“Deeper debt monetization should raise inflation expectations, strengthening hard assets like Bitcoin as a hedge against currency devaluation,” analysts emphasized.

Earlier in December, cryptocurrency investment funds received $308 million in the week from December 15 to 21, following $3.2 billion the previous week. The figure significantly decreased amid the Federal Reserve’s “hawkish” rate cut.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!